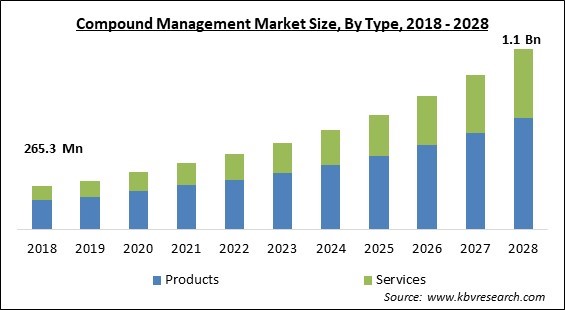

The Global Compound Management Market size is expected to reach $1.1 billion by 2028, rising at a market growth of 15.5% CAGR during the forecast period.

Compound management comprises maintaining the chemical libraries, which includes robotics for chemical retrieval and database updates of chemical information. It also includes restoring out-of-date chemicals and maintaining the quality of the storage environment. Compound Control is another name for compound management.

Compound Management provides the infrastructure and logistics that aid in managing research compounds. It aids in the development of new drugs, and entails the logistics of storing, preparing, and evaluating compounds for testing as well as dispensing them during the drug discovery process. To avoid significant ripple effects that could prevent the release of treatments that are feasible and effective, compound management must be handled properly and meticulously. Due to the impact of using the incorrect chemical for comparison, inaccurate compound concentrations, or testing.

Compound collection management is made simpler, sample integrity is guaranteed, and turnaround times for samples are sped up through automated storage options. Additionally, novel high-throughput screening methods are now supported by advancements brought about by new computerized sample management technology. Fully automated processes for assay plate preparation, molecular weighing and dissolution, and library maintenance greatly enhance drug discovery workflows by reducing labor-intensive and error-prone processes.

Despite the decrease in COVID-19 incidences, the importance of COVID-19 vaccinations has increased significantly. The demand for COVID-19 vaccinations is rising as a result of the concern that a new COVID-19 variation would emerge. As a result, numerous pharmaceutical companies are creating vaccines. This is probably going to increase demand for COVID-19 vaccine compound management. The majority of COVID-19 medications and vaccines were in development during the pandemic. However, according to the Pharma R & D annual assessment for 2022, the two main pharmaceuticals in development at the time were biotechnology and anticancer medications. Due to the increased demand for biotechnology and anticancer medications, the drug pipeline for these substances is anticipated to improve in the upcoming years. The Compound Management market is anticipated to be significantly affected by COVID 19.

The pharmaceutical industry's fastest-growing subsegment is biopharmaceuticals. As the demand for sample management rises as a result of increased biologic production, the expansion of this industry will also aid that of the sample management market. Biologics demand is on the rise, biosimilars are developing, biopharmaceutical companies are spending more on research and development, and chronic diseases are on the rise. Additionally, by concentrating on outsourcing tasks to CROs and CMOs, the majority of biotech and biopharma businesses can concentrate on their core competencies.

inIn the sciences, accuracy and speed don't combine well. An effective compound management system must strike a balance between speed and accuracy because quick outcomes are frequently hurried, careless, or erroneous. Most compound handling systems aim to reduce human handling because it is the source of the vast majority of problems. Racks, carousels, and robotic arms are frequently used in automated compound backup and recovery systems to store and transfer compounds. The recommended method of storage is in a -20 °C dimethyl sulfoxide (DMSO) solution.

One or more people who oversee a chemical library at a research facility incur large costs for compound management regularly. For high-throughput screening and chemical genomics, it has emerged as a crucial technological element. The requirement for compound management presents significant problems, which are being overcome by coordinated efforts in both the public and private spheres. A compound/sample management facility requires significant financial outlays for both hardware and software, including the construction of new automated liquid compound storage systems connected to a substantial inventory database.

Based on type, the compound management market is classified into Products (Automated Compound/Sample Storage Systems, Automated Liquid Handling Systems, and Other Compound/Sample Storage Systems) and services. The service segment witnessed a significant revenue share in the compound management market in 2021. It is due to the rise in drug development activities, the rising need for compound management services, and the growing desire to save costs associated with drug research are some of the key factors influencing the service segment's expansion.

On the basis of sample type, the compound management market is segmented into Chemical Compounds and Bio Samples. The bio sample segment witnessed a substantial revenue share in the compound management market in 2021. The industry is expanding due to the rising need for tailored treatments. Medical research requires access to essential biological material. The growth of cell-based research activities has resulted in a significant need for various biospecimens kept in biobanks.

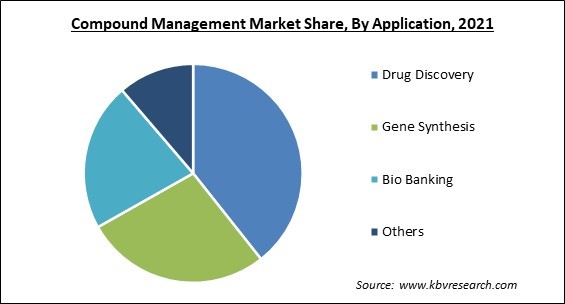

By application, the compound management market is divided into Drug Discovery, Gene Synthesis, Bio Banking and Others. The drug discovery segment garnered the highest revenue share in the compound management market in 2021. It is because to test a large number of chemicals with a biological target, high output screening is performed. The information on target activities is gathered from a large library. It is possible to find more active molecules through drug discovery. Thus, it is projected that an increase in drug discovery activity would lead to a significant increase in demand.

Based on end-use, the compound management market is fragmented into Pharmaceutical Companies, Biopharmaceutical Companies, Contract Research Organizations and Others. The pharmaceutical companies segment garnered the highest revenue share in the compound management market in 2021. It is because more drugs are being discovered, that there is a raising need for chemicals, which is boosting the market's expansion. The market for compound management is divided into biopharmaceutical businesses, the pharmaceutical industry, contract research organizations (CROs), and others, which include governmental, academic, and research institutions, based on end-use.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 403.6 Million |

| Market size forecast in 2028 | USD 1.1 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 15.5% from 2022 to 2028 |

| Number of Pages | 280 |

| Number of Tables | 530 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Application, Sample Type, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the compound management market is analyzed across North America, Europe, Asia Pacific and LAMEA. The North America region procured the largest revenue share in the compound management market in 2021. This is because the region is home to numerous pharmaceutical and biotechnology companies engaged in the drug discovery process. Consequently, there is a raising need for services in this area. A further factor driving this sector's growth is the increase in disease-related morbidity and mortality, which has led to the creation of more medication candidates. Positive drug discovery and research endeavors by public entities are further fostering regional market expansion.

Free Valuable Insights: Global Compound Management Market size to reach USD 1.1 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Danaher Corporation (Beckman Coulter), Azenta US, Inc., Hamilton Company, BioAscent, Evotec SE, SPT Labtech Ltd., Tecan Group Ltd., Titian Software, LiCONiC AG, and AXXAM S.p.A.

By Type

By Application

By Sample Type

By End User

By Geography

The Compound Management Market size is projected to reach USD 1.1 billion by 2028.

Growing Pharmaceutical And Biopharmaceutical Manufacturing are driving the market in coming years, however, Compound Management Facilities Required Huge Investments restraints the growth of the market.

Danaher Corporation (Beckman Coulter), Azenta US, Inc., Hamilton Company, BioAscent, Evotec SE, SPT Labtech Ltd., Tecan Group Ltd., Titian Software, LiCONiC AG, and AXXAM S.p.A.

The expected CAGR of the Compound Management Market is 15.5% from 2022 to 2028.

The Products segment acquired maximum revenue share in the Global Compound Management Market by Type in 2021, thereby, achieving a market value of $675.3 million by 2028.

The North America market dominated the Global Compound Management Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $396.5 million by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.