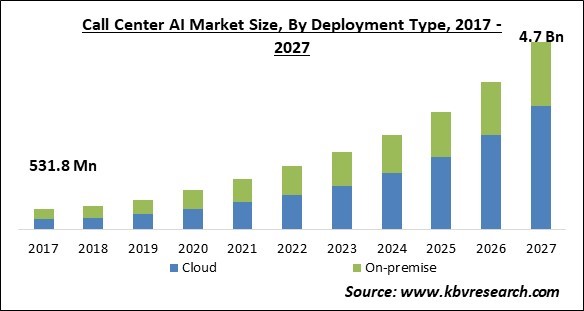

The Global Call Center AI Market size is expected to reach $4.7 billion by 2027, rising at a market growth of 24.3% CAGR during the forecast period.

Call Center AI refers to the utilization of artificial intelligence across call centers with the purpose of providing human-like services to customers with robotic assistance. In call centers, one of the most common uses of AI is to provide in-depth data on call times and first resolution along with other metrics. These technologies can detect patterns and have access to client data, allowing them to determine if customers are having a good or bad experience.

According to a study conducted by Oracle, more than 80% of businesses are now using chatbots for customer service or aim to do so by 2020. Respondents cited 24-hour service, rapid responses to inquiries, and solutions to easy questions as some of the advantages of AI deployment.

There are some instances wherein dealing with customer inquiries in real-time might be a difficult task for a customer service representative, as customers may not understand the context of their inquiry. This has necessitated the development of better data analytics skills.

For example, with AI, previous customer interactions and chat data may be examined in seconds, and concise information about the customer can be supplied to the executive. Because of its large in-house data scientists and analysts, Amazon, in partnership with its subsidiary Amazon Web Services, developed specific algorithms aimed at evaluating consumer wants and offering accurate responses based on those needs. As a result, the global market is growing due to the requirement for increased data analysis skills.

In the fourth quarter of 2019, the deadly COVID-19 emerged from the Wuhan City of China and till the end of the first quarter of 2020, it emerged as one of the most deadly and hazardous pandemics for both the people and economies. The COVID-19 caused Governments all over the world to enforce lockdowns across their countries which substantially slammed all the industries across the world. However, due to the increased necessity for organizations to replace old infrastructure to build a more flexible approach to customer engagement during the COVID-19 pandemic, the usage of advanced call center software solutions has surged.

Because call center software use has expanded despite unprecedented circumstances, the COVID-19 pandemic had a positive impact on the expansion of the call center AI market. Enterprises have seen an increase in the requirement to replace old infrastructure in order to build a more agile approach to client engagement.

Customer experience must be maintained by providing accurate and timely feedback. Customer experience is critical to a company's long-term success. Call center as a service provides solutions that assist in providing appropriate customer support. By delivering real-time customer query-related data, the service assists agents in efficiently handling consumers. It displays information on clients and their buying history in pop-up windows. This saves time for the agent and allows them to rapidly resolve the customer's issue.

Traditional on-premises call centers are substantially more expensive than cloud-based call centers. Companies save money on overall expenses such as hardware installation and maintenance service charges by implementing AI solutions in a call center. Moreover, cloud-based services aid in the reduction of overhead costs, downtime, and power usage. It also offers a pay-per-use subscription model, which allows businesses to choose the plan that best suits their needs and budget. Web-based call centers are becoming more popular among businesses with minimal resources.

The Call Center has a large amount of data that is vulnerable to malevolent attackers. Personal and confidential information, such as health information and credit card data, is stored in call centers. Internally and externally, there is a considerable risk of data breaches and hacking. Internally, for example, the agent could leak information or be bribed to provide it. This poses a significant risk of privacy violations. For example, in 2017, a data breach occurred at the LaunchPoint insurance company in the United States, when a corporate employee used his personal email to steal client healthcare information.

Based on the Deployment Type, the Call center AI market is bifurcated into Cloud and On-premise. In 2020, the On-premise segment followed the cloud segment by acquiring the second-largest revenue share of the call center AI market. The on-premise deployment ensures data safety by saving all the databases and servers of the call center at the location of the organization.

Based on the End-user, the Call center AI market is segregated into BFSI, Retail & E-commerce, Telecom, Healthcare, Media & Entertainment, Travel & Hospitality, and Others. In 2020, the retail and E-commerce segment accounted for a promising revenue share of the call center AI market. The increased growth of this segment of the market is attributed to the fact that a lot of stores and supermarkets are adopting the newly introduced method of providing over-the-phone services to their customers. This method offers convenience and an enhanced shopping experience to customers.

