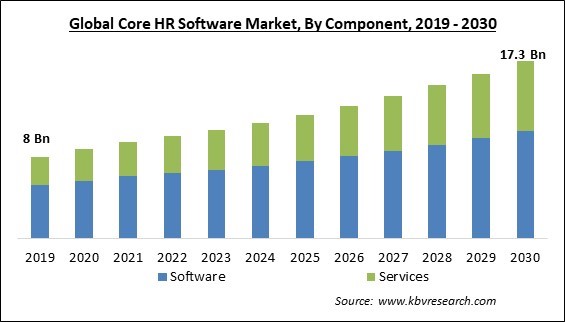

The Global Core HR Software Market size is expected to reach $17.3 billion by 2030, rising at a market growth of 7.3% CAGR during the forecast period.

With the introduction of core HR software, all HR-related activities, such as personnel records, benefit administration, payroll, and performance management, are merged into a single platform. Therefore, the software segment would generate approximately 3/5th share of the market by 2030. Traditional HR operations were disjointed, with data dispersed across numerous platforms and manual workflows, resulting in inefficiencies and inconsistent data. This centralization streamlines HR procedures and provides a comprehensive perspective of worker data, enabling reasoned decision-making and strategic planning.

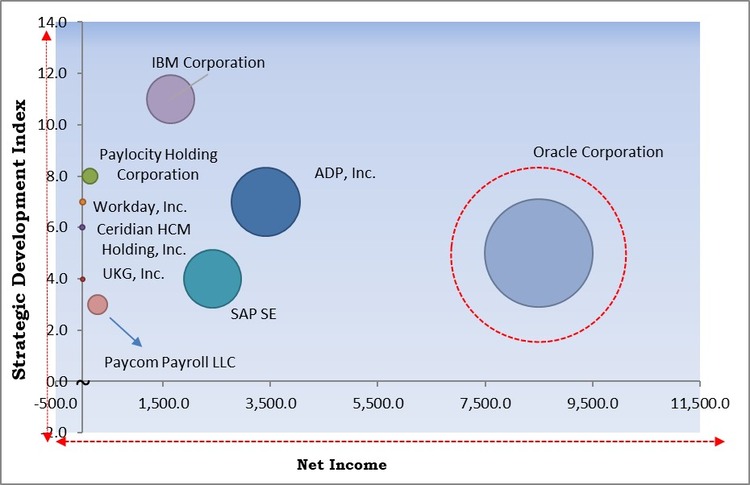

The major strategies followed by the market participants are Acquisitions as the key developmental strategy to keep pace with the changing demands of end users. For instance, In June, 2023, UKG, Inc. has announced the acquisition the agreement to acquire Immedis, to launch UKG One View. UKG. Additionally, In 2023, May, IBM Corporation acquired Polar Security, to furnish security teams with a comprehensive data security platform encompassing all data formats across various storage locations, including SaaS, on-premises, and public cloud infrastructure.

Based on the Analysis presented in the KBV Cardinal matrix; Oracle Corporation is the forerunners in the Market. Companies such as SAP SE, IBM Corporation, ADP, Inc. are some of the key innovators in Market. In April, 2021, SAP SE formed a joint venture with Dediq GmbH, to create tailored applications and services designed exclusively for banking and insurance companies.

Robot Process Automation technology is crucial in bringing efficiency and innovation to human resource management solutions and allows businesses to implement improved talent strategies. Companies are searching for innovative approaches to minimize costs associated with service delivery and talent acquisition. Enterprises may standardize operations by reducing unnecessary IT expenditures using RPA capabilities embedded with AI and machine learning. To meet end-user needs, market participants provide cutting-edge tools integrated with RPA. Market players are anticipated to combine RPA with HR tools, including recruiting software and application tracking systems, due to the favorable results of RPA integrated with HR tools across human resource departments. This is anticipated to help the market expansion for core HR software.

The market for core HR software is being entirely transformed by AI and automation, which presents enormous prospects for improving labor management and HR procedures. By analyzing massive amounts of data to find the best candidates, AI-driven algorithms are revolutionizing the hiring process by speeding up the hiring process and raising the quality of employees. Routine HR processes like benefits administration, onboarding, and leave management are simplified by automation, freeing HR professionals to concentrate on strategic projects and employee development. Without needing explicit data entry from the employees, AI features compute and track the workforce's working hours and pay rates, then send the information to payroll for processing. In conclusion, the market for core HR software is expected to increase due to the growing popularity of AI and automation for changing HR operations.

