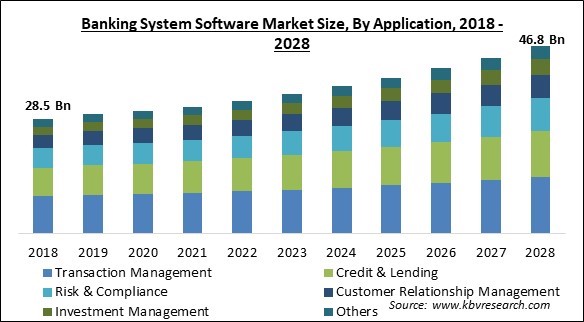

The Global Banking System Software Market size is expected to reach $46.8 billion by 2028, rising at a market growth of 5.9% CAGR during the forecast period.

Banks are provided with the newest technology developments in banking because of banking system software. Banking software satisfies the needs of banks by automating their banking procedures and improving client efficiency. Moreover, banking software provides tailored solutions to meet the particular needs of potential customers. Worldwide, mid and large-size institutions can access cutting-edge technology and cost-effective banking solutions owing to banking software.

The widespread use of smartphones and the internet has increased the demand for financial system software. Customers may now manage their accounts as well as complete transactions via mobile personal devices due to the growth of digital banking, which has increased the need for reliable, secure, and cutting-edge solutions that improve customer experience.

Another important factor influencing the banking system software market is digital transformation. With the implementation of new technology, banks are searching for methods to modernize their processes and enhance the client experience. This includes building software programs that might automate manual procedures, lower mistake rates, and deliver real-time data. Thus, there is a rising need for software programs for digital banking that might aid in the banking sector's transformation.

The market for banking system software has also been significantly impacted by the growth of fintech. Innovative software solutions provided by fintech companies are revolutionizing how people handle their finances. In order to compete with fintech firms and maintain up with the evolving financial scene, banks are searching for technological solutions. As a result, there is an increasing need for software programs that may enhance both customer satisfaction and financial management.

The market is anticipated to grow over the next years as a result of businesses' increasing requirement to assess the elements of their client management systems in order to address the current context of their enterprises. Furthermore, businesses deploy cutting-edge capabilities provided by intelligent client connection and customer relationship management platforms throughout the pandemic. Additionally, it is anticipated that the banking system software market will grow quickly due to the banking industry's digitalization.

Major firms are also concentrating on introducing new items to obtain an advantage over rivals in the market. Customers of new items would receive complete banking capability. Its goal is to hasten business use of the cloud. Hence, the market expansion of banking systems software is projected to be driven by various banks' increasing usage of cloud-based banking systems. Additionally, it is anticipated that increasing adoption of Payment-as-a-Service (PaaS), Big Data, remote banking solutions, and cybersecurity will spur market expansion during the projected period. These elements would support the growth of the regional market.

IoT has a variety of impacts on banking customer service. Consumers benefit from timely information and a tailored experience. Due to gadget connectivity, a visitor can book an appointment and validate it on their phone. Consumers now comprehend when they can stand in the queue rather than wait at the counter. The bank also keeps track of each client's appointments, the services they use each time they visit, and any inquiries they may have. Banks may offer their customers more services than simply the traditional ones owing to IoT technology. For instance, US banks have begun implementing IoT initiatives to motivate their clients to lead healthy lifestyles.

The sensitive data security and protection issue, which is handled by the bulk of the banking sector, is the biggest obstacle to IoT adoption. Due to the potential for serious consequences of any data leak or security breach, the banking industry is heavily controlled by stringent adherence to standards and governance. As a result, companies are putting more and more useful as well as provider data into complex, AI-powered algorithms, creating innovative personal data without considering how it will affect clients and staff, which in turn is causing privacy concerns to rise. As a result, this would limit the growth of the banking system software market.

Based on component, the banking system software market is segmented into software (without services) and services. In 2021, the software segment dominated the banking system software market with maximum revenue share. The market for banking system software has been primarily dictated by the rise in people purchasing mobile devices. As a result, retailers have been hard at work developing application suites that offer protected and secure financial management systems. These systems are intended to cut down on fraud and other undesirable behaviors. The expedited use of this software is promoting the growth of the segment.

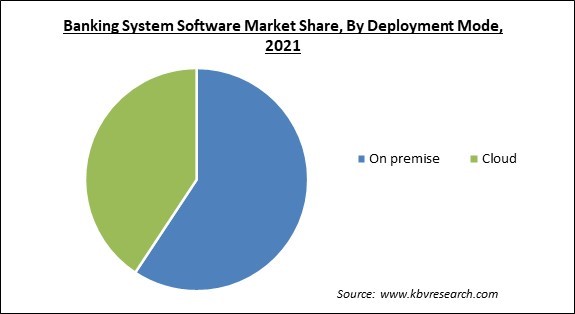

Based on deployment mode, the banking system software market is segmented into on-premise and cloud. The on-premise segment dominated the market in 2021 and accounted for a highest revenue share. Given the sensitive aspect of financial data and the requirement for banks to keep control of their IT infrastructure, the on-premise deployment method is the one that is recommended. Through the use of an on-premise deployment, financial institutions can keep their software and data on their servers, which grants them full ownership of what they store as well as the ability to protect confidentiality and privacy.

