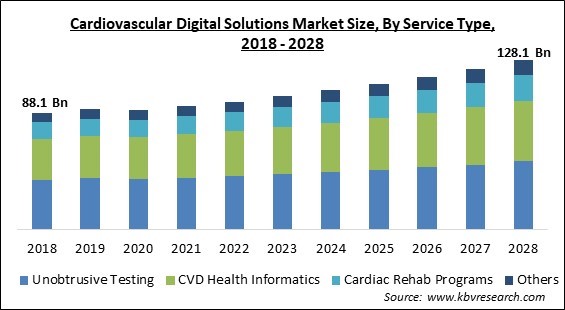

The Global Cardiovascular Digital Solutions Market size is expected to reach $128.1 billion by 2028, rising at a market growth of 4.8% CAGR during the forecast period.

Cardiovascular digital solutions are the fusion and application of digital technologies like software, sensors, wearables, smartphones, artificial intelligence, and virtual healthcare solutions. In order to develop and offer effective healthcare solutions, digital healthcare solutions are being used. The most frequent cause of morbidity and mortality, cardiovascular (CVD) illnesses, necessitates a comprehensive multi-parameter examination beyond the ECG.

For the early detection, monitoring, and treatment of cardiac problems, digital solutions are crucial. This allows for more specialized and effective cardiac care. One of the main reasons propelling the expansion of the cardiovascular digital solutions market is the rise in the prevalence of cardiovascular disorders worldwide, as well as the quickening pace of healthcare technology internationally.

Inadequate or wrong food intake, inactivity, use of tobacco, and excessive alcohol consumption are the biggest behavioral risk factors for cardiovascular diseases like heart disease and stroke. In addition, raised blood pressure, elevated blood glucose, elevated blood lipids, as well as being overweight, and obesity might be symptoms of behavioral risk factors in people. In primary care settings, these "intermediate risk factors" can be assessed and show a higher risk of complications like heart attack, stroke, and heart failure.

There are other additional underlying causes of CVDs. These reflect the three main forces that are causing social, economic, and cultural change: urbanization, population aging, and globalization. Hereditary factors, stress, and poverty are other CVD predictors. In order to lower cardiovascular risk and stop strokes and heart attacks in persons with these illnesses, the pharmacological treatment for hypertension, diabetes, and excessive blood lipids is also required.

Patients with mild symptoms were required to consult online as part of the social distancing procedures. Additionally, it eased the strain on hospitals already overburdened with COVID-19 patient counts. The development of Medical IoT devices also helped patients maximize outpatient care and reduce follow-up visits. These devices could also be employed in an emergency. Additionally, the resource shortage encountered during the pandemic led to the development of value-based and competitive pricing models. Therefore, the pandemic had a favorable impact on the market.

New cardiovascular therapy alternatives are being developed, and the MedTech CVD industry is growing, owing to the adoption of cutting-edge treatment technologies like TAVR and 3D printing. Providers are looking for a wide range of therapeutic, diagnostic, and monitoring solutions that they can use to manage the patient journey. These solutions should be empowered by the right technology, backed by research and a compelling value proposition, and made available at the appropriate time. This will propel the growth of the cardiovascular digital solutions market in the coming years.

There is mounting evidence that certain CVD initiatives centered on digital tools have benefited patients and physicians alike. For example, since devices may collect data via remote connectivity, digital health interventions for patients may result in fewer doctor visits. Furthermore, digital solutions can be used as clinical decision-support tools by healthcare professionals who input patient data to produce therapy suggestions. Hence, the changing methods of healthcare delivery and availability of healthcare providers have substantiated the use of technology to cater to more patients in a shorter time, which has also boosted the growth prospects for the market.

According to the Association of Clinical Research Organizations, there is a particularly great need for clinical trial associates (CTA) and clinical research associates (CRA). Unfortunately, over the past ten years, the problem has worsened because neither manufacturers nor CROs has provided graduates with enough skill training to meet the needs of the industry's research. This talent gap may hinder the adoption of innovative techniques and technology, which may have an adverse effect on the market for cardiovascular digital solutions in the years to come.

Based on service type, the cardiovascular digital solutions market is categorized into unobtrusive testing, CVD health informatics, cardiac rehab programs, and others. The unobtrusive testing segment garnered the highest revenue share in the cardiovascular digital solutions market in 2021. Unobtrusive monitoring techniques are being deployed to collect physiological signals and characteristics that interfere with a person's daily life, like heart rate, ECG, blood pressure, and blood glucose. In addition, modern advances in inconspicuous and wireless communication technologies enable real-time on-site physiological data collection from remote sites.

On the basis of components, the cardiovascular digital solutions market is divided into devices and software. The software segment recorded a significant revenue share in the cardiovascular digital solutions market in 2021. An essential marker of a patient's progress in recovering from chronic cardiac diseases is cardiovascular health. Therefore, monitoring cardiovascular health has become an integral part of the therapy strategy, which has increased the demand for software solutions. Cardiologists and clinic staff can easily do cardiac testing with patients using technological breakthroughs and the latest software updates.

Based on deployment, the cardiovascular digital solutions market is segmented into cloud-based and on-premises. The cloud-based segment witnessed the maximum revenue share in the cardiovascular digital solutions market in 2021. To stay within budgetary restrictions, the healthcare industry needs to develop efficient ways to enhance its resources and decrease spending. Therefore, the adoption of cloud-based solutions by healthcare organizations and hospitals has increased. Cloud-based solutions have emerged as a substitute for the conventional strategy, in which institutions must buy and own all the technology.

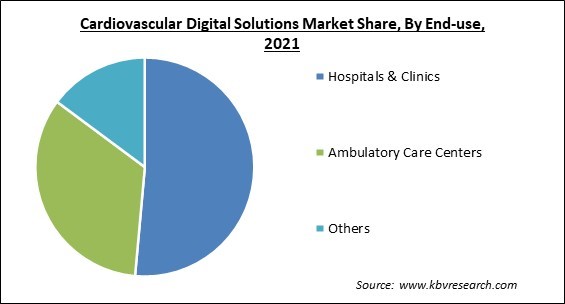

On the basis of end-use, the cardiovascular digital solutions market is segmented into hospitals & clinics, ambulatory care centers, and others. The ambulatory care centers segment acquired a substantial revenue share in the cardiovascular digital solutions market in 2021. Various circumstances call for using ambulatory cardiac monitoring services like MCOT (Mobile Cardiac Outpatient Telemetry). As it continually monitors heart activity and provides essential information, it enables real-time diagnosis of clinically severe arrhythmias that may arise in transcatheter aortic valve replacement (TAVR) patients after discharge.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 93.2 Billion |

| Market size forecast in 2028 | USD 128.1 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 4.8% from 2022 to 2028 |

| Number of Pages | 253 |

| Number of Table | 433 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Service Type, Deployment, Components, End-use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on region, the cardiovascular digital solutions market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific region witnessed a considerable growth rate in the cardiovascular digital solutions market in 2021. The expansion of the regional market is being driven by the rise in the elderly population and the advancement of heart health management systems in Asian nations. However, Asia Pacific presents several difficulties in the prevention and treatment of cardiovascular disease as the region with the biggest density of population and the greatest range of cultures, socioeconomic levels, ethnicities, and healthcare systems.

Free Valuable Insights: Global Cardiovascular Digital Solutions Market size to reach USD 128.1 Billion by 2028

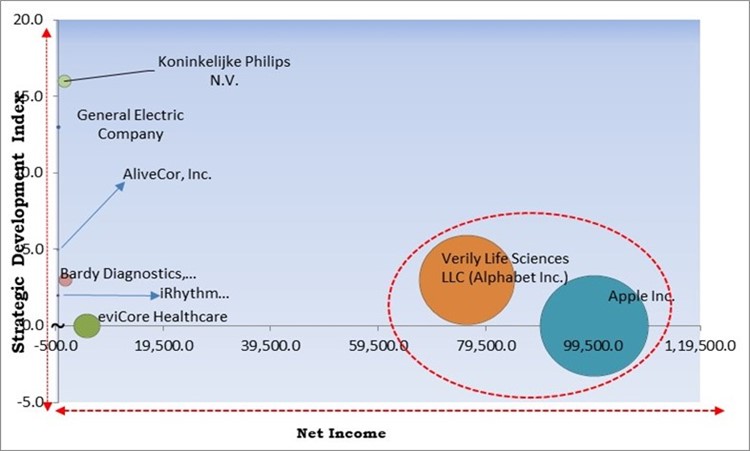

The major strategies followed by the market participants are Product Launches Based on the Analysis presented in the Cardinal matrix; Apple, Inc. and Verily Life Sciences LLC are the forerunners in the Cardiovascular Digital Solutions Market. Companies such as eviCore Healthcare, Koninklijke Philips N.V. and Bardy Diagnostics, Inc., are some of the key innovators in Cardiovascular Digital Solutions Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Apple, Inc., General Electric Company, Koninklijke Philips N.V., Verily Life Sciences LLC (Alphabet, Inc.), iRhythm Technologies, Inc., Bardy Diagnostics, Inc. (Hill-Rom Holdings Inc) (Baxter International Inc.), eviCore Healthcare (Express Scripts Holding Company) (Cigna Corporation), AliveCor, Inc., Cardiotrack, and HeartFlow, Inc.

By Service Type

By End-use

By Deployment

By Components

By Geography

The global Cardiovascular Digital Solutions Market size is expected to reach $128.1 billion by 2028.

Rising use of cutting-edge treatment methods are driving the market in coming years, however, Insufficiently qualified staff for clinical trials restraints the growth of the market.

Apple, Inc., General Electric Company, Koninklijke Philips N.V., Verily Life Sciences LLC (Alphabet, Inc.), iRhythm Technologies, Inc., Bardy Diagnostics, Inc. (Hill-Rom Holdings Inc) (Baxter International Inc.), eviCore Healthcare (Express Scripts Holding Company) (Cigna Corporation), AliveCor, Inc., Cardiotrack, and HeartFlow, Inc.

The Devices segment is generating highest revenue share in the Global Cardiovascular Digital Solutions Market by Components in 2021 thereby, achieving a market value of $93.4 billion by 2028.

The Hospitals & Clinics segment is leading the Global Cardiovascular Digital Solutions Market by End-use in 2021 thereby, achieving a market value of $64.3 billion by 2028.

The North America market dominated the Global Cardiovascular Digital Solutions Market by Region in 2021 and would continue to be a dominant market till 2028; thereby, achieving a market value of $48 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.