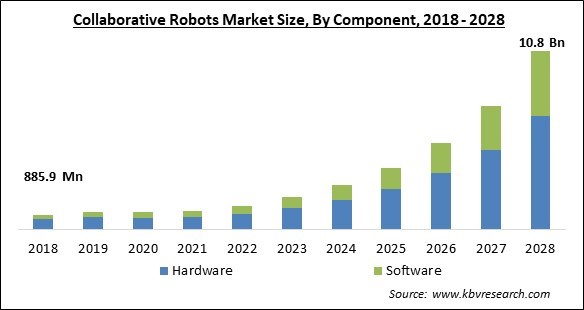

The Global Collaborative Robots Market size is expected to reach $10.8 billion by 2028, rising at a market growth of 40.1% CAGR during the forecast period.

In a shared area or when people and robots are close to each other, a cobot, or collaborative robot, is designed for direct human-robot contact. In contrast to conventional industrial robot applications, which keep robots away from people, cobot applications allow for human interaction. Cobot safety may depend on soft edges, low weight materials, speed and force limitations built in, or sensors and software that enforce safe behaviour.

Robotics-using sectors are under constant pressure to lower operational costs while boosting production and upholding necessary standards of quality. For example, Yaskawa introduced the HC20XP Human-Collaborative Robot in March 2020. It includes precise hand-guided education for quick robot system setup.

The innovative 20 kg payload collaborative robot is ideal for applications where it is necessary for the robots to securely work alongside or close to humans. The first collaborative robot in its field to receive an IP67 rating is prepared for continuous usage in wet or splash-prone conditions. Additionally, the cost of, ease of use, and complexity of the available collaborative robots for training purposes are all decreasing.

This would primarily give businesses a variety of options, which will boost interest in and demand for such robots. Because collaborative robots utilize the most recent sensors, plug-and-play technologies, and autonomous robot programming from CAD data, companies of all sizes and scales may remain competitive.

An extremely contagious illness called COVID-19, which first appeared in China, has since spread over the entire world. This pandemic had a negative effect on the market in 2020 because China is regarded as a crucial market in the APAC region. Few of the market's top businesses are Universal Robots, ABB, and FANUC, have experienced a major decline in sales in 2020. The COVID-19 pandemic hindered and slowed the adoption of collaborative robots in a number of important industries, like electrical & electronics, metals and machining, and automotive.

The deployment of conventional industrial robots in production facilities calls for a complicated setup. These bigger robots demand a substantial number of fixed and linked engineering controls. Robotic arms, a variety of robot accessories, including controllers, grippers, end-effectors, and vision systems, are needed for these robots. Additionally, it needs additional gear like conveyors, fixtures, and safety fence because these robots cannot function inside the fencing like collaborative robots can.

The global COVID-19 pandemic epidemic has accelerated the introduction of robots for automation in the healthcare industry. The healthcare sector has seen a dramatically increased emphasis on robotics. Robotic automated systems have been employed to disinfect operating rooms and patient rooms all across the pandemic. For instance, in Shenzhen Third People's Hospital in China, a robot named Aimbot patrols the hallways while dispensing disinfectant and maintaining the face-mask and social-distancing requirements.

The maximum payload for most collaborative robots is typically 15 kg or less. As a result, the majority of collaborative robots are utilized for low payload applications. A rise in payload frequently causes a loss in the robot's repeatability and a rise owing to the increased sensors. Additionally, collaborative robots are built to move as quickly as a human arm, allowing for safe deployment next to a human. The mechanical design of cobots, notably the motorized robot joints, needs to take into account performance constraints.

By component, the collaborative robots market is segmented into Hardware and Software. The software segment recorded a significant revenue share in the collaborative robots market in 2021. A range of programming languages and software packages are accessible for creating collaborative robot applications. Every cobot has a customized programming system that is simple to use and enables the robot to rapidly and readily pick up new jobs. Additionally, there is simulator software available that may be utilized to develop a strong robot integration before moving forward with the project's implementation.

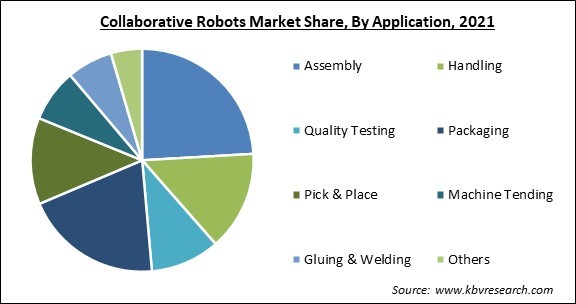

Based on application, the collaborative robots market is divided into Assembly, Pick & Place, Handling, Packaging, Quality Testing, Machine Tending, Gluing & Welding and Others. The metal equipment, electrical, and electronic industries where specialized spare components are put together and fitted in the finished product are projected to grow as the automotive sector expands. In addition, the expansion of the manufacturing sector across various nations of the world would surge the growth of the segment during the forecast period.

By Vertical, the collaborative robots market is fragmented into Automotive, Electronics, Metals & Machining, Plastics and Polymers, Food and Beverages, Furniture & Equipment, Pharma and Others. The electronics segment recorded a significant revenue share in the collaborative robots market in 2021. A cobot has the ability to place chips into test equipment and then sort them. In addition, a cobot is ideal for these kinds of delicate products since it is so accurate and can operate with great delicacy owing to integrated sensors. The electronics industry is embracing collaborative robots.

On the basis of Payload, the collaborative robots market is classified into Up to 5 Kg, up to 10 Kg and Above 10 Kg. The upto 5Kg segment acquired the highest revenue share in collaborative robots market in 2021. They optimize low-weight collaborative activities including picking, positioning, and testing while being lightweight and flexible. The introduction of sophisticated cobots with payloads in this range is creating new market expansion potential.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 1.1 Billion |

| Market size forecast in 2028 | USD 10.8 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 40.1% from 2022 to 2028 |

| Number of Pages | 326 |

| Number of Tables | 533 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Payload, Vertical, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the collaborative robots market is analyzed across North America, Europe, Asia Pacific and LAMEA. Asia Pacific emerged as the leading region in the collaborative robots market with the largest revenue share in 2021. This can be ascribed to the fact that companies are being compelled to automate the production processes in order to retain their cost advantage due to rising labour prices in APAC. The APAC region, particularly in nations like South Korea, China, and Taiwan, is a significant demand for collaborative robots from the automotive and electrical sectors. There is a higher need for the adoption of collaborative robots as a result of factors including growing wages, an ageing workforce on average, focus on the miniaturization trend in electronics, and the lightening trend in the automotive industry.

Free Valuable Insights: Global Collaborative Robots Market size to reach USD 10.8 Billion by 2028

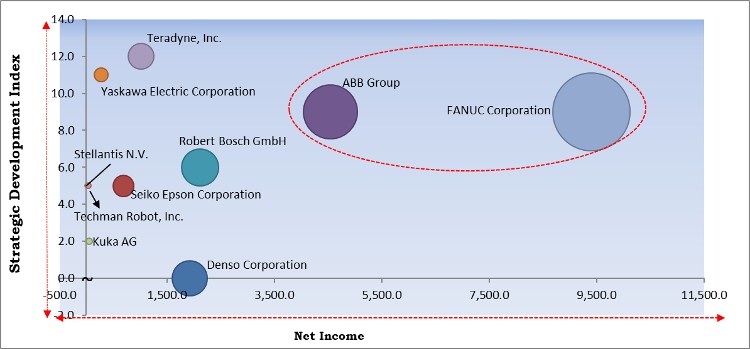

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; ABB Group and FANUC Corporation are the forerunners in the Collaborative Robots Market. Companies such as Robert Bosch GmbH, Teradyne, Inc. and Yaskawa Electric Corporation are some of the key innovators in Collaborative Robots Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include ABB Group, Robert Bosch GmbH, Denso Corporation, Seiko Epson Corporation, FANUC Corporation, Yaskawa Electric Corporation, Teradyne, Inc. (Universal Robots A/S), Techman Robot, Inc. (Quanta Storage, Inc.), Stellantis N.V. (Comau S.P.A), and Kuka AG (Midea Investment Holding Co., Ltd.)

By Application

By Component

By Payload

By Vertical

By Geography

The global Collaborative Robots Market size is expected to reach $10.8 billion by 2028.

High Rate of ROI in Comparison to Conventional Industrial Robots are driving the market in coming years, however, Restricted Payload and Speed of Cobots due to its Inherent Design restraints the growth of the market.

ABB Group, Robert Bosch GmbH, Denso Corporation, Seiko Epson Corporation, FANUC Corporation, Yaskawa Electric Corporation, Teradyne, Inc. (Universal Robots A/S), Techman Robot, Inc. (Quanta Storage, Inc.), Stellantis N.V. (Comau S.P.A), and Kuka AG (Midea Investment Holding Co., Ltd.)

The Hardware market segment shows high market share in Global Collaborative Robots Market by Component in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $6.9 billion by 2028.

The Automotive market is leading the Global Collaborative Robots Market by Vertical in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $2.7 billion by 2028.

Asia Pacific dominated the Global Collaborative Robots Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $3.4 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.