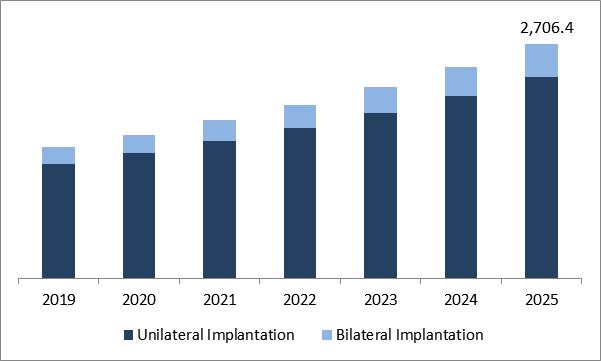

The Global Cochlear Implants Market size is expected to reach $2,706.4 million by 2025, rising at a market growth of 10.2% CAGR during the forecast period (2019-2025). Cochlear implants can be defined as the electronic medical devices used for replacing the internal ear function if it gets damaged. In contrast to other listening aids, cochlear implants are used to bypass the harmed inner ear skin cells (cochlea) to promote the transmission of sound signals to the body. These implants are helpful in both ears for patients with average to extreme listening impairment.

Market growth of cochlear implants can be ascribed to a favorable reimbursement situation, increased awareness of hearing aids, and increased implant adoption. Besides, technological advances in cochlear implants to render the instrument more effective and user-friendly can increase the demand. And this is expected to propel the market growth during the forecast period. Because of the proximity of cochlear implant surgery to several essential parts of the inner ear, some patients report a post-operative sense of imbalance or vertigo. There have been numerous reasons, including the vibrations caused by drilling during surgery that patients may suffer from vertigo after the surgery. And this can be a major restraining factor for market growth.

Global Cochlear Implants Market Size (USD Million)

The key players operating in the market are Cochlear Ltd., MED-EL GmbH, Sonova Holding AG, William Demant Holding A/S, Starkey, Nurotron Biotechnology Co. Ltd., Widex USA, Inc., Cochlear Ltd., Advanced Bionics AG, and Oticon Medical. Market players are taking step-by-step approaches to leverage business possibilities. Companies focus on creative market-space competitive policies.

For example, in March 2019, Widex USA merged with Sivantos named after WS Audiology for developing hearing aids solutions.

Likewise, the Switzerland based company, MED-EL released SONNET 2 audio processor and MAESTRO 8 fitting software to provide the best hearing audio quality.

In January 2019, Cochlear Ltd. launched Nucleus 7 Sound Processor, implantable hearing device for the people with single-sided deafness, conductive and mixed hearing loss. In the same year, in March, the company expanded its reach to the UK to provide the criteria for a cochlear implant to professionals.

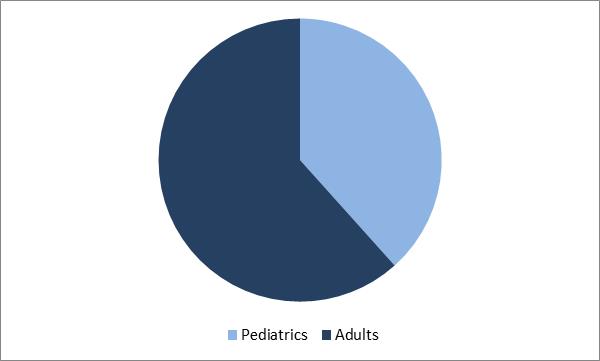

Global Cochlear Implants Market Share By Product Type (2018)

Based on Fitting Type, the market is segmented into Unilateral Implantation and Bilateral Implantation. Based on End Use, the market is segmented into Pediatrics and Adults. Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa.

The overall cochlear implant market was dominated by unilateral implantation in 2018. Unilateral implantation dominance is largely attributed to higher consumer demand. Unilateral implantation surgery is performed at a reduced price than bilateral implant surgery. Also, several pieces of research have found a more cost-effective unilateral cochlear implant for adults. High demand from the older customer population is, therefore, likely to be responsible for the industry's dominance.

Geographically, Europe dominated the market in 2018 and during the forecast period is anticipated to keep its position. This is mainly linked to the European Union's favorable health infrastructure, which enables early implantation. Over the coming years, Asia Pacific is expected to experience the fastest development. This can be ascribed to increased consciousness of market players in the region and local involvement.

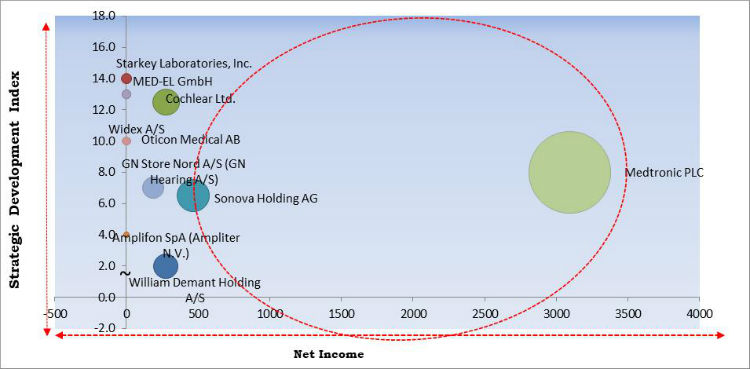

Cochlear Implants Market Cardinal Matrix

The major strategies followed by the market participants are Product launches and Partnerships & Collaborations. Based on the Analysis presented in the Cardinal matrix, Sonova Holding AG and Medtronic PLC are some of the forerunners in the Cochlear Implants Market. Medtronic acquired Sophono in order to enhance its ENT procedures by developing hearing devices. Sonova opened a new training center in Germany in order to provide training program for hearing care professionals. Sonova released Belong comprises of pioneering lithium-ion rechargeable battery technology in hearing aids.

Companies such as Cochlear Ltd., Med-EL GmbH, William Demant Holding A/S, Starkey laboratories, Inc., Widex A/S, Amplifon SpA, Oticon Medical AB, and GN Store Nard A/S are some of the key innovators in Cochlear Implants Market. Widex USA merged with Sivantos named after WS Audiology for developing hearing aids solutions. Amplifon took over GAES Group in order to expand its business in hearing aid. MED-EL acquired bone conduction technology from Otorix AB in order to strengthen its portfolio of hearing solutions.

» Partnerships, Collaborations and Agreements:

» Product Launches and Expansions:

» Mergers & Acquisitions:

Market Segmentation:

By Fitting Type

By End Use

By Geography

Companies Profiled

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.