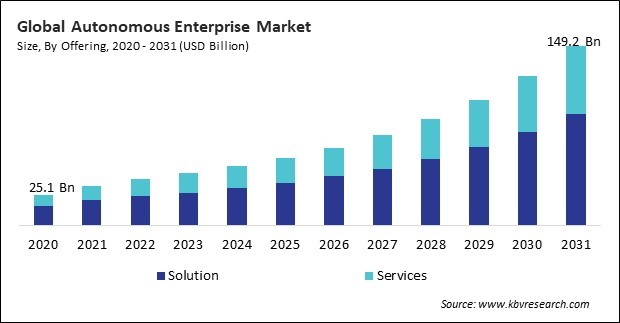

“Global Autonomous Enterprise Market to reach a market value of 149.2 Billion by 2031 growing at a CAGR of 17.2%”

The Global Autonomous Enterprise Market size is expected to reach $149.2 billion by 2031, rising at a market growth of 17.2% CAGR during the forecast period.

The North America segment procured 39% revenue share in the autonomous enterprise market in 2023. This dominance is driven by the region’s strong technological infrastructure, high investment in AI and automation technologies, and widespread adoption of advanced enterprise solutions across manufacturing, healthcare, and financial services. The market growth in this region is further accelerated by the significant investments in autonomous systems by key participants such as IBM, Microsoft, and Amazon.

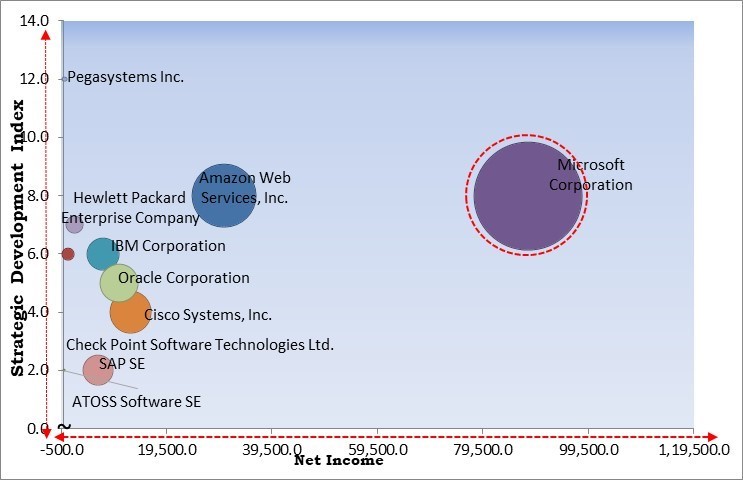

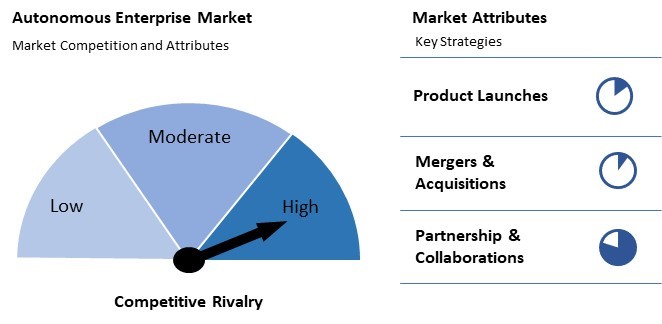

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In January, 2024, Pegasystems partnered with Blackbuck Education to launch a post-graduate Digital Process Automation program. Hosted at JNTUH and IIDT, the program offers hands-on training, certifications, and career support, preparing graduates for roles in digital process automation and bridging industry skills gaps. Moreover, In September, 2024, Amazon Web Services and Oracle have announced a strategic partnership, integrating Oracle Autonomous Database and Exadata services into AWS. This collaboration simplifies cloud migration, enhances flexibility and security, and supports enterprise modernization through automated and optimized cloud solutions.

Based on the Analysis presented in the KBV Cardinal matrix; Microsoft Corporation is the forerunner in the Autonomous Enterprise Market. In October, 2023, Microsoft Corporation came into partnership with Siemens to drive cross-industry AI adoption. They introduced Siemens Industrial Copilot, an AI-powered assistant for enhanced human-machine collaboration, and integrated Siemens Teamcenter with Microsoft Teams to boost productivity across various industries. Companies such as Pegasystems Inc. and Amazon Web Services, Inc. are some of the key innovators in Autonomous Enterprise Market.

AI and ML technologies are no longer limited to basic automation; they enable organizations to tackle complex decision-making processes, predict outcomes, and optimize operations with minimal human intervention. Robotic process automation (RPA) is one of the most frequently implemented AI technologies in the business sector. RPA uses AI and ML algorithms to perform repetitive and rules-based tasks traditionally handled by humans, such as data entry, invoice processing, and order management. Hence, advancements in AI and ML have allowed businesses to automate a wide range of operations.

Additionally, The widespread adoption of cloud computing is revolutionizing the development of these enterprises by providing scalable and flexible infrastructure. Instead of relying on traditional hardware, businesses now have access to on-demand cloud resources, enabling them to deploy AI-driven automation with reduced costs. This shift is particularly evident in healthcare, retail, and financial services industries, where cloud platforms like Microsoft Azure, Google Cloud, and Amazon Web Services (AWS) support essential operations. Thus, businesses across industries increasingly turn to cloud computing to support their move toward automation and more efficient operations.

