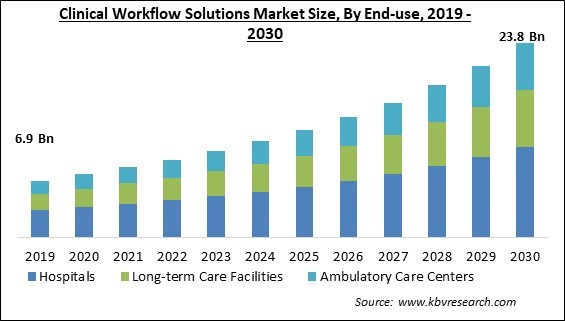

The Global Clinical Workflow Solutions Market size is expected to reach $23.8 billion by 2030, rising at a market growth of 12.3% CAGR during the forecast period.

Hospitals are being mismanaged due to increased accidents, blood sugar fluctuations, and heart attacks since it is difficult for staff members and medical professionals to communicate efficiently in an emergency. Therefore, the unified communication solutions segment would generate approximately $809.7 million revenue in the market in 2030. By creating a uniform method for information exchange and document access, sponsors, and locations, combined information sharing can increase operational effectiveness and greatly reduce administrative responsibility in trials, Clinical workflow solutions are supported by the healthcare industry to streamline the procedure for healthcare professionals. Companies and organizations can use contemporary, interactive, efficient network solutions by combining communications technologies into a single straightforward, accessible platform.

The major strategies followed by the market participants are partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In April, 2023, Koninklijke Philips N.V. entered a partnership with Amazon Web Services to enhance its communications and imaging archiving systems. Moreover, In March, 2023, Veradigm, Inc. signed a partnership with Opargo to integrate its Practice Management suite with Opargo's scheduling and revenue optimization offerings.

Based on the Analysis presented in the KBV Cardinal matrix; Cisco Systems, Inc. is the forerunner in the Market. Companies such as Cerner Corporation, McKesson Corporation, Vocera Communications, Inc. are some of the key innovators in the Market. In November, 2022, Cerner Corporation partnered with Labcorp to provide solutions for efficient healthcare operations workflow.

During the COVID-19 pandemic, healthcare practitioners faced significant challenges, underscoring the necessity of effective clinical procedures and remote access to data insights. In many places worldwide, the rising incidence of COVID-19 increased the demand for accurate diagnosis and treatment equipment. In this regard, linked care technologies proved useful, allowing medical professionals to monitor patients using non-invasive digitally connected devices like pulse oximeters and home blood pressure monitors. Therefore, due to the need for businesses to broaden and integrate their product portfolios, the COVID-19 pandemic stimulated market growth and increased acquisition activity.

During the anticipated period, the market is expected to experience profitable growth due to the quick development of technology and the introduction of new products by the key market players. IT developments include remote patient monitoring, electronic health records (EHR), high-speed mobile networks, and high-definition video conferencing. The use of auxiliary medical equipment has enabled patients to remotely monitor their health indicators at home, such as blood pressure, electrocardiogram (ECG), body temperature, and glucose levels, automatically relaying real-time information to a doctor or nurse. Therefore, these technological advancements are propelling the growth of the market.

In every country on earth, the old population is growing swiftly. By 2050, there will be about 1.5 billion people on the planet, a rise of more than three times the current population. Additionally, it is anticipated that 16.0% of people will be over 60 worldwide by this time. One out of every six people will be 65 or older by the middle of the twenty-first century. The "population aging phenomenon" refers to the increase in the percentage and prevalence of older people worldwide. In 2019, approximately 703 million people were 65 or older in the world. People 65 and over made up 9% more of the population in 2019 than in 2018. It is predicted that increased demand for new medication delivery and monitoring systems will fuel market growth due to the world's aging population and these people being more prone to age-related issues.

The variety of health information systems poses substantial challenges to effectively adopting and applying healthcare information technology solutions. Many nations lack specific IT standards for data storage and exchange, which raises interoperability difficulties. Although there are several data storage, transit, and safety standards, the adoption and integration of these interoperability standards by healthcare providers and IT solution vendors are extremely difficult. Due to the lack of a single health information system that can satisfy a large healthcare provider's administrative, clinical, technological, and laboratory requirements, the need for interoperability and interoperability standards has become increasingly important. Therefore, these factors are projected to restrain market expansion throughout the forecasted period.

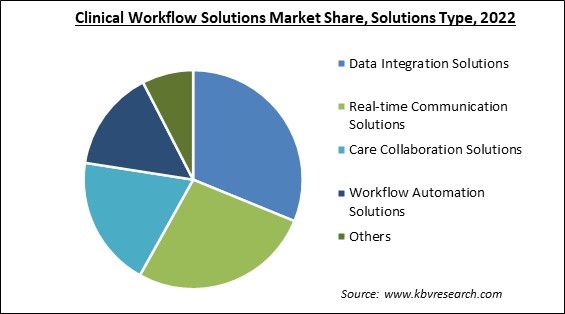

Based on solutions type, the market is characterized into data integration solutions, real-time communication solutions, workflow automation solutions, care collaboration solutions, and enterprise reporting & analytics solutions. The care collaboration solutions segment acquired a promising growth rate in the clinical workflow solutions market in 2022. The demand for care collaboration solutions is predicted to grow as the focus on patient-centric services increases. Payers, employer organizations, and governmental bodies adopt integrated solutions to meet their management needs.

On the basis of end-use, the market is classified into hospitals, long-term care facilities, and ambulatory care facilities. The hospitals segment procured the maximum revenue share in the market in 2022. The segment is expanding since it is applicable, and more healthcare facilities, along with the associated data, need adequate administration and privacy. Government attempts to promote the healthcare industry and declutter the complexity of a vast amount of data in healthcare facilities are also anticipated to fuel market expansion.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 9.5 Billion |

| Market size forecast in 2030 | USD 23.8 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 12.3% from 2023 to 2030 |

| Number of Pages | 424 |

| Number of Table | 623 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Solutions Type, End-use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment recorded the highest revenue share in the market in 2022. This is caused by an increase in the number of research and development (R&D) projects and hospital patient admissions, which generates a lot of data. Additionally, an emphasis on patient care and increased expenditures on digitization for safe data transfer within organizations, growing government efforts to promote the efficient implementation of EHR, interoperability, and other solutions is also demanding the use of clinical workflow solutions.

Free Valuable Insights: Global Clinical Workflow Solutions Market size to reach USD 23.8 Billion by 2030

The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Veradigm, Inc., Cerner Corporation, NEXTGEN HEALTHCARE, INC., McKesson Corporation, Koninklijke Philips N.V., Cisco Systems, Inc., Getinge AB, Vocera Communications, Inc. (Stryker Corporation), Spok, Inc. (Spok Holdings, Inc.) and Ametek, Inc.

By Solutions Type

By End-Use

By Geography

The Market size is projected to reach USD 23.8 billion by 2030.

Rising technological development of workflow solutions are driving the Market in coming years, however, Issues of interoperability among new and old solutions restraints the growth of the Market.

Veradigm, Inc., Cerner Corporation, NEXTGEN HEALTHCARE, INC., McKesson Corporation, Koninklijke Philips N.V., Cisco Systems, Inc., Getinge AB, Vocera Communications, Inc. (Stryker Corporation), Spok, Inc. (Spok Holdings, Inc.) and Ametek, Inc.

The expected CAGR of this Market is 12.3% from 2023 to 2030.

The Data Integration Solutions segment is generating the highest revenue in the Market by Solutions Type in 2022; thereby, achieving a market value of $6.9 billion by 2030.

The North America region dominated the Market by Region in 2022 and would continue to be a dominant market till 2030; thereby, achieving a market value of $8.9 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.