“Global Claims Management Market to reach a market value of USD 11.48 billion by 2031 growing at a CAGR of 13.1%”

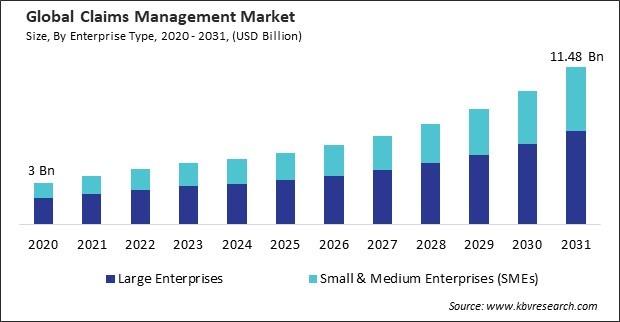

The Global Claims Management Market size is expected to reach $11.48 billion by 2031, rising at a market growth of 13.1% CAGR during the forecast period.

Life insurance providers rely on advanced claims management systems to streamline claim adjudication, reduce manual errors, and improve transparency. The need for robust fraud detection mechanisms also plays a critical role in driving the adoption of these systems as insurers seek to identify and mitigate fraudulent claims. Additionally, the demand for faster settlements and enhanced customer satisfaction has propelled AI-driven claims platforms, enabling insurers to process claims efficiently while maintaining compliance with regulatory standards. Thus, the life insurance claims segment recorded 36% revenue share in the market in 2023.

The integration of predictive analytics in claims management solutions is revolutionizing the insurance and healthcare industries by enabling data-driven decision-making and improving operational efficiency. Predictive analytics utilizes both historical and real-time data to forecast trends, identify potential hazards, and enhance claims processing methodologies. Additionally, automation is a key component of digitized claims management, with technologies like robotic process automation (RPA) and artificial intelligence (AI) driving efficiency. Insurers like Liberty Mutual Insurance use AI-powered chatbots to guide customers through the claims process, collect necessary data, and minimize errors. Therefore, these factors are supporting the growth of the market.

However, Implementing advanced claims management systems can require significant financial investment, particularly for small and medium-sized enterprises (SMEs). These costs often create a substantial barrier for businesses with limited budgets. The initial expenses are not confined to purchasing the software; they extend to critical aspects like system customization, integration with existing IT infrastructure, and user training. Hence, this cost barrier slows the adoption of modern claims management systems.

Based on enterprise type, the market is bifurcated into large enterprises and small & medium enterprises (SMEs). The large enterprises segment garnered 63% revenue share in the market in 2023. These organizations often process high volumes of claims across multiple regions, necessitating systems with capabilities like automation, artificial intelligence, and real-time analytics to ensure accuracy and efficiency.

On the basis of deployment mode, the market is classified into cloud and on-premise. The on-premise segment recorded 39% revenue share in the market in 2023. Organizations prioritizing data security and control over their infrastructure drive the segment's growth. Large enterprises, in particular, exhibit a preference for on-premise solutions for the management of sensitive data, including financial and healthcare documents, due to the comprehensive ownership and control they provide. Industries with strict regulatory requirements often opt for on-premise deployment to ensure compliance and mitigate cybersecurity risks.

By technology, the market is divided into Internet of Things (IoT), Blockchain, robotic process automation (RPA), AI & ML, and others. The robotic process automation (RPA) segment garnered 21% revenue share in the market in 2023. RPA solutions are particularly effective in streamlining data entry, document verification, and claims adjudication processes.

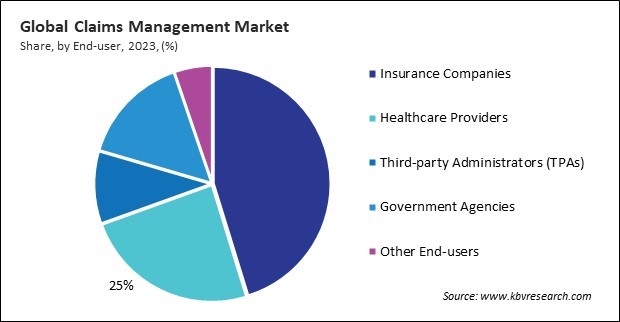

Based on end-user, the market is segmented into insurance companies, healthcare providers, third-party administrators (TPAs), government agencies, and others. The insurance companies segment procured 45% revenue share in the market in 2023. The segment is growing due to its direct involvement in managing many claims across diverse health, life, auto, and property insurance sectors.

On the basis of type, the market is divided into life insurance claims, property & casualty insurance claims, health insurance claims, worker’s compensation claims, disability insurance claims, and others. The property & casualty insurance claims segment garnered 15% revenue share in the market in 2023. Insurers in this segment increasingly rely on IoT technology, such as smart home sensors and telematics, to gather real-time data and assess claims accurately.

Free Valuable Insights: Global Claims Management Market size to reach USD 11.48 billion by 2031

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Europe segment acquired 30% revenue share in the market in 2023. Regulations such as the General Data Protection Regulation (GDPR) have compelled insurers and healthcare providers to implement advanced claims management systems prioritizing secure data handling and transparency.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 4.49 Billion |

| Market size forecast in 2031 | USD 11.48 billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 13.1% from 2024 to 2031 |

| Number of Pages | 345 |

| Number of Tables | 570 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Type, Enterprise Type, Deployment Mode, Technology, End-user, Region |

| Country scope |

|

| Companies Included | Salesforce, Inc., Conduent, Inc., Aclaimant, Inc., UnitedHealth Group, Inc. (Optum, Inc.), Accenture PLC, IBM Corporation, PLEXIS Healthcare Systems, Inc., Oracle Corporation, McKesson Corporation and DXC Technology Company |

By Enterprise Type

By Deployment Mode

By Technology

By End-user

By Type

By Geography

This Market size is expected to reach $11.48 billion by 2031.

Continuous Rise in Healthcare Costs are driving the Market in coming years, however, Substantially High Implementation Costs restraints the growth of the Market.

Salesforce, Inc., Conduent, Inc., Aclaimant, Inc., UnitedHealth Group, Inc. (Optum, Inc.), Accenture PLC, IBM Corporation, PLEXIS Healthcare Systems, Inc., Oracle Corporation, McKesson Corporation and DXC Technology Company

The expected CAGR of this Market is 13.1% from 2024 to 2031.

The Cloud segment is leading the Market by Deployment Mode in 2023; thereby, achieving a market value of $7.4 million by 2031.

The North America region dominated the Market by Region in 2023, and would continue to be a dominant market till 2031; thereby, achieving a market value of $4.4 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges