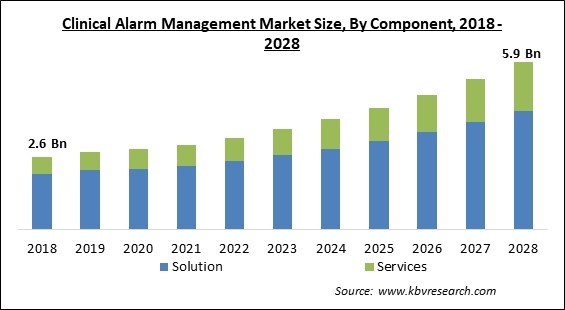

The Global Clinical Alarm Management Market size is expected to reach $5.9 billion by 2028, rising at a market growth of 10.5% CAGR during the forecast period.

Clinical alarm systems react to emergencies just like any other alarm system. Clinical alarms enable medical personnel to react to a patient's deteriorating state. It can be difficult to determine which patients are being monitored by continuous monitoring systems and which ones require immediate treatment. The clinical alarm systems assist the healthcare systems at this point. When a nurse notices aberrant rates in a patient's condition, she can manually activate the alarm systems if she believes the patient needs immediate attention. As a result, the system facilitates speedy emergency response by the healthcare systems. Clinical systems management is necessary because these systems, can occasionally be erroneous and become a waste of effort.

Alarms notify employees when a situation is dangerous or life-threatening and calls for rapid action, yet they frequently ring even when no such scenario exists. Most non-urgent alarms don't need to be attended to right away by a staff member. The persistent onslaught of nuisance alerts causes alarm fatigue, which is demonstrated by slow or no response, silencing or muting the alarm, or completely turning off the alarm. This cacophony creates the background noise of a unit's environment. The staff member may not be warned of an emergency if the alert is turned off or muffled.

Even though there are strategies, none of them by themselves can solve this issue. Multiple actions are needed for mitigation, some of which might need to be customized for the unit or patient. For instance, when necessary, alarm parameters may be changed to increase the likelihood that the alarm will only go off when the patient genuinely needs to be attended to. In some circumstances, it might also be able to place a small delay on the alarm; in such cases, things automatically adjust themselves after just a few seconds. Employing technicians to keep an eye on the patient monitors and notify staff of any events is another tactic. This advice piece examines these interventions in greater detail.

Growth in Telehealth has been delayed over the last few years by legislative and behavioral constraints. The segment is expected to rise over the next two years, though, as many healthcare providers are now focusing on video conferencing and phone calls. Additionally, it significantly lessened the strain on hospitals that were already overwhelmed with COVID-19 patient counts. Medical IoT devices that reside in the patient's house are now utilized to maximize outpatient care and reduce follow-up visits; these devices can also be employed in an emergency.

The rise in alarm-based devices, patients connected to more devices, and a lack of device standardization have all contributed to an increase in the adoption of the clinical alarm management. Due to alarm fatigue brought on by the excessive frequency of alarms, medical staff may become desensitized, which could lead to alarms being disregarded or turned off. This could lead to overriding or avoiding potentially crucial notifications, with serious repercussions and a further burden on hospital resources in the future. Inaccurate and bothersome alarms can prevent patients from getting enough sleep and impede recovery, in addition to causing annoyance and stress for caregivers. The sector will rise as a result of increased government initiatives in both developed and developing nations for the use of clinical alarms.

Patient data included in electronic health records is frequently complex, private, and unstructured. To make use of the possibilities for bettering patient care, the barrier of integrating this knowledge into the process of providing healthcare must be overcome. Even though EHRs have been used for more than ten years, the market has accelerated because of national government initiatives targeted at enhancing patient protection. The context-specific data about the clinical care setting and patients will probably be used in the next phase of the EHR development process to enhance the relevance of reference content and alerts sent to patients at the point of treatment and to improve functionality. The growing adoption of Electronic health records surges the growth of the clinical alarm management market.

The lack of compatibility is a major obstacle to the successful delivery of clinical alarm management solutions and services. Electronic systems need to be able to communicate with one another to integrate and analyze data. Without adequate data interchange and analysis, clinical alarm management will not be effective. Approximately 10 percent of doctors were able to send, receive, and integrate health data into their respective EHR systems, according to the National Electronic Health Records Survey conducted between 2015 and 2017. The majority of hospitals are unable to perform all four information exchange activities, even though many of these hospitals can conduct some information exchange activities that support interoperability. The lack of the interoperability hampers the growth of the clinical alarm management market.

Based on the Component, the Clinical Alarm Management Market is segmented into Solutions and Services. The solution segment acquired the highest revenue share in the clinical alarm management market in 2021. It is due to the continual demand for software application upgrades and improvements. The greater proportion of this market can be due to the ongoing requirement for software application upgrades and enhancements. This is due to measures taken by important firms, the growing use of connected care technology in healthcare, and the requirement to lessen alert fatigue.

