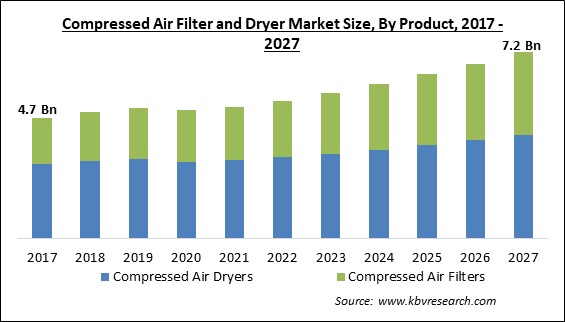

The Global Compressed Air Filter and Dryer Market size is expected to reach $7.2 billion by 2027, rising at a market growth of 6.0% CAGR during the forecast period.

Filters for air compressors, also known as airline filters, are utilized in condensed airlines to keep liquids and solids impurities out of the compressor. In addition, they prevent these impurities from entering and inflicting damage to the equipment. Millions of dirt particles, as well as substantial volumes of oil and water, can be found in a cubic foot of compressed air. The compressed air may contain lead, mercury, or other heavy metals, depending on the use.

The operation of essential system components like cylinders and valves would be hampered if pollutants are not removed by air compressor filters. Additionally, filtration is an important part of compressed air preparation because it keeps seals from swelling and wearing out prematurely. Clean compressed air saves money on energy expenditures in addition to minimizing downtime.

The function of an air dryer is to reduce the dew point of compressed air by eliminating moisture. Moreover, compressed air can contain moisture, which can reach the dew point temperature and condense into a hazardous liquid under the correct conditions. This can be a significant concern since it can infect the products or equipment, cause frozen pipes, induce corrosion, and cause other problems.

A compressor is mechanical equipment that transfers the energy generated by a machine into fluid energy. The volume of compressed air is reduced by the compressor, which raises the temperature of compressed air. The compressor is chosen based on the desired operating pressure and supply volume. Compressed air filters are primarily used to prevent harm from air impurities that must be filtered out. There are two types of inlet filters viz. dry and wet filters. In addition, these filters are utilized to meet the compressor's filtering needs. Incoming air passes through an oil bath before passing through a fine wire mesh filter in the wet filter. Second, while repairing a dry filter, cartridges are swapped. As a result, moist filters must be cleaned with detergent while being cleaned.

Because of the COVID-19 outbreak, the demand for compressed air filters and dryers decreased in 2020. In addition, several industries, including automotive, oil and gas, power, and electronics, were negatively impacted. Due to the global automobile and electric vehicle industries' reliance on China for batteries and other components, major global automakers such as General Motors (US), Ford (US), and Daimler (Germany) have had difficulty sourcing raw materials, batteries, and other components needed for automobile production. Due to a shortage of batteries supplied from China, Fiat Chrysler, a UK-based automaker, temporarily halted vehicle production.

When air is not filtered, dirt, oil, and water accumulate in the cracks and crevices of compressed air pipes and fittings, polluting the compressed air stream. In addition, the contaminants that have accumulated in the cracks begin to corrode the pipes, causing serious glitches or complete shutdown of compressed air equipment. Moreover, filters for compressed air ensure that no pollutants enter the air stream, ensuring proper operation and equipment longevity, as well as lower maintenance costs. The lower the moisture content, the higher the system's production. Corrosion is caused by the accumulation of water and water vapor in equipment, which can block fittings, valves, and instrument control lines, causing system failure.

Compressed air is needed to power machines, and with expanding industrialization in many countries around the world. In addition, developed nations such as North America and Europe are already technologically advanced countries with extensive machine deployment, necessitating a higher need for air compressors and compressed air treatment equipment. With the rise of industries such as food and beverage, pharmaceuticals, energy exploration, and others, air compressors are becoming increasingly widespread. To ensure that clean air is used in this process, polluting particles must be removed using filters, dryers, and other related equipment.

In all sectors, compressed air production is one of the costliest auxiliary functions. The most essential parts of compressed air systems are compressed air filters and dryers. In addition, these systems are extremely sensitive to their surroundings. Moreover, the efficiency, output, and working life of compressed air filters and dryers can be affected by changes in cabin temperature, energy supply, and air feed. Maintaining the system temperature at the appropriate level in high-pressure working conditions can lead to system explosion. Furthermore, it is difficult for end-users to maintain an exceptionally controlled atmosphere in order for compressed air filters and dryers to perform properly.

Based on Product, the market is segmented into Compressed Air Dryers and Compressed Air Filters. Based on Compressed Air Dryers Type, the market is segmented into Refrigeration Dryers, Desiccant/Adsorption Dryers, Deliquescent Dryers and Membrane Dryers. Based on Compressed Air Filters Type, the market is segmented into Particulate Filters, Coalescing Filters, Compressed Intake Filters and Activated Carbon Filters. The Compressed Air Filters segment held a significant revenue share of the Compressed Air Filter and Dryer Market in 2020. This is because dust, grime, grease, and water are all protected by compressed air filters. In addition, dust would wear down the equipment (such as air motors in grinders, pneumatic actuators, and pneumatic control valves), and it can also cause pneumatic control valves to become stuck. A sticky mess can build inside valves, motors, and other compressed air equipment, especially when dirt and dust are coupled with oil (as is commonly the case with compressors). In such instances, the installation of compressed air filters is highly useful to protect the equipment.

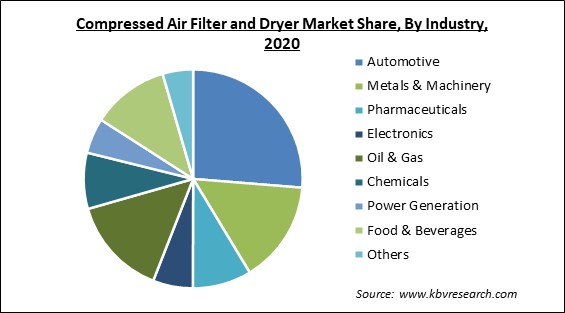

Based on Industry, the market is segmented into Automotive, Metals & Machinery, Pharmaceuticals, Electronics, Oil & Gas, Chemicals, Power Generation, Food & Beverages and Others. In 2020, the Automotive segment acquired the maximum revenue share of the Compressed Air Filter and Dryer Market. This is because the automotive industry relies on compressed air filters and dryers for cabin air filtration, spray painting, air conditioning, and laser purging, as well as air spindles, air bearings, air guns, and pneumatic brakes. Moreover, a diesel particulate filter is a filter that catches and stores exhaust soot (also known as soot traps) in order to minimize diesel vehicle emissions. However, because they have a limited capacity, this trapped soot must be discharged or 'burned off' on a regular basis in order to replenish this device. This regeneration process effectively eliminates the excess soot accumulated in the filter, lowering harmful exhaust emissions and preventing the tell-tale black smoke associated with diesel vehicles, especially while accelerating.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 5 Billion |

| Market size forecast in 2027 | USD 7.2 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 6% from 2021 to 2027 |

| Number of Pages | 310 |

| Number of Tables | 513 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Product, Industry, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2020, North America emerged as the leading region in the overall Compressed Air Filter and Dryer Market by procuring the largest revenue share. In addition, the regional market is expected to showcase a similar kind of trend even during the forecasting period. The presence of several automotive and food and beverage manufacturing plants is projected to propel the compressed air filter and dryer market in North America. Moreover, the need for compressed air filters and dryers has expanded dramatically in the United States as a result of stricter environmental air purity standards.

Free Valuable Insights: Global Compressed Air Filter and Dryer Market size to reach USD 7.2 Billion by 2027

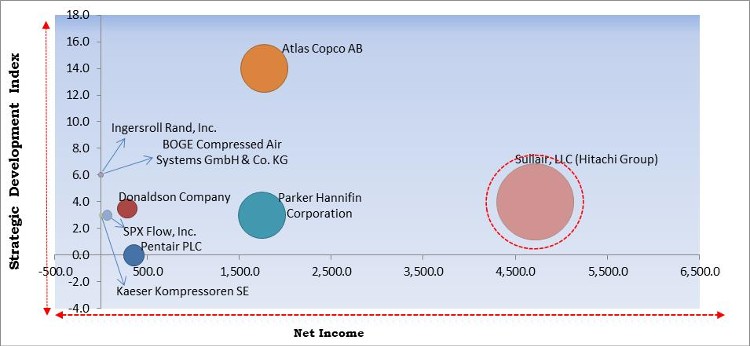

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Sullair, LLC (Hitachi Group) is the forerunners in the Compressed Air Filter and Dryer Market. Companies such as Atlas Copco AB, Parker Hannifin Corporation, Donaldson Company, Inc. are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Ingersoll Rand, Inc., Parker Hannifin Corporation, Pentair PLC, Donaldson Company, Inc., SPX Flow, Inc., Atlas Copco AB, BOGE Compressed Air Systems GmbH & Co. KG, Sullair, LLC (Hitachi Group), Sullivan-Palatek, Inc., and Kaeser Kompressoren SE.

By Product

By Industry

By Geography

The global compressed air filter and dryer market size is expected to reach $7.2 billion by 2027.

Increase in awareness among end-users are driving the market in coming years, however, privacy and data security limited the growth of the market.

Ingersoll Rand, Inc., Parker Hannifin Corporation, Pentair PLC, Donaldson Company, Inc., SPX Flow, Inc., Atlas Copco AB, BOGE Compressed Air Systems GmbH & Co. KG, Sullair, LLC (Hitachi Group), Sullivan-Palatek, Inc., and Kaeser Kompressoren SE.

The Compressed Air Dryers segment acquired the maximum revenue share in the Global Compressed Air Filter and Dryer Market by Product in 2020; thereby, achieving a market value of $4.0 billion by 2027.

The North America is the fastest growing region in the Global Compressed Air Filter and Dryer Market by Region in 2020, and would continue to be a dominant market till 2027.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.