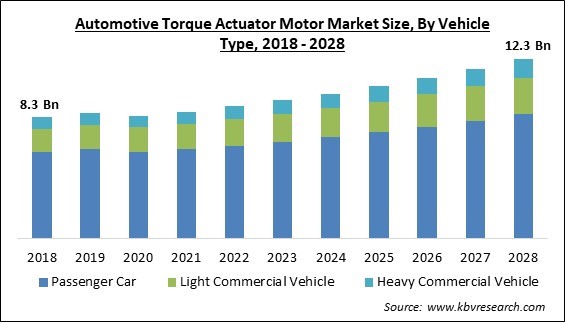

The Global Automotive Torque Actuator Motor Market size is expected to reach $12.3 billion by 2028, rising at a market growth of 5.3% CAGR during the forecast period.

A torque motor, sometimes called an automotive torque actuator motor, is a particular kind of DC electric motor. The car turbocharger is the primary use for the torque actuator motor. The torque actuator motor controls the turbocharger's throttle, which generates rotational energy force. It handles the vehicle's speed, fuel consumption, and airflow in the turbocharger. Also, the direct drive system, which comprises direct automotive current (DC) motors with turbochargers and exhaust gas recirculation, uses the torque motor of the automotive actuator (EGR).

Rotating torque is produced by electric motors from an electric current. In vehicles and trucks, they are the most prevalent electro-mechanical actuator. Almost every pump, fan, and positioner uses an electric motor in a car. More than one hundred motors may be found in luxury cars. These motors come in various sizes and powers, from the small milliwatt-powered stepper motors that move the indications on "analog" gauges to the starting motors used in internal combustion engine automobiles to the electric drives used in electric and hybrid vehicles (hundreds of kilowatts).

Automobile AC motors may be three-phase or single-phase. Motors that aren't DC-brushed motors need some power converter since an automobile's power source is normally a DC supply (such as a battery), which can't be used to drive a motor. Servo motors are motors with a controller that fixes the angle of the rotor using data from position sensors.

Torque motors produce high torque at moderate speeds and when stopped or "stalled." In contrast to conventional drives, a torque motor's selection and size are only focused on torque, not power. In essence, the peak torque establishes the most excellent torque that the motor is physically capable of producing, and the continuous torque establishes the maximum torque that the motor can constantly provide. The reliance on peak or continuous torque will be determined by the application's duty cycle.

The automobile production and sales activities are intricately related to the sales of automotive torque actuator motors. Due to the decline in car sales and production, the pandemic has affected providers of automotive torque actuator motors. When COVID-19 instances began to decline globally, severe measures and limitations were gradually relaxed internationally. Because of the pandemic, car manufacturing was slowed down internationally, but automobile makers concentrated on creating new products and declared strategic industry growth. These elements were in charge of the fluctuations in the sales of automobile torque actuator motors. The gradual easing of harsh regulations is predicted to encourage sales growth in the automotive torque actuator motor market and support a recovery in consumer demand for these motors.

When building automobiles for the automotive industry, the practice known as "turbocharger downsizing" substitutes smaller combustion turbochargers for larger ones with the same power capability. It results from manufacturers' attempts to provide cleaner-burning, more efficient automobiles, usually mandated by laws. To reduce the size of the Turbocharger overall, the cylinder count must be decreased. The friction in the Turbocharger is decreased by lowering the number of cylinders. Additionally, the continued desire for car manufacturers to comply with environmental emission rules is a major factor in expanding exhaust heat recovery system technology. Due to this, the market for automotive torque actuator motors is anticipated to grow due to the increased usage of exhaust heat recovery system technology for turbocharger downsizing.

To lessen pollution and the effect of cars on the environment, governments from all over the world have mandated the use of fuel-efficient vehicles. For instance, the EU has set mandates for manufacturers' fleets that call for an average fuel efficiency of 57 U.S. mpg in 2021, up from 41.9 mpg in 2015 and 92 mpg in 2030. Only a massive and impractical contribution from pricey electric automobiles can make this happen. The EU currently demands a 37.5% reduction in carbon dioxide (CO2) from 2021's 95 g/km to 59 g/km by 2030. Thus, increased fuel economy and turbocharger performance are the main factors driving the development of the automotive torque actuator motor market.

Due to issues like climate change and initiatives to attain net zero emissions, the market for electric cars is expanding dramatically. Moreover, the development of the EV business is aided by the favorable incentives and regulations that governments of many nations have implemented to encourage electric cars. The demand for electric vehicles has increased along with awareness of climate change, which has led to increased manufacture of these vehicles. In addition, several nations declared plans to phase out and prohibit gasoline and diesel vehicles. Such government actions encourage manufacturers and other market participants to follow the new electric car trend, which is predicted to hamper the market for automotive torque actuator motors