On the basis of Product, the Clinical Alarm Management Market is divided into Nurse call systems, Physiological monitors, EMR integration systems, Ventilators, Other. The nurse call system segment procured the largest revenue share in the clinical alarm management market in 2021. The significant market share can be attributed to the efforts of research organizations to lessen the risks of alarm exhaustion, the increase in the number of technically sophisticated nurse call systems introduced to the market, and the increased focus of healthcare providers on developing alarm management strategies to reduce alarm fatigue.

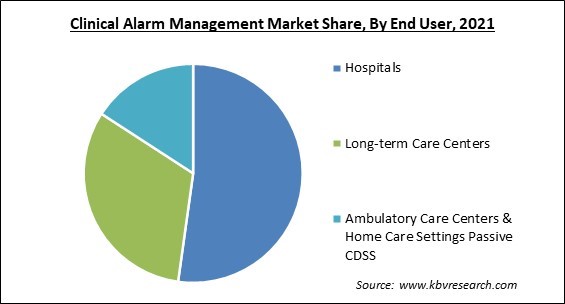

By End-user, the Clinical Alarm Management Market is classified into Hospitals, Long-term care centers, and Ambulatory care centers & home care settings Passive CDSS. The long-term care centers segment registered a significant revenue share in the clinical alarm management market in 2021. It is because there are more senior living institutions and more people are becoming aware of the value of clinical alarm management solutions at these facilities. Alarm fatigue and safety have become crucial concerns in protecting patient safety. To find the fundamental cause and provide solutions, a multidisciplinary examination at the systems level is necessary.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 3 Billion |

| Market size forecast in 2028 | USD 5.9 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 10.5% from 2022 to 2028 |

| Number of Pages | 237 |

| Number of Tables | 364 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Product, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, Australia, South Korea, Singapore, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the Clinical Alarm Management Market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment acquired the largest revenue share in the clinical alarm management market in 2021. It is because alarm fatigue cases are on the rise, and the government is working to reduce its effects, and healthcare IT systems are in high demand. As a result, the cause of this phenomenon is attributed to the fact that these systems provide reliability, efficient data maintenance, and data integrity, and facilitate the availability of patient data to authorized healthcare professionals.

Free Valuable Insights: Global Clinical Alarm Management Market size to reach USD 5.9 Billion by 2028

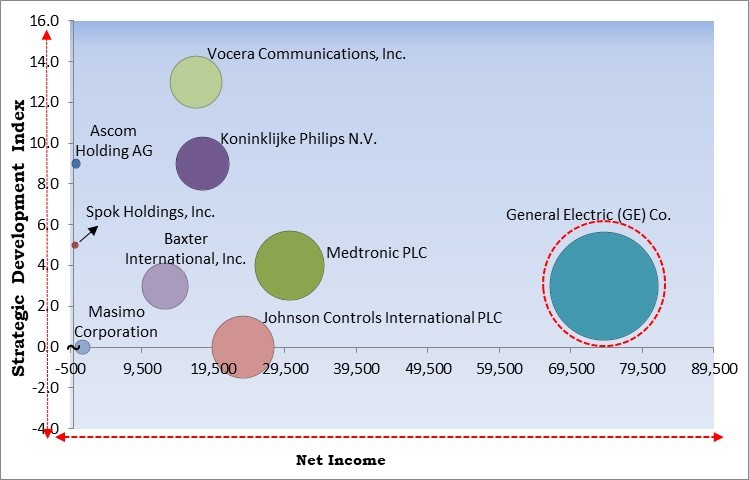

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; General Electric (GE) Co. is the major forerunner in the Clinical Alarm Management Market. Companies such as Vocera Communications, Inc., Koninklijke Philips N.V. and Ascom Holding AG are some of the key innovators in Clinical Alarm Management Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Koninklijke Philips N.V., General Electric (GE) Co. (GE Healthcare), Ascom Holding AG Spok Holdings, Inc. (Spok, Inc.), Masimo Corporation, Cornell Communications, Inc., Baxter International, Inc., Johnson Controls International PLC, Medtronic PLC, and Vocera Communications, Inc. (Stryker Corporation).

By Component

By End User

By Product

By Geography

The global Clinical Alarm Management Market size is expected to reach $5.9 billion by 2028.

The fatigue caused by alarms is increasing are driving the market in coming years, however, Interoperability issues with the clinical alarm management restraints the growth of the market.

Koninklijke Philips N.V., General Electric (GE) Co. (GE Healthcare), Ascom Holding AG Spok Holdings, Inc. (Spok, Inc.), Masimo Corporation, Cornell Communications, Inc., Baxter International, Inc., Johnson Controls International PLC, Medtronic PLC, and Vocera Communications, Inc. (Stryker Corporation).

The Hospitals market has acquired the maximum revenue share in the Global Clinical Alarm Management Market by End User in 2021, thereby, achieving a market value of $3 billion by 2028.

The EMR Integration Systems market has shown the high growth rate of 10.9% during (2022 - 2028).

The North America market dominated the Global Clinical Alarm Management Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $2.1 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.