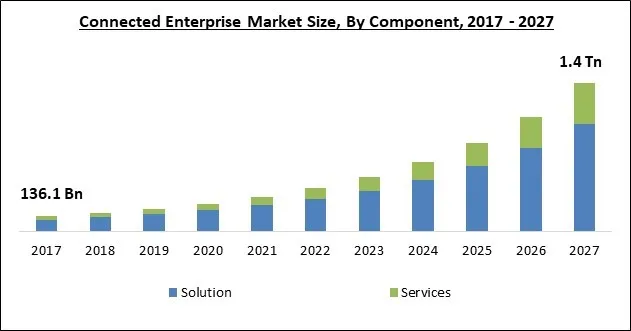

The Global Connected Enterprise Market size is expected to reach $1.4 Trillion by 2027, rising at a market growth of 27.9% CAGR during the forecast period.

The connected enterprise is a monitor’s equipment, that links the company’s critical hubs, to authorize deep insight and predictive analytics in real-time. It makes operations faster and attracts customers by providing more advanced services. Moreover, it helps to gain an advantage in business as compared to other competitors.

Smart city programs have grown in popularity urging the energy & utility business to embrace connected enterprise devices. Most of the regions are embracing developing technologies of smart meters, which would further fuel the growth of the market. Developing economies offer remarkable chances to showcase their connected enterprise offering to expand the business. Growth in initiatives and developments towards digital technologies can drift the growth opportunities.

AI has been a part of the most crucial discussion incorporated over the past 5 years. Although, it’s a challenge to normalize AI insight across large numbers of employees. With the emergence of AI-powered BI products, silos data will be insecure and every user would be able to authorize insights and data analytics easily. Restaurant to healthcare business organizations are building a cloud for better scalability and agility.

Additionally, more data and analytics will be stored in the cloud, which is attracting more organizations towards its adoption. The focus would shift from dashboards and analytical reports to analyzing the behavior of customer changes in real-time for actionable insights. In 2020, there is an increase in the demand for audiovisual mediums such as live video classrooms, OTT streaming of movies, virtual business conferences, and on-demand channel content.

The COVID-19 pandemic has impacted the whole enterprise sector. It has created a whole new ecosystem for the companies, people, and government. Many enterprises have shifted to the digital platform, expanding their suite and creating new service borders, forcing an organization to revisits their digital strategies to conquer new opportunities. Additionally, to protect people from the COVID-19 has created new offerings in IoT, such as automation, spatial computing, Telemedicine wearables, UAVs, and Digital Twins.

The widespread of the virus escorted technological uprising in the healthcare sector. Implementation of the automation solutions, good outcomes have fueled the business to migrate completely towards an automated ecosystem. It would prompt individuals to interact with their data in a contactless manner without taking help from anyone. It has become one of the major factors in the growth of the connected enterprise market during the health crisis. An enterprise adopting the responsive and digital platform can be able to survive during the COVID-19 pandemic.

Automations flexibility and cloud computing helps enterprises to operate at saving time, peak efficiency, money, and energy to enhance overall productions. Moreover, clouds have solved the issues of data management, allowing devices to connect with organizations store data directly in the cloud for decision-making and analytics purposes. Affordable costs of the clouds system enterprise are handling budgets and operations with greater fluency in cloud operations. It allows businesses to look after from a comprehensive point of view for end-to-end enterprise operations.

Artificial intelligence (AI) and machine learning have been growing momentum in the digital computer world. The up-gradation in technology such as the merging of artificial intelligence and machine learning is assumed to boost the growth of the market. The introduction of the 5G connectivity would provide better digital performance for the business. Additionally, this remarkable forward step would help to develop the Internet of Things, since 5G networks are capable to handle linked smart devices.

Privacy and security concern of data is some of the sensitive issue faced by most enterprises. With the General Data Protection Regulation rule and regulations, customer data privacy issues are always kept forefront. Companies are developing AI-fueled algorithms to form new bits of sensitive information, without affecting employees and consumer privacy and security. The restaurant and retail sector commonly are the biggest hub where consumer data collection is always kept at the forefront.

Based on Component, the Connected Enterprise Market is segmented into Solutions and Services. The solution segment generated the highest revenue share in the Connected Enterprise Market in 2020. A large number of data files and the capability to enhance customer experience are boosting the demand for various solutions. This solution provides real-time monitor assistance to maximize operational efficiency. The demand for the IoT in the industry has enlarged the demand for application and infrastructure management services.

Based on End Users, the Connected Enterprise Market is segmented into Manufacturing, IT & Telecommunication, Retail & E-commerce, BFSI, Healthcare, Energy and Utility, and Others. IT & Telecom segment registered a promising revenue share in the connected enterprise market in 2020. With the increasing complexities in the telecom services infrastructure, IoT helps to update IT operations, architectures, and policies processes to rebuild efficiency. It also helps to cut down the cost of operation as well as provides privacy, asset management, real-time analytics, and data security to the IoT and telecom sectors.

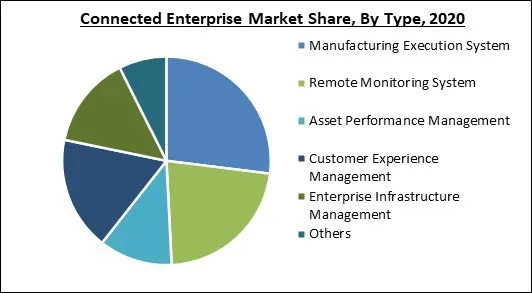

Based on Type, the Connected Enterprise Market is segmented into Manufacturing Execution System, Customer Experience Management, Enterprise Infrastructure Management, Asset Performance Management, Remote Monitoring System, and Others. The Remote Monitoring segment witnessed a significant revenue share in the Connected Enterprise Market in 2020. Advance connected technologies offering opens up opportunities to connect equipment and sensors across manufacturing plants. The necessity of a real-time monitoring system to resolve and identify issues would surge the growth of this segment.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 255.4 Billion |

| Market size forecast in 2027 | USD 1384.5 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 27.9% from 2021 to 2027 |

| Number of Pages | 261 |

| Number of Tables | 413 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Type, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on region, the Connected Enterprise Market is analyzed into North America, Europe, Asia Pacific, and LAMEA. North America dominated the connected enterprise market with the largest revenue share in 2020. Technological in the countries such as Canada and USA have increased the penetration of IoT. However, telecom and healthcare sectors in these regions have adopted IoT and devices to enhance customers' experience and interface. An increase in the functionality and flexibility of automation is expected to have a positive impact on the growth of the industry.

Free Valuable Insights: Global Connected Enterprise Market size to reach USD 1384.5 Billion by 2027

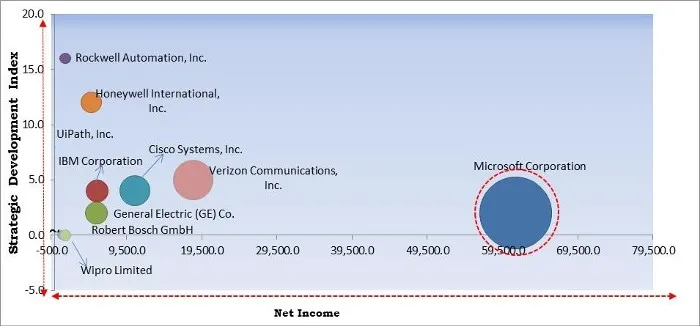

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Microsoft Corporation is the forerunners in the Connected Enterprise Market. Companies such as Verizon Communications, Inc., Cisco Systems, Inc. and Honeywell International, Inc. are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Rockwell Automation, Inc., Cisco Systems, Inc., Microsoft Corporation, IBM Corporation, Robert Bosch GmbH, Honeywell International, Inc., UiPath, Inc., Verizon Communications, Inc., General Electric (GE) Co., and Wipro Limited.

By Component

By End User

By Type

By Geography

The global connected enterprise market size is expected to reach $1.4 Trillion by 2027.

Businesses increasingly relying on digital methods are driving the market in coming years, however, concerns regarding data privacy limited the growth of the market.

Rockwell Automation, Inc., Cisco Systems, Inc., Microsoft Corporation, IBM Corporation, Robert Bosch GmbH, Honeywell International, Inc., UiPath, Inc., Verizon Communications, Inc., General Electric (GE) Co., and Wipro Limited.

The Services market shows high growth rate of 31% during (2021 - 2027).

The Manufacturing market acquired maximum revenue share in the Global Connected Enterprise Market by End User in 2020, achieving a market value of $372.0 Billion by 2027.

The North America market is the fastest growing region in the Global Connected Enterprise Market by Region in 2020, and would continue to be a dominant market till 2027.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.