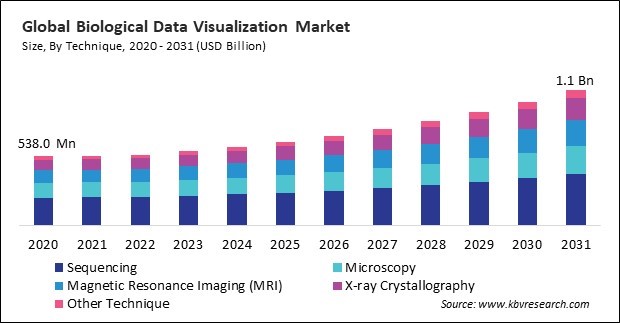

“Global Biological Data Visualization Market to reach a market value of 1.1 Billion by 2031 growing at a CAGR of 8.2%”

The Global Biological Data Visualization Market size is expected to reach $1.1 billion by 2031, rising at a market growth of 8.2% CAGR during the forecast period.

MRI is a crucial non-invasive imaging technique widely used in medical diagnostics, particularly for imaging soft tissues in the brain, spine, and joints. The demand for advanced MRI visualization tools is growing due to their ability to provide high-resolution, 3D images for more precise diagnostics and treatment planning. Hence, in 2023, the magnetic resonance imaging (MRI) segment held nearly 1/5th revenue share in the market. Integrating AI and machine learning into MRI visualization software further enhances image quality, aids in automating analyses, and improves decision-making, driving market growth in this segment.

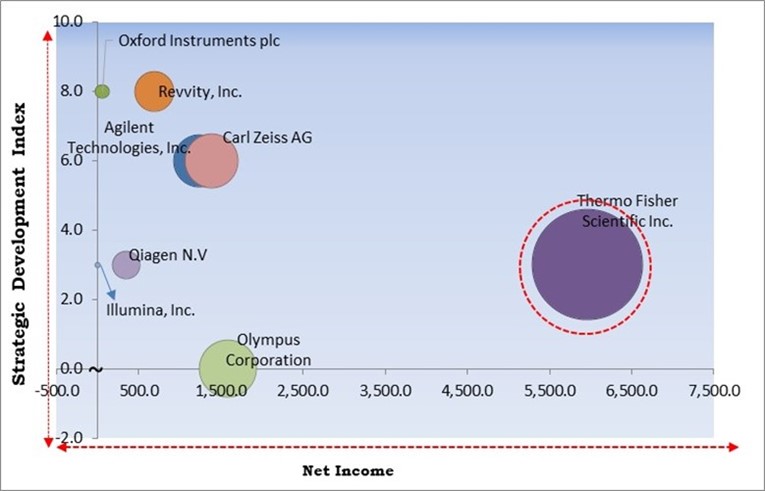

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In February, 2024, Revvity, Inc. launched the Signals Clinical™ solution, an end-to-end clinical data science platform designed to centralize clinical trial data for faster, data-driven decisions. Integrated with Spotfire® visual analytics, the platform enables seamless data visualization, empowering quicker clinical insights and advancing drug development. Additionally, In October, 2023, Illumina, Inc. introduced the TruSight™ Software Suite, a solution designed to enhance the identification of genetic diseases using whole-genome sequencing. Developed in collaboration with Mayo Clinic, this software streamlines the process of analyzing genetic variants, reducing interpretation time from weeks to hours. TruSight Software aims to improve rare disease diagnostics, addressing high costs and lengthy diagnostic odysseys by enabling faster, more accurate genetic analysis.

Based on the Analysis presented in the KBV Cardinal matrix; Thermo Fisher Scientific Inc. is the forerunner in the Biological Data Visualization Market. In October, 2024, Thermo Fisher Scientific launched Amira-Avizo Software, a robust visualization solution for core imaging facilities. This software provides 2D–5D imaging capabilities, facilitating comprehensive data analysis and visualization across life sciences, materials science, and natural sciences. Companies such as Carl Zeiss AG, Agilent Technologies, Inc. and Olympus Corporation are some of the key innovators in Biological Data Visualization Market.

The COVID-19 outbreak highlighted the importance of bioinformatics in understanding viruses and diseases, resulting in an increased reliance on biological data visualization platforms to analyze genomic data and track virus mutations. The urgent need for real-time analysis of COVID-19-related data, such as infection rates, hospital capacities, and vaccination coverage, created a demand for dynamic biological data visualization tools capable of representing real-time updates and trends. Thus, the COVID-19 pandemic had a positive impact on the market.

Integrating multi-omics data is crucial for advancing personalized medicine and improving therapeutic outcomes. As omics technologies continue to develop, the need for more sophisticated visualization tools becomes essential. Tools capable of visualizing large, high-dimensional data will play a key role in enabling breakthroughs in genomics, cancer research, and other complex biological fields, driving demand for biological data visualization solutions. Thus, expansion of omics technologies and integration of multi-omics data is driving the growth of the market.

The aging global population and the increasing prevalence of chronic diseases like cancer and cardiovascular disorders are amplifying the demand for efficient data interpretation. The ability to quickly and accurately interpret biological data can significantly enhance treatment outcomes and optimize healthcare processes, leading to broader adoption of biological data visualization in healthcare systems. In conclusion, rising demand for efficient data interpretation in healthcare is driving the growth of the market.

The financial and technical barriers to adopting advanced visualization tools greatly restrain their widespread use, especially in regions or organizations with limited research and technological investment resources. This can slow the market's overall growth for biological data visualization tools. In conclusion, high cost and complexity of implementing advanced visualization tools is impeding the growth of the market.

