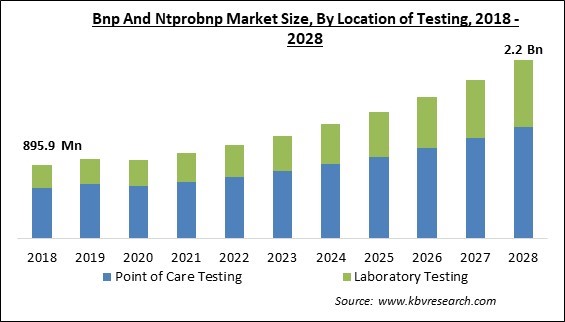

The Global BNP and NT-proBNP Market size is expected to reach $2.2 billion by 2028, rising at a market growth of 11.4% CAGR during the forecast period.

BNP (B-type natriuretic peptide) & NT-proBNP (N-terminal pro B-type natriuretic peptide) are two extensively used biomarkers that are used to diagnose heart failure and lower ejection fraction, evaluate the effectiveness of therapy, and predict outcomes. As cardiomyocytes stretch, they release proBNP, which breaks down into two circulating fragments. The first fragment is the 32-amino acid C-terminal BNP, and the second fragment is inactive 76-amino acid NT-proBNP.

Both pieces are frequently utilized to aid in detecting heart failure, make predictions about results, and monitor the impact of treatment. The heart produces peptides known as natriuretic peptides. N-terminal pro-B-type natriuretic peptide and Brain natriuretic peptide (BNP) are the two primary forms of these chemicals. BNP & NT-proBNP are typically only detected in trace amounts in the blood.

However, high levels may indicate that the heart isn't supplying the body with enough blood as it requires. Heart failure, sometimes called congestive heart failure, occurs when this happens. Natriuretic peptide assays gauge the blood's levels of NT-proBNP or BNP. Although they employ various parameters, they are both helpful in diagnosing heart failure. The option users will rely on the tools the suggested laboratory of the provider has.

The main biological distinction between BNP & NT-proBNP is that BNP acts as a hormone and is biologically active. In contrast, NT-proBNP is passively excreted from the body as well as is not biologically active. Thus, NT-proBNP tends to have a longer half-life than BNP, which has a significantly shorter half-life. As a result, NT-proBNP circulates in the bloodstream at higher quantities, which suggests that it is more likely to be sensitive for identifying earlier stages of heart failure since it does so at somewhat elevated levels.

The COVID-19 pandemic lockdown period had a negative effect on the BNP and NTproBNP market. This is due to stringent governmental controls and limits that resulted in fewer cardiac disease diagnostic tests being performed. In addition, the low level of knowledge and the high price of diagnostic tests during the COVID period further hindered market growth. COVID-19, however, was also capable of causing venous and arterial thrombosis, arrhythmia, and cardiac damage. Thus, optimizing cardiac illness detection and therapy was crucial, which eventually led to a rise in the usage of point-of-care BNP & NT-proBNP testing.

The Global Health Data Exchange database estimates that there is currently 64.34 million congestive heart failure (CHF) cases worldwide. This amounts to USD 346.17 billion spent on healthcare and 9.91 million YLDs (years lost due to disability). HF is significantly influenced by age. Moreover, cardiovascular issues can significantly reduce a patient's functional capacity and raise their mortality risk. Therefore, to avoid repeated hospital stays, optimize patient outcomes, and boost the quality of life, it is crucial to correctly diagnose and treat the disease. As a result, the population's increased prevalence of cardiovascular illness presents an opportunity for leading market participants to invest in and commercialize the products and, in turn, accelerate the growth of the bnp and ntprobnp market.

The heart is affected by these changes and develops cardiomyopathy and congestive heart failure over time. Markers for this involvement include natriuretic peptides like BNP and NT-proBNP. Natriuretic peptide levels are higher in people with CKD, especially those receiving dialysis. It has been observed that a more accurate risk indicator for CKD is the variations in BNP levels over time. It is important to highlight that renal function and NT-pro-BNP levels are highly inversely correlated in renal failure. Therefore, the increasing use of bnp and ntprobnp assays to diagnose renal function accurately to treat CKD has resulted in market expansion.

