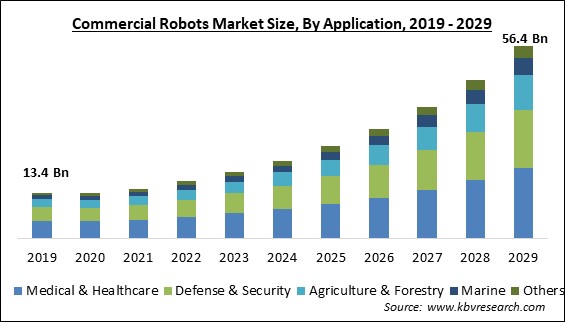

The Global Commercial Robots Market size is expected to reach $56.4 billion by 2029, rising at a market growth of 19.5% CAGR during the forecast period.

Commercial robots are tools, a company employs to duplicate, supplement, or replace human labor. Consumer or personal robots that can perform chores in the house, like automatic floor cleaning, are different from commercial robots. Drones are one type of robot that has both personal and professional use. Commercial robots and autonomous, piloted drones are frequently utilized in the field for medical applications.

Commercial robots provide superior service to traditional techniques, probably increasing investment and usage. Drones are gaining popularity and being used in various contexts, including the commercial sector. Additionally, numerous startups and tech behemoths are investing in this technology to quickly increase their market share.

The market's primary growth driver, the ongoing transition from manual to automated operations, has increased the need for commercial robots. The smooth operation of industrial workflows depends on coordinating management, production, and control. Therefore, commercial robots have grown increasingly important since they simplify processes and increase the accuracy and efficiency of workflow.

The need for these robots is being driven by the expansion of small businesses, increased investment in automation, and stringent governmental regulations on handling hazardous materials and products. Similar to how they assist in the customization of machines and the production of autos, industrial robots carry heavy payloads. In addition, the advent of smart factories increases the market's potential.

COVID-19 has significantly influenced many businesses, including the automotive industry, resulting in a precipitous decrease in automotive sales. Due to the extensive usage of commercial robots in the automobile industry, there was a decline in the demand for commercial robots. In addition, the COVID-19 pandemic compelled several enterprises in the market for commercial robotics to temporarily cease operations to comply with new government rules to control the disease's spread. This suspension of activities immediately impacted the market's revenue flow.

Ground and aerial vehicles must be coordinated to complete their respective missions. Large-scale farm automation will profit substantially from the control of several robots via a centralized software platform. Due to the ability of multimodal robotic devices to operate swarms of robots in farms to simultaneously perform various agricultural applications, like spraying and weeding, it is anticipated that market participants will adopt these types of systems in large numbers over the forecast period. Investments in multimodal systems are anticipated to expand the revenue streams of market participants in the commercial robots market.

In comparison to conventional robots, cobots offer a significant return on investment. In addition to the prospective rise of robot adoption in many countries, their substantial return on investment is appealing to small and medium-sized enterprises. Also, the expense associated with installing collaborative robot-additional hardware exceeds the cost of this type of robot. In contrast, the cost of deploying regular industrial robot-additional hardware exceeds the cost of the robot itself. As a result, the increased interest in cobots is anticipated to contribute to expanding the market for commercial robots.

The lack of technology standardization further affects system integration, as the bulk of equipment manufacturers employ proprietary interface protocols for communications. In many instances, creating extra gateways is required for the translation & transfer of data between equipment from various manufacturers. An increasing number of businesses that provide agricultural software are attempting to acquire farmer data. Software vendors sell data to third parties or employ it in a manner that does not help farmers. These security concerns associated with agricultural drones may hamper their adoption. This would further slowdown the market growth in the upcoming years.

Based on application, the commercial robots market is segmented into medical & healthcare, defense & security, agriculture & forestry, marine and others. The medical & healthcare segment dominated the commercial robots market with the maximum revenue share in 2022. Robotic surgery is a minimally invasive surgery that uses robotic technology to carry out surgical procedures. The surgical procedures may be carried out precisely due to these robotic systems, which are controlled by surgeons and comprise miniature surgical instruments mounted on robotic arms.

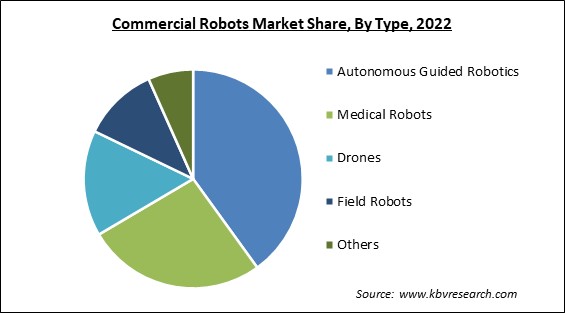

By type, the commercial robots market is bifurcated into field robots, medical robots, autonomous guided robotics, drones, and others. The medical robots segment garnered a significant revenue share in the commercial robots market in 2022. The growing elderly population, who have decreased bone densities and frequently sustain fractures in accidents, is anticipated to increase demand for medical robots. Robotics represents the next wave of change, with automation becoming essential to pharmaceutical production, upholding higher precision standards, and reducing workload.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 16.6 Billion |

| Market size forecast in 2029 | USD 56.4 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2029 |

| Revenue Growth Rate | CAGR of 19.5% from 2023 to 2029 |

| Number of Pages | 206 |

| Number of Table | 303 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Application, Type, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the commercial robots market is analyzed across North America, Europe, Asia Pacific and LAMEA. In 2022, the Asia Pacific region witnessed the largest revenue share in the commercial robots market. This is a result of the region's increasing automation levels in the industrial sector and the advancement of technology. Moreover, the two fundamental growth factors driving industrial automation are rising government initiatives in the manufacturing sector and a greater emphasis on economic diversification in emerging economies. Therefore, the most promising factor driving the market's significant growth over the forecast period in the region is the increasing commercial robot penetration across the regional market.

Free Valuable Insights: Global Commercial Robots Market size to reach USD 56.4 Billion by 2029

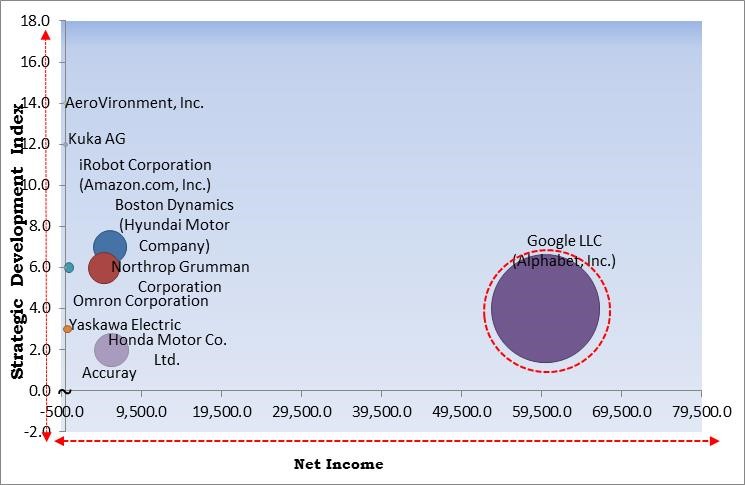

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Google LLC (Alphabet, Inc.) are the forerunners in the Commercial Robots Market. Companies such as Northrop Grumman Corporation, Boston Dynamics (Hyundai Motor Company), and AeroVironment, Inc. are some of the key innovators in Commercial Robots Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Google LLC (Alphabet, Inc.), Omron Corporation, Boston Dynamics (Hyundai Motor Company), Northrop Grumman Corporation, iRobot Corporation (Amazon.com, Inc.), Kuka AG (Midea Investment Holding Co., Ltd.), Yaskawa Electric Corporation, Honda Motor Co. Ltd., Accuray Incorporated and AeroVironment, Inc.

By Application

By Type

By Geography

The Market size is projected to reach USD 56.4 billion by 2029.

High ROI on cobots resulting in grown utilization are driving the market in coming years, however, Data privacy concerns and strict regulations restraints the growth of the market.

Google LLC (Alphabet, Inc.), Omron Corporation, Boston Dynamics (Hyundai Motor Company), Northrop Grumman Corporation, iRobot Corporation (Amazon.com, Inc.), Kuka AG (Midea Investment Holding Co., Ltd.), Yaskawa Electric Corporation, Honda Motor Co. Ltd., Accuray Incorporated and AeroVironment, Inc.

The expected CAGR of this market is 19.5% from 2023 to 2029.

The Autonomous Guided Robotics segment is leading the Market by Type in 2022 thereby, achieving a market value of $21.6 billion by 2029.

The Asia Pacific market dominated the Market by Region in 2022, and would continue to be a dominant market till 2029; thereby, achieving a market value of $21.3 billion by 2029.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.