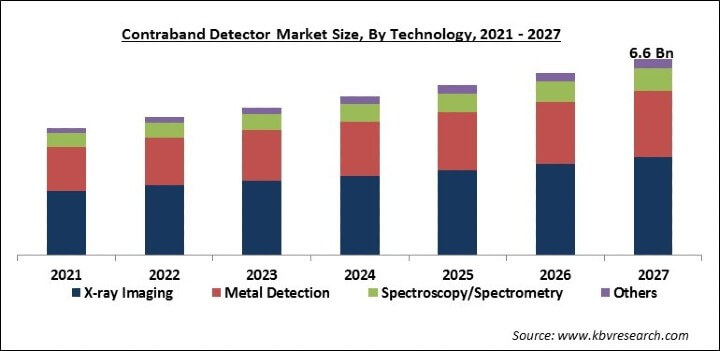

The Global Contraband Detector Market size is expected to reach $6.6 billion by 2027, rising at a market growth of 7.5% CAGR during the forecast period. Contrabands refer to the illegal items like nuclear materials, weapons, and explosives. A contraband detector is a gadget, which helps in detecting hidden illegal items like drugs, weapons, and explosives. There are two kinds of contraband detectors available in the market fixed and portable.

These types of detectors are majorly utilized in government and military areas to ensure the security & safety of the borders and at airports & metro stations to check the entire luggage and safeguard the areas that are prone to contraband materials. Whenever any contraband detector comes in contact with illegal materials, it produces a sound to alert the guards for further investigation of the luggage. Contraband detectors determine the mass density of the object during the inspection process and show the variation among the densities of any kind of illegal contraband materials and the items in which the unauthorized materials are hidden. In addition, contraband detectors are utilized at various places like transportation, government facilities, and homeland security.

The growing demand for security X-ray machines that help in detecting the metallic and non-metallic objects hidden in clothes or cavities with very little dose penetrating radiation is fueling the growth of the contraband detector market. The demand for X-ray imaging technology is high due to the rising adoption of new security measures, which would surge the demand for contraband detectors in the market.

The global COVID-19 pandemic has impacted every domain of society. The imposition of various restrictions across the globe like nationwide lockdown travel ban across nations, and the temporary shutdown of the manufacturing unit have impacted almost every sector of the business domain and the contraband detector market is one of them. Governments of many major nations have imposed lockdowns to curb the spread of coronavirus.

Due to this travel ban, the need for contraband at various places like metro stations, airports has decreased, and thus, the growth of the contraband detector would witness a slowdown. In addition, the absence of labors in the manufacturing sector is estimated to hamper the production of contrabands. However, at the recovering stage, the growth of contraband will get back on track with a significant growth rate.

Based on Technology, the market is segmented into X-ray Imaging, Metal Detection, Spectroscopy/Spectrometry, and Others. There is a broad variety of hidden materials like metallic & non-metallic threat objects, detected by utilizing x-ray screening systems. There are huge investments made in the development of X-ray scanning systems to detect possible threats by people & their luggage. Moreover, several improvements in x-ray systems including Computed Tomography and backscatter are among the major factors surging the market growth, which has further bolster the market for x-ray technology.

Based on Deployment Type, the market is segmented into Fixed and Portable. The Fixed market dominated the Global Contraband Detector Market by Deployment Type 2020. The Portable market is expected to witness a CAGR of 9.6% during (2021 - 2027).

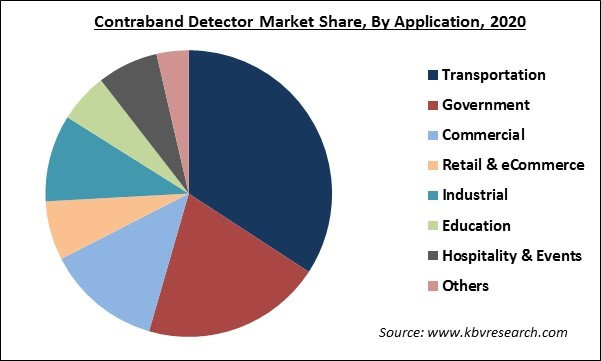

Based on Application, the market is segmented into Transportation, Government, Commercial, Retail & eCommerce, Industrial, Education, Hospitality & Events and Others. The retail application market segment is estimated to emerge as the fastest-growing segment over the forecast period. The growing demand for improved contraband detector systems like screening devices & metal detectors in the segment of retail applications is among the major factors bolstering the growth of the contraband detector market.

