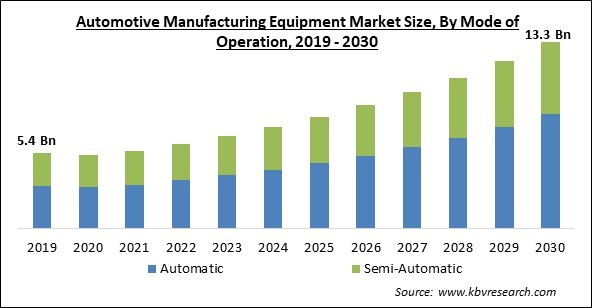

The Global Automotive Manufacturing Equipment Market size is expected to reach $13.3 billion by 2030, rising at a market growth of 10.6% CAGR during the forecast period.

The Automatic mode of operation is leading the market because the electric vehicle industry is growing due to ongoing regulatory support, advancements in battery technology, infrastructure for fast charging, a shift by automakers to electrify their fleets, and shifting consumer tastes. Consequently, the Automatic segment is anticipated to capture more than 60% share of the market by 2029. For example, According to US Bureau of Labor and Statistics, over the decade of 2011–21, the number of EVs on the road increased significantly, from around 22,000 to over 2 million in the US. Additionally, as part of the government's initiative to create tens of thousands of green employments and assist all areas in rising to the next level, electric car registrations in the UK trebled to more than 74,000.

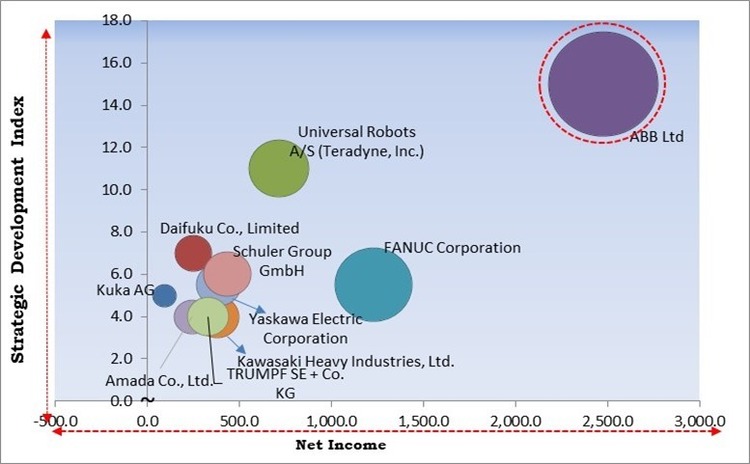

The major strategies followed by the market participants are Partnerships as the key developmental strategy in order to keep pace with the changing demands of end users. For instance, In February, 2023, Yasakawa has partnered with Rapid Robotics for a wider reach of enterprises looking for automation solutions. Through this partnership, Yasakawa would be able to shift the dangerous tasks from humans to the robotic manipulators developed with the combined expertise of both companies. Moreover, In February, 2023, Schuler teamed up with AutoForm to develop new digital press shop solutions. The collaboration would enable automotive part producers and stampers to employ real-time press line control strategies.

Based on the Analysis presented in the KBV Cardinal matrix; ABB Ltd is the forerunner in the Market. In July, 2022, ABB came into a Memorandum of Understanding (MoU) with SKF to detect and analyze solutions to enhance manufacturing capabilities and complement customers' better production efficiency. Companies such as FANUC Corporation, Universal Robots A/S (Teradyne, Inc.), Schuler Group GmbH are some of the key innovators in the Market.

Traditional systems are almost completely being replaced by smart manufacturing and digitization globally. Using machine learning and artificial intelligence, they enabled physical equipment or machines to connect with control systems and behave independently. In a time when preserving consumer trust is crucial, flaws can harm a brand's or retailer's credibility. As a result, many businesses are using automation and artificial intelligence (AI) to speed up supply chains, increase order and inventory accuracy, and enhance quality control. Thus, such cutting-edge technologies would encourage the increased use of automotive manufacturing equipment and drive market growth.

The shift in consumer needs and behavior is the most important factor influencing technology adoption in the automotive industry. Industry 4.0 develops interconnected ecosystems that improve the visibility of factory floor operations and enable OEMs to communicate directly with customers. The capacity of OEMs to communicate with consumers expands chances to more accurately assess demand and consumer preferences to improve the customer experience while minimizing manufacturing and innovation inefficiencies. Hence, the automobile industry will have a greater need for and access to high-tech manufacturing equipment due to the “Industry 4.0” revolution, which will ultimately fuel market expansion.

