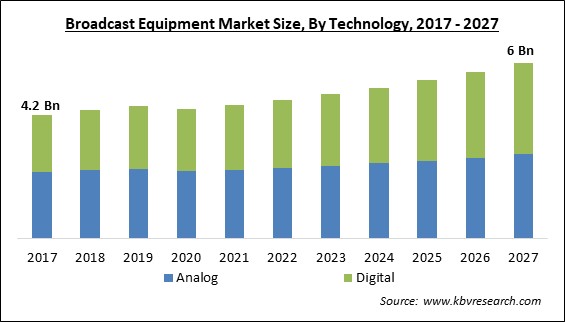

The Global Broadcast Equipment Market size is expected to reach $6 billion by 2027, rising at a market growth of 4.8% CAGR during the forecast period.

The presentation of audio & video data to an audience through electronic mass communications is known as broadcasting. FM Radio was the first kind of broadcasting, which became widespread around 1920 as vacuum tube radio transmitters became more widely available. A broadcast is a method of disseminating information to a large audience. In most cases, broadcasting is limited to a local area network system. Broadcasting services remain appealing because they provide the most direct and dependable information to a large audience. It will provide free service once individuals obtain the broadcast equipment. Broadcast signals have a greater range than cable, broadband, or cellphone networks.

The expansion of the Broadcast Equipment Market is being driven by an increase in the consumption of smart electronic devices, an increase in the demand for 3D and HD content, and an increase in internet penetration. People may now watch their favorite broadcasting shows, such as web series, movies, and cartoons, on their portable electronic gadgets, such as smartphones, tablets, and laptops, due to the internet, which provides high-quality content that is easy to reach to anybody. Moreover, the industry is seeing increased investment in high-speed broadband infrastructure, technological improvements, and demand for D2C offerings via OTT services, all of which are generating growth prospects.

HD video quality has been enhanced with developments in broadcasting equipment devices due to emerging technologies such as IoT and AI. The industry is growing because of an increase in the number of digital channels and over-the-top (OTT) services available.

During 2020 & 2021, the COVID-19 Pandemic had a detrimental impact on the broadcast equipment business, leading in lower revenues among market players. As a consequence, between the first half of 2020 and also the first half of 2021, the market's growth trajectory slowed. With the organization of various sporting events, soaring OTT subscriptions, and an elevated expansion of digital broadcasting by broadcasters in the second half of 2021, the demand for broadcast equipment is estimated to rise. The COVID-19 pandemic is having a significant influence on the broadcaster's income, since businesses around the world are hesitant to spend money on advertisements. The brands must use their limited financial reserves, notably when demand is restricted due to the slowdown of the economy.

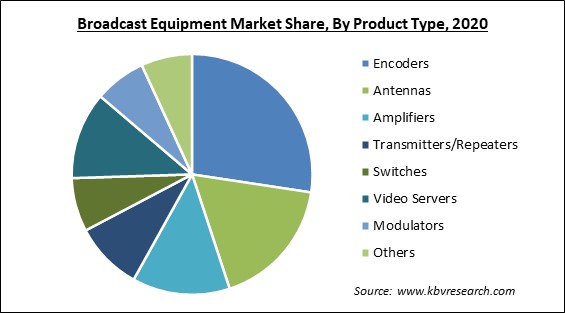

In the broadcasting sector, encoders have become a need for maintaining precision, accuracy, and control. They transform an active input signal into a coded output signal using combinational logic circuits. Encoders for media broadcasting support a variety of formats, including video, audio, and image data structures. OTT services use the internet to provide music, video, as well as other media content without using wires. Video encoders are used by broadcasting players to provide higher viewing experience to subscribers. The growing popularity of over-the-top (OTT) content viewing has fueled demand for encoders in broadcasting. The introduction of video encoders provides a feasible alternative for the sports, media, and entertainment industries, allowing for remote operation, remote production, plus live production in the cloud.

In recent years, artificial intelligence (AI) has played a significant role in strengthening and revolutionizing companies all over the world. AI is employed by a variety of entities across numerous platforms, ranging from government agencies to huge corporations to small online companies. In the broadcasting workflow, artificial intelligence-enhanced broadcasting technologies are being deployed. It enables viewers to increase efficiency, productivity, and creative opportunities throughout content creation in a precise and automatic manner. AI is being used in the broadcasting sector to make visual material more engaging and entertaining. Furthermore, AI can be utilized in FM stations to monitor and record illegal broadcasts.

