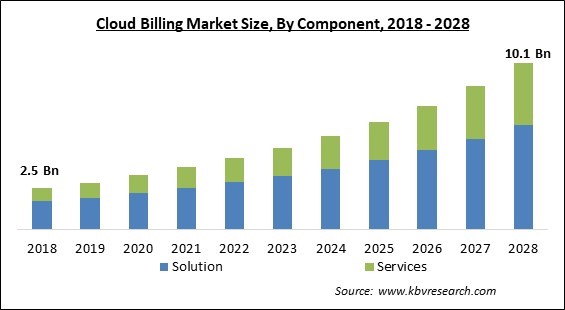

The Global Cloud Billing Market size is expected to reach $10.1 billion by 2028, rising at a market growth of 15.2% CAGR during the forecast period.

Cloud billing refers to the combination of electronic billing and cloud computing. Several companies are expanding their range by adopting a billing platform on-premises. Cloud billing is transforming the computer system by helping to access the data quickly and flexibility for billing. This is a prominent method for managing different subscription-based offers, services, and products.

Billing is a crucial interaction with any client; with the help of well-managed and proper billing, the relationship the customer relationships can be strengthened. Cloud billing is elaborated as a method that helps companies generate invoices by implementing particular standards. Authors often address functional requirements like quotation services, payment methods, and others when describing the demand for cloud billing facility modules.

When describing the term cloud billing, non-functional requirements like security, fault tolerance, etc., are also included. The arrival of the cloud billing market has allowed the much-reviewed cloud-optimized billing factor to offer a bill generating interface. Additionally, the reference might be used for abstract projects of currency transactions and real money. Although, this is mainly depended on a person's cloud computing tactics.

Businesses are now leaving the use of traditional systems and are shifting towards cloud technologies. The increasing demands of companies and ever-shifting client choices have made it necessary to redefine the agility through the acceptance of effective company models. The capability to offer usage-based price schemes and a lean system that record invoices issues related to the cost & metering and also keep track on the resource consumption are making new business prospects possible.

The COVID-19 pandemic had a positive effect on the cloud billing market. Because of the COVID-19 pandemic, cloud billing solutions have obtained attraction, mainly in usage-based billing, as companies have transformed their preferences and budgets to survive through this outbreak. Furthermore, companies worldwide are investing more on cloud billing solutions to sustain their operations. Governments are introducing packages to aid companies throughout the pandemic period, with a particular concentration on SMEs. The COVID-19 pandemic has also stimulated cloud acceptance across businesses as operators move to cloud advantages, like cost and scalability. All these elements resulted in growth of cloud billing market during the pandemic period.

The acceptance of IoT technology is improving the operation of cloud billing in business procedures. Recently, the processing industries, like chemical, oil & gas, etc., have begun utilization of IoT technology. IoT aids in enhancing the productivity of cloud billing. There has been a growing demand for the acceptance of IoT technology in businesses as this system is combined with cloud billing. Therefore, IoT could be utilized to enhance the efficiency and performance of cloud billing, which results in creating a more secure work environment and saving maintenance costs, thus boosting the cloud billing market. These are the main propelling factors for the development of the market.

The price of the goods and the quality of the services being provided are the main factors to compete in any market. The main benefit of cloud billing to decrease the administration and operational expenditure is offering new opportunities in several industry verticals. Furthermore, the financial and banking facilities institutions are shifting to cloud-based services to improve customer management and operations. Also, due to the changing business landscape across the BFSI sector, financial organizations have been taking vital actions for automated banking facilities involving billing and concentrating on risk management methods linked with the operations. These are the main propelling factors for the development of the market.

The main issue with cloud billing is the high cost to be spent as investment. Enforcing a complete cloud billing comprises a substantial initial investment. The scenario is not same with the on-premise model. For example, the initial investment linked with changing from a human manufacturing line to an automated manufacturing line is costly. Additionally, the license for cloud based solutions is charged per operator or the number of customers, and in several circumstances, operators order lesser permissions than needed to manage their charges. Which eventually would limit market growth.

Based on deployment Type, the cloud billing market is segmented into private cloud, public cloud and hybrid cloud. In 2021, the private cloud segment garnered a significant revenue share in the cloud billing market. This is credited to the factor that private clouds offer better privacy and security by using both internal hosting and business firewalls to ensure that sensitive data and operations are not available to third-party suppliers. Virtual private cloud (VPC) works with a specific level of separation among clients and is just as virtual as the public cloud, space inside a public infrastructure, and sharing resources.