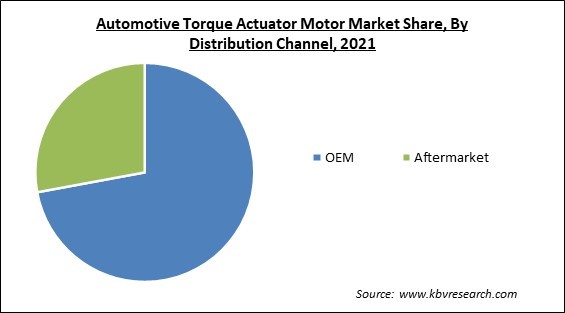

Based on distribution channel, the automotive torque actuator motor market is segmented into OEM and aftermarket. In 2021, the aftermarket segment witnessed a significant revenue share in the automotive torque actuator motor market. This is due to the better pricing of EV power batteries in these distribution channels. The word "aftermarket" refers to any market where customers are likely to buy an additional or related good or service after acquiring a primary good or service. The word "aftermarket" is used in the automobile industry to describe the addition of non-factory components, accessories, and enhancements to a vehicle after it has been placed on the market. The better pricing offered by these places is expected to surge the segment's growth.

Based on application, the automotive torque actuator motor market is segmented into turbocharger, electronic throttle control (ETC), exhaust gas circulation (EGR), and others. In 2021, the turbocharger segment garnered a promising growth rate in the automotive torque actuator motors market. This is because turbos boost an engine's strength, torque, and power, especially at low speeds. That's helpful for little petrol engines, which without a turbo tend to have low torque output at high speeds. In contrast, naturally aspirated diesel engines generate a lot of torque at low rpm. When a turbo is added, the result is amplified, which is the reason why turbo types of diesel feel so powerful when the throttle is depressed. These above-mentioned factors are expected to propel the segment's growth in the projected period.

Based on vehicle type, the automotive torque actuator motor market is segmented into light commercial vehicle, heavy commercial vehicle, and passenger car. The heavy commercial vehicle segment witnessed a considerable growth rate in the automotive torque actuator motor market in 2021. This is due to the demand for commercial cars in emerging countries will expand significantly in the following years due to urbanization and increasing industrial activity. Most commercial vehicles have rear-wheel-drive, which necessitates the use of high-performance differential assemblies. The demand for delivery and transportation solutions has increased due to new players and market leaders in automotive torque actuator motors operating in various developing country industries, such as the food industry and e-commerce, which has boosted the demand for heavy commercial vehicle production.

Based on type, the automotive torque actuator motor market is segmented into electrical and pneumatic & mechanical. The pneumatic & mechanical segment accounted for the maximum revenue share in the automotive torque actuator motor market in 2021. This is due to the automotive torque actuation systems employing pneumatic actuators. Cars often use them to give the driver easy and smooth clutch release and engagement. The pneumatic actuator has several advantages over its hydraulic counterpart, including lower power consumption, improved fuel efficiency, no need for routine maintenance or replacement, lightweight construction, and mobility, which will propel the segment's expansion.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 8.6 Billion |

| Market size forecast in 2028 | USD 12.3 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 5.3% from 2022 to 2028 |

| Number of Pages | 251 |

| Number of Table | 430 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Application, Vehicle Type, Distribution Channel, Type, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on region, the automotive torque actuator motor market is segmented into North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment recorded the highest revenue share in the automotive torque actuator motor market in 2021. This is due to increasing vehicle needs and increased vehicle ownership. Also, a number of technical advancements in electric cars are happening due to government initiatives, which promote growth even more. Moreover, the market will continue to expand due to factors such as the sharp rise in income levels and the rapid urbanization of emerging Asia-Pacific countries which is driving the market growth in the region.

Free Valuable Insights: Global Automotive Torque Actuator Motor Market size to reach USD 12.3 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include NSK Ltd., HIWIN Technologies Corp., Mabuchi Motor Co., Ltd., MITSUBA Corporation, Continental AG, Johnson Electric Holdings Limited, CTS Corporation, ElectroCraft, Inc. (DMI Technology Corporation), Val-Matic Valve & Manufacturing Corporation (A.Y. McDonald Manufacturing Company), and Bray International, Inc.

By Application

By Vehicle Type

By Distribution Channel

By Type

By Geography

The global Automotive Torque Actuator Motor Market size is expected to reach $12.3 billion by 2028.

Turbocharger optimization to lighten the vehicle are driving the market in coming years, however, A rise in interest in battery-powered cars restraints the growth of the market.

NSK Ltd., HIWIN Technologies Corp., Mabuchi Motor Co., Ltd., MITSUBA Corporation, Continental AG, Johnson Electric Holdings Limited, CTS Corporation, ElectroCraft, Inc. (DMI Technology Corporation), Val-Matic Valve & Manufacturing Corporation (A.Y. McDonald Manufacturing Company), and Bray International, Inc.

The expected CAGR of the Automotive Torque Actuator Motor Market is 5.3% from 2022 to 2028.

The Electronic Throttle Control (ETC) market acquired the maximum revenue share in the Global Automotive Torque Actuator Motor Market by Application in 2021, thereby, achieving a market value of $5.5 billion by 2028.

The Asia Pacific market dominated the Global Automotive Torque Actuator Motor Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $4.5 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.