No published investigation had evaluated the diagnostic concordance of BNP & NT-proBNP for ruling out and ruling in HF at the established cut-points, despite the broad recognition that both tests are fundamentally clinically comparable. Measuring BNP or NT-proBNP in patient samples has several well-known problems, such as variable antibody reactivity with the precursor proBNP and changes in half-lives, renal clearance, protein glycosylation, and biochemical variety in HF patients. Hence, it is obvious that BNP and NT-proBNP cannot be used interchangeably. This increases the expense of these test assays and presents factors that will slow down the market's growth.

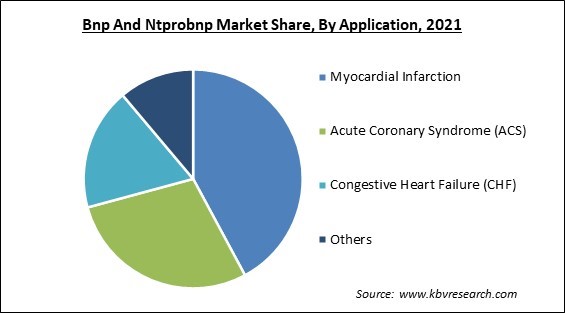

Based on application, the BNP and NT-proBNP market is categorized into myocardial infarction, congestive heart failure (CHF), acute coronary syndrome (ACS), and others. The congestive heart failure segment procured a considerable growth rate in the BNP and NT-proBNP market in 2021. Congestive heart failure, or CHF, is a gradual, chronic illness that impairs the ability of the heart muscle to contract. These metrics have been demonstrated to reduce costs in the emergency room setting and can be used to identify heart failure, particularly diastolic dysfunction. BNP testing' high negative predictive accuracy is especially useful for excluding heart failure.

On the basis of location of testing, the BNP and NT-proBNP market is divided into point of care testing and laboratory testing. The point of care testing segment acquired the largest revenue share in the BNP and NT-proBNP market in 2021. Better resource utilization, increased patient convenience, growth in demand for cardiology biomarker testing, and improved clinical decision-making are all credited with this. It also results from improved heart failure diagnosis and treatment. Most point-of-care testing equipment includes kits, assays, analyzers, and devices focused on testing.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 1 Billion |

| Market size forecast in 2028 | USD 2.2 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 11.4% from 2022 to 2028 |

| Number of Pages | 170 |

| Number of Table | 260 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Location of Testing, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on region, the BNP and NT-proBNP market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region witnessed the maximum revenue share in the BNP and NT-proBNP market in 2021. This can be ascribed to the advanced healthcare system and the widespread use of BNP and NTproBNP as diagnostic and prognostic disease tools. In addition, the need for testing products is driven by the growing elderly population's need for biomarker testing to diagnose diseases like acute myocardial infarction. Another factor boosting the expansion of this market is the concentration of important companies in the region.

Free Valuable Insights: Global BNP and NT-proBNP Market size to reach USD 2.2 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Abbott Laboratories, Siemens AG, Danaher Corporation, Gentian Diagnostics ASA, PerkinElmer, Inc., BioMérieux S.A., Quidel Corporation, Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd. (Roche Holding Ltd.), and Scripps Laboratories.

By Location of Testing

By Application

By Geography

The global BNP and NT-proBNP size is expected to reach $2.2 billion by 2028.

Growing use of BNP and NT-proBNP assays in chronic kidney disease are driving the market in coming years, however, Non-interchangeable nature of BNP and NT-proBNP assays restraints the growth of the market.

Abbott Laboratories, Siemens AG, Danaher Corporation, Gentian Diagnostics ASA, PerkinElmer, Inc., BioMérieux S.A., Quidel Corporation, Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd. (Roche Holding Ltd.), and Scripps Laboratories.

The expected CAGR of the BNP and NT-proBNP Market is 11.4% from 2022 to 2028.

The Myocardial Infarction segment acquired maximum revenue share in the Global BNP and NT-proBNP Market by Application in 2021 thereby, achieving a market value of $879.9 Million by 2028.

The North America market dominated the Global BNP and NT-proBNP Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $746 Million by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.