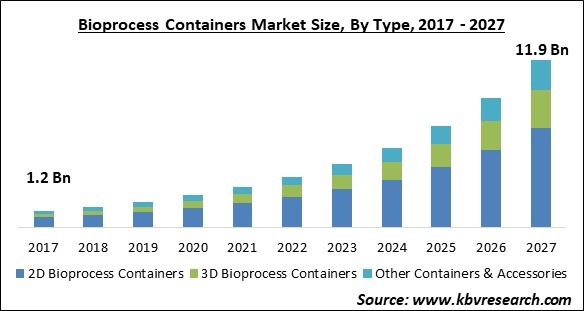

The Global Bioprocess Containers Market size is expected to reach $11.9 billion by 2027, rising at a market growth of 26.2% CAGR during the forecast period.

The bioprocess containers are flexible, single-use containers mainly developed to store sterile liquids. The bioprocess containers are also used in the biopharmaceutical industry for manufacturing various vaccines. In addition, the main function of bioprocess containers is to increase the speed of the biopharmaceutical process & facilitate the storage process of sterile liquids. Additionally, the Bioprocess containers are equipped with ports, fitting, tubbing, and plastic films.

In the healthcare sector, one of the major concerns for stakeholders is the cross contamination of the product. The possibilities of cross contamination occur when the same processed equipment is utilized to produce various monoclonal antibodies proteins.

Contamination of unessential protein could decrease the production yields as it needs some more purifications or the proteins which can co-purify lead to possibly fatal treatments. However, the possibility of cross contamination is eliminated by using single use bioprocess containers as the product flow path of the product is discarded & replaced after every batch.

The most important component of a bioprocess container chamber is the port which connect chamber to the tube. In addition, there is a wide variety of port designs available in the market considering the chamber’s type. The bioprocess container chamber is needed to be developed in ISO 7 certified cleanrooms and then the additional components are attached to the chamber, developing a complete bioprocess container. Assembling a bioprocess container is a process that enables the production of customized bioprocess containers assemblies to perform all the tasks in smooth manner.

The outspread of the C0VID-19 pandemic resulted in the imposition of various restrictions over trade and the lockdown to curb the transmission rate, which in turn disrupted the supply chains and the production in various sectors. As a result, the global economy declined immensely. Whereas, the Bioprocess container industry witnessed massive growth during the pandemic period. The pharmaceutical companies significantly utilized bioprocess containers to come up with the treatments and vaccines for novel coronavirus.

Most of the COVID-19 vaccination program uses several approaches which include the mRNA, DNA vaccine and vectors which are mainly developed by single-use technology. Most of the facilities related to the COVID-19 are using single-use systems because of the high speed, lower cost along with the flexibility of bioprocess containers in comparison to stainless steel equipment.

The rising demand for advanced technologies for various activities in the healthcare industry would need more bioprocess containers in the upcoming years. The pharmaceutical industry faces various challenges which could be easily overcome by adopting various advanced technologies. The adoption of advanced single use technologies such as bio process containers may result in improved efficiency of bio pharmaceutical industry in terms of the quality and quantity of the produced medicines.

Many patented products would become off-patent in coming years which is resulting in a shortage of funds for companies to invest in R&D pipelines. In addition, by eliminating cleaning-in-place and sterilization-in-place (CIP/SIP) systems, setup, maintenance, and validation times are reduced, allowing for improved productivity. Due to cheaper expenditure, bioprocess containers allow for a faster time to market and a decrease in risk earlier in the product development cycle.

One of the major issues faced by biomanufacturing companies is the disposal of solid waste generated due to the use of single use technologies such as bioprocess containers which also increases the cost of waste management. Additionally, many of the bioprocess containers are made up of multiple materials or layers which mainly include ethylene vinyl alcohol, polyethylene, nylon, or polypropylene. There is a need for extra efforts in order to separate such products into homogeneous components.

Based on type, the bio process container market is segmented into 2D bioprocess containers and 3D bioprocess containers. In 2020, the 2D bioprocess container segment dominated the market by generating the maximum revenue. The 2D bioprocess containers are generally utilized for transporting the bulk amount of drug products & precursors and cell harvesting. These types of containers help expedite the biopharmaceutical production process and are helpful in fluid management, media preparation, and storage.

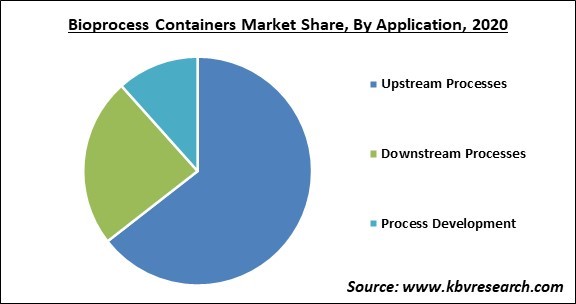

On the basis of application, the bio process container market is fragmented into upstream processes, downstream processes and process development. The downstream process segment acquired a significant market share in 2020. The downstream process is the recovery & purification of biochemical products. It includes various activities such as product recovery, filtration, cell separation, extraction of product. These are the important steps to be followed for getting the pure form of the product. These activities can be performed with the help of bio process containers.

By end user, the bio process container market is divided into pharmaceutical & biopharmaceutical companies, CROs & CMOs and academic & research institutes. The CROs & CMOs segment would showcase a promising revenue share in the market over the forecast years. This is due to the rising number of biotechnology companies, a surge in the number of research projects in the pharmaceutical sector. Moreover, the growth of the segment is expected to be driven by the rise in inclination towards outsourcing research and manufacturing activities.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 2.3 Billion |

| Market size forecast in 2027 | USD 11.9 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 26.2% from 2021 to 2027 |

| Number of Pages | 209 |

| Number of Tables | 350 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Application, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the bio process container market is analyzed in North America, Europe, Asia Pacific and LAMEA. In 2020, the North American region emerged as the leading region in the overall bioprocess container market. This is due to the widespread presence of many pharmaceutical companies that need bioprocess container for storing and preserving the medicines, and vaccines.

Free Valuable Insights: Global Bioprocess Containers Market size to reach USD 11.9 Billion by 2027

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Saint-Gobain Group, Thermo Fisher Scientific, Inc., Danaher Corporation, Merck Group, Avantor, Inc., Parker Hannifin Corporation, Corning Incorporated, Entegris, Inc., Lonza Group Ltd., and Sartorius Stedim Biotech S.A. (Sartorius AG).

By Type

By Application

By End User

By Geography

The bioprocess containers market size is projected to reach USD 11.9 billion by 2027.

Growing demand for advanced technologies are driving the market in coming years, however, disposable of Waste have limited the growth of the market.

Saint-Gobain Group, Thermo Fisher Scientific, Inc., Danaher Corporation, Merck Group, Avantor, Inc., Parker Hannifin Corporation, Corning Incorporated, Entegris, Inc., Lonza Group Ltd., and Sartorius Stedim Biotech S.A. (Sartorius AG).

The expected CAGR of the bioprocess containers market is 26.2% from 2021 to 2027.

The Pharmaceutical & Biopharmaceutical Companies market acquired maximum revenue share in the Global Bioprocess Containers Market by End User 2020, thereby, achieving a market value of $5.3 billion by 2027.

The North America market region is leading the Global Bioprocess Containers Market by Region 2020, and would continue to be a dominant market till 2027.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.