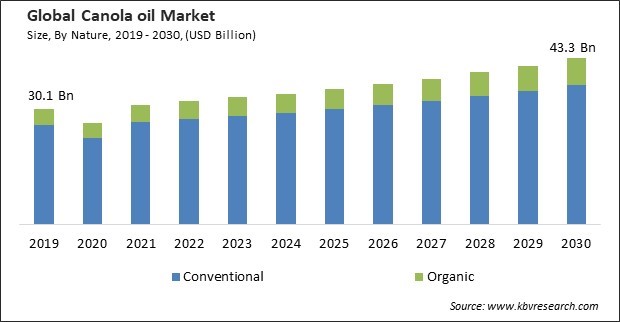

The Global Canola Oil Market size is expected to reach $43.3 billion by 2030, rising at a market growth of 3.9% CAGR during the forecast period. In the year 2022, the market attained a volume of 33,294.2 Kilo Tonnes, experiencing a growth of 2.8% (2019-2022).

Canola oil is well-suited for health-conscious consumers due to its low saturated fat and high levels of heart-healthy monounsaturated and polyunsaturated fats, including omega-3 and omega-6 fatty acids. Thus, the Europe segment acquired $8,644.7 million revenue in the market in 2022. The region's adoption of canola oil has been motivated by the desire for a balanced diet and the potential to decrease the risk of heart disease. Due to these factors, the segment is expected to experience growth in the future. Some of the factors impacting the market are rapid expansion of the food service sector, growing recognition of canola oil as a sustainable choice and stiff competition from other cooking oils.

The growth of the food service sector is driven by several influential factors that collectively shape its expansion and development. One pivotal factor is changing consumer lifestyles and habits. As people lead increasingly busy lives, there is a growing preference for convenient dining options. The food service sector responds by offering a wide range of choices, including fast food, takeout, food delivery services, and ready-made meals, to cater to the on-the-go needs of consumers. This adaptability to shifting consumer lifestyles and preferences has fueled the sector's growth. Consumers prioritizing sustainability and eco-friendly practices are increasingly choosing products made with canola oil. Canola's reputation as a more sustainable oilseed crop aligns with its environmental values and concerns. The focus on environmental sustainability is a global phenomenon, and the demand for sustainable products is not limited to specific regions. As a result, the market has expanded its reach, as consumers in various countries and regions recognize canola oil as a sustainable choice. These regulations encourage farmers and food producers to choose sustainable options like canola oil, which leads to increased market demand. This trust in the product positively influences their purchasing decisions, benefiting the market.

However, Cooking oil manufacturers may engage in price wars to remain competitive, leading to lower consumer prices. While this may benefit consumers in the short term, it can negatively impact the profitability of canola oil producers, leading to reduced investments in marketing, product development, and quality control. The presence of multiple cooking oil options can lead to market saturation, making it challenging for canola oil to gain or maintain market share. As the market becomes crowded with choices, it can be difficult for canola oil to stand out and differentiate itself from competitors. the competitive nature of the cooking oil market may necessitate increased promotional and advertising expenses to maintain or grow market share. Retailers often offer private-label or store-brand cooking oils, which can be priced lower than branded options. These private-label products can divert consumer attention from canola oil and affect its market share. All these factors can hinder the growth of the market in the coming years.

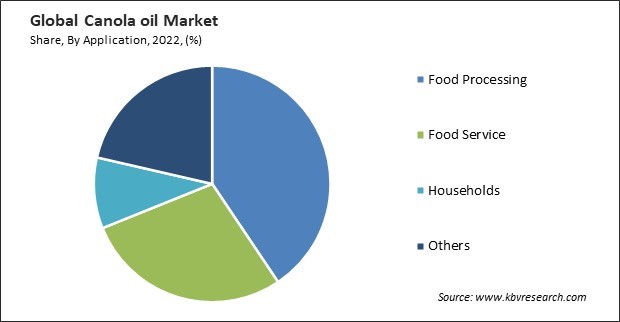

On the basis of application, the market is divided into food processing, food service, households, and others. The food processing segment recorded the maximum revenue share in the market in 2022. Canola oil is an excellent carrier for fat-soluble vitamins, including vitamins E and K. Canola oil's neutral flavor and ability to maintain a pleasing texture in various food products, such as baked goods, snacks, and salad dressings, make it a favorite among food processors. This enables manufacturers to produce products with consistent and attractive sensory experiences. Consequently, the segment is expected to experience significant growth in the coming years.

Based on nature, the market is segmented into organic and conventional. In 2022, the organic segment garnered a significant revenue share in the market. The organic segment has benefited from increased environmental and sustainability awareness. Consumers become more environmentally conscious and choose organic canola oil as a more sustainable option. Stringent regulations and certification processes for organic products have created a sense of trust and confidence among consumers. Organic canola oil must meet specific criteria for organic certification, ensuring it adheres to rigorous standards. Owing to these factors, there will be an increase in demand in the segment.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 32.2 Billion |

| Market size forecast in 2030 | USD 43.3 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 3.9% from 2023 to 2030 |

| Number of Pages | 256 |

| Number of Table | 510 |

| Quantitative Data | Volume in Kilo Tonnes, Revenue in USD Billion, and CAGR from 2019 to 2030 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Nature, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment procured the highest revenue share in the market in 2022. The food processing sector in the Asia-Pacific region has expanded significantly. Canola oil's neutral flavor and stability have made it a preferred choice for food manufacturers in producing snacks, baked goods, and processed foods. The Asia-Pacific region has experienced robust growth in the food processing industry. Food manufacturers use canola oil in various products, including snacks, fried foods, and packaged foods. Therefore, the segment will expand rapidly in the future.

Free Valuable Insights: Global Canola oil Market size to reach USD 43.3 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Louis Dreyfus Company B.V., Cargill, Incorporated, Associated British Foods PLC, Archer Daniels Midland Company, Wilmar International Limited, Bunge Limited, Jivo Wellness Pvt. Ltd., American Vegetable Oils, Inc., Richardson International Limited and La Tourangelle, Inc.

By Nature Volume, Kilo Tonnes, USD Million, 2019-2030)

By Application (Volume, Kilo Tonnes, USD Million, 2019-2030)

By Geography (Volume, Kilo Tonnes, USD Million, 2019-2030)

This Market size is expected to reach $43.3 billion by 2030.

Rapid expansion of the food service sector are driving the Market in coming years, however, Stiff competition from other cooking oils restraints the growth of the Market.

Louis Dreyfus Company B.V., Cargill, Incorporated, Associated British Foods PLC, Archer Daniels Midland Company, Wilmar International Limited, Bunge Limited, Jivo Wellness Pvt. Ltd., American Vegetable Oils, Inc., Richardson International Limited and La Tourangelle, Inc.

In the year 2022, the market attained a volume of 33,294.2 Kilo Tonnes, experiencing a growth of 2.8% (2019-2022).

The Conventional segment is leading the Market by Nature in 2022; thereby, achieving a market value of $36.4 Billion by 2030.

The Asia Pacific region dominated the Market by Region in 2022 and would continue to be a dominant market till 2030; thereby, achieving a market value of $19.8 Billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.