Automated equipment might rank among a business's highest operational expenses. Depending on the type and level of automation, automated equipment can cost anywhere between thousands and millions of dollars. Several unforeseen costs may exceed the real cost saved by automation. These expenses include the price of developing an automated process, the price of preventative maintenance, and the price of training staff to run automated machinery. Additional expenditures include the cost of industrial robots, integration fees, and the cost of peripherals like end effectors and vision systems. Thus, using manufacturing equipment in the automotive sector is a pricey investment, especially for SMEs, particularly when involved in low-volume production, which hinders the market's growth.

Based on equipment, the market is segmented into CNC machines, conveyor belt, injection molding machine, robot, stamping machine and welding machine. The CNC machine segment acquired a significant revenue share in the market in 2022. This is because computer-controlled CNC machines are devices that precisely cut metal into desired shapes. Although CNC machines come in a few different varieties, they all serve the same purpose. Also, such machines are capable of performing complex shapes and designs on metals. Thus, mentioned factors are anticipated to drive the segment's growth in the projected period.

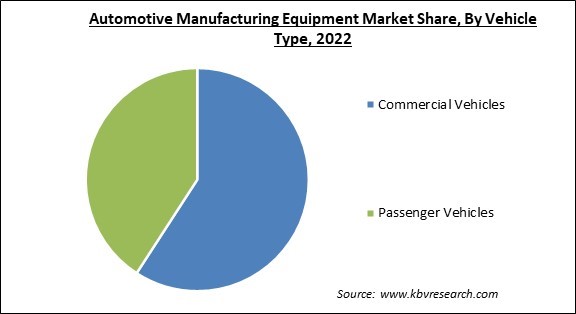

By vehicle type, the market is classified into passenger vehicles and commercial vehicles. The commercial vehicles segment witnessed the largest revenue share in the market in 2022. The segment is expanding as a result of an increase in commercial vehicle sales. Numerous positive factors, such as the replacement of aging vehicles and an uptick in mining, infrastructure, and construction operations, continue to support the CV industry's production. Additionally, the segment's growth was aided by the improvement in the overall macroeconomic environment and good fleet utilization levels, which led to enhanced fleet operator viability.

On the basis of mode of operation, the market is divided into automatic and semi-automatic. The automatic segment held the highest revenue share in the market in 2022. This is due to the automatic mode of operations' ability to increase productivity, efficiency, and quality; they are frequently utilized in the production of automobiles. Automated manufacturing tools can complete tasks without requiring human input, which lowers labor costs and boosts production. In addition, various operations like assembling, painting, and inspection are performed using automatic production equipment.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 6 Billion |

| Market size forecast in 2030 | USD 13.3 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 10.6% from 2023 to 2030 |

| Number of Pages | 243 |

| Number of Table | 364 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Mode of Operation, Equipment Type, Vehicle Type, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific region registered the highest revenue share in the market in 2022. The segment growth is owing to the fact that the region is one of the major future prospective markets for the automobile manufacturing equipment market. The use of machinery for making automobiles is significantly increasing in the Asia-Pacific region. The region's increasing middle class has raised the demand for automobiles, prompting regional automakers to invest in brand-new facilities and machinery for production. In addition, the region's huge pool of skilled laborers also influences the adoption of manufacturing equipment.

Free Valuable Insights: Global Automotive Manufacturing Equipment Market size to reach USD 13.3 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include ABB Ltd, FANUC Corporation, Kuka AG (Midea Group Co., Ltd.), Daifuku Co., Limited, Yaskawa Electric Corporation, Kawasaki Heavy Industries, Ltd., Amada Co., Ltd., Schuler Group GmbH (Andritz Group), Universal Robots A/S (Teradyne, Inc.) and TRUMPF SE + Co. KG.

By Mode of Operation

By Equipment Type

By Vehicle Type

By Geography

The Market size is projected to reach USD 13.3 billion by 2030.

Industry 4.0 in the automotive sector are driving the Market in coming years, however, High installation costs for small businesses restraints the growth of the Market.

ABB Ltd, FANUC Corporation, Kuka AG (Midea Group Co., Ltd.), Daifuku Co., Limited, Yaskawa Electric Corporation, Kawasaki Heavy Industries, Ltd., Amada Co., Ltd., Schuler Group GmbH (Andritz Group), Universal Robots A/S (Teradyne, Inc.) and TRUMPF SE + Co. KG.

The Robot segment is leading the Global Automotive Manufacturing Equipment Market by Equipment Type in 2022 thereby, achieving a market value of $4.4 billion by 2030.

The Asia Pacific market dominated the Global Automotive Manufacturing Equipment Market by Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $4.9 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.