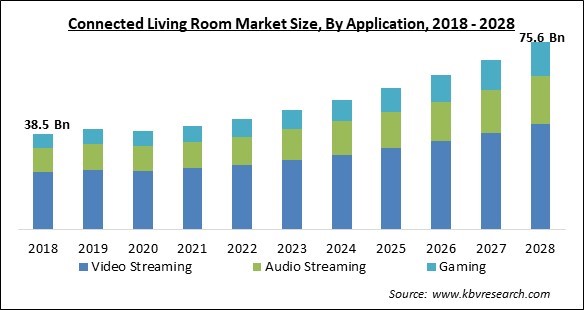

The Global Connected Living Room Market size is expected to reach $75.6 billion by 2028, rising at a market growth of 9.2% CAGR during the forecast period.

Connected living room is characterized as a living room setting involving numerous interconnected devices that offer ease of function. People use various intelligent technologies in their everyday lives to enhance their experiences and can easily operate those devices. It is a requirement that all devices have the communication technologies needed to connect to the Internet and to one another.

New consumer items including the digital video recorder, digital set-top box, home theatre systems, gaming consoles, and media players such as Blu-ray players have entered the living room owing to inventions and developments in the consumer electronics sector. A number of factors have contributed to the living room becoming the centre of the home's digital entertainment.

The starting of the transition towards digitalization, which makes the usage and media content storage very user friendly and highly convenient, has been one of these important causes. With the development of technology, consumers' attitudes are becoming more affluent and hostile to standard home entertainment, and they are consequently demanding increasing amounts of technology.

Due to the nature of this sector, it has the problem of retaining and expanding its customer base. Currently, living spaces are brimming with devices for pleasure and amusement, accompanied by a tangled web of wires and complications. Therefore, customers want something that can assist them operate every gadget in their home with just a single system that fits conveniently in their hands, a condition that is fulfilled by the connected living rooms.

The pandemic increased the demand for smart home energy-saving gadgets that monitor energy usage and minimize utility bills. Similarly, it led to an increase in demand for smart TVs, interactive set-top boxes, streaming devices with voice control, and other related products. Various market participants observed an increase in demand for voice-controlled smart home gadgets as the lockdown period lengthened due to an increase in instances. Thus, the COVID-19 outbreak restriction boosted the connected living room market.

The need for connected living rooms has increased significantly in both developed and developing nations. Increasing consumer preference for high-quality content-viewing gadgets over traditional television devices is one of the primary reasons. The propensity of customers to integrate advanced interactive elements into home entertainment systems with advanced software technology has propelled the widespread use of multimedia streaming and networking.

From smart security devices and speakers to lights and televisions, connecting these gadgets have proved to increase the productivity of living rooms. Integrating smart devices and services has emerged as a practical method for monitoring a large array of home-based systems. This connectivity enables customers to remotely control and monitor thermostats, programme interior and outdoor lighting, and more without moving. Additionally, this reduces utility costs and other home expenses.

In addition to its many advantages, the connected living room pose a number of possible obstacles for users and industry. The biggest security dangers facing an internet connected living room are pre-existing internet threats that leverage LRCD weaknesses to identify new attack vectors. LRCDs may retain the personal or financial information of users, making them prime targets for cybercriminals wishing to inflict economic or psychological harm.

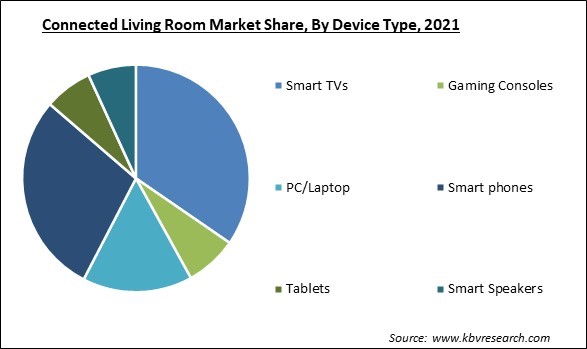

Based on the device type, the connected living room market is categorized into smart TVs, gaming consoles, PC/laptop, smart speakers, smartphones, and tablets. The smartphone segment acquired a significant revenue share in the connected living room market in 2021. Smartphones are becoming indispensable in the connected living room. The increasing use of smartphones in developing countries is a result of a growing young population, higher levels of disposable money, and the expansion of telecommunication networks.

On the basis of application, the connected living room market is divided into video streaming, audio streaming, and gaming. The video streaming segment witnessed the largest revenue share in the connected living room market in 2021. As part of their efforts to extend their number of subscribers by targeting new clients in developing nations, video-on-demand service providers such as Netflix have provided affordable membership packages.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 39.8 Billion |

| Market size forecast in 2028 | USD 75.6 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 9.2% from 2022 to 2028 |

| Number of Pages | 200 |

| Number of Tables | 291 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Application, Device Type, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on the region, the connected living room market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment acquired the maximum revenue share in the connected living room market in 2021. China and Taiwan, among others, have positioned themselves as manufacturing hubs for electronics in the region. Some of the world's major emerging nations, including China and India are also based in the Asia-Pacific region. The Asia-Pacific region is home to a big youth population that rapidly adopts new technologies.

Free Valuable Insights: Global Connected Living Room Market size to reach USD 75.6 Billion by 2028

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; Apple, Inc. and Google LLC are the forerunners in the Connected Living Room Market. Companies such as Panasonic Corporation, Netflix, Inc., Hitachi, Ltd. are some of the key innovators in Connected Living Room Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Hitachi, Ltd., Toshiba Corporation, Koninklijke Philips N.V., LG Electronics, Inc. (LG Corporation), Panasonic Corporation, Netflix, Inc., Google LLC, Apple, Inc., Amazon Web Services, Inc., and Motorola Mobility Holdings. Inc. (Lenovo Group Limited).

By Application

By Device Type

By Geography

The global Connected Living Room Market size is expected to reach $75.6 billion by 2028.

Growing Demand for Connected Living Rooms are driving the market in coming years, however, Lack Of Awareness Among Consumers May Increase Risks of Security restraints the growth of the market.

Hitachi, Ltd., Toshiba Corporation, Koninklijke Philips N.V., LG Electronics, Inc. (LG Corporation), Panasonic Corporation, Netflix, Inc., Google LLC, Apple, Inc., Amazon Web Services, Inc., and Motorola Mobility Holdings. Inc. (Lenovo Group Limited).

The expected CAGR of the Connected Living Room Market is 9.2% from 2022 to 2028.

The Smart TVs segment is leading the Global Connected Living Room Market by Device Type in 2021 thereby, achieving a market value of $23.9 billion by 2028.

The Asia Pacific market dominated the Global Connected Living Room Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $28.1 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.