Based on Screening Type, the market is segmented into Baggage & Cargo Screening, People Screening and Vehicle Screening. The Baggage & Cargo Screening market dominated the Global Contraband Detector Market by Screening Type 2020, and would continue to be a dominant market till 2027. The People Screening market is showcasing a CAGR of 8.1% during (2021 - 2027). Additionally, The Vehicle Screening market is estimated to grow at the highest CAGR of 8.8% during (2021 - 2027).

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 3.8 Billion |

| Market size forecast in 2027 | USD 6.6 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 7.5% from 2021 to 2027 |

| Number of Pages | 293 |

| Number of Tables | 494 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Deployment Type, Application, Screening Type, Technology, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. North America includes various developed nations that have high technological adoption rates. The increasing concerns of security & safety of many different critical areas present in countries like Canada and the US would bolster the growth of the contraband detector market in this region. In addition, the aviation industry in this region is highly adopting the latest technology of these contraband detectors for improving their security services and eliminate any foul activities.

Free Valuable Insights: Global Contraband Detector Market size to reach USD 6.6 Billion by 2027

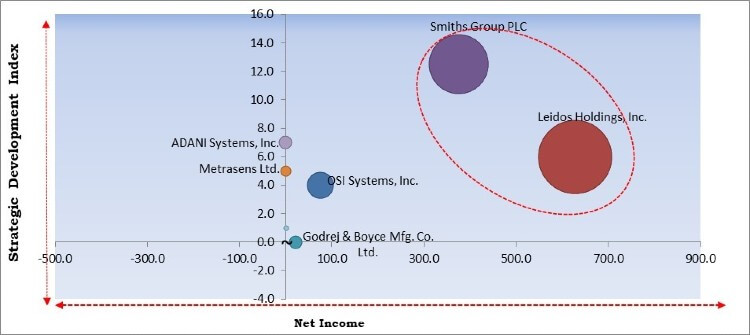

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Smiths Group PLC and Leidos Holdings, Inc. are the forerunners in the Contraband Detector Market. Companies such as ADANI Systems, Inc., Metrasens Ltd. are some of the key innovators in the market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Smiths Group PLC, Godrej & Boyce Mfg. Co. Ltd. (Godrej Security Solutions), OSI Systems, Inc., Leidos Holdings, Inc., Nuctech Company, Ltd. (Tsinghua Tongfang Co., Ltd.), Metrasens Ltd., ADANI Systems, Inc. (LINEV Group), Berkeley Varitronics Systems, Inc., CEIA S.p.A. (Costruzioni Elettroniche Industriali Automatismi), and Campbell/Harris Security Equipment Company.

By Deployment Type

By Application

By Screening Type

By Technology

By Geography

The contraband detector market size is projected to reach USD 6.6 billion by 2027.

The growing adoption of Contraband Detectors at Transportation Facilities are driving the market in coming years, however, Possibilities of false alarms have limited the growth of the market.

Smiths Group PLC, Godrej & Boyce Mfg. Co. Ltd. (Godrej Security Solutions), OSI Systems, Inc., Leidos Holdings, Inc., Nuctech Company, Ltd. (Tsinghua Tongfang Co., Ltd.), Metrasens Ltd., ADANI Systems, Inc. (LINEV Group), Berkeley Varitronics Systems, Inc., CEIA S.p.A. (Costruzioni Elettroniche Industriali Automatismi), and Campbell/Harris Security Equipment Company.

Yes, In addition, the absence of labors in the manufacturing sector is estimated to hamper the production of contrabands. However, at the recovering stage, the growth of contraband will get back on track with a significant growth rate.

The North America market dominated the Global Contraband Detector Market by Region 2020.

Asia Pacific region is anticipated to register the highest growth rate in the contraband detector market during the forecast period.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.