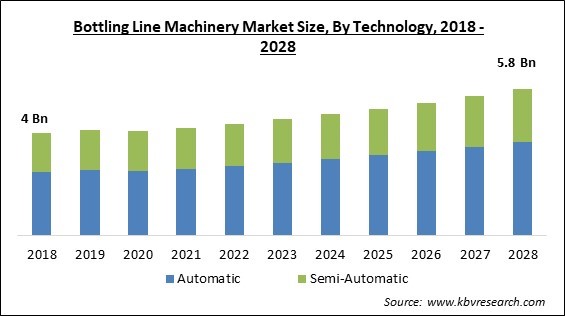

The Global Bottling Line Machinery Market size is expected to reach $5.8 billion by 2028, rising at a market growth of 4.6% CAGR during the forecast period.

Bottling machinery is used to fill the glass and plastic containers with consumable beverages like wine and liquor. Beer and soda are examples of carbonated products that are often free-flowing. The machines with the biggest capacity employ rotary turrets to fill the bottles while they remain in motion. The ability to start and stop the process without swirling low-viscosity liquid is a plus. When bottling low-viscosity products, in-line fillers usually run continuously.

Filling is a more generic name for bottling, and fillers are the machines that do it. From modest single-station laboratory fillers to huge volume, positive displacement piston fillers used to package sticky foods or chunky sauces, these are employed everywhere and in every capacity.

Aside from the filling equipment, there are several machines related to bottling. These firms make bottle filling machines, although they could also make additional machines that make up a whole bottling line.

The rise in demand for healthy beverages and pharmaceuticals as a result of the COVID-19 pandemic also boosted the market growth. To fulfill the increased demand for their products, companies in the beverage and pharmaceutical industries introduced modern and automated lines, raising bottling machinery demand.

Growing urban populations in the United States have affected food preferences, favoring the processing and bottling business. Furthermore, chemical sector participants in the United States are eager to develop and build capacity, resulting in increased demand for bottling. Over the projection period, this is expected to have a favorable impact on the industry.

COVID-19 is an unprecedented global public health crisis that has impacted practically every business, and its long-term repercussions are expected to have an influence on industry growth during the forecast period. Due to the incredible speed at which the virus spread, governments of most major countries implemented nationwide lockdowns. Production of all goods deemed non-essential by the government came to a halt as the workers could not head to factories. Only industries where the work from home system did not affect productivity drastically survived the pandemic relatively unharmed. COVID-19 led to changes in consumer behavior and demand, purchasing patterns, supply chain re-routing, market dynamics, and government involvement.

The food and beverage business plays a significant part in the global food value chain. The growing global demand for safe, hygienic, and healthful food and beverage items is driving up demand for bottled products, which are readily available and ready to eat. Efforts to build local or regional food value chain market participants are emphasized by governments of many developed and developing countries. The primary initiative of incorporating innovative business models that are cost-effective and provide advanced product integrity is projected to boost filling machine demand. Food and beverage goods such as fresh fruit and vegetable juices, milk, and other beverages require long-term preservation, which increases the demand for bottle filling equipment.

The global beverage industry's strong growth will force the bottle filling machine market forward. In the food and beverage business, these machines are mostly used to fill bottles of various shapes and sizes with the necessary liquid. IoT, AI, and Big Data are examples of modern filling machine technologies that indicate a lucrative market expansion for bottle filling machines. IoT helps reach the highest degree of food safety, as well as proper beverage distribution monitoring and control. Manufacturers have saved time and money by using innovative packing machinery. Companies in the packing machines sector are adopting cutting-edge sterile filling technologies.

These devices are used not only to fill bottles with liquid products but also to seal them. The high initial cost of a bottle filling and sealing machine limits its use in a variety of industries. Therefore, many companies are hesitant These machines are equipped with a variety of modern technologies, such as machine vision and IoT, which raises the overall cost of ownership. Furthermore, the equipment's complexity, combined with its high maintenance costs, is limiting its adoption in underdeveloped countries, reducing market potential. As a result of the high total cost of bottling machinery, which includes both manufacturing and implementation costs, some small and medium-sized manufacturing units would be hesitant to adopt automated and advanced bottling gear.

Based on Technology, the market is segmented into Automatic and Semi-Automatic. The semi-automatic segment procured a significant revenue share in the bottling line machinery market in 2021. This is due to the low initial capital and operating costs required for semi-automatic machinery. This is why these machines are high in demand in labor-intensive nations such as China, Brazil, and India which have easy access to low-cost labor. These are the key factors driving the segment.

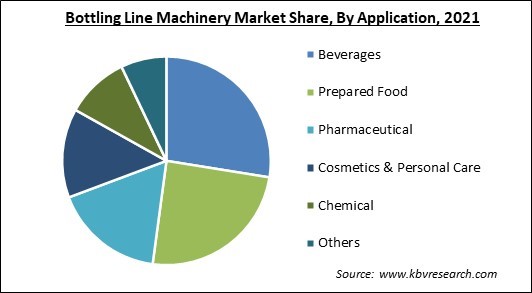

Based on Application, the market is segmented into Beverages, Prepared Food, Pharmaceutical, Cosmetics & Personal Care, Chemical, and Others. The beverages segment acquired the largest revenue share in the bottling line machinery market in 2021. The beverages segment led the market due to consumer dietary alterations amidst the COVID-19 pandemic and a rise in demand for sports, low-calorie, and other nutritional drinks. Furthermore, increased collaboration between private label companies and beverage producers is expected to drive the growth of the segment.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 4.2 Billion |

| Market size forecast in 2028 | USD 5.8 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 4.6% from 2022 to 2028 |

| Number of Pages | 166 |

| Number of Tables | 280 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Technology, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. Asia-Pacific acquired the largest revenue share in the bottling line machinery market in 2021. In countries like India, Vietnam, Malaysia, and Thailand, there exists a large food and beverage contract manufacturing sector. This region also boasts of a well-developed chemical production industry, leading to high demand for bottling line machinery.

Free Valuable Insights: Global Bottling Line Machinery Market size to reach USD 5.8 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Tetra Laval International S.A., ProMach, Inc., Syntegon Technology GmbH, The Krones Group, KHS Group, Barry-Wehmiller Companies, Inc., Coesia S.p.A., Zhangjiagang King Machine Co., Ltd., Sacmi Imola S.C., and OPTIMA packaging group GmbH.

By Technology

By Application

By Geography

The global bottling line machinery market size is expected to reach $5.8 billion by 2028.

Growing beverage Industry Raising Demand for Bottling Line Machinery are driving the market in coming years, however, high initial investment growth of the market.

Tetra Laval International S.A., ProMach, Inc., Syntegon Technology GmbH, The Krones Group, KHS Group, Barry-Wehmiller Companies, Inc., Coesia S.p.A., Zhangjiagang King Machine Co., Ltd., Sacmi Imola S.C., and OPTIMA packaging group GmbH.

The expected CAGR of the bottling line machinery market is 4.6% from 2022 to 2028.

The Automatic segment acquired maximum revenue share in the Global Bottling Line Machinery Market by Technology in 2021, thereby, achieving a market value of $3.7 billion by 2028.

The Asia Pacific market dominated the Global Bottling Line Machinery Market by Region in 2021, and would continue to be a dominant market till 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.