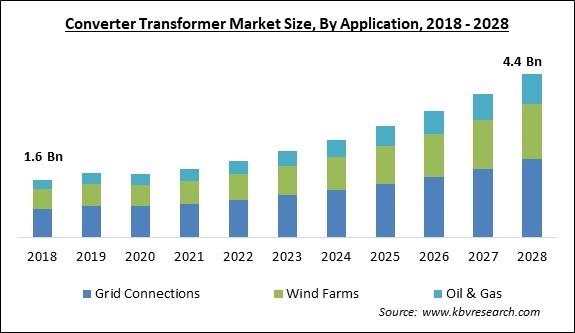

The Global Converter Transformer Market size is expected to reach $4.4 billion by 2028, rising at a market growth of 13.4% CAGR during the forecast period.

A converter transformer is a type of transformer that is designed to provide high current, low voltage solutions for a variety of applications. Voltage converters adjust the voltage of electronic equipment, whereas transformers transport power from one voltage to another. By adopting a star-to-delta (wye-delta) transformer winding connection, the conversion transformers can function with 12 pulses for each cycle in the AC supply, removing several harmonic current components. Transformer winding insulation must be properly built to withstand significant DC potentials to the ground. Converter transformers can be constructed in sizes up to 300 Megavolt-amperes (MW).

Vibrational devices for turbo and hydro-generators, electric drives of drilling equipment, semiconductor converters of the traction substation for city electrified public transportation (tram, trolley bus, and subway), and DC & AC electric drives are all applications for converter transformers. Through a rectifier, stimulation transformers are used to stimulate the field of generators. Static excitation systems for power plant generators use transformers with a rating of up to 5.2 MVA. Converting transformers are mostly made of cast resin dry-type transformers. Leading dry-type transformer manufacturers offer customized configurations for specific purposes.

The development of sophisticated electric cars, as well as incentives utilized them, is driving up electricity usage in the automotive industry. Due to the power plants are typically located in remote areas, the electricity generated is then carried via power transmission lines to substations, where it is stepped down and supplied to end consumers. A converter transformer performs the step-down function. Converter transformers are used in industries, environmentally sensitive locations, forest substations, indoor and subterranean substations, and onshore and offshore sites where there is a lot of moisture or a lot of fire threat. Furthermore, most countries have underutilized energy resources, whereas developing countries' power systems need to be improved across the board.

The pandemic has significantly impacted many people's general economic conditions, resulting in lower consumer spending for non-essential goods, decreasing demand for converter transformers. Weekly electricity usage has decreased by 10-35 percent across the pandemic-affected regions as a result of COVID-19 lockdown measures. Furthermore, the demand for converter transformers has increased as the intake of variable renewable energy to the distribution system has increased. Furthermore, consumer demand has decreased as people are now more focused on removing non-essential expenditures from their budgets as the overall economic situation of most people has been badly impacted by the outbreak.

Converter transformer demand has increased dramatically as the demand for efficient power transmission networks grows. As a result of endeavors to provide electricity to every home, the need for high voltage transmission technologies is likely to remain high. The focus is mostly on a variety of government projects and huge expenditures aimed at improving the electricity generation and distribution industry. As a result, converter transformer demand for high-efficiency power distribution applications has skyrocketed.

The use of smart grid solutions is moving the Converter transformer market forward. HVDC (high-voltage direct current) is a frequently used smart grid solution around the world since it is a cost-effective way to carry huge amounts of energy over long distances and for unique uses. As a crucial facilitator in the future energy system based on renewables, HVDC is genuinely shaping the grid of the future. It serves as a link between the AC system and the thyristor valves in HVDC systems. A Converter transformer's main benefit is that it functions as a capacitive border between the AC and DC systems, preventing DC potential from entering the AC systems. Between the AC supply and the HVDC system, it also converts voltage.

One of the most important issues limiting the growth of the Converter Transformer Market is the high installation cost. The cost of manufacturing a converter transformer is higher because it is made up of a variety of components. Converter transformers have a lower power factor and excess tolerance during installation, thus they're preferred among small-scale power generation and distribution units. Furthermore, converter transformers are highly noisy when in use, causing significant disruption in many densely populated regions. As a result, the installation location is equally important.

Based on Application, the market is segmented into Grid Connections, Wind Farms, and Oil & Gas. The wind farms segment witnessed a significant revenue share in the converter transformer market in 2021. It is due to the wind turbines with variable speeds to capture more energy than fixed-speed competitors. Induction generators have been demonstrated to be superior to DC generators in many areas when it comes to generating electrical power over a wide range of speeds: efficiency, maintainability, power density, and so on.

Based on Type, the market is segmented into 401-600 Kv, 201-400 Kv, and 601-800 Kv. The 401-600 Kv segment procured the largest revenue share in the converter transformer market in 2021. Due to the demand for converter transformers rises as crude oil demand rises in the petroleum and chemical industries. As the population and industrialization grew, so did demand for power, prompting the development of renewable energy sources such as large-scale offshore wind farms. The power generation from offshore wind farms is rapidly increasing, which has a beneficial impact on converter transformer demand.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 1.8 Billion |

| Market size forecast in 2028 | USD 4.4 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 13.4% from 2022 to 2028 |

| Number of Pages | 158 |

| Number of Tables | 259 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling |

| Segments covered | Type, Application, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. The Asia Pacific region garnered the highest revenue share in the converter transformer market in 2021. Asia-Pacific, which includes China, India, Japan, South Korea, Australia, and the rest of Asia-Pacific, accounts for the majority of the converter transformer market. Due to the large number of ongoing electricity projects in China, it is quickly becoming a powerhouse in Asia. China has risen to the top of the renewable energy sources market, with a slew of solar projects. As a result, China has emerged as a key player in the converter transformer industry. In China, the ongoing COVID-19 pandemic has had little impact on new railway developments.

Free Valuable Insights: Global Converter Transformer Market size to reach USD 4.4 Billion by 2028

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include ABB Group, Siemens AG, General Electric (GE) Co., Toshiba Corporation, Mitsubishi Electric Corporation, Kirloskar Electric Co. Ltd., CG Power & Industrial Solutions Ltd., Bharat Heavy Electricals Ltd., and Xi'an Xidian Transformer Co., Ltd.

By Application

By Type

By Geography

The global converter transformer market size is expected to reach $4.4 billion by 2028.

Demand for Efficient Power Transmission Solutions is Growing are driving the market in coming years, however, investing in installation costs of converter transformer is expensive limited the growth of the market.

ABB Group, Siemens AG, General Electric (GE) Co., Toshiba Corporation, Mitsubishi Electric Corporation, Kirloskar Electric Co. Ltd., CG Power & Industrial Solutions Ltd., Bharat Heavy Electricals Ltd., and Xi'an Xidian Transformer Co., Ltd.

The demand for converter transformers has increased as the intake of variable renewable energy to the distribution system has increased.

The Grid Connections segment acquired maximum revenue share in the Global Converter Transformer Market by Application in 2021, thereby, achieving a market value of $2.11 billion by 2028.

The Asia-Pacific would showcase the faster growth rate in the converter transformer market throughout the forecast period.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.