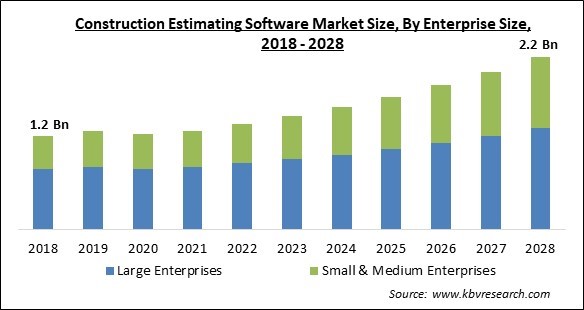

The Global Construction Estimating Software Market size is expected to reach $2.2 billion by 2028, rising at a market growth of 8.5% CAGR during the forecast period.

Construction estimating is beneficial before and during a project's lifespan for keeping track of costs, avoiding mistakes, and managing the budget. As a result, more companies are using construction estimating software. Construction estimating software is employed to increase the efficiency and precision of the aggregate estimation method for a construction project.

The application gives clients a precise assessment of the initiative's costs, enhancing the sales process and profitability. These services aid in calculating the direct project costs and thus boost net income. Regardless of the size of the development project, the product can increase the viability of business operations and provide accurate cost estimates for raw materials. Estimating programming refers to material, labor, and equipment expenses for constructing a gauge.

The current market expansion can be ascribed to the increase in building activity and the shift in construction companies' attention to project cost optimization. Companies are incorporating lean principles into building projects to minimize waste, boost productivity, and lower costs to support the market trend, which is being driven by the aggressive rise of construction activities being carried out around the world.

Software companies are using a variety of business tactics to boost their net sales in response to the rising demand for construction estimating software. Industry players are concentrating on strengthening their client base through partnerships with construction design firms to increase their market revenue and broaden their service network.

For instance, in March 2022, Software-as-a-Service (SaaS) supplier Cedro and construction estimating software vendor Cost Certified teamed up to create a single platform containing estimation and designing capabilities for residential projects. In addition, cost Certified intended to incorporate its platform-based, streamlined construction estimating software.

The global COVID-19 pandemic has hampered the construction sector's development and most nations' economies. Governments from many countries are investing in the construction industry to help the pandemic-affected economy recover, opening up significant prospects for the construction estimating software market. Governments are initiating several infrastructure development initiatives, including residential, commercial, and bridge construction as well as their upkeep, to support market expansion. During the first 3 quarters of 2020, the COVID-19 virus's spread has had a detrimental effect on the market for construction estimating software.

The necessity for building, mall and workplace construction has expanded due to the growing world population, implementing programs like smart cities, and the development of high-speed transit. Therefore, significant stakeholders are deploying construction software to manage these projects efficiently and effectively. The construction industry has also changed its perspective due to the pandemic by eliminating factors such as decision-making overlap, poor communication, duplication of effort, etc.

The COVID-19 epidemic forced a significant number of daily tasks and enterprises to move their operations online; yet, given the current fragile state of the market, operating on a construction site is rather challenging. Construction projects require manufacturing, quality control, and understanding among the many parties involved in a project because of the collaborative nature of the construction business. A building project also frequently incorporates several different parts, such as suppliers, engineers, architects, contractors, and workers.

Many businesses, notably SMEs, are projected to find it difficult to adopt and use construction software due to the high installation costs. Because construction estimating software requires significant capital expenditures, SMEs often struggle to acquire such sophisticated software. Additionally, this kind of software requires ongoing upkeep and updates, raising the total cost of ownership. Additionally, the difficulty in using and controlling this software deters many construction companies from implementing it.

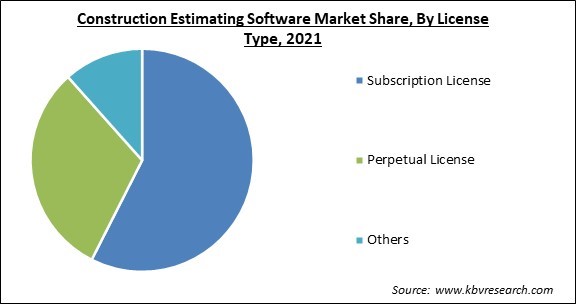

Based on License, the Construction Estimating Software Market is categorized into Perpetual License, Subscription License, and Others (Free Source, Open Source). In 2021, the sector with subscription licenses maintained the largest market share. The rise in popularity of subscription business models, as well as the emphasis on subscriber attrition reduction, regulatory compliance, and customer retention, can be contributed to the segment growth. The subscription-based licence models now have more flexibility than ever, owing to developments in cloud computing.

Based on Deployment, the Construction Estimating Software Market is categorized into Cloud and On-premise. It is anticipated that the on-premises category will grow rapidly throughout the projected period. The segment is expanding due to the intricacy of real-time cooperation between project stakeholders and the significant up-front financial investments required to purchase and administer the software and the servers, hardware, and other facilities. For construction projects, on-premise solutions often offer strong data protection while supporting capabilities, including project management, job costing, project planning, and estimation.

Based on Enterprise Size, the Construction Estimating Software Market is divided into Small and Medium-Sized Enterprises and Large Enterprises. In 2021, the large enterprise sector held the highest market share. Construction estimating software has been implemented by several significant businesses, including Granger Construction, DPR Construction, and Eckardt Group, among many others, as part of their efforts to eliminate errors while guaranteeing cost-effectiveness, data privacy, and flexibility.

Based on End-use, the Construction Estimating Software Market is categorized into Architects & Builders, Contractors, Construction Managers, and Others (Consultants, Professional Contractors, Designers, and Government Agencies). The contractor segment is displaying the significant revenue share in 2021. Contractors and subcontractors can improve project accountability and efficiency using construction estimating software by streamlining project communication and documentation and enhancing market presence. For instance, Sage 100 contractor is a comprehensive construction management solution that includes capabilities for scheduling, accounting, estimating, equipment management, project management, and payroll management.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 1.2 Billion |

| Market size forecast in 2028 | USD 2.2 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 8.5% from 2022 to 2028 |

| Number of Pages | 256 |

| Number of Tables | 430 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | License Type, Enterprise Size, Deployment, End-use, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on geography, the construction estimating software market is divided into North America, Europe, Asia Pacific, and LAMEA. In 2021, the North American market dominated the construction estimating software. The rapid industrialization and widespread use of digital technologies among architects, engineers, and builders are responsible for the region's progress. To attract clients and increase market share, reputable market companies like Autodesk Inc., Oracle Corporation, and Procore Technologies, in the United States are successfully working on new product creation and upgrading of existing products.

Free Valuable Insights: Global Construction Estimating Software Market size to reach USD 2.2 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Microsoft Corporation, Bluebeam, Inc. (Nemetschek Group), Autodesk, Inc., Corecon Technologies, Inc., RIB Software SE (Schneider Electric Investment AG), Pacific Northern Environmental LLC, Vision InfoSoft (JDM Technology Group), Trimble, Inc., Glodon Company Limited, and The Sage Group PLC.

By License Type

By End User

By Large Enterprises

By Deployment

By Geography

The global Construction Estimating Software Market size is expected to reach $2.2 billion by 2028.

Rise In Projects In Construction Sectors are driving the market in coming years, however, High Cost Of Installation restraints the growth of the market.

Microsoft Corporation, Bluebeam, Inc. (Nemetschek Group), Autodesk, Inc., Corecon Technologies, Inc., RIB Software SE (Schneider Electric Investment AG), Pacific Northern Environmental LLC, Vision InfoSoft (JDM Technology Group), Trimble, Inc., Glodon Company Limited, and The Sage Group PLC.

The Architects & Builders segment acquired maximum revenue share in the Global Construction Estimating Software Market by End-use 2021 thereby, achieving a market value of $868.7 million by 2028.

The North America market dominated the Global Construction Estimating Software Market by Region 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $850.6 million by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.