Autonomous enterprises rely on a foundation of cutting-edge technologies such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT). To create an ecosystem where these technologies can operate effectively, businesses must make substantial investments in purchasing infrastructure, which includes AI platforms, IoT devices, and cloud services. These components are expensive and require frequent updates to stay current with evolving technological standards. Hence, such cost disparities create significant bottlenecks in market growth.

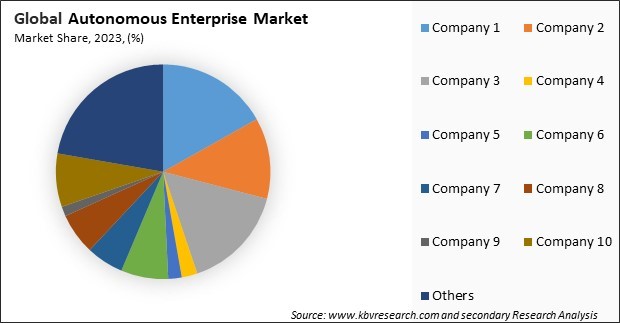

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

Based on offering, this market is bifurcated into solution and services. The services segment procured 37% revenue share in this market in 2023. Many organizations require expert assistance to integrate autonomous solutions with existing legacy systems, ensure compliance with regulations, and train personnel on new technologies. Moreover, the complexity of autonomous technologies often necessitates ongoing support and customization, further driving demand for services.

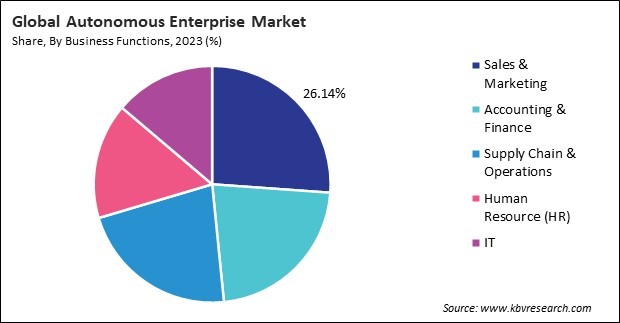

On the basis of business functions, this market is classified into accounting & finance, IT, human resources (HR), sales & marketing, and supply chain & operations. The supply chain & operations segment acquired 22% revenue share in this market in 2023. Businesses are progressively utilizing autonomous solutions to oversee logistics, inventory, and production processes as supply chains become more intricate and global. Autonomous technologies, such as AI-powered demand forecasting, autonomous warehousing, and robotic process automation, are helping businesses optimize their operations by reducing human error, improving inventory accuracy, and enhancing the efficiency of logistics management.

By application, this market is divided into process automation, customer & employee engagement, order management, credit evaluation & management, predictive maintenance, and others. The order management segment garnered 17% revenue share in this market in 2023. As e-commerce and digital transactions continue to rise, businesses are adopting autonomous systems to manage orders more efficiently, ensuring timely fulfillment, reducing errors, and improving customer satisfaction.

Based on vertical, this market is segmented into BFSI, IT & ITeS, telecom, retail & eCommerce, healthcare, transportation & logistics, manufacturing, government & defense, and others. The IT & ITeS segment acquired 16% revenue share in this market in 2023. The IT and ITeS industry is at the forefront of digital transformation, leveraging advanced technologies such as AI, machine learning, robotic process automation (RPA), and autonomous networks to optimize operations. Automating IT operations, enhancing system reliability, and improving cybersecurity have become a crucial competitive advantage for companies in this sector.

Free Valuable Insights: Global Autonomous Enterprise Market size to reach USD 149.2 Billion by 2031

Region-wise, this market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment acquired 26% revenue share in this market in 2023. The automation of manufacturing, logistics, and retail has been rapidly implemented by countries such as China, Japan, and South Korea. Government initiatives that encourage the adoption of artificial intelligence (AI) and the region's strong emphasis on digital transformation have contributed to the market's growth.

The autonomous enterprise market is driven by increasing demand for AI-driven solutions that enhance operational efficiency and decision-making. Competition centers around providing seamless automation, advanced analytics, and integration across industries like finance, manufacturing, and logistics. Key differentiators include technological innovation, scalability, and customization to address diverse business needs and challenges.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 43.2 Billion |

| Market size forecast in 2031 | USD 149.2 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 17.2% from 2024 to 2031 |

| Number of Pages | 462 |

| Tables | 723 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Offering, Business Functions, Application, Vertical, Region |

| Country scope |

|

| Companies Included | Microsoft Corporation, IBM Corporation, Amazon Web Services, Inc. (Amazon.com, Inc.), Check Point Software Technologies Ltd., Pegasystems Inc., Cisco Systems, Inc., Hewlett Packard Enterprise Company, SAP SE, ATOSS Software SE, and Oracle Corporation |

By Offering

By Business Functions

By Application

By Vertical

By Geography

This Market size is expected to reach $149.2 billion by 2031.

Advancements In Artificial Intelligence (Ai) And Machine Learning (Ml) are driving the Market in coming years, however, Substantially High Initial Investment Costs restraints the growth of the Market.

Microsoft Corporation, IBM Corporation, Amazon Web Services, Inc. (Amazon.com, Inc.), Check Point Software Technologies Ltd., Pegasystems Inc., Cisco Systems, Inc., Hewlett Packard Enterprise Company, SAP SE, ATOSS Software SE, and Oracle Corporation

The expected CAGR of this Market is 17.2% from 2024 to 2031.

The Solution segment led the maximum revenue in the Market by Offering in 2023, thereby, achieving a market value of $92.7 billion by 2031.

The North America region dominated the Market by Region in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $55.2 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges