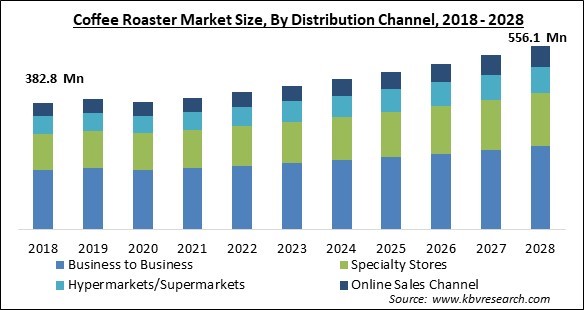

The Global Coffee Roaster Market size is expected to reach $556.1 Million by 2028, rising at a market growth of 4.9% CAGR during the forecast period.

Machines called coffee roasters are used to roast green, unroasted coffee beans into ground beans that can be utilized to make coffee. These coffee roasters assist in eliminating the water that gives the beans their brittle and crunchy texture. The length of time the coffee is roasted and the level to which it is roasted affect the flavors, fragrance, as well as texture of the coffee significantly. These factors can be regulated manually in gas coffee roasters or automatically in electric coffee roasters. With the exception of stovetop roasters, which are only gas-powered, coffee roasters can be powered by either gas or electricity according to their needs and requirements.

Although the use of gas-powered coffee roasters is still very common, especially among coffee roasting purists and traditional roasters, the sales of electric coffee roasters are rising quickly as a result of an increase in the demand for precise and easy-to-use coffee roasting machines. The demand for coffee beans and coffee bean roasters is also rising quickly due to a rise in the number of coffee shops and other coffee-serving institutions as well as a rise in coffee consumption culture, particularly among millennials and Gen Z. The revitalizing and energizing properties of coffee are well studied, and research is being done on the aroma of coffee and using coffee roasting as a form of aromatherapy, which is also causing an increase in home coffee roasting so that people can benefit from the aroma of coffee roasting.

Due to the numerous breakthroughs and advancements occurring in modern technology, the number of functions offered on coffee roasters is growing quickly. The majority of these functions are designed to make coffee manufacturing completely consistent. Additionally, the adoption of technologies like automation and artificial intelligence may prove to be powerful market drivers for coffee shops. There are many different kinds of coffee roasters in the market, and their design and principal heating source vary based on the uses and circumstances for which they will be put to use. Machines used for residential and industrial purposes have a different volumes, types, intensities, and functionalities.

Due to government restrictions and mandates to stay at home, which prevented the authorities from checking the coffee roaster more effectively than before, the pandemic had a detrimental effect on the sector. Due to the pandemic, some testing laboratories were granted the ability but were constrained to adhere to social segregation and had less material and staff available. This boost in sales is anticipated to continue in the post-COVID-19 scenario because of the pandemic's pervasive effect on consumers' attitudes regarding health and wellbeing.

The market for coffee roasting equipment is estimated to rise as end-user demand for tasty, fragrant, and fresh coffee increases. This is mainly due to the numerous advantages of freshly roasted coffee, such as the fact that it is packed with minerals and antioxidants, which improve general health by increasing immunity and preventing cancer as well as other serious diseases. In addition to this, in order to increase the visibility of their brands, the top companies are experimenting with new coffee technologies like flavor-added coffee and value-added RTD in order to draw more customers to specialty roasters.

By providing a variety of coffee flavors, coffee roaster manufacturers want to draw in customers. The coffee roaster market now has a competitive environment as a result of this. Manufacturers give consumers a wide range of options by providing coffee roasters in upscale packaging. Additionally, the majority of conventional coffee roaster manufacturers have gone digital and now sell their roasters on e-commerce websites. Sales have increased as a result, particularly during the COVID-19 pandemic phase. The increased rate of product innovation & product launches internationally is also credited with driving market expansion. More customers are probably drawn in as a result of the growing number of product launches that contain increased features and added functionality.

Regular coffee use can lead to anxiety and irritation. For other people who are sensitive to what it does to their bodies over time, the same amount might no longer be enjoyable. Additionally, it might alter sleep habits and raise blood pressure. The flavor, aroma, and energizing qualities that a cup of coffee in the morning offers are appreciated by many people, yet these qualities are disliked by others. One remedy may be to switch to decaffeinated or low caffeine coffee products for those who have headaches or sleep issues as a result of their coffee consumption. It's crucial to realize that staying up for extended periods is unhealthy.

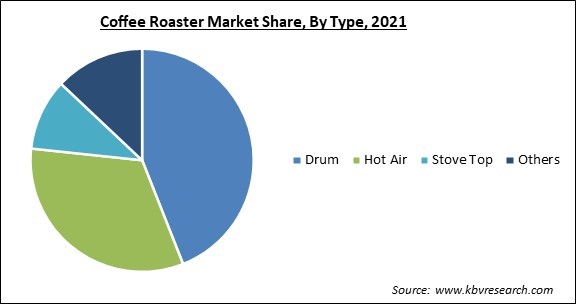

By Type, the coffee roaster market is segmented into drum, hot air, stove top and others. In 2021, the drum roaster segment dominated the coffee roaster market with the largest revenue share. These devices heat a revolving drum to roast coffee. Both convection from the surrounding air and conductive heat transfer from the drum's surface is applied to the beans. A Drum Roaster's straightforward construction makes it suitable for a wide range of heat sources, flexible manual & automated procedures, long-lasting moving parts, and a range of sizes.

Based on category, the coffee roaster market is fragmented into electric roaster and gas roaster. In 2021, the gas roaster segment garnered the maximum revenue share in the coffee roaster market. The conventional method of roasting coffee beans includes utilizing a gas-powered device. In most cases, other than hiring a gas fitter, there are permits needed. It is remarkably sensitive and incredibly powerful. However, given the sensitivity of coffee beans, these gadgets make it possible for temperatures to vary quickly something that isn't necessarily beneficial.

On the basis of end-user, the coffee roaster market is divided into commercial and residential. The residential roaster segment acquired a substantial revenue share in the coffee roaster market in 2021. This can be attributed to the emerging trend of roasting coffee at home. Along with this, the demand for coffee roasters for residential purpose has also benefited from the various restrictions and lockdown imposed due to COVID-19, as a large number of people now prefer to roast coffee at home because of the threat of the virus.

By Distribution Channel, the coffee roaster market is classified into business to business, specialty stores, hypermarkets and supermarkets and online sales channels. The online sales channel segment procured a significant revenue share in the coffee roaster market in 2021. The leading market participants should have more prospects due to the online distribution channel. The demand is probably being driven by convenience, ease of ordering, and shifting customer preferences. Major firms are also starting online sites to take advantage of the shifting shopping habits of consumers. All these sectors are resulting in the market growth in this segment.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 399.4 Million |

| Market size forecast in 2028 | USD 556.1 Million |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 4.9% from 2022 to 2028 |

| Number of Pages | 230 |

| Number of Tables | 440 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Category, Distribution Channel, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Australia, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the coffee roaster market is analyzed across North America, Europe, Asia Pacific and LAMEA. In 2021, the Europe region dominated the coffee roaster market with the highest revenue share. Germany and Italy are huge producers as well as exporters of coffee. Switzerland, Spain, Poland, and the Netherlands are further significant roast coffee bean exporters in Europe. In addition, the Europe region is among the largest consumers of coffee. In addition, this growth is attributed to higher fresh coffee consumption as well as the presence of numerous small & medium roasters in European nations.

Free Valuable Insights: Global Coffee Roaster Market size to reach USD 556.1 Million by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Panasonic Corporation, Nestle S.A., Buhler Group, Diedrich Roasters (Keurig Dr Pepper, Inc.), Giesen Coffee Roasters, Genio Roaster, US Roaster Corp, Roaster & Roaster, Toper Coffee Roasters, and Mill City Roasters.

By Distribution Channel

By Category

By End User

By Type

By Geography

The global Coffee Roaster Market size is expected to reach $556.1 Million by 2028.

Increased Fresh Coffee Consumption are driving the market in coming years, however, Disadvantages Of Coffee Reducing Its Consumption restraints the growth of the market.

Panasonic Corporation, Nestle S.A., Buhler Group, Diedrich Roasters (Keurig Dr Pepper, Inc.), Giesen Coffee Roasters, Genio Roaster, US Roaster Corp, Roaster & Roaster, Toper Coffee Roasters, and Mill City Roasters.

The Business to Business segment acquired maximum revenue share in the Global Coffee Roaster Market by Distribution Channel in 2021 thereby, achieving a market value of $251.6 million by 2028.

The Commercial segment is leading the Global Coffee Roaster Market by End User in 2021 thereby, achieving a market value of $379.9 million by 2028.

The Europe market dominated the Global Coffee Roaster Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $194.7 million by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.