The Global Citizen Services AI Market size is expected to reach $48.6 billion by 2028, rising at a market growth of 39.8% CAGR during the forecast period.

Citizen service in AI refers to the application of AI technology to various government public services. By providing analytical information, public service management, and technological proficiency, the use of AI can transform government functioning and operations. Implying AI will prompt efficiency and provide adequate and evidence-based information and analysis.

Improvising citizen services, demand for digital transformation in the government sector, and rising costs of automation of manual processes to alleviate pressure are amongst some elements that drive the business development of the artificial intelligence for citizen services. Also, the reduction in administrative burdens, complex task performance, and help to resolve allocation issues led to the growth of the market.

Artificial intelligence has considerable applications in varied government organizations. In road traffic management real-time data collection from CCTV cameras, consumer service centres manned by robots, and traffic flow optimization uses AI for enhanced results. Using algorithms and machine learning techniques enormous amounts of data to identify statistical behaviours and models to make precise predictions are the key components for governments.

Assisting in shrinking administrative issues, carrying out complex tasks, and rectifying resource allocation issues have constructive and practical opportunities for citizen service AI. AI is used in countless ways, thereby, making lives more convenient and interesting. From voice recognition to self-driving cars, chatbots, online shopping, healthcare technologies, streaming services, and education to factory and warehouse systems life has eased due to adoption of AI in citizen services.

AI industry observes stronger career prospects during the pandemic. The need for isolated contacts that can facilitate safety is the driving force for the production of new technologies. No contact pickup and delivery, or reservation systems in the hospital & restaurants. Almost all educational institutions gradually turning to online study program cultures with AI-powered smart learning have prompted the growth of the industry. Companies are launching AI-powered check-in options for patients to adjust to the need of the time. As a result, the citizen service in AI market has benefited from the outbreak of COVID-19.

The employability and expansion of digitalization in the organisations have made the procedures efficient and faster. With the introduction of AI technologies business do not have to engage themselves with enormous data manually. By engaging into more intelligent processing and data management capabilities, the productivity of organisations will increase. Use of AI and analytics in the organisations will make data procurement more precise and help to row themselves in a competitive market.

Due to the enhanced citizen satisfaction by the implementation of the internet of things (IoT), and other emerging technologies, like machine learning and biometric systems, governments along with various organisations are exploring the adoption of artificial intelligence in citizen services. Corporations have the highest regard for emerging technologies as they will assist them in addressing citizen grievances. Technology that helps in direct interaction with citizen-centred services is being preferred and adopted by the government and the public & private sectors.

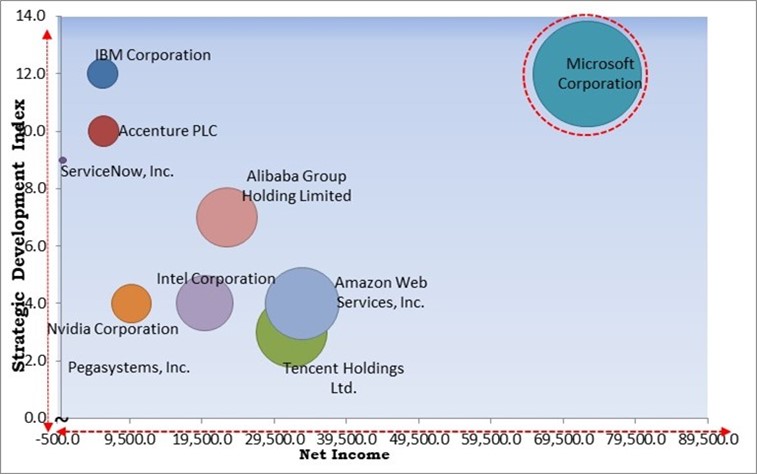

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The below illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

A sturdy framework and environment are essential for any government organisation to build up comprehensive end-to-end AI-based citizen services. As most organizations do not have the basic infrastructure and manpower, it has been observed that they are unable to properly comply with these technologies for citizen services. Since there is little or poor knowledge among government agencies, the deployment of any digital solutions to citizen services becomes difficult.

By component, citizen services AI market is divided into solution and services. In 2021, the solution segment dominated the citizen services AI market with maximum revenue share. By incorporating artificial intelligence various organisations are deploying citizen service solutions to manage & receive information and service requests from citizens as well as servicing investigations from government organizations.