Based on operating system, the banking system software market is segmented into android, windows, iOS, and others. The windows segment is anticipated to register significant growth rate in the banking system software market in 2021. The increasing popularity of cloud computing is fueling demand for banking system software that runs on Microsoft Windows. Windows is a successful cloud-based financial solutions system, allowing clients to access their financial data from any location and on any device, they want. Cloud computing offers users this capability.

Based on organization size, the banking system software market is segmented into large enterprises and small & medium enterprises. The small & medium enterprises segment procured a remarkable growth rate in the banking system software market in 2021. The fact that banking system software may be modified to cater to the individual requirements of small and medium-sized businesses is one of the key elements contributing to expanding the market segment. Small and medium businesses often have more versatile and streamlined financial activities than huge corporations, which typically have complicated financial operations and severe regulatory requirements.

Based on application, the banking system software market is segmented into transaction management, credit & lending, risk & compliance, customer relationship management, investment management, and others. The transaction management segment dominated the market in 2021 and accounted for a largest revenue share. Transaction management is crucial for financial institutions since it guarantees that financial transactions are accurate, secure, and efficient. This is one of the most important reasons why transaction management is so important. Moreover, transaction management provides financial institutions with real-time insight and control over business transactions, which enables financial institutions to rapidly and conveniently manage and monitor their financial operations.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 31.7 Billion |

| Market size forecast in 2028 | USD 46.8 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 5.9% from 2022 to 2028 |

| Number of Pages | 399 |

| Number of Table | 643 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Operating System, Deployment Mode, Organization Size, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on region, the banking system software market is segmented into North America, Europe, Asia Pacific, and LAMEA. North America region witnessed the maximum revenue share in the banking system software market in 2021. The expansion of the regional market has been helped by the presence of many of the world's most successful banking software businesses in the region. These companies include Bank of America, JPMorgan Chase, and Citigroup. These businesses have a great need for innovative banking system software products that may help them optimize their business processes and boost their level of competitiveness.

Free Valuable Insights: Global Banking System Software Market size to reach USD 46.8 Billion by 2028

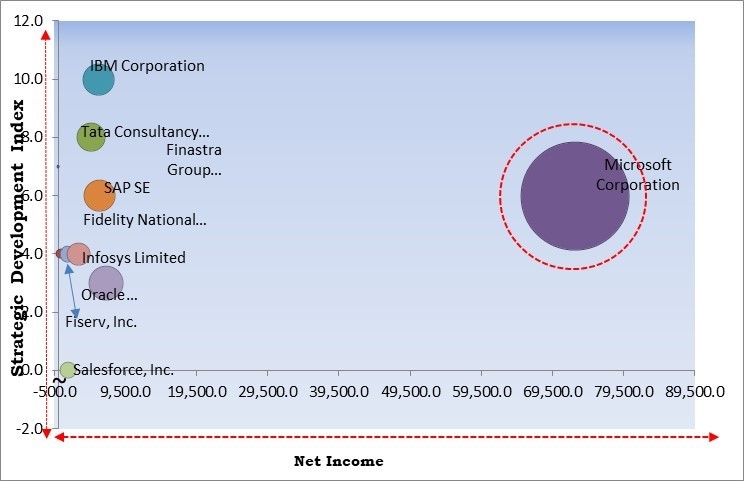

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Microsoft Corporation is the forerunners in the Banking System Software Market. Companies such as Oracle Corporation, SAP SE and IBM Corporation are some of the key innovators in Banking System Software Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include IBM Corporation, Microsoft Corporation, SAP SE, Salesforce.com, Inc., Oracle Corporation, Tata Consultancy Services Ltd., Infosys Limited, Fiserv, Inc., Fidelity National Information Services, Inc., and Finastra Group Holdings Limited (Vista Equity Partners).

By Application

By Operating System

By Deployment Mode

By Organization Size

By Component

By Geography

The global Banking System Software Market size is expected to reach $46.8 billion by 2028.

Increasing enterprise use of cloud-based solutions are driving the market in coming years, however, Rising number of security breaches and data theft restraints the growth of the market.

IBM Corporation, Microsoft Corporation, SAP SE, Salesforce.com, Inc., Oracle Corporation, Tata Consultancy Services Ltd., Infosys Limited, Fiserv, Inc., Fidelity National Information Services, Inc., and Finastra Group Holdings Limited (Vista Equity Partners).

The Android segment acquired maximum revenue share in the Global Banking System Software Market by Operating System in 2021 thereby, achieving a market value of $15.3 billion by 2028.

The Large Enterprises segment is leading the Global Banking System Software Market by Organization Size in 2021 thereby, achieving a market value of $30.4 billion by 2028.

The North America market dominated the Global Banking System Software Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $16.2 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.