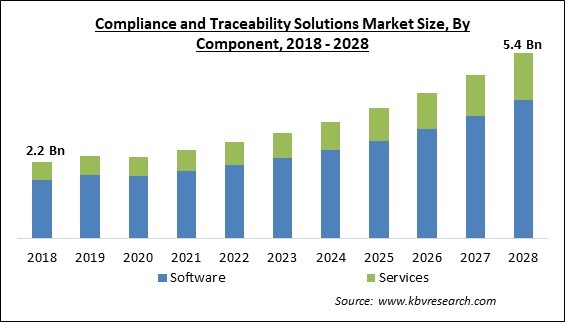

The Global Compliance and Traceability Solutions Market size is expected to reach $5.4 billion by 2028, rising at a market growth of 11.6% CAGR during the forecast period.

Across the whole supply chain, from the supplier to the customer, a compliance and traceability system uses software to load units and monitor shipments, items, or vehicles. The management of the value chain could be significantly impacted by these systems at each stage. To address problems with production efficiency, regulatory compliance, product sustainability, and risk, it can be used proactively as real data. As a result, client connections are guaranteed, protected, and improved.

This has a broad spectrum of uses across end-use industries, including the manufacturing, BFSI, and IT & telecom sectors. Solutions for compliance and traceability are, therefore, important components of business operations. The demand for real-time traceability and compliance audits is growing, which helps the market for these solutions and developing supply chain management systems. Also, supportive laws, guidelines for serialization deployment, and increased product recall because of packaging drive the market's expansion.

Furthermore, throughout the forecast period, the market for compliance and traceability solutions is anticipated to see profitable growth prospects due to the rise in the adoption of cutting-edge technologies and digital solutions in the logistics sector. As manufacturers become more aware of the benefits of compliance solutions, sales of compliance & traceability solutions are increasing. Businesses increasingly use compliance solutions to comply with legal, security, and regulatory obligations.

These strategies ensure regulatory compliance with various financial, environmental, and information technology hazards as organizations and governments increasingly adopt digital solutions to adhere to laws and industry standards. Moreover, pharmaceutical and healthcare organizations frequently deal with issues related to medical fraud. As a result, many healthcare firms are implementing supply chain monitoring technology and traceability systems. As developers create more complex programs using commercially available components and services, managing cloud infrastructure becomes more challenging. Construction of fully automated and compliant infrastructures can take money, time, and already-stretched engineering resources.

Compliance and traceability solutions are anticipated to gain ground in the long run because of the ongoing spike in demand for traceability solutions across many business verticals, particularly the food and pharmaceutical industries, in the wake of a pandemic. Innovations and developments in compliance and traceability solutions, including real-time monitoring and RFID technology, have assisted the market expansion since the COVID-19 outbreak. Furthermore, the market estimate for compliance and traceability solutions has seen a significant expansion in growth prospects due to the rise in supply chain digital transformation projects.

Compliance and traceability solutions are steadily gaining momentum among companies to comply with regulatory, security, legal, and industry standards. Increasing counterfeits, improved supply chain visibility, and complications in monitoring returns or product recall are progressively driving the deployment of efficient traceability systems in line with regulatory standards. Hence, several regional governments are striving to pass specific regulations and mandates for deploying serialization in trace systems to assure significant supply chain process efficiency.

To boost agricultural production, farmers require access to high-quality seeds, and characteristics such as germination rate, seed purity, and moisture content are essential. In the seed sector, digital traceability solutions are necessary due to the absence of information being used for malicious seed mixing, seed production & processing, and manual recordkeeping. Since the seed is the fundamental and most essential component of agriculture, the seed industry has expanded in parallel with the agriculture industry. For a good crop in agriculture, it is essential to have access to high-quality seeds. As a result, the compliance and traceability solutions market will expand during the next few years.

The Total Cost of Ownership (TCO), which might be ten times or more than the initial acquisition cost, can also vary based on the serialization requirements and the firm's size. Therefore, it is essential to conduct proper planning while taking into consideration the major cost elements, such as software license or subscription fees, variable transaction fees, and the price of adding surplus hardware as well as infrastructure to support on-site or private services for data storage, access, and processing. These considerations raise the price of serializing cartooning lines to the item level, limiting market expansion throughout the forecast period.

Based on component, the compliance and traceability solutions market is segmented into software, and services. In 2021, the software segment held the highest revenue share in the compliance and traceability solutions market. This is ascribed to numerous advantages provided by the software, such as decreased risks, more secure operations, and finding gaps in documentation and risk assessment, which has led to an increase in the installation of compliance and traceability software. Also, it is projected that growing brand protection awareness, an increase in the number of counterfeit medications and associated items, and increased secure packaging knowledge would all support the expansion of the software market globally.

By deployment mode, the compliance and traceability solutions market is categorized into on-premise and cloud. The cloud segment covered a considerable revenue share in the compliance and traceability solutions market in 2021. With cloud-based corporate traceability solutions that concentrate on the supply chain for product traceability, manufacturers may better track the path of their products from the sources of their raw materials to the point of sale or beyond.

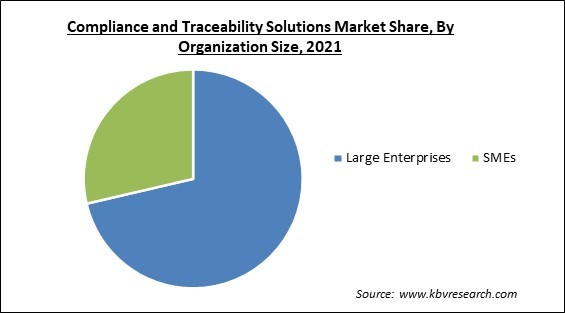

On the basis of organization size, the compliance and traceability solutions market is bifurcated into large enterprise and small & medium-sized enterprises. The large enterprise segment generated the maximum revenue share in the compliance and traceability solutions market in 2021. Lack of sound traceability for products that need to comply with functional safety regulations might cause major issues. Heavy fines, possibly prison time for executives, or even bankruptcy for the company could result from traceability gaps. The demand for compliance and traceability is increasing as a result of regulatory bodies' tough regulations, which is fueling the segment's expansion.

By industry vertical, the compliance and traceability solutions market is fragmented into IT& Telecom, BFSI, healthcare, food & agriculture, government, manufacturing and others. The food & agriculture segment registered a prominent revenue share in the compliance and traceability solutions market in 2021. The agricultural value chain is fully visible due to compliance and traceability solutions. With the help of its technological platform, businesses can now gather transactional data right at the source, even in distant areas with little to no telecommunications infrastructure.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 2.6 Billion |

| Market size forecast in 2028 | USD 5.4 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 11.6% from 2022 to 2028 |

| Number of Pages | 258 |

| Number of Table | 450 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Deployment Mode, Organization Size, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the compliance and traceability solutions market is analyzed across North America, Europe, Asia Pacific and LAMEA. The North America witnessed the largest compliance and traceability solutions market in 2021. Expanding the manufacturing, healthcare, and IT & telecom sectors will stimulate adoption of compliance and traceability solutions in North America. The U.S. healthcare sector's tight legislation and aggregation criteria will foster market expansion. As a result of the region's expanding digitalization and development of its IT infrastructure, the market for compliance and traceability solutions will expand. Europe is predicted to have enormous development potential for businesses that offer compliance and traceability solutions.

Free Valuable Insights: Global Compliance and Traceability Solutions Market size to reach USD 5.4 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include SAP SE, Tata Consultancy Services Ltd., Omron Corporation, Mettler-Toledo International, Inc., Sys-Tech Solutions, Inc. (Dover Corporation), Optel Group, 4CRisk.ai, Agrilyze, Tuleap, and TraceLink, Inc.

By Component

By Deployment Mode

By Organization Size

By Vertical

By Geography

The global Compliance and Traceability Solutions Market size is expected to reach $5.4 billion by 2028.

Supportive regulations & standards for serialization implementation are driving the market in coming years, however, High price along with the longer time to be spent on serialization restraints the growth of the market.

SAP SE, Tata Consultancy Services Ltd., Omron Corporation, Mettler-Toledo International, Inc., Sys-Tech Solutions, Inc. (Dover Corporation), Optel Group, 4CRisk.ai, Agrilyze, Tuleap, and TraceLink, Inc.

The On-premise segment is generating highest revenue share in the Global Compliance and Traceability Solution Market by Deployment Mode in 2021 thereby, achieving a market value of $3.2 billion by 2028.

The Healthcare segment is leading the Global Compliance and Traceability Solution Market by Vertical in 2021 thereby, achieving a market value of $1.5 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.