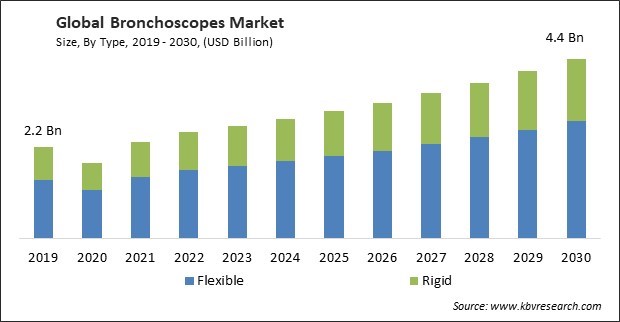

The Global Bronchoscopes Market size is expected to reach $4.4 billion by 2030, rising at a market growth of 6.9% CAGR during the forecast period. In the year 2022, the market attained a volume of 1,308.1 thousand units, experiencing a growth of 9.6% (2019-2022).

Video bronchoscopes have high-resolution cameras and advanced imaging technologies, such as high-definition (HD) and 4K video capabilities. Hence, video segment would acquire approximately 1/2th share in the Flexible segment of the market by 2030. These technologies provide clear and detailed images of the respiratory tract, allowing healthcare professionals to visualize and assess the airway more effectively. Video bronchoscopes offer real-time visualization of the airway during procedures. This real-time feedback is crucial for diagnosing conditions, guiding interventions, and ensuring patient safety. Video bronchoscopes allow healthcare providers to document procedures by recording video and capturing images. This documentation can be used for patient records, education, and consultation with colleagues, contributing to improved patient care.

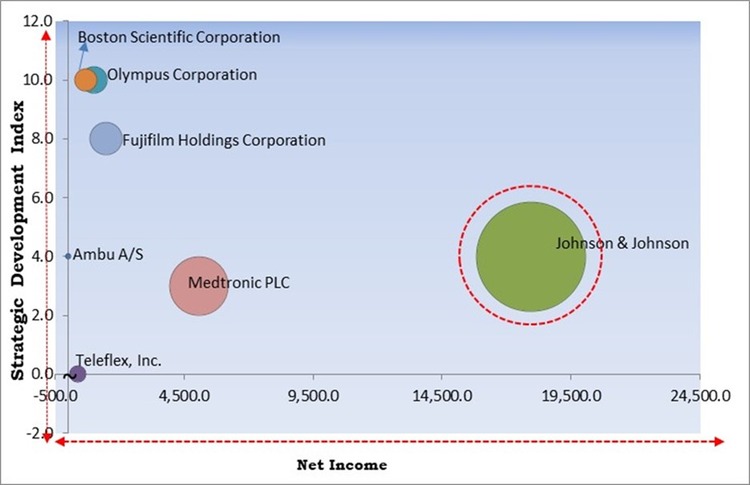

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In January, 2023, Fujifilm Holdings Corporation unveiled PB2020-M2, an ultrasonic probe system for enhanced examination. The probe has an outer diameter range of 1.4-1.9mm and is compatible with a 2mm working channel bronchoscope. In November, 2022, Fujifilm Holdings Corporation introduced EB-710P, a slim video bronchoscope. The EB-710P comes with a compact CMOS sensor and a 4.1 mm tip diameter.

Based on the Analysis presented in the KBV Cardinal matrix; Johnson & Johnson is the forerunner in the Market. Companies such as Medtronic PLC, Fujifilm Holdings Corporation, Olympus Corporation are some of the key innovators in the Market. In July, 2022, Medtronic PLC announced the launch of ILLUMISITE, a system used for bronchoscopic procedures. The system offers several benefits including minimally invasive facility, better visibility for tissue abnormality, expanded access for lesions, etc.

The respiratory system was the system that COVID-19 most affected, which caused a spike in demand for bronchoscopes and other diagnostic tools for the respiratory system. Hospitals and healthcare facilities needed bronchoscopes to diagnose and treat COVID-19 patients, especially those with severe respiratory symptoms. Many healthcare facilities had to reallocate resources and prioritize COVID-19-related care and equipment. The pandemic accelerated research and development efforts in the healthcare sector, including developing new medical devices and technologies. This led to innovations in bronchoscope design and functionality. Infection control measures became a top priority in healthcare settings. Manufacturers and healthcare providers implemented enhanced sterilization and cleaning protocols for bronchoscopes to reduce the risk of cross-contamination. Therefore, COVID-19 pandemic had a moderate effect on the market.

The increasing incidence of respiratory diseases such as lung cancer, chronic obstructive pulmonary disease (COPD), asthma, and pneumonia has driven the demand for bronchoscopic procedures for diagnosis and treatment. Lung cancer is one of the leading causes of cancer-related deaths globally. It often requires bronchoscopic procedures for diagnosis, staging, and treatment planning. Early detection and accurate diagnosis through bronchoscopy are critical for improving survival rates. COPD comprises conditions including chronic bronchitis and emphysema. It assess airway inflammation, collect tissue samples for diagnosis, and provide therapeutic interventions to manage symptoms and improve lung function. The rising prevalence of respiratory diseases is a significant driver of growth in the market.

The growth of telemedicine and remote healthcare services has expanded the reach of bronchoscopic procedures. Video bronchoscopes enable healthcare professionals to conduct remote consultations and collaborate with specialists. Telemedicine authorizes patients in remote or underserved areas to access healthcare services, including bronchoscopic consultations and follow-up care, without traveling long distances to a healthcare facility. Telemedicine enables healthcare providers to conduct remote consultations with patients. Bronchoscopic findings, images, and videos can be shared with specialists for evaluation and recommendations, allowing expert input regardless of geographical location. The growth of telemedicine and remote healthcare services has significantly impacted the market.

Bronchoscopic procedures carry the risk of infection transmission. Ensuring proper cleaning, disinfection, and sterilization of bronchoscopes is crucial to prevent healthcare-associated infections. Bronchoscopes are intricate medical devices with multiple channels and components, which makes them challenging to clean thoroughly. Contaminants, including microbial biofilms, can hide in crevices and channels, increasing the risk of infection transmission. Human error during the cleaning and reprocessing of bronchoscopes is a significant concern. Manual cleaning, disinfection, or sterilization errors can leave behind contaminants that harbour infectious agents. This can result in delayed recognition of infection clusters or outbreaks. The risk of infection transmission associated with bronchoscopes presents a significant challenge in the healthcare industry and the market.

Under flexible type, the market is divided into video, fiberoptic, and hybrid. The fiberoptic segment garnered a significant revenue share in the market in 2022. Fiberoptic bronchoscopes are commonly used for diagnostic purposes. They allow healthcare providers to examine the bronchial tree and detect abnormalities like tumours, infections, foreign bodies, and inflammation. The optical clarity provided by fiberoptic bundles enables precise visualization. Fiberoptic bronchoscopes are used to inspect the airway, assess airway patency, and identify any obstructions or lesions. They are valuable tools for evaluating patients with respiratory symptoms, including cough, hemoptysis, and wheezing. Fiberoptic bronchoscopes are used to locate and remove foreign objects, such as food particles or inhaled objects, from the airway. Their flexibility and maneuverability aid in precision during these procedures.

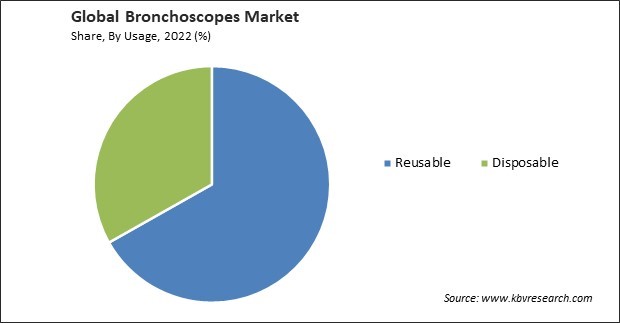

By usage, the market is categorized into reusable and disposable. The disposable segment covered a considerable revenue share in the market in 2022. Disposable bronchoscopes are manufactured under controlled conditions, ensuring that each scope is optimal. This consistency can be especially important for critical procedures where image quality and functionality are essential. Healthcare providers find disposable bronchoscopes convenient because they can be used immediately without the need for setup, calibration, or sterilization. This can be particularly advantageous in emergencies. Disposable bronchoscopes are well-suited for use in remote or field settings where access to reprocessing facilities is limited or impractical.

