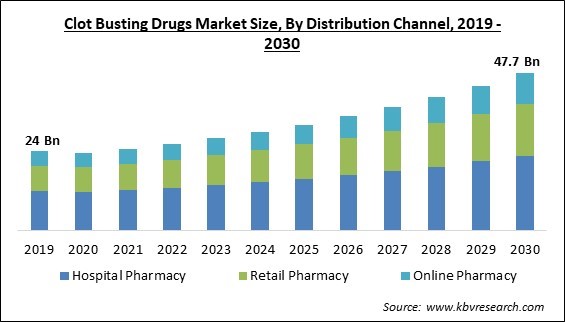

The Global Clot Busting Drugs Market size is expected to reach $47.7 billion by 2030, rising at a market growth of 7.9% CAGR during the forecast period.

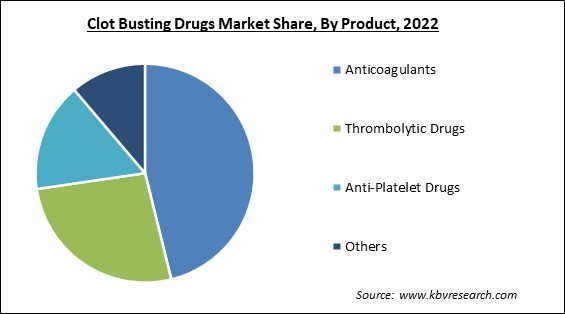

Anticoagulants can aid the situation and dissolve the blood clot accumulating in the veins, resulting in lower blood pressure, which is necessary given the rising number of cardiovascular diseases cases. Therefore, Anticoagulants would generate more than 40% share of the market by 2030. Cardiovascular diseases (CVDs), which claim approximately 17.9 million lives annually, are the leading cause of mortality worldwide, according to the World Health Organization. Heart attacks and strokes account for more than four out of every five CVD deaths, with premature deaths accounting for one-third of these deaths in those under the age of 70. Unhealthy food, inactivity, cigarette use, and alcohol abuse are the four biggest behavioral risk factors for heart disease and stroke. Raised blood pressure, elevated blood glucose, elevated blood lipids, as well as being overweight and obesity might be symptoms of behavioral risk factors in people. Some the factors impacting the market are technological advances to create excellent opportunities, increased stroke cases, and growing risk of bleeding.

Cardiovascular problems can be quickly and accurately diagnosed with diagnostic imaging advancements like computed tomography (CT) scans and magnetic resonance imaging (MRI). Directly delivering thrombolytic medications to the site of the clot is one way catheter-based technology advancements, for instance, can increase efficacy while reducing systemic side effects. These technological advancements enhance patient care, treatment outcomes, and the delivery efficiency of clot-busting drugs. They also present potential for pharmaceutical firms and healthcare experts to create and distribute cutting-edge clot-busting drugs. The demand for efficient stroke treatment options, such as pharmaceuticals, medical devices, and rehabilitation therapies, is increasing as more people suffer from strokes. The World Health Organization predicts that during the next 20 years, there will be a 25% global increase in stroke cases, with the highest increases anticipated in low- and middle-income nations. Over 147,000 deaths in the United States were attributable to stroke in 2019, according to the Centers for Disease Control and Prevention (CDC). Additionally, approximately 795,000 Americans suffered a stroke in 2018, with 610,000 being first-time strokes. Additionally, rehabilitation centers are increasing the range of therapies they offer to individuals recovering from strokes so they can regain their independence. As a result, the need for clot busting drugs will grow as a result of the increasing stroke cases.

However, the increased risk of bleeding is the main problem with clot-busting drugs. These medications encourage blood clots to dissolve but can also affect the body's clotting processes, raising the risk of bleeding. This may manifest as internal or gastrointestinal hemorrhage or bleeding at the injection site. Mild bruises to a hemorrhage that poses a severe threat to one's life may be the extent of the bleeding. In the following years, these issues are anticipated to restrain the market expansion for clot-busting drugs. Furthermore, the initial months of the pandemic outbreak had an adverse impact on the market for clot-bursting drugs. During the pandemic, the world's pharmaceutical supply chain was disrupted, which affected the accessibility and distribution of several medications, including clot-bursting drugs. The availability of clot-bursting drugs was restricted in some areas due to issues with production, transportation limitations, and a rise in the demand for critical care treatments.

By distribution channel, the market is categorized into hospital pharmacy, online pharmacy, and retail pharmacy. The online segment recorded a remarkable revenue share in the market in 2022. The market is expanding in this segment as a result of the rising internet penetration. Other factors enabling growth in this segment include the convenience provided by the online platforms such as doorstep delivery, discounts and others. Also, the easy availability of clot busting drugs through these platforms supports the growth in this segment.

By product, the market is classified into thrombolytic drugs, anti-platelet drugs, anticoagulants and others. The anticoagulants segment held the highest revenue share in the market in 2022. Increasing occurrences of coagulation disorders are driving the anticoagulants subsegment. The anticoagulants’ demand is expected to develop in the future due to strategic agreements between major businesses that will increase product penetration. The market for anticoagulants is anticipated to grow during the forecast period due to factors including an increase in the elderly population, an increase in obesity prevalence, and an increase in hip & knee procedures.

On the basis of route of administration, the market is segmented into oral and injectable. The oral segment garnered a significant revenue share in the market in 2022. The ability to be administered orally by way of a pill or tablet is one of the main benefits of oral clot-busting medications. Compared to IV therapies, which demand the insertion of an intravenous catheter and close physician supervision, this form of administration is more practical and less invasive.

Based on indication, the market is bifurcated into deep vein thrombosis, atrial fibrillation, others, and pulmonary embolism. In 2022, the pulmonary embolism segment witnessed the largest revenue share in the market. When blood clot becomes embedded in a lung artery and prevents blood from reaching a specific lung area, it causes a pulmonary embolism (PE). Typically, blood clots develop in the legs, travel up the right side of the heart, and enter the lungs. Deep vein thrombosis (DVT) is the medical term for this condition. As more people take chemotherapy or have a family history of pulmonary embolism, there will likely be an increase in the need for clot-busting medications.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 26.2 Billion |

| Market size forecast in 2030 | USD 47.7 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 7.9% from 2023 to 2030 |

| Number of Pages | 298 |

| Number of Table | 450 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Product, Indication, Route of Administration, Distribution Channel, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the drugs market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region led the market by generating the highest revenue share. The consistently high demand for clot-busting drugs in this region results from the increasing prevalence of cardiovascular disease and the geriatric population. Clot-busting medication is necessary because older people are more susceptible to developing blood clots. This demographic trend probably drives the regional demand for these drugs.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Sanofi S.A., Dr. Reddy’s Laboratories Ltd., Bayer AG, Boehringer Ingelheim International GmbH, Sun Pharmaceutical Industries Ltd., Bristol Myers Squibb Company, Eli Lilly And Company, Johnson & Johnson (Johnson & Johnson Services, Inc.), Pfizer, Inc., Merck & Co., Inc.

Free Valuable Insights: Global Clot Busting Drugs Market size to reach USD 47.7 Billion by 2030

By Distribution Channel

By Product

By Route of Administration

By Indication

By Geography

The Market size is projected to reach USD 47.7 billion by 2030.

Technology Advances to Create Excellent Opportunities are driving the Market in coming years, however, Growing Risk of Bleeding restraints the growth of the Market.

Sanofi S.A., Dr. Reddy’s Laboratories Ltd., Bayer AG, Boehringer Ingelheim International GmbH, Sun Pharmaceutical Industries Ltd., Bristol Myers Squibb Company, Eli Lilly And Company, Johnson & Johnson (Johnson & Johnson Services, Inc.), Pfizer, Inc., Merck & Co., Inc.

The Hospital Pharmacy segment acquired maximum revenue share in the Market by Distribution Channel in 2022; thereby, achieving a market value of $22.6 billion by 2030.

The Injectable segment is leading the Market by Route of Administration in 2022; thereby, achieving a market value of $34.2 billion by 2030.

The North America region dominated the Market by Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $16.3 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.