The Global Bioprocess Validation Market size is expected to reach $650.6 Million by 2028, rising at a market growth of 8.5% CAGR during the forecast period.

The documentation of all procedures, evidence, and activities of the process of biological and biopharmaceutical product formation is known as bioprocess validation. The documentation is performed as per the guidelines of various regulatory bodies, for instance, US FDA (Food and Drug Administration).

It ensures the maintenance of compliance in all the stages of the product testing procedures. Assessing Active Pharmaceutical Ingredients (API) and impurities is essential to bioprocess validation. The primary principle of validation is to ensure that every process of the bioproduct processing is evaluated, which provides quality products, maintaining scientifically documented evidence.

Quality, efficacy, and safety are maintained during the bioprocess validation. Validation has become an essential issue in manufacturing biopharmaceuticals or biologies intended for therapeutic usage. In addition to the validation of final product quality, manufacturing process validation is gaining wide attention. Bioprocesses are sensitive and delicate and hence require careful planning and organization for successful process validation. As a result, bioprocess chromatography is the most generally utilized unit operation in biologics manufacturing.

The COVID-19 pandemic has adversely impacted the world economy due to the imposed lockdown, business shutdown, and restriction on travel. This critically affected numerous industries' manufacturing plants and factories, affecting the sales and product supply chains negatively. The rising COVID-19 infections have led to the development of precision medicines and biosimilars that raise the demands for outsourcing services and the bioprocess validation process. As a result, major market players have also started to enhance and implement the validation process for the bioprocess of biologics and drug developments. An effective validation ensures the product's safety, quality, and efficiency, which is expected further to surge the market growth of the bioprocess validation.

In the pharmaceutical sector, compliance with the standards of different regulatory bodies is essential, which is why bioprocess validation is an integrated process in pharmaceuticals. Validation verifies that all procedures stick to the stated requirements by the government’s regulations. Any validation method requires exhaustive documentation that conforms to standard operating procedures and ongoing activities. Pharmaceutical manufacturing is being outsourced to third-party service providers to raise production yields. The wide usage of disposable technologies in medication development aids in reducing production costs. The increasing outsourcing of bioprocesses validation to third-party service providers will propel the growth of the bioprocess validation market.

The implementation of single-use bioprocessing systems enhances manufacturing processes' productivity by reducing automation's cost and complexity. It also eliminates the requirement for changeover cleaning/validation between consecutive operations. In addition, single-use bioprocessing systems eliminate the need for additional investments by removing the requirement for sterilization. The initial investment costs with single-use bioprocessing systems are lower compared to that of the stainless-steel facility at the same scale, making it suitable for new players with low investments. Thereby boosting the demand for the bioprocess validation market.

The food and pharmaceutical sectors are dealing with difficulties with the trace quantity of contaminants generated by the extraction or leaching process. Even after the strict regulations of many nations’ governments, corporations are still disregarding such issues and the risk to the lives of consumers/patients. Pharmaceutical manufacturers and regulatory agencies are concerned with extractable and leachable. Any containers and pharmaceutical packaging system, including plastic bottles, labeling ink, packing materials, glass, and foil pouches, can leach undesired pollutants into the food ingredient or drug products. Oral drugs, parental and ophthalmic products often pose a more eminent danger. Hence, the issues related to extractables and leachable are expected to hamper the growth of the bioprocess validation market.

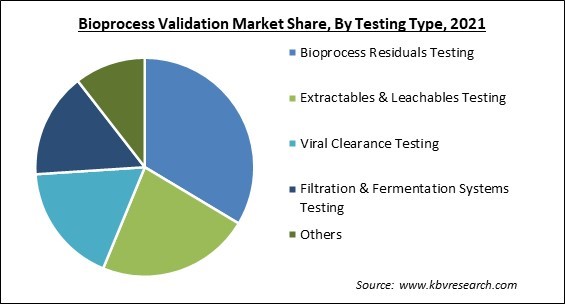

Based on testing type, the bioprocess validation market is segmented into extractables & leachables testing, bioprocess residuals testing, viral clearance testing, filtration & fermentation systems testing and others. The extractables & leachables testing segment garnered a significant revenue share in the bioprocess validation market in 2021. The growth is attributed to the presence of good manufacturing practice guidelines and US FDA regulations. Due to this, there is a huge demand for certified quality bioproducts. The biotechnology and biopharmaceutical companies are engaged in manufacturing cGMP-certified bioproducts. The requirement for government-certified products will propel the segment’s growth in the forecasted period.

On the basis of stage, the bioprocess validation market is divided into process design, process qualification, and continued process verification. The continued process verification segment witnessed the largest revenue share in the bioprocess validation market in 2021. This is because it collects the processing, data collection analysis, and storage of every batch. The primary reasons for creating a continued process verification plan are to achieve compliance with regulatory bodies, prevent batch discards, and mitigate process vulnerabilities while finding constant enhancement possibilities. These features and the automation in this process will boost the segment's expansion.

By mode, the bioprocess validation market is bifurcated into in house and outsourced. The outsourced segment projected a substantial revenue share in the bioprocess validation market in 2021. This is due to biopharmaceutical and biotechnology companies' high demand for testing services. There is an increase in expenditure for healthcare and the supply of raw materials needed by the market players. In addition, there is also a rising number of CDMOs (Contract Development and Manufacturing Organization) providing drug development and manufacturing services to the pharma and biopharma industries.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 375.1 Million |

| Market size forecast in 2028 | USD 650.6 Million |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 8.5% from 2022 to 2028 |

| Number of Pages | 221 |

| Number of Tables | 360 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Stage, Mode, Testing Type, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the bioprocess validation market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region dominated the bioprocess validation market with the largest revenue share in 2021. This is because of significant outsourcing services providers in the region, which leads to the rise in life science research and the production of biologics. Also, the region has many FDA-approved biopharmaceuticals and biotechnological industries. The increased government funding for the bioprocess validation process and the conduct of clinical trials, combined with the presence of many key players, will surge the market’s growth in the region.

Free Valuable Insights: Global Bioprocess Validation Market size to reach USD 650.6 Million by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Thermo Fisher Scientific, Inc., Eurofins Scientific SE, Sartorius AG, Merck KGaA, Lonza Group AG, Danaher Corporation, Charles River Laboratories International, Inc., SGS S.A., Labcorp Corporation, and Cobetter Filtration equipment Co., Ltd.

By Stage

By Mode

By Testing Type

By Geography

The global Bioprocess Validation Market size is expected to reach $650.6 Million by 2028.

The rise in the need to outsource bioprocess validation are driving the market in coming years, however, Possible issues with extractables & leachable restraints the growth of the market.

Thermo Fisher Scientific, Inc., Eurofins Scientific SE, Sartorius AG, Merck KGaA, Lonza Group AG, Danaher Corporation, Charles River Laboratories International, Inc., SGS S.A., Labcorp Corporation, and Cobetter Filtration equipment Co., Ltd.

The expected CAGR of the Bioprocess Validation Market is 8.5% from 2022 to 2028.

The In House segment acquired maximum revenue share in the Global Bioprocess Validation Market by Mode in 2021 thereby, achieving a market value of $528 Million by 2028.

The North America market dominated the Global Bioprocess Validation Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $229.7 Million by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.