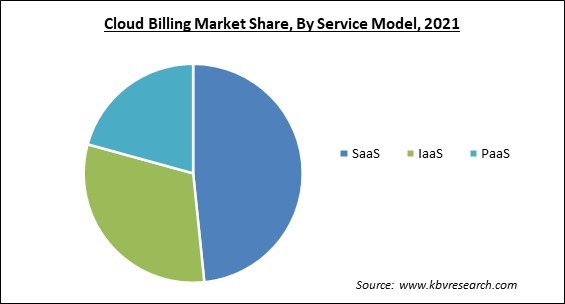

On the basis of service Model, the cloud billing market is fragmented into IaaS, PaaS and SaaS. In 2021, the IaaS segment registered a substantial revenue share in the cloud billing market. With IaaS, the operator simply accesses facilities in terms of the operating systems, number of servers, networking Infrastructure through one common service delivery point, and file storage systems. Cloud billing in Infrastructure as a Service (IaaS) is a complete lifecycle solution that offers inventory analysis, cost & invoice management, chargebacks, cost allocations, usage management, AP or GL file integration, the option of bill payment, and optimization recommendations.

By enterprise size, the cloud billing market is divided into large enterprises and small & medium-sized enterprises. In 2021, the large enterprises segment witnessed the largest revenue share in the cloud billing market. The increasing focus on digitalization of financial procedures has modified conventional banking systems, because of which several banks are providing fintech cloud to serve all-inclusive company requirements. Large enterprises are embracing cloud billing solutions to decrease their total cost. The embracing of developed technologies in these companies and significant capital is influencing them to shift to cloud-based facilities.

Based on Vertical, the cloud billing market is classified into BFSI, IT & Telecom, education, healthcare, media & entertainment, consumer goods & retail, construction, and others. In 2021, the BFSI segment recorded a considerable growth rate in the cloud billing market. Cloud billing assists financial service suppliers in decreasing hand operation of billing, which lowers the opportunities for mistakes because of human errors. Banking systems have embraced cloud technology for protected payment, where billing is the main contact with any customer-client relationship. A powerful connection is made through easy accessibility, secured & faster fund transfer, and proper & well-managed billing.

On the basis of components, the cloud billing market is bifurcated into solutions and services. In 2021, the solutions segment dominated the cloud billing market by generating the largest revenue share. Cloud billing solutions assists in representing the worth of the cloud facilities portfolio with automated periodic billing for usage-based accounts and license, resulting in improved working efficiency. The main disadvantage of hand-operated billing including risk of errors and time consumption, are the main reasons pushing institutions to embrace cloud billing solutions, as these solutions offer insights into cloud services and detailed visibility.

By billing type, the cloud billing market is segmented into subscription, usage based, one-time and others. In 2021, the usage-based segment witnessed the largest revenue share in the cloud billing market. This is credited to the factor that usage-based billing offers a technique for consumers to obtain new clients and develop with them because it offers the option for them to test the goods and keep the prices free or less as they slowly increase and embrace the utilization of SaaS products.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 3.8 Billion |

| Market size forecast in 2028 | USD 10.1 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 15.2% from 2022 to 2028 |

| Number of Pages | 354 |

| Number of Tables | 660 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Service Model, Billing Type, Deployment Type, Enterprise Size, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the cloud billing market is analysed across North America, Europe, Asia Pacific and LAMEA. In 2021, the North America region held the maximum revenue share in the cloud billing market. This is because the government of regional nations have made cloud governance compulsory in order to ensure successful cloud migrations and cloud security. This aids the region in owning the secure cloud services. In addition, the nations in North America have the presence of leading vendors that assist in improving the cloud billing services and solutions in the market.

Free Valuable Insights: Global Cloud Billing Market size to reach USD 10.1 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Amazon Web Services, Inc. (Amazon.com, Inc.), Aria Systems, Inc., Recurly, Inc., Zuora Inc., SAP SE, Oracle Corporation, Cerillion PLC, Salesforce.com, Inc., Zoho Corporation Pvt. Ltd., and CGI, Inc.

By Component

By Service Model

By Billing Type

By Deployment Type

By Enterprise Size

By Vertical

By Geography

The global Cloud Billing Market size is expected to reach $10.1 billion by 2028.

Acceptance of IOT technology are driving the market in coming years, however, Higher investment cost as compared to the on-premise model restraints the growth of the market.

Amazon Web Services, Inc. (Amazon.com, Inc.), Aria Systems, Inc., Recurly, Inc., Zuora Inc., SAP SE, Oracle Corporation, Cerillion PLC, Salesforce.com, Inc., Zoho Corporation Pvt. Ltd., and CGI, Inc.

The Public segment is leading the Global Cloud Billing Market by Deployment Type in 2021 thereby, achieving a market value of $4.8 billion by 2028.

The SaaS segment acquired maximum revenue share in the Global Cloud Billing Market by Service Model in 2021 thereby, achieving a market value of $4.7 billion by 2028.

The North America market dominated the Global Cloud Billing Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $3.4 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.