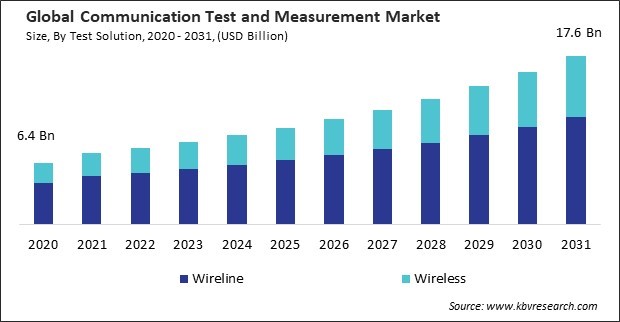

“Global Communication Test and Measurement Market to reach a market value of USD 17.6 billion by 2031 growing at a CAGR of 9.5%”

The Global Communication Test and Measurement Market size is expected to reach $17.6 billion by 2031, rising at a market growth of 9.5% CAGR during the forecast period.

North America is a hub for technological innovation, particularly in the telecommunications and information technology sectors. Canadian manufacturers are investing in smart manufacturing initiatives and digital transformation projects to digitize production processes, monitor equipment performance, and optimize supply chain operations. Consequently, the North America region would generate approximately 34% revenue share of the market in 2031.

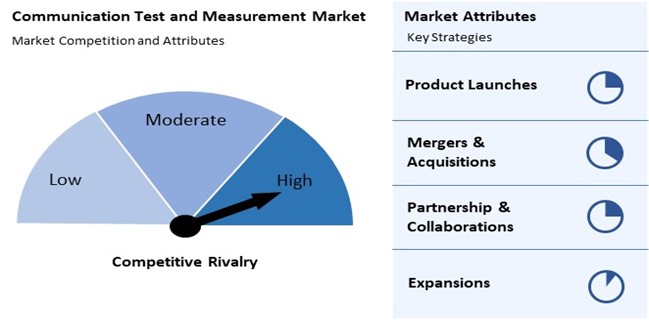

The major strategies followed by the market participants are Mergers & Acquisitions as the key developmental strategy to keep pace with the changing demands of end users. For instance, In December 2023, Luna Innovations, Incorporated completed the acquisition of Silixa Ltd., a distributor of fiber optic sensing solutions. With this acquisition, Luna strengthened its standing in the fiber optic sensing market. And in October 2021, Keysight Technologies, Inc. took over SCALABLE Network Technologies, a provider of communications network simulation and solutions for design, testing, and analysis. Through this acquisition, Keysight and SCALABLE will empower customers to model, prototype, and evaluate multi-domain networks and applications using software simulations, reducing risks during development and enhancing the time to market for their products.

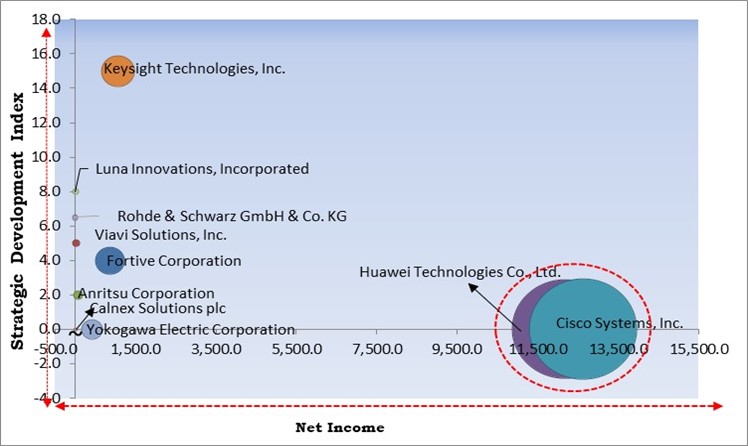

Based on the Analysis presented in the KBV Cardinal matrix; Huawei Technologies Co., Ltd. and Cisco Systems, Inc. are the forerunners in the Communication Test and Measurement Market. Companies such as Keysight Technologies, Inc., Fortive Corporation and Yokogawa Electric Corporation are some of the key innovators in Communication Test and Measurement Market. In January 2024, Fortive Corporation took over EA Elektro-Automatik (EA) Holding GmbH, a leading supplier in the sector of power electronics for R&D and industrial applications. Through this acquisition, Fortive enhanced its standing in the electronic test and measurement solutions segment within its precision technologies segment.

Cybersecurity testing services help organizations proactively identify and mitigate security risks before malicious actors can exploit them. Organizations can identify weaknesses in their network infrastructure, applications, and security controls by conducting comprehensive security assessments, penetration testing, vulnerability scanning, and threat modelling. Therefore, the market is expanding significantly due to the rising cybersecurity testing services.

Additionally, Industry 4.0 and smart manufacturing involve the integration of automation, data exchange, and advanced manufacturing technologies. This increased connectivity and automation require reliable and high-performance communication networks. Communication test and measurement solutions are needed to ensure these networks' performance, reliability, and security. Thus, because of the adoption of Industry 4.0 and smart manufacturing, the market are anticipated to increase significantly.

The high upfront cost of testing equipment can make it inaccessible for smaller organizations, startups, and companies operating on tight budgets. This limits their ability to invest in comprehensive testing capabilities, potentially hindering their competitiveness and ability to deliver high-quality products and services. High testing equipment costs can deter investment in research and development (R&D) initiatives to develop new testing methodologies, technologies, and solutions. Thus, high cost of testing equipment can slow down the growth of the market.

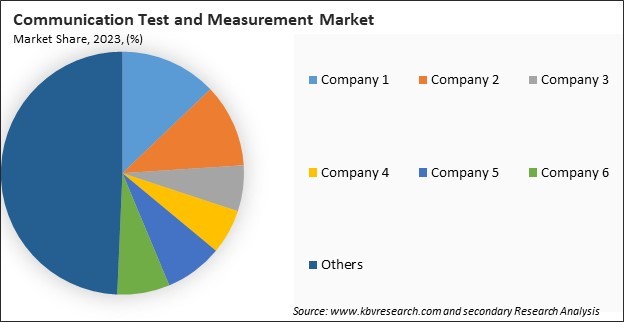

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions.

Based on test solution, the market is classified into wireline and wireless. The wireless segment recorded a 32.7% revenue share in the market in 2023. Wireless test solutions provide real-world simulation and emulation capabilities to replicate diverse wireless environments, scenarios, and conditions in controlled testing environments. By simulating various network conditions, mobility patterns, interference scenarios, and propagation characteristics, these solutions enable organizations to validate the performance and resilience of wireless systems under different real-world scenarios.

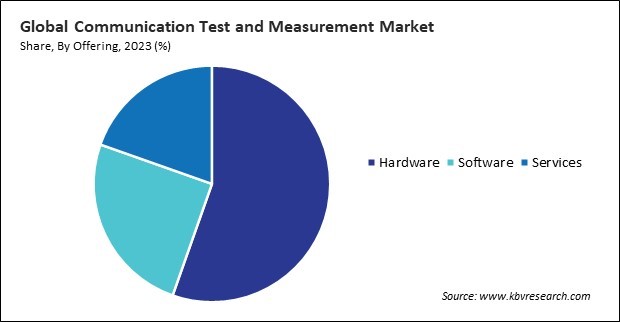

By offering, the market is categorized into hardware, software, and services. In 2023, the hardware segment held 55.4% revenue share in the market. Hardware components such as test instruments, analyzers, probes, and meters form the backbone of communication test and measurement infrastructure. These devices are essential for conducting a wide range of tests and measurements, including signal analysis, spectrum analysis, power measurements, and modulation analysis, across various communication technologies and protocols.

On the basis of type of test, the market is divided into enterprise test, field network test, lab & manufacturing test, and network assurance test. The enterprise test segment covered a 18.5% revenue share in the market in 2023. Enterprise test solutions offer end-to-end testing capabilities that cater to the diverse communication infrastructure deployed within enterprises. These solutions encompass a wide range of testing functionalities, including network performance testing, security testing, protocol conformance testing, interoperability testing, and user experience testing, ensuring comprehensive coverage of enterprise communication systems.

By end-user, the market is fragmented into telecommunication service provider, network equipment manufacturer, mobile device manufacturer, and others. In 2023, the telecommunication service provider segment held 46.2% revenue share in the market. Telecommunication providers prioritize quality assurance to deliver reliable, high-performance customer communication services. They invest in communication test and measurement solutions to validate network performance, assess service quality, and ensure compliance with service level agreements (SLAs), driving demand for testing tools and technologies that support their quality assurance initiatives.

Free Valuable Insights: Global Communication Test and Measurement Market size to reach USD 17.6 billion by 2031

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2023, the Asia Pacific region acquired a 28.53% revenue share in the market. The Asia Pacific region is experiencing rapid growth in telecommunications infrastructure, driven by increasing internet penetration, rising smartphone adoption, and growing demand for digital services. The Asia Pacific region is home to a large manufacturing base and is experiencing increasing adoption of industry automation technologies such as robotics, artificial intelligence, and industrial IoT.

The market is competitive, with established players like Keysight Technologies, Cisco Systems, Inc., Anritsu, and Rohde & Schwarz. They offer a variety of equipment for testing wireless, optical, and wired communications. Competition centers around innovation, performance, pricing, and customer support. Smaller players focusing on specific segments also contribute to the competition. Hence the competitive rivalry is relatively high.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 8.6 Billion |

| Market size forecast in 2031 | USD 17.6 billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 9.5% from 2024 to 2031 |

| Number of Pages | 324 |

| Number of Tables | 454 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Offering, Test Solution, Type of Test, End-user, Region |

| Country scope |

|

| Companies Included | Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Cisco Systems, Inc., Fortive Corporation (Fluke Corporation), Viavi Solutions, Inc., Yokogawa Electric Corporation, Keysight Technologies, Inc., Rohde & Schwarz GmbH & Co. KG, Calnex Solutions plc, Anritsu Corporation, Luna Innovations, Incorporated |

By Test Solution

By Offering

By Type of Test

By End-user

By Geography

This Market size is expected to reach $17.6 billion by 2031.

Rising Cybersecurity Testing Services are driving the Market in coming years, however, High Cost of Testing Equipment restraints the growth of the Market.

Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Cisco Systems, Inc., Fortive Corporation (Fluke Corporation), Viavi Solutions, Inc., Yokogawa Electric Corporation, Keysight Technologies, Inc., Rohde & Schwarz GmbH & Co. KG, Calnex Solutions plc, Anritsu Corporation, Luna Innovations, Incorporated

The expected CAGR of this Market is 9.5% from 2024 to 2031.

The Wireline segment is leading the Market by Test Solution in 2023, thereby achieving a market value of $11.2 billion by 2031.

The North America region dominated the Market by Region in 2023 and would continue to be a dominant market till 2031; thereby, achieving a market value of $5.97 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges