The Global Cloud Native Applications Market size is expected to reach $16.2 billion by 2028, rising at a market growth of 22.9% CAGR during the forecast period.

The term "cloud-native" describes creating and operating applications that use the distributed computing capabilities offered by the cloud delivery model. Cloud-native apps are created and designed to benefit from the cloud's scalability, dependability, and flexibility. One can easily bring their ideas to market due to built-in cloud-native applications. Users need responsiveness, zero downtime, a cloud-native approach to operating applications, and cutting-edge functionality. This underlines that the cloud is the foundation of the strategic transformation that accelerates the pace of business.

Due to cloud-native technologies, modern businesses may now run and create scalable applications in dynamic, contemporary environments, including hybrid clouds, private clouds, and public clouds. Many large corporations are developing massively scalable cloud-native platforms. Most businesses today integrate cutting-edge innovations like machine learning, artificial intelligence, and big data analytics into their routine operations.

Cloud-native applications are necessary for enterprises to design and run applications across public, private, and hybrid clouds at scale, given the rise in cloud computing demand and the volume of cloud traffic. As a result, companies must alter how they design, develop, and use applications to succeed in quick-moving software-driven marketplaces. Building, executing, and improving apps using well-established methods and technology for cloud computing is known as "cloud-native application development." These are applications created for cloud computing architecture.

Due to their interoperability & workload portability, cloud native applications often rely on open source and standards-based technology, which helps reduce vendor lock-in and leads to greater portability. In addition, cloud native applications also offer several advantages, like independent building up of the applications so they are managed & deployed separately, resilient architecture aids survival & remaining online regardless of the event of an infrastructure outage, and cloud native applications owing to interoperability & workload portability.

As a result of the new insights organizations has gained regarding work-from-home (WFH) and data accessibility during the lockdown period, the demand for space & services in data centers has increased. In addition to the policy-level push for automation, the implementation of automation is increasing. Even when things return to "normal," the work style will continue to rely heavily on data centers, as demand for e-commerce, digital payments, and big data will continue to rise. These trends positively impacted the market due to the pandemic outbreak.

Businesses are emulating this trend, notably for telecom apps based on microservices, containers, and state-optimized design. The rising need for cloud-native systems in this business can be attributed, among other things, to the increased rate of software changes and releases. Using the integrated characteristics of the Network Functions Virtualization Infrastructure (NFVI) layer and modifying the software architecture, businesses can also automate cloud data center resources. In addition, cost reductions, rapid implementation, and consumer involvement contribute to this market's revenue expansion.

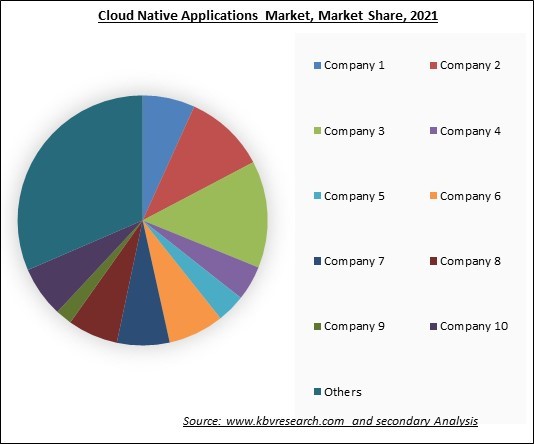

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions.

Cloud-native applications can leverage the most recent cloud technologies and services, giving customers new functionality and features that traditional apps cannot. If a company's primary data center is collapsed or damaged, cloud-native applications can be swiftly and simply installed in a new location. Cloud-native applications can be deployed on a range of cloud platforms, allowing enterprises to select the platform that matches their needs the most effective. As users become more aware of these benefits offered by cloud native applications, the adoption is rising significantly and thus leading to market expansion.

Cloud-native application development methodologies and architectures are more sophisticated than conventional applications. As a result, cloud-native applications have more moving elements and necessitate a more complex development approach than monolithic programs built with a single codebase. Thus, organizations that adopt cloud-native must install tools and processes that allow them to handle the complexity associated with both the development and deployment of the application and management process, which increases the system's running cost. Thus, the cost overrun may hamper the market growth in the near future.

Based on component, the cloud native applications market is segmented into platforms and services. A cloud-native platform is developed, optimized, and operated only in the cloud. Since the platform is designed in the cloud, cloud-based tools are rapid and flexible. This technology offers dependable performance, seamless interconnectivity, and improved business continuity. Cloud-native applications are entirely developed in the cloud and give developers new and innovative deployment methods to quickly evolve the businesses' overall architecture.

On the basis of deployment type, the cloud native applications market is divided into public cloud and private cloud. The private cloud segment covered a considerable revenue share in the cloud native applications market in 2021. Private cloud users can choose the hardware & software they want to acquire. Customers who use private clouds can alter servers whatever they choose and can alter software as necessary with add-ons or via custom development. Since all workloads are run behind the clients' own firewall, there is better visibility over access and security management, which is the main factor supporting the segment’s expansion.

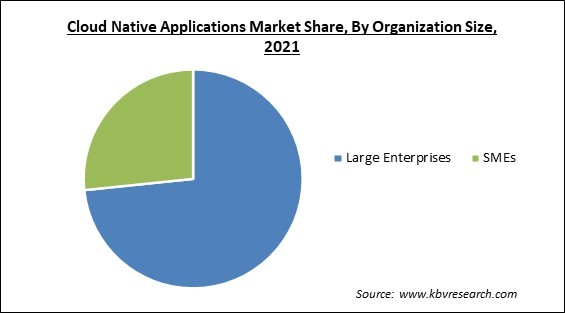

By organization size, the cloud native applications market is classified into small & medium-sized enterprises (SMEs) and large enterprises. In 2021, the large enterprise segment dominated the cloud native applications market with the maximum revenue share. Large organizations were early users of CNA and related professional or managed services. Large enterprises have adopted cloud-based technologies over traditional on-premises offerings in high proportions. Many departments or teams within these organizations are responsible for distinct operations.

Based on the vertical, the cloud native applications market is bifurcated into BFSI, IT & telecom, government & public sector, retail & ecommerce, healthcare & life sciences, manufacturing and others. The IT & telecom segment recorded a remarkable revenue share in the cloud native applications market in 2021. The growing use of Fifth Generation (5G) technologies in the telecommunications sector is a major driver driving market revenue growth. Moreover, numerous operators and manufacturers are adopting cloud-native applications due to their multiple benefits.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 3.9 Billion |

| Market size forecast in 2028 | USD 16.2 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 22.9% from 2022 to 2028 |

| Number of Pages | 291 |

| Number of Table | 453 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Deployment Mode, Organization Size, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the cloud native applications market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2021, the North America region led the cloud native applications market by generating maximum revenue share. Along with many other cutting-edge technologies, North America ranks among the regions with the most developed edge and cloud computing infrastructure. The use of cloud technology and rising levels of digitalization have been fairly noticeable throughout the region. With public and private deployment options, IT investment in system infrastructure is dramatically moving away from conventional solutions and into the cloud. Businesses are using cloud services quickly for new initiatives or to replace outdated systems.

Free Valuable Insights: Global Cloud Native Applications Market size to reach USD 16.2 Billion by 2028

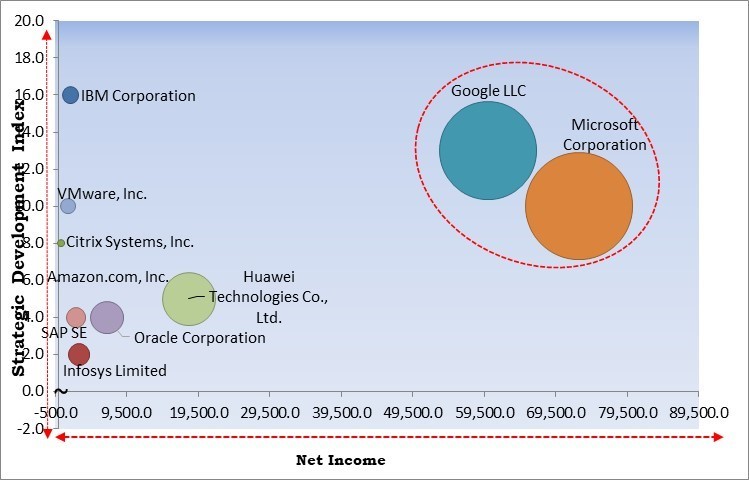

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Microsoft Corporation and Google, LLC is the major forerunner in the Cloud Native Applications Market. Companies such as Adobe, Inc., VMware, Inc., and Infosys Limited are some of the key innovators in Cloud Native Applications Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Amazon.com, Inc., Google LLC (Alphabet, Inc.), IBM Corporation, Infosys Limited, VMware, Inc., Microsoft Corporation, Oracle Corporation, SAP SE, Citrix Systems, Inc. (Cloud Software Group, Inc.), and Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.)

By Component

By Deployment Mode

By Organization Size

By Vertical

By Geography

The global Cloud Native Applications Market size is expected to reach $16.2 billion by 2028.

Growing awareness regarding benefits of cloud native applications are driving the market in coming years, however, Budget overruns being an obstacle to market expansion restraints the growth of the market.

Amazon.com, Inc., Google LLC (Alphabet, Inc.), IBM Corporation, Infosys Limited, VMware, Inc., Microsoft Corporation, Oracle Corporation, SAP SE, Citrix Systems, Inc. (Cloud Software Group, Inc.), and Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.)

The expected CAGR of the Cloud Native Applications Market is 22.9% from 2022 to 2028.

The Public Cloud segment acquired maximum revenue share in the Global Cloud Native Applications Market by Deployment Mode in 2021 thereby, achieving a market value of $11.2 billion by 2028.

The North America market dominated the Global Cloud Native Applications Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $5.7 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.