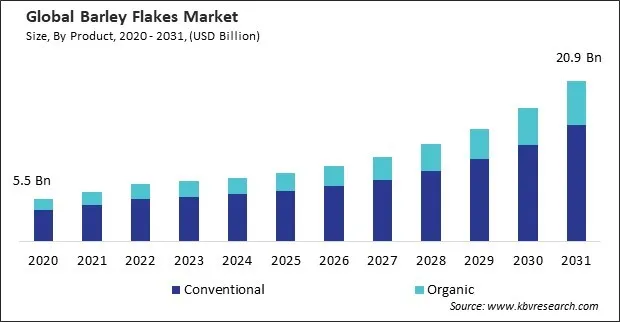

“Global Barley Flakes Market to reach a market value of 20.9 Billion by 2031 growing at a CAGR of 14.1%”

The Global Barley Flakes Market size is expected to reach $20.9 billion by 2031, rising at a market growth of 14.1% CAGR during the forecast period. In the year 2023, the market attained a volume of 1,263.60 kilo tonnes, experiencing a growth of 10.3% (2020-2023).

The demand for plant-based, nutrient-dense foods is rising as more Australians embrace vegan and vegetarian lifestyles. Barley flakes are a popular option because of their high fiber content and many health advantages. Australia's growing vegan and vegetarian population drives the barley flakes market as consumers increasingly seek wholesome, natural products. Consumers' increased health consciousness and their increasing adherence to Western eating practices, which include whole grains like barley, are the main drivers of growth in this area. Consequently, in 2023, the Asia Pacific region generated 1/4th revenue share in the market. In terms of volume, 1,239.57 kilo tonnes of barney flakes are expected to be utilized by the year 2031. Countries such as China, India, and Japan are experiencing increasing demand for healthy breakfast cereals, including barley flakes, due to changing lifestyles and the influence of global food trends. Moreover, the expanding middle-class population with higher disposable incomes and the rapid growth of the retail sector in the Asia Pacific region contribute to the significant market share of barley flakes in this area.

The trend toward incorporating ancient grains into modern diets has also played a pivotal role in propelling the demand for barley flakes. Barley flakes are a popular option for consumers who are concerned about their health because they fit in with the plant-based and whole-food diets that are becoming increasingly popular. This awareness of health benefits helps the barley flakes market grow. Additionally, the demand for ready-to-eat options is further fuelled by the desire for balanced meals catering to gluten-free or vegan dietary preferences. Barley flakes, as a versatile and nutritious base, serve as an attractive offering within this space, leading to further market expansion. This shift in consumer behaviour toward faster yet healthy food options continue to drive the barley flakes market forward. In conclusion, increasing health consciousness among consumers and the growing demand for convenient and ready-to-eat breakfast options propels the market's growth.

However, as competition intensifies among breakfast cereals, price wars can affect consumer choices, with many opting for cheaper, more widely available options. If barley flakes are positioned as a premium product, it may limit their appeal to a niche market rather than capturing a broader demographic. This price sensitivity remains a key restraint for barley flakes' growth potential. Therefore, the high price of barley flakes compared to other breakfast cereals is hindering the market's growth.

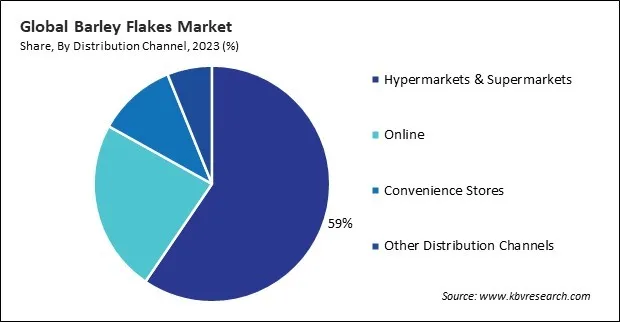

On the basis of distribution channel, the market is segmented into hypermarkets & supermarkets, online, convenience stores, and others. The hypermarkets & supermarkets segment recorded 60% revenue share in the market in 2023. In terms of volume, 1,629.12 kilo tonnes of barley flakes are expected to be sold through hypermarkets & supermarkets by the year 2031. This can be attributed to the widespread availability of barley flakes in these stores, which consumers frequent for grocery shopping. Hypermarkets and supermarkets offer a variety of brands and product choices, making it convenient for consumers to compare and purchase barley flakes.

Based on product, the market is divided into conventional and organic. The organic segment attained 26% revenue share in the barley flakes market in 2023. In terms of volume, 629.14 kilo tonnes of organic barley flakes are expected to be utilized by the year 2031. This segment's growth reflects the increasing consumer preference for organic and health-conscious food products. Organic barley flakes are produced without synthetic chemicals, adhering to strict agricultural standards that promote environmental sustainability and health benefits.

Free Valuable Insights: Global Barley Flakes Market size to reach USD 20.9 Billion by 2031

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Europe region witnessed 38% revenue share in the market in 2023. In terms of volume, 781.39 kilo tonnes of barney flakes are expected to be utilized by the year 2031. This dominance can be attributed to the region's high consumer demand for healthy and nutritious food products. Barley's popularity has increased dramatically as people become more aware of its health advantages, including its high fiber content and potential to lower cholesterol levels. Additionally, major market players and the widespread availability of barley flakes in various retail channels, including supermarkets and online stores, further support the market's growth in Europe.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 7.9 Billion |

| Market size forecast in 2031 | USD 20.9 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 14.1% from 2024 to 2031 |

| Quantitative Data | Volume in Kilo Tonnes, Revenue in USD Billion, and CAGR from 2020 to 2031 |

| Number of Pages | 235 |

| Number of Tables | 509 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Product, Distribution Channel, Region |

| Country scope |

|

| Companies Included | Nestle S.A., King Arthur Baking Company, Inc., Briess Malt & Ingredients Co., Bob’s Red Mill Natural Foods, Inc., Kellogg Company, PepsiCo, Inc. (The Quaker Oats Company), Nature’s Path Foods, Inc., Grain Millers, Inc., Post Holdings, Inc. (Attune Foods LLC) |

By Product (Volume, Kilo Tonnes, USD Billion, 2020-2031)

By Distribution Channel (Volume, Kilo Tonnes, USD Billion, 2020-2031)

By Geography (Volume, Kilo Tonnes, USD Billion, 2020-2031)

This Market size is expected to reach $20.9 billion by 2031.

Increasing Health Consciousness Among Consumers Driving Demand for Barley Flakes are driving the Market in coming years, however, High Price of Barley Flakes Compared to Other Breakfast Cereals restraints the growth of the Market.

Nestle S.A., King Arthur Baking Company, Inc., Briess Malt & Ingredients Co., Bob’s Red Mill Natural Foods, Inc., Kellogg Company, PepsiCo, Inc. (The Quaker Oats Company), Nature’s Path Foods, Inc., Grain Millers, Inc., Post Holdings, Inc. (Attune Foods LLC)

In the year 2023, the market attained a volume of 1,263.60 kilo tonnes, experiencing a growth of 10.3% (2020-2023).

The Conventional segment is leading the Market by Product in 2023; thereby, achieving a market value of $15.1 billion by 2031.

The Europe region dominated the Market by Region in 2023; thereby, achieving a market value of $7.7 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges