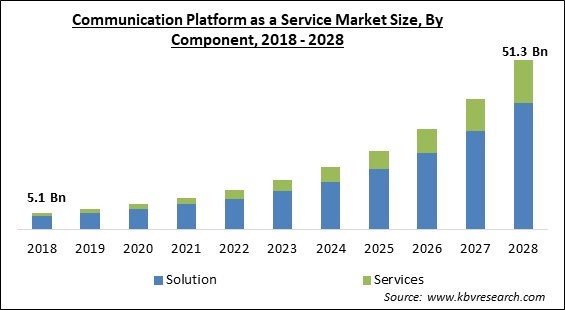

The Global Communication Platform as a Service Market size is expected to reach $51.3 billion by 2028, rising at a market growth of 27.5% CAGR during the forecast period.

An application program interface (API) provides real-time communications features, such as audio, video, and messaging, to corporate applications using the cloud-based communications platform as a service (APIs). APIs provide phone, video, MMS (Multimedia Messaging Service), SMS (Short Message Service), and MMS (Multimedia Messaging Service) functionalities. In addition, business programs, like sales software, may include communication services to provide capabilities like alerts, click-to-call, and multifactor authentication (MFA).

Organizations that wish to integrate communications into their business systems, cloud service providers, and developers who want to provide their products and services more communications functionality use CPaaS.

The platforms provide extensive software development kits (SDKs), Java or .NET libraries, and standards-based APIs for developing applications across many platforms. Additionally, CPaaS providers may offer packages with ready-to-use communication capabilities that can be placed into apps.

CPaaS aims to enable developers to upgrade an organization's current business application with real-time communications capabilities. Instead of using programs designed exclusively for communications, like Microsoft Teams or Skype, CPaaS enables these functionalities (including live chat, SMS, audio or video conferencing, and group messaging) to be included in business programs with other main responsibilities.

The COVID-19 pandemic, which increased reliance on online shopping, digital financial services, and telehealth options, is proving to have a significant impact that must be managed. Communications applications made possible by the communications platform as a service (CPaaS) are crucial in this regard. Organizations worldwide were compelled to use remote mode, leading to team communication problems. CPaaS platforms helped businesses function more efficiently by closing communication gaps in this case. Furthermore, due to COVID-19's debut, companies ranging from online stores to healthcare services have been inundated with calls, emails, and even SMS demands. Given all of this, it is expected that the market for communication platforms as services will grow in the area.

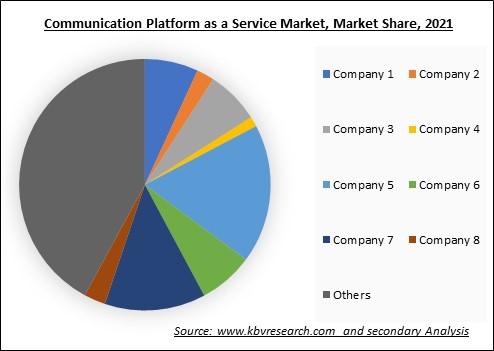

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The below illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions.

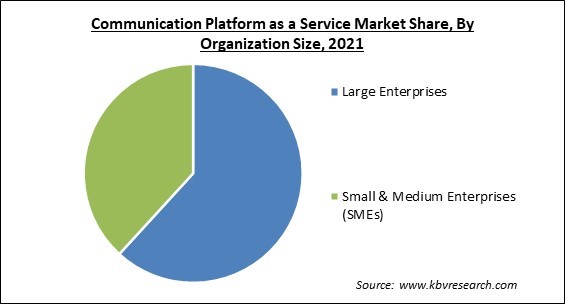

As this method offers flexibility and efficiency, which are critical for fostering corporate development, it is becoming increasingly popular to employ communication platforms as services. Because cloud-based service providers manage server setup, maintenance, and updates, businesses don't need to. The IT governance issue is removed, and immediate access to internal infrastructure is made possible by the communication platform as a service model, which aids in managing all applications from a single location. The market is expanding due to the growing demand from SMEs for inexpensive communication solutions.

Any relationship needs communication, and success depends on establishing a direct line of communication with your clients. Through several techniques, the top CPaaS suppliers will assist businesses in raising customer loyalty, lifetime value, and satisfaction. Ensuring team members communicate correctly about the goods or services they provide is essential for boosting client satisfaction. Before a consumer buy anything from a company, they should be able to give clear information about anything from pricing strategies to product features and advantages.

Many businesses are switching from on-premises communications to cloud platforms as CPaaS becomes more prevalent. Enhanced productivity and third-party app integration are two advantages of CPaaS platforms. These systems are vulnerable to data security issues, however. Applications from several clients are often executed on the same OS in a public cloud. Therefore, it is essential to plan a communication protection strategy and consider the risk-to-benefit ratio of CPaaS in advance of any possible security concerns. Such persistent security issues might limit the growth of the CPaaS industry.

Based on component, the Communication Platform as a Service Market is segmented into solutions and services. The services segment accounted for the significant revenue share in the market in 2021. For example, software engineering executives may programmatically link communications software with corporate processes using CPaaS' cloud-based middleware.

Based on organization size, the communication platform as a service market is divided into large enterprises and SMEs. With the largest revenue share in 2021, the large enterprises segment dominated the Communication Platform as a Service Market. Large enterprises should see an increase in demand for communication platform-as-a-service due to the fast-expanding digital client involvement. These businesses are boosting their IT spending to improve customer service on digital platforms, which is projected to increase the market share for communication platforms as a service.

Based on vertical, the Communication Platform as a Service Market is divided into BFSI, retail & e-commerce, IT & Telecom, government, healthcare, education, manufacturing, and others. The BFSI segment acquired the significant revenue share in the market in 2021. Banks can inexpensively add audio, video, and other communication channels to their applications due to the CPaaS. The platform provides a full structure, so creating banking applications is simple. Numerous CPaaS suppliers offer to complete the integration for a reasonable charge as part of the package. This industry is expected to expand due to the advantages of CPaaS adoption.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 9.6 Billion |

| Market size forecast in 2028 | USD 51.3 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 27.5% from 2022 to 2028 |

| Number of Pages | 331 |

| Number of Tables | 564 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Organization Size, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on region, the Communication Platform as a Service Market is categorized into North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific region is registering the rapid growth rate in the Communication Platform as a Service Market. The use of CPaaS solutions in the area is also being fueled by government measures to improve the digital infrastructure. Asia Pacific has become one of the fastest-growing markets internationally because of the significant growth in the usage of these solutions there. The main drivers of the development of the CPaaS market in this area are the rising need for converged communications and product differentiation among service providers.

Free Valuable Insights: Global Communication Platform as a Service Market size to reach USD 51.3 Billion by 2028

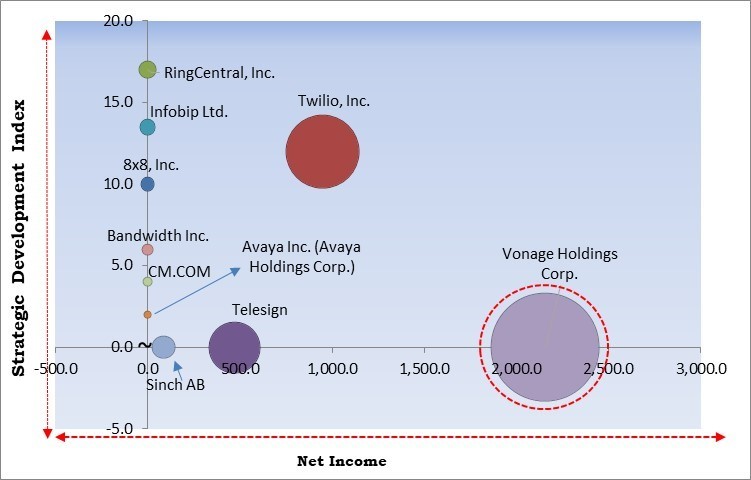

The major strategies followed by the market participants are Acquisition. Based on the Analysis presented in the Cardinal matrix; Vonage Holdings Corp. is the forerunners in the Communication Platform as a Service Market. Companies such as Twilio, Inc., Telesign, RingCentral, Inc. are some of the key innovators in Communication Platform as a Service Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include RingCentral, Inc, 8x8, Inc., Avaya Inc. (Avaya Holdings Corp.), Sinch AB, Twilio, Inc., Telesign (Proximus Group), Bandwidth, Inc, CM.com N.V., Vonage Holdings Corp. (Ericsson AB), and Infobip Ltd.

By Component

By Organization Size

By Vertical

By Geography

The global Communication Platform as a Service Market size is expected to reach $51.3 billion by 2028.

Standardized application management are driving the market in coming years, however, Growing security worries might prevent growth restraints the growth of the market.

RingCentral, Inc, 8x8, Inc., Avaya Inc. (Avaya Holdings Corp.), Sinch AB, Twilio, Inc., Telesign (Proximus Group), Bandwidth, Inc, CM.com N.V., Vonage Holdings Corp. (Ericsson AB), and Infobip Ltd.

The expected CAGR of the Communication Platform as a Service Market is 27.5% from 2022 to 2028.

The Solution segment acquired maximum revenue share in the Global Communication Platform as a Service Market by Component in 2021 thereby, achieving a market value of $38.3 billion by 2028.

The North America market dominated the Global Communication Platform as a Service Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $17.3 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.