Among fraudsters and malware experts, cyber security is a critical and never-ending concern. Cyber-attacks have tremendous reputational and financial consequences for an organization. It can get access to user data on the broadcasting operator's channel, like content as well as other sensitive information. Regardless matter how secure a system is, it will have vulnerabilities. For content generation, storage, and distribution, the broadcasting equipment market heavily relies on IT, the internet, and internal and web-connected networks. Because it is such an essential aspect of the broadcast equipment business, data security becomes a major focus. Cyber attackers are difficult to spot and avoid in real time, limiting the growth of the broadcasting equipment industry.

Based on Technology, the market is segmented into Analog and Digital. The digital technology segment acquired a significant revenue share in the broadcast equipment market in 2020. Digital broadcasting is the technique of broadcasting across radio frequency bands utilizing digital transmissions instead of analogue signals. It has gained in popularity, particularly in digital tv formats such as digital satellite television & terrestrial television.

Based on Product Type, the market is segmented into Encoders, Antennas, Amplifiers, Transmitters/Repeaters, Switches, Video Servers, Modulators, and Others. The encoders segment garnered the highest revenue share in the broadcast equipment market in 2020. In digital broadcasting, encoders are widely employed. One of primary elements fueling the expansion of the industry is the growing need for Ultra HD content transmission & production. In the coming years, the growing number of digital channels is expected to provide significant growth prospects for both new and established broadcast equipment ecosystem companies.

Based on Application, the market is segmented into Television, and Radio. Radio segment registered a significant revenue share in the broadcast equipment market in 2020. Radio broadcasting is one of the earliest forms of broadcasting medium. This kind of broadcasting needs wide range of devices like Microphones and Processors. These devices and equipment help companies to carry out broadcasting of radio signals in a better way without any disruption.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 4.4 Billion |

| Market size forecast in 2027 | USD 6 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 4.8% from 2021 to 2027 |

| Number of Pages | 218 |

| Number of Tables | 383 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Technology, Product Type, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. North America emerged as the leading region in the broadcast equipment market with the maximum revenue share in 2020. It is due to the growing count of cable and satellite television channels, as well as the widespread use of the internet, which have given broadcasters a variety of options for maintaining their market dominance in the future. North America leads the way in terms of increasing the number of broadcast channels, which has increased demand for radio broadcast equipment.

Free Valuable Insights: Global Broadcast Equipment Market size to reach USD 6 Billion by 2027

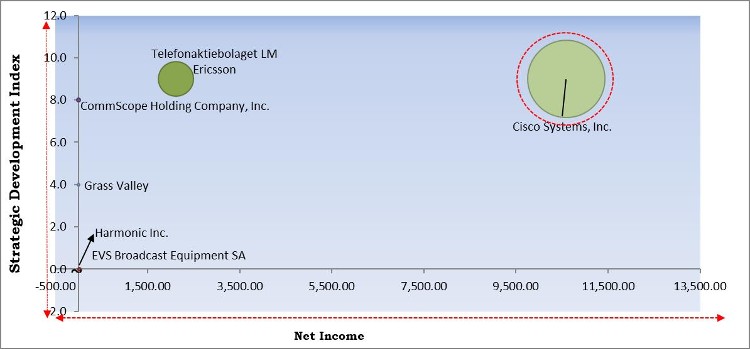

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Cisco Systems, Inc. is the major forerunner in the Broadcast Equipment Market. Companies such as Telefonaktiebolaget LM Ericsson, Grass Valley, CommScope Holding Company, Inc. are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include CommScope Holding Company, Inc., Evertz Technologies Limited, Harmonic Inc., EVS Broadcast Equipment SA, Grass Valley, Wellav Technologies Ltd., Eletec S.a.r.l., Clyde Broadcast Technology Ltd., Telefonaktiebolaget LM Ericsson, and Cisco Systems, Inc.

By Technology

By Product Type

By Application

By Geography

The global broadcast equipment market size is expected to reach $6 billion by 2027.

Huge demand for encoders that support various formats are driving the market in coming years, however, increase in the number of cyber-attacks limited the growth of the market.

CommScope Holding Company, Inc., Evertz Technologies Limited, Harmonic Inc., EVS Broadcast Equipment SA, Grass Valley, Wellav Technologies Ltd., Eletec S.a.r.l., Clyde Broadcast Technology Ltd., Telefonaktiebolaget LM Ericsson, and Cisco Systems, Inc.

The Analog segment is leading the Global Broadcast Equipment Market by Technology in 2020, and would achieve a market value of $2.8 billion by 2027.

The Television segment acquired the maximum revenue share in the Global Broadcast Equipment Market by Application in 2020; thereby, achieving a market value of $4.2 billion by 2027.

The North America market dominated the Global Broadcast Equipment Market by Region in 2020, and would continue to be a dominant market till 2027.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.