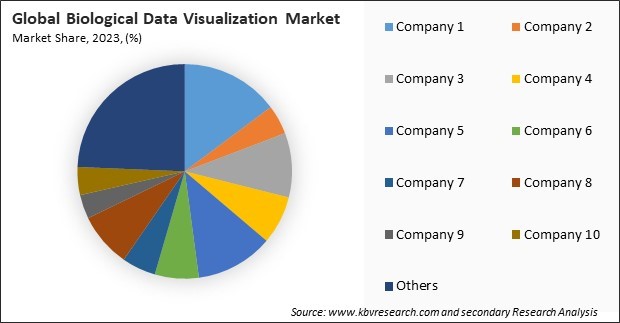

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

By end use, the market is divided into academic research, pharmaceutical & biotechnology companies, hospitals & clinics, and others. In 2023, the academic research segment registered 63% revenue share in the market. Academic research remains the dominant driver of demand for biological data visualization tools, as researchers across universities, research institutes, and laboratories heavily rely on advanced visualization methods to analyze and interpret biological data. This includes the visualization of genetic sequences, protein structures, cellular behavior, and imaging data, which are critical for various fields of biological science.

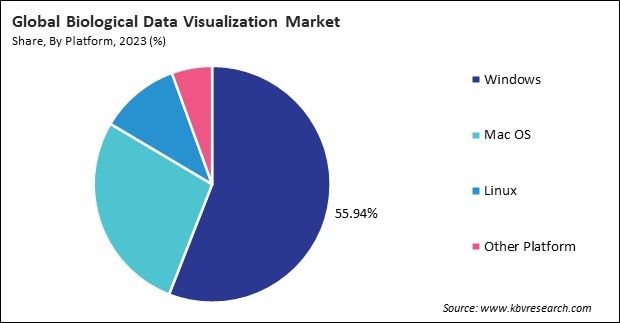

On the basis of platform, the market is segmented into Windows, Mac OS, Linux, and others. The Windows segment recorded 56% revenue share in the market in 2023. Windows remains the dominant platform for biological data visualization due to its widespread use in the research and healthcare sectors. Many biological data visualization tools and software are optimized for Windows, providing researchers with powerful, user-friendly interfaces for processing and visualizing complex biological data.

Based on application, the market is categorized into cell & organism imaging, alignment, phylogeny, & evolution, genomic analysis, system biology, and structural biology & molecular modeling. The alignment, phylogeny, & evolution segment witnessed 23% revenue share in the market in 2023. This segment analyzes evolutionary relationships and genetic alignments, helping researchers visualize the genetic connections between species, populations, and individuals. Tools for phylogenetic tree construction, gene sequence alignment, and evolutionary modelling are in high demand, particularly in evolutionary biology, anthropology, and biodiversity studies.

Based on technique, the market is divided into sequencing, microscopy, magnetic resonance imaging (MRI), x-ray crystallography, and others. The microscopy segment procured 21% revenue share in the market in 2023. Microscopy techniques, including electron and fluorescence microscopy, are critical in visualizing cellular structures and biological processes at a microscopic level. Visualization software enhances image clarity, accuracy, and analysis, enabling scientists to study intricate biological phenomena.

Free Valuable Insights: Global Biological Data Visualization Market size to reach USD 1.1 Billion by 2031

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region witnessed 42% revenue share in the market in 2023. North America remains the dominant market due to the strong presence of advanced research facilities, universities, pharmaceutical and biotechnology companies, and healthcare institutions. The region is home to leading players in the biological data visualization industry, driving the adoption of innovative technologies in research and clinical applications.

The Biological Data Visualization Market is highly competitive, fueled by the increasing need for advanced tools to interpret complex biological datasets in fields like genomics, proteomics, and drug discovery. Providers are focused on delivering visualization platforms that offer clarity, scalability, and integration with analytical tools to support data-driven research. As the volume of biological data grows, competition centers around user-friendly interfaces, real-time visualization capabilities, and compatibility with diverse data sources. Continuous innovation in machine learning and graphical representation is essential for companies to stay competitive and meet the evolving demands of researchers and healthcare professionals.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 580 Million |

| Market size forecast in 2031 | USD 1.1 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 8.2% from 2024 to 2031 |

| Number of Pages | 332 |

| Number of Tables | 503 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share, Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Technique, Platform, Application, End Use, Region |

| Country scope |

|

| Companies Included | Thermo Fisher Scientific Inc., 3M Company, Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Illumina, Inc., Revvity, Inc., Qiagen N.V, Carl Zeiss AG, Oxford Instruments plc, Olympus Corporation |

By Technique

By Platform

By Application

By End Use

By Geography

This Market size is expected to reach $1.1 billion by 2031.

Rising Demand for Efficient Data Interpretation in Healthcare are driving the Market in coming years, however, High Cost and Complexity of Implementing Advanced Visualization Tools restraints the growth of the Market.

Thermo Fisher Scientific Inc., 3M Company, Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Illumina, Inc., Revvity, Inc., Qiagen N.V, Carl Zeiss AG, Oxford Instruments plc, Olympus Corporation

The expected CAGR of this Market is 8.2% from 2024 to 2031.

The Sequencing segment is leading the Market by Technique in 2023; thereby, achieving a market value of $397.9 million by 2031.

The North America region dominated the Market by Region in 2023; thereby, achieving a market value of $420.5 million by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges