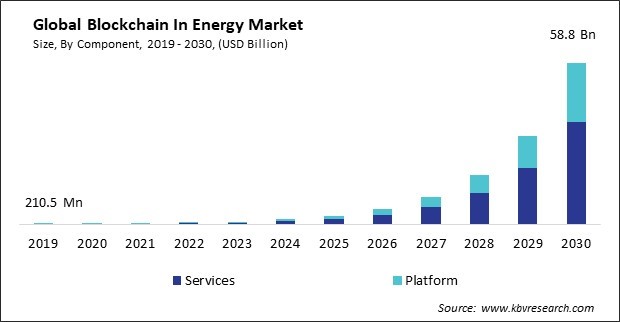

“Global Blockchain In Energy Market to reach a market value of USD 58.8 Billion by 2030 growing at a CAGR of 75%”

The Global Blockchain In Energy Market size is expected to reach $58.8 billion by 2030, rising at a market growth of 75.0% CAGR during the forecast period.

Grid transactions on the blockchain can support the development of decentralized energy industry. Therefore, the grid transactions segment acquired $136.3 million in 2022. By enabling direct peer-to-peer transactions between energy producers and consumers, blockchain reduces the reliance on centralized intermediaries and fosters a more distributed and resilient energy ecosystem. Blockchain can support demand response initiatives by enabling real-time communication and settlement between energy consumers and grid operators. Participants in demand response programs can receive incentives for adjusting their energy consumption patterns during peak demand periods, promoting grid stability.

Smart contracts, self-executing contracts with the terms of the agreement directly written into code, automate and streamline various energy trading and settlement processes. They eliminate the need for intermediaries, reduce manual errors, and ensure swift execution of transactions. Blockchain facilitates the implementation of smart contracts in a secure and decentralized manner. The immutability of blockchain ensures that, once programmed, smart contracts execute exactly as intended, reducing the risk of disputes and delays in settlements. Manual billing and invoicing processes are prone to errors and can lead to settlement delays. Automation of billing and invoicing reduces administrative overhead, accelerates payment cycles, and enhances overall efficiency. Additionally, the increasing integration of renewable energy sources, including solar and wind, creates a need for a more flexible and decentralized energy infrastructure. Blockchain supports the seamless integration of renewable energy resources into the grid, allowing efficient energy management and distribution from diverse sources. Optimal utilization of renewable energy sources requires improved grid administration due to their intermittent nature. Integrating renewables necessitates flexibility in energy distribution and consumption to accommodate fluctuations in generation. Blockchain supports real-time data sharing and automated decision-making through smart contracts. This facilitates grid optimization by allowing seamless adjustments in response to changes in renewable energy generation, promoting grid stability and efficiency. Incentivizing renewable energy production is crucial for accelerating the transition to clean energy. Blockchain-based incentive mechanisms, such as tokenized rewards or peer-to-peer trading, can motivate individuals and businesses to invest in renewable technologies. Thus, because of the integration of renewable energy sources, the market is anticipated to increase significantly.

However, without standardized protocols, the blockchain ecosystem in the energy sector becomes fragmented. Different organizations and projects may adopt proprietary standards, leading to a lack of cohesion and hindering the development of a unified blockchain network. A fragmented ecosystem complicates data sharing, collaboration, and interoperability. It can result in isolated blockchain networks that operate independently, limiting the overall efficiency and potential benefits of a connected and interoperable energy infrastructure. The lack of standardized protocols increases the complexity of integrating blockchain solutions with energy systems and technologies. Each integration may require custom interfaces, leading to higher costs, longer development timelines, and increased potential for errors. Scaling blockchain applications to accommodate a growing number of participants, transactions, and data sources becomes more complex and challenging without common standards. Thus, lack of standardized protocols and interoperability can slow down the growth of the market.

Based on component, the market is classified into services and platform. In 2022, the services segment witnessed the largest revenue share in the market. Blockchain enables the creation of decentralized energy grids where energy producers can directly sell excess energy to nearby consumers without intermediaries. Services can be developed to build and maintain the infrastructure required for decentralized energy grids, ensuring secure and efficient transactions. Services within the market can be designed to provide grid management solutions. Blockchain can help optimize the energy grid by efficiently managing demand, balancing loads, and integrating renewable energy sources. This can lead to a more resilient and sustainable energy infrastructure.

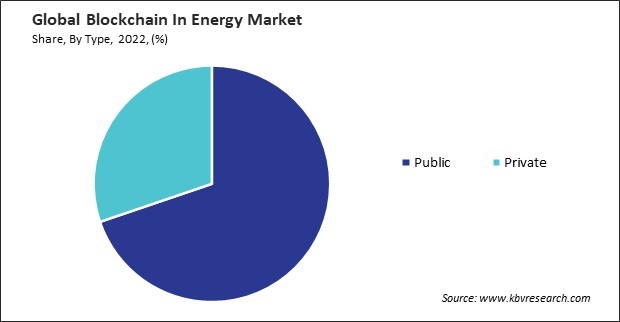

By type, the market is categorized into public and private. The private segment covered a considerable revenue share in the market in 2022. Private environments provide a dedicated infrastructure, ensuring that blockchain data and transactions are isolated and secure. This heightened level of security addresses the confidentiality and data privacy concerns inherent in the energy industry. Private environments avoid the multi-tenancy risks associated with public. The dedicated nature of private reduces the risk of interference or unauthorized access from other entities, providing a secure environment for blockchain data and transactions. Private give enterprises greater control over their infrastructure, enabling them to configure and optimize resources based on their blockchain requirements. This control enhances the reliability and performance of blockchain applications in the energy sector.

On the basis of end-use, the market is divided into power and oil & gas. In 2022, the power segment dominated the market with maximum revenue share. Blockchain can facilitate the integration of renewable energy sources into the power grid. By providing a secure and transparent ledger, blockchain enables the tracking and verification of renewable energy generation, promoting trust in the origin and sustainability of green energy. Blockchain's smart contracts enable real-time settlements and automated billing in the power segment. This can reduce the administrative burden on utilities and enhance the accuracy and transparency of billing processes for producers and consumers.

By application, the market is segmented into peer-to-peer transaction, grid transactions, energy financing, sustainability attribution, and others. The energy financing segment procured a promising growth rate in the market in 2022. Blockchain provides a transparent and auditable ledger tracking funds throughout the energy project's lifecycle. Investors and stakeholders can trace the use of funds, ensuring accountability and reducing the risk of fraud or mismanagement. Renewable energy projects can benefit from blockchain-based financing by attracting environmentally conscious investors. Blockchain's transparency ensures that funds are directed toward sustainable projects, aligning with the increasing demand for environmentally friendly investments.

Free Valuable Insights: Global Blockchain In Energy Market size to reach USD 58.8 Billion by 2030

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the Europe region led the market by generating the highest revenue share. Blockchain is being considered for cross-border energy trading within the European Union. The technology can facilitate secure and transparent transactions between different energy industries and support the development of a more interconnected and efficient European energy grid. European countries are exploring blockchain for grid management and integrating renewable energy into existing grids.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 707 Million |

| Market size forecast in 2030 | USD 58.8 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 75% from 2023 to 2030 |

| Number of Pages | 239 |

| Number of Tables | 430 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Component, Type, End-use, Application, Region |

| Country scope |

|

| Companies Included | IBM Corporation, The Linux Foundation, Microsoft Corporation, Accenture PLC, Circle Internet Financial Limited, Deloitte Touche Tohmatsu Limited, Digital Asset Holdings, LLC, Global Arena Holding, Inc., Monax Industries Limited, Oracle Corporation |

By Component

By Type

By End-use

By Application

By Geography

This Market size is expected to reach $58.8 billion by 2030.

Efficient energy trading and settlements are driving the Market in coming years, however, Lack of standardized protocols and interoperability restraints the growth of the Market.

IBM Corporation, The Linux Foundation, Microsoft Corporation, Accenture PLC, Circle Internet Financial Limited, Deloitte Touche Tohmatsu Limited, Digital Asset Holdings, LLC, Global Arena Holding, Inc., Monax Industries Limited, Oracle Corporation

The expected CAGR of this Market is 75.0%from 2023 to 2030.

The Public segment is leading the Market, By Type in 2022; thereby, achieving a market value of $39.9 billion by 2030.

The Europe region dominated the Market, By Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $20.5 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges