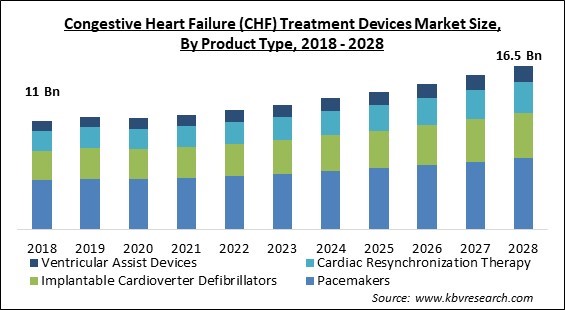

The Global Congestive Heart Failure (CHF) Treatment Devices Market size is expected to reach $16.5 billion by 2028, rising at a market growth of 5.4% CAGR during the forecast period.

A cardiac device is employed to keep the heart in a regular rhythm. There are a variety of devices to choose from. An ICD (implantable cardiac defibrillator) is an electrical device that is implanted into the heart. An ICD constantly monitors the cardiac rhythm and, if it becomes abnormal, provides a mild shock to the heart muscle (arrhythmia). If a shock is required, it can be extremely unpleasant, but it will pass rapidly. Instead of a shock, some ICDs employ a pacing system. To restore normal heart rhythm, this type of ICD gives a rapid impulse to the heart muscle. A pacemaker can help the patient to avoid sudden cardiac arrest (SCA).

According to the Cleveland Clinic, electrical issues in the ventricles cause delays when they pump/contract in about 30% of people with heart failure. There is less oxygen-rich blood transported to the organs and muscles when the ventricles do not pump simultaneously. Pumping delays aggravate heart failure and raise the likelihood of death from the condition. A pacemaker is implanted in the patient's body as part of CRT treatment. The pacemaker is connected to three wires (leads) that send tiny electrical impulses to the heart muscle to maintain the ventricles pumping together. A CRT-D is a system that includes the capabilities of a CRT and an ICD. It prevents the ventricles from colliding. The CRT-D provides a shock to restore normal rhythm if they become out of sync due to ventricular tachycardia or fibrillation. CRT, with or without an ICD, improves the symptoms of about 75% of patients who do not find relief from their symptoms with medication. Cardiac resynchronization therapy improves the quality of life, survival, heart function, and exercise capacity, as well as lowers hospitalization risk.

The COVID-19 outbreak is one of the most hazardous pandemics that majorly demolished the worldwide economy. Various businesses were completely devastated while several were majorly impacted due to the advent of the pandemic. Governments all over the world were compelled to impose lockdowns across their countries, due to which, the manufacturing units of numerous goods were temporarily closed. Moreover, the global supply chain was also disrupted as a result of stringent travel restrictions imposed by governments. Owing to this, the growth of various industries was hampered.

The failure of the ventricles in order to pump enough blood to the body's organs is the initial stage of congestive heart failure. Fluid builds up in the lungs, liver, belly, and lower body as a result of this. The technologies used to treat CHF include pacemakers, cardiac resynchronization therapy (CRT), implantable cardioverter defibrillators (ICDs), as well as ventricular assist devices. The market for congestive heart failure treatment devices is being driven by an increase in the number of cardiovascular ailments, technical advancements, and the number of cardiovascular procedures.

One of the major factors that are propelling the growth of the congestive heart failure devices market is the increasing number of efforts and initiatives that are being taken by the government and market players all over the world. Governments in several countries have introduced a number of healthcare schemes, which, a patient can leverage for the treatment of several diseases and disorders. In addition, congestive heart failure is a very lethal and prevalent disorder, becoming the reason for the death of a considerable number of people all over the world each year. The inclusion of CHF in these policies is allowing people to take advantage of CHF treatment devices.

One of the major factors that are impeding the deployment of congestive heart failure treatment devices is the high cost of these devices that are occurred in installing and operating these devices. There is a significant number of people that suffers from cardiac disorders and diseases all over the world. Congestive heart failure treatment devices are the most effective and quick treatment for these disorders. However, people all over the world are not able to leverage the full benefits of these devices due to their high cost. The implementation cost of these devices is significantly high due to the composition of various complex and advanced technologies.

Based on Product Type, the market is segmented into Pacemakers, Implantable Cardioverter Defibrillators, Cardiac Resynchronization Therapy, and Ventricular Assist Devices. In 2021, the pacemakers segment acquired the largest revenue share of the congestive heart failure treatment devices market. The growth of this segment is rising due to an increase in pharmaceutical and medical device R&D, increased demand for congestive heart failure therapy devices for the treatment of heart failure, and an increase in pacemaker adoption. Moreover, it is a being more preferred by patients as well as surgeons due to its feature of maintaining the heart rhythm in a painless manner.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 11.5 Billion |

| Market size forecast in 2028 | USD 16.5 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 5.4% from 2022 to 2028 |

| Number of Pages | 141 |

| Number of Tables | 184 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Product Type, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

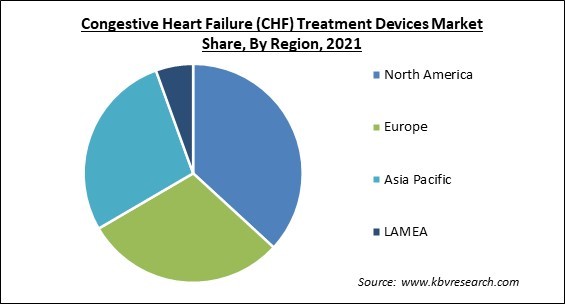

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. In 2021, North America procured the largest revenue share of the congestive heart failure treatment devices market. The constantly rising growth of the regional market is owing to the rise in the number of cardiac surgeries, the presence of key players, the development of the healthcare sector, and the presence of novel innovative ventricular assist and devices products in the region.

Free Valuable Insights: Global Congestive Heart Failure (CHF) Treatment Devices Market size to reach USD 16.5 Billion by 2028

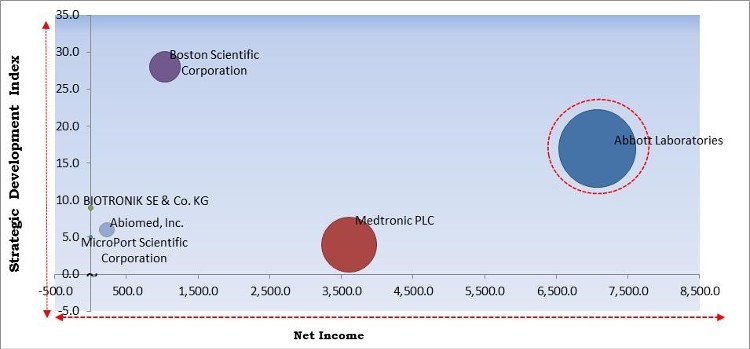

The major strategies followed by the market participants are Acquisitions. Based on the Analysis presented in the Cardinal matrix; Abbott Laboratories is the forerunners in the Congestive Heart Failure (CHF) Treatment Devices Market. Companies such as Medtronic PLC, AND Abiomed, Inc. are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Boston Scientific Corporation, MicroPort Scientific Corporation, Abbott Laboratories, Medtronic PLC, Abiomed, Inc., Berlin Heart GmbH, Jarvik Heart, Inc., Lepu Medical Technology (Beijing) Co., Ltd., BIOTRONIK SE & Co. KG, and Osypka Medical GmbH.

By Product Type

By Geography

The global congestive heart failure (CHF) treatment devices market size is expected to reach $16.5 billion by 2028.

Increase in the prevalence of cardiac diseases all over the world are driving the market in coming years, however, high cost of these devices growth of the market.

Boston Scientific Corporation, MicroPort Scientific Corporation, Abbott Laboratories, Medtronic PLC, Abiomed, Inc., Berlin Heart GmbH, Jarvik Heart, Inc., Lepu Medical Technology (Beijing) Co., Ltd., BIOTRONIK SE & Co. KG, and Osypka Medical GmbH.

The expected CAGR of the congestive heart failure (CHF) treatment devices market is 5.4% from 2022 to 2028.

The North America market dominated the Global Congestive Heart Failure (CHF) Treatment Devices Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $5.9 Billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.