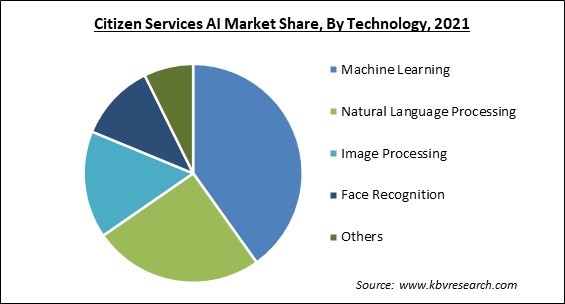

On the basis of technology, citizen services AI is fragmented into machine learning, natural language processing, image processing, face recognition and others. In 2021, the natural language processing segment generated prominent revenue growth in the citizen services AI market. Healthcare sectors are prominently to play a key role in the new market as artificial intelligence-based text-mining tools are being adopted, allowing the physician to swiftly search through large amounts of medical literature.

Based on organization size, citizen services AI is bifurcated into large enterprise and SMEs. The SMEs segment procured a promising revenue share in the citizen services AI market in 2021. AI is considerably affecting the SME business environment. The efficiency of the public administration has been enhanced, digital infrastructures have been secured, improved finance access of SMEs', management skills eased and experimentation and innovation cost has been reduced.

By deployment mode, citizen services AI is classified into On-premises and cloud. In 2021, the on-premise segment registered the largest revenue in the citizen services AI market. This is because the use of on-premise citizen services is cheaper and can work with mass amounts of computing power. Being economical or favouring capital expense over operational expenses, customers are more likely to invest in on-premise services. It is also very helpful for customers who need prompt decision-making for data manipulation. These factors would support the market growth in this segment.

On the basis of verticals, the citizen services AI is segmented into transportation, healthcare, government & public sector, energy & utility, agriculture, and education & training. The government & public sector segment recorded the highest revenue in the citizen services AI in 2021. By utilizing various advanced technologies like artificial intelligence and machine learning, the government is speeding up the delivery of citizen services. Now citizens don't have to wait in lines and can expect immediate responses and services.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 4.9 Billion |

| Market size forecast in 2028 | USD 48.6 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 39.8% from 2022 to 2028 |

| Number of Pages | 335 |

| Number of Tables | 553 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Technology, Deployment Mode, Organization Size, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the citizen services AI market is analysed across North America, Europe, Asia-Pacific and LAMEA. In 2021, the North America region accounted for the maximum revenue share in the citizen services AI market. Being a repository of a developed market, artificial intelligence services are being used for citizen redressal. From mass data collection, and automated surveillance to face recognition AI technologies are employed to address the rising need for better citizen services.

Free Valuable Insights: Global Citizen Services AI Market size to reach USD 48.6 Billion by 2028

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; IBM Corporation and Oracle Corporation are the forerunners in the Citizen Services AI Market. Companies such as OpenText Corporation, Genpact Limited, Software AG are some of the key innovators in Citizen Services AI Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include ServiceNow, Inc., Microsoft Corporation, IBM Corporation, Accenture PLC, Amazon Web Services, Inc. (Amazon.com, Inc.), Nvidia Corporation, Intel Corporation, Alibaba Group Holding Limited, Tencent Holdings Ltd., and Pegasystems, Inc.

By Component

By Technology

By Deployment Mode

By Organization Size

By Vertical

By Geography

The global Citizen Services AI Market size is expected to reach $48.6 billion by 2028.

Ai Adoption Would Enable Faster Decision Making are driving the market in coming years, however, Less Availability of Skilled Workers Along with Infrastructure Inefficiency restraints the growth of the market.

ServiceNow, Inc., Microsoft Corporation, IBM Corporation, Accenture PLC, Amazon Web Services, Inc. (Amazon.com, Inc.), Nvidia Corporation, Intel Corporation, Alibaba Group Holding Limited, Tencent Holdings Ltd., and Pegasystems, Inc.

The Machine Learning segment acquired maximum revenue share in the Global Citizen Services AI Market by Technology in 2021 thereby, achieving a market value of $18.7 billion by 2028.

The North America market dominated the Global Citizen Services AI Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $17.8 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.