Based on type, the market is classified into rigid and flexible. The fiberoptic segment garnered a significant revenue share in the market in 2022. Flexible bronchoscopes have a smaller diameter and are less invasive, which can reduce patient discomfort and anxiety during the procedure. Flexible bronchoscopes are highly versatile and can be used for various diagnostic and therapeutic procedures. They are suitable for visualizing the entire respiratory tract, including the bronchi and peripheral airways. Flexible bronchoscopes are easier to maneuver and navigate through the airways due to their flexibility. The advantages of flexible bronchoscopes include their patient-friendly design, versatility, advanced imaging capabilities, and suitability for various diagnostic and therapeutic applications. They have become a standard tool in respiratory medicine and play a significant role in diagnosing and treating lung and airway disorders.

On the basis of end-use, the market is segmented into hospitals and outpatient facilities. In 2022, the hospitals segment registered the maximum revenue share in the market. Hospitals use bronchoscopes for diagnostic purposes. These procedures involve the insertion of the bronchoscope into the patient's airways to visualize the trachea, bronchi, and bronchioles. This helps identify abnormalities like tumours, infections, inflammation, and bleeding. It enables the collection of tissue samples from the airways, which are then sent to the pathology department for analysis. Hospitals utilize bronchoscopes for therapeutic purposes. They can be used to deliver medications, perform bronchial thermoplasty for asthma management, or treat conditions like hemoptysis (coughing up blood) or strictures (narrowing of airways).

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 2.6 Billion |

| Market size forecast in 2030 | USD 4.4 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 6.9% from 2023 to 2030 |

| Number of Pages | 346 |

| Number of Table | 724 |

| Quantitative Data | Volume in Units, Revenue in USD Billion, and CAGR from 2019 to 2030 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Usage, End-use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region led the market by generating the highest revenue share. The region's advanced healthcare infrastructure enables the adoption of the latest medical technologies and devices, including bronchoscopes. High-quality healthcare facilities and a skilled workforce contribute to the market's growth. North America is a hub for medical technology innovation. Manufacturers in the region continually develop and introduce advanced bronchoscope technologies, such as digital video bronchoscopes with high-definition imaging, enhanced manoeuvrability, and integration with digital systems.

Free Valuable Insights: Global Bronchoscopes Market size to reach USD 4.4 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Teleflex, Inc., Olympus Corporation, Ambu A/S, Karl Storz SE & Co. KG, Fujifilm Holdings Corporation, Boston Scientific Corporation, Cook Medical, Inc. (Cook Group), Medtronic PLC, Johnson & Johnson, Richard Wolf GmbH (The Richard and Annemarie Wolf Foundation)

By Type (Volume, Thousand Units, USD Billion/Million, 2019-2030)

By Usage (Volume, Thousand Units, USD Billion/Million, 2019-2030)

By End Use (Volume, Thousand Units, USD Billion/Million, 2019-2030)

By Geography (Volume, Thousand Units, USD Billion/Million, 2019-2030)

The Market size is projected to reach USD 4.4 billion by 2030.

Rising prevalence of respiratory diseases are driving the Market in coming years, however, Higher risk of infection transmission restraints the growth of the Market.

Teleflex, Inc., Olympus Corporation, Ambu A/S, Karl Storz SE & Co. KG, Fujifilm Holdings Corporation, Boston Scientific Corporation, Cook Medical, Inc. (Cook Group), Medtronic PLC, Johnson & Johnson, Richard Wolf GmbH (The Richard and Annemarie Wolf Foundation)

In the year 2022, the market attained a volume of 1,308.1 thousand units, experiencing a growth of 9.6% (2019-2022).

The Reusable segment acquired the highest revenue in the Market, By Usage in 2022; thereby, achieving a market value of $2.7 billion by 2030.

The North America region dominated the Market, By Region in 2022; and would continue to be a dominant market till 2030, thereby, achieving a market value of $16 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.