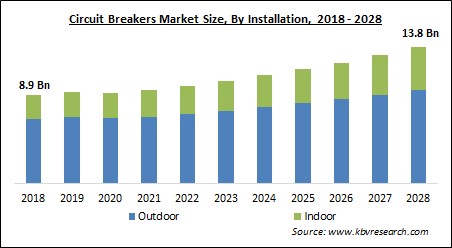

The Global Circuit Breakers Market size is expected to reach $13.8 billion by 2028, rising at a market growth of 5.7% CAGR during the forecast period.

A circuit breaker is defined as an electrical switching mechanism used to protect and control an electric power supply. It can be operated manually or automatically. During a short circuit or another sort of electrical fault, a large fault current travels through the device that trips the circuit. This contributes to the protection of the electrical system. In addition, it is used to protect the electrical system in small and medium substations, high voltage transmission, railway systems, distribution lines, and other applications.

Also, the participation of domestic governments, non-profit organizations, and international financial institutions such as the World Bank in the growth of the energy access rate have a significant impact on the global adoption of circuit breakers. Furthermore, rising electricity usage proportionately increases the demand for circuit breakers. Circuit breakers are used in energy-related applications to define the sensitivity of high residual current in order to give the best possible protection. The SF6 circuit breaker, on the other hand, emits greenhouse gases that would hamper market growth.

Because of increased urbanization and population growth, there is a huge increase in the requirement for updating electrical transmission networks, particularly in emerging economies. As a result, governments in these nations are focusing on increasing their power generation capacity in order to fulfill the growing demand for electricity in both rural and urban regions. Hence, the need for circuit breakers has increased. In addition, governments in industrialized countries are replacing obsolete electrical equipment with energy-efficient systems in order to assure electrical safety and reduce waste. Countries, for example, are modernizing their electricity grids and transmission lines, which is boosting industry growth.

Due to the outbreak of COVID-19, the market for circuit breakers is likely to decline in 2020. For the past two months, the COVID-19 pandemic has had a detrimental influence on the electricity industry around the world. Electricity demand curves have taken on new shapes, particularly in nations where the pandemic had a significant impact. In addition, lockdowns across countries to combat the spread of the virus are reducing electricity demand, which is likely to have a negative influence on the global market. Furthermore, grid modernization efforts are likely to decline throughout this time period.

As per the International Energy Agency (IEA), the total investment in renewable energy generation in 2020 is estimated to be USD 281 billion globally. In 2018, global investments in renewable energy in the power industry were USD 308 billion. Photovoltaic and wind turbines, for example, necessitate a specialized safety mechanism. Circuit breakers are therefore required to connect power plants to switchyards and the electrical grid. In an electrical system, it is one of the most crucial and critical components. It protects the power system and regulates the power supply. Concerns about renewable energy's reliability have strengthened the market for renewable generation and distribution.

With increasing investment in the power transmission and distribution industry, medium voltage circuit breakers are in high demand. Medium voltage circuit breakers are those that have a medium voltage range of 400 volts to 15 kV. The reason they are called so is that they can't operate properly in very low voltage circumstances, and neither can they operate perfectly at very high voltage. As a result, they commonly work at a medium voltage level around this amount. There is an increased need for medium voltage fuses in transformers, T&D networks, circuit and motor protection, as well as industrial applications, and renewable energy generation and distribution.

The COVID-19 pandemic has hindered the expansion of the power industry, as more countries implement state-wide lockdowns to prevent the sickness from spreading further. The renewable energy sector, which had been growing at a breakneck pace until recently, has slowed in recent months. This slowdown is primarily due to economic downturns, which have resulted in lower power consumption from a variety of end-use industries. With lower power consumption, utilities are expected to invest very little in replacing existing grid infrastructure and installing new renewables.

Based on Installation, the market is segmented into Outdoor and Indoor. In 2021, the Outdoor segment had the highest share of the market. As infrastructural upgrades take place in nations with high urbanization rates, the demand for outdoor circuit breakers is expanding. The growth of the segment would be driven by an increase in demand for outdoor circuit breakers from industrial and utility applications for the protection of electrical equipment and circuits. Moreover, rising infrastructural developments, as well as the building and construction of power infrastructures such as generation, transmission, and distribution, as well as the rapid growth of the renewable energy industry, are expected to boost demand for outdoor circuit breakers in these industries.

Based on Insulation Type, the market is segmented into Gas, Oil, Vacuum, and Air. In 2021, the Gas Circuit Breakers segment acquired the biggest revenue share of the Circuit Breakers Market. Gas circuit breakers are popular because of their strong dielectric properties and small footprint. Because of increased investments in renewable energy, demand for renovations to existing substations or the construction of new ones is likely to boost the market for SF6-based gas-insulated switchgear in the Asia Pacific, followed by Europe. The growth of the segment would be driven by the increased demand for gas circuit breakers from the industrial, utility, and commercial sectors. Moreover, increased focus on distributed power infrastructure and rapid growth of the renewable energy sector is expected to fuel market growth.