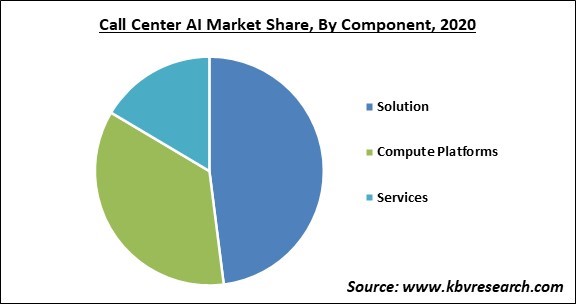

Based on the Component, the Call center AI market is segmented into Solution, Compute platform, and Services. The solution segment accounted for the largest revenue share of the call center AI market in 2020. This is due to the widespread use of chatbots/IVAs in many processes. In comparison to other verticals, the BFSI sector has the highest rate of adoption of call center platforms and solutions. Call center AI solutions to help financial organizations interact with consumers perfectly, improve customer experience, and reduce response time, all while enhancing overall efficiency. This is the factor driving the growth of this segment.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 1 Billion |

| Market size forecast in 2027 | USD 4.7 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 24.3% from 2021 to 2027 |

| Number of Pages | 222 |

| Number of Tables | 382 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Deployment Type, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on the Region, the Call center AI market is analyzed across North America, Europe, APAC, and LAMEA. In 2020, North America led the call center AI market by accounting for the largest revenue share of the market across the world. In addition, the increasing growth for the market in this region is attributed to the ongoing growth in call center solutions spending across the United States and Canada. Moreover, the widespread adoption of call center AI solutions in sectors such as BFSI, healthcare, retail, and government to deliver exceptional customer service would further boost the growth of the regional call center AI market during the forecasting period.

Free Valuable Insights: Global Call Center AI Market size to reach USD 4.7 Billion by 2027

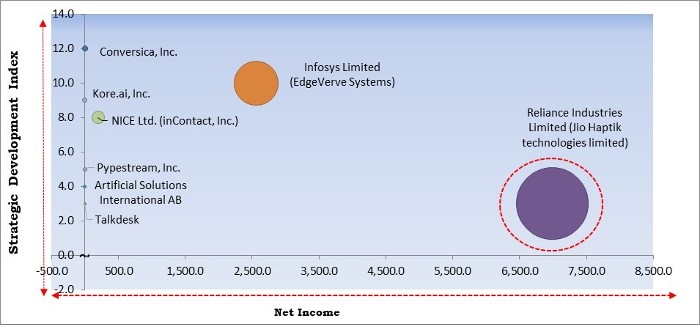

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Reliance Industries Limited (Jio Haptik technologies limited) are the forerunners in the Call Center AI Market. Companies such as Infosys Limited (EdgeVerve Systems), NICE Ltd. (inContact, Inc.), Conversica, Inc. are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Reliance Industries Limited (Jio Haptik technologies limited), Artificial Solutions International AB, Conversica, Inc., Rulai, Inc., Kore.ai, Inc., Pypestream, Inc., Infosys Limited (EdgeVerve Systems), Avaamo, Inc., and NICE Ltd. (inContact, Inc.).

By Deployment Type

By End User

By Component

By Geography

The call center AI market size is projected to reach USD 4.7 billion by 2027.

Rising demand for enhanced customer experience are driving the market in coming years, however, Data security and privacy risks have limited the growth of the market.

Reliance Industries Limited (Jio Haptik technologies limited), Artificial Solutions International AB, Conversica, Inc., Rulai, Inc., Kore.ai, Inc., Pypestream, Inc., Infosys Limited (EdgeVerve Systems), Avaamo, Inc., and NICE Ltd. (inContact, Inc.).

The Telecom market acquired maximum revenue share in the Global Call Center AI market by End User 2020, and would continue to be a dominant market till 2027.

The Compute Platforms market shows highest growth rate of 24.3% during (2021 - 2027). This is attributed to the operation of many AI-enabled solutions relying heavily on compute platforms.

The North America market region shows high market share in the Global Call Center AI market by Region 2020, and would continue to be a dominant market till 2027.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.