Based on Voltage, the market is segmented into High, Medium, and Low. The Medium voltage segment obtained a significant revenue share of the Circuit Breakers Market in 2021. This is because medium voltage breakers are highly used in industrial, infrastructure, and utility-scale applications. In addition, the medium-scale breaker applications have the most applications and are predicted to increase at a high rate. Due to its compact size and better dependability over air circuit breakers, vacuum circuit breakers are the most preferred type of medium-voltage breaker for industrial situations. The fundamental difference between vacuum circuit breakers and air circuit breakers is that the contact assembly is enclosed in a vacuum bottle. The moveable contact assembly is made up of a stem with the enclosed contact on one end and a driving mechanism outside the vacuum bottle on the other.

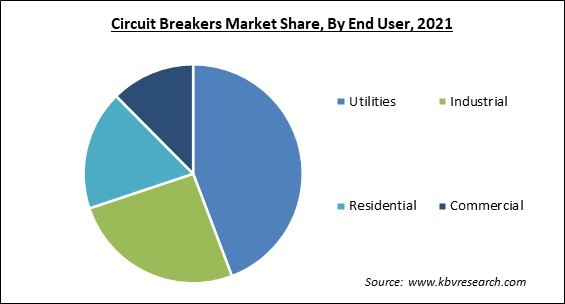

Based on End User, the market is segmented into Utilities, Industrial, Residential, and Commercial. In 2021, the Utilities segment held the maximum revenue share of the Circuit Breakers Market. This is due to the rising need for energy in developing and developed nations, which resulted in increased demand for circuit breakers in utility applications. Furthermore, rising energy consumption combined with cleaner electricity generation is likely to fuel the expansion of the renewable power generating segment. For utility applications, medium and high voltage switching devices are commonly utilized. SF6 circuit breakers are losing favor in utility-scale applications due to environmental concerns, and a replacement for an SF6-based automatically operated electrical switch is being researched, developed, and demonstrated.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 9.4 Billion |

| Market size forecast in 2028 | USD 13.8 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 5.7% from 2022 to 2028 |

| Number of Pages | 259 |

| Number of Tables | 453 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Installation, Insulation Type, Voltage, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2021, the Asia Pacific emerged as the dominating region in the Circuit Breakers Market by procuring the maximum revenue share. This is owing to the enormous consumer base and presence of major players in the region. Moreover, significant growth in the renewable energy sector, increased investment in upgrading aging power infrastructure, and rapid industrialization in the region are expected to fuel the circuit breakers market in the coming years.

Free Valuable Insights: Global Circuit Breakers Market size to reach USD 13.8 Billion by 2028

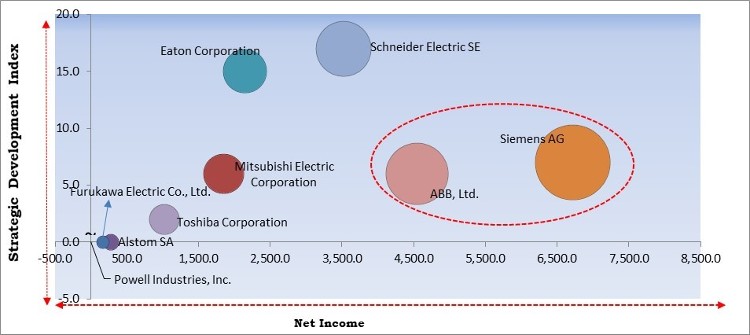

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Siemens AG and ABB, Ltd. are the forerunners in the Circuit Breakers Market. Companies such as Schneider Electric SE, Mitsubishi Electric Corporation, Eaton Corporation are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Siemens AG, ABB Group, Eaton Corporation PLC, Schneider Electric SE, Alstom Holdings, Mitsubishi Electric Corporation, Furukawa Electric Co., Ltd., Toshiba Corporation, Kirloskar Electric Co. Ltd., and Powell Industries, Inc.

By Installation

By Insulation

By Voltage

By End User

By Geography

The global circuit breakers market size is expected to reach $13.8 billion by 2028.

Growing demand for Medium Voltage Circuit Breakers and increased electrification Initiatives are increasing are driving the market in coming years, however, the adverse impact of the COVID-19 pandemic growth of the market.

Siemens AG, ABB Group, Eaton Corporation PLC, Schneider Electric SE, Alstom Holdings, Mitsubishi Electric Corporation, Furukawa Electric Co., Ltd., Toshiba Corporation, Kirloskar Electric Co. Ltd., and Powell Industries, Inc.

The High voltage segment is leading the Global Circuit Breakers Market by Voltage in 2021, thereby, achieving a market value of $6.0 billion by 2028.

The Asia Pacific market dominated the Global Circuit Breakers Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $5.0 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.