Specifically for small & medium-sized businesses (SMEs), the cost of deploying essential HR software has emerged as a significant barrier to adoption. The cost for installation also covers employee training, customization, software licensing fees, data migration, and regular upkeep expenses. Furthermore, depending on the size and complexity of the business, the cost of deploying core HR software could vary from tens of thousands to millions of dollars. SMEs with limited budgets may find such costs onerous and refrain from modernizing their HR systems. The latent potential for core HR software acceptance across multiple company sectors may be unlocked if the cost issues are resolved and more flexible pricing models are offered. Hence, the high cost of such software can hamper the growth of the market.

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Mergers and Acquisitions.

On the basis of component, the market is segmented into software and services. In 2022, learning management the segment witnessed the largest revenue share in the market. Effective employee learning and development has a beneficial impact on employee performance & organizational competitiveness, making it a crucial component of workforce development and corporate growth. When they receive training, employees are better equipped to acquire and gain new skills, boosting their productivity and competitiveness at work and within their businesses. It entails technological integration, content production, and distribution strategy. LMS aids businesses in creating useful training modules that employees may use to learn and retain information. Since they may access the modules whenever they choose, employees can be more productive and add value to the business.

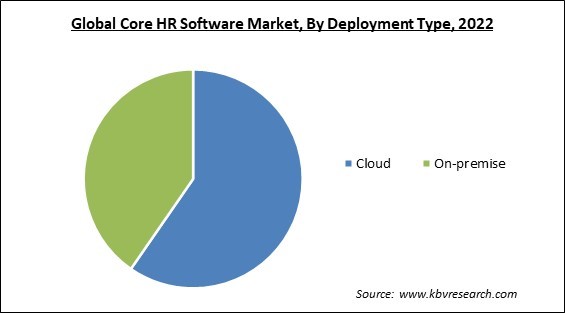

Based on deployment type, the market is classified into cloud and on-premise. The on-premise segment recorded a remarkable revenue share in the market in 2022. This can be associated with the many benefits of on-premises deployment, including high data protection and safety. Industries favor on-premises deployment methods over cloud-based deployment models because they offer higher data security and experience fewer data breaches. This preference fuels demand for on-premises deployment models in both the public and private sectors.

By vertical, the market is categorized into government, manufacturing, energy & utilities, consumer goods & retail, healthcare, transportation & logistics, IT & telecom, BFSI, and others. In 2022, the government segment generated the highest revenue share in the market. Local governments' Human Resources (HR) division is essential to maintaining employee satisfaction. From the interview through the offboarding process and all in between, HR has a part to play in an employee's path while working for that government agency. The government has a sizable staff; therefore, managing employee paperwork requires software. The government sector seeks improved tools to manage its budgetary challenges and shifting priorities for managing HR.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 9.95 Billion |

| Market size forecast in 2030 | USD 17.3 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 7.3% from 2023 to 2030 |

| Number of Pages | 357 |

| Number of Table | 523 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Market Share Analysis, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Deployment Type, Vertical, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region led the market by generating the highest revenue share. Such solutions are in high demand due to the region's extensive and diverse corporate environment, including small and medium-sized businesses (SMEs) and international firms. North America likewise has intricate and dynamic labor rules and regulations. By precisely managing tax calculations, payroll, and reporting, the leading HR software aids businesses in abiding by these regulations. Due to its adaptability, scalability, and affordability, cloud-based core HR software is becoming more popular in the area. Cloud solutions simplify accessing HR data, even for distant or distributed teams.

Free Valuable Insights: Global Core HR Software Market size to reach USD 17.3 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Workday, Inc., SAP SE, ADP, Inc., UKG, Inc., Oracle Corporation, Ceridian HCM Holding, Inc., IBM Corporation, Paycom Payroll LLC, Paylocity Holding Corporation and Cornerstone OnDemand, Inc.

By Component

By Deployment Type

By Vertical

By Geography

The Market size is projected to reach USD 17.3 billion by 2030.

Acceptance of robot process automation (RPA) are driving the Market in coming years, High deployment costs of core HR software restraints the growth of the Market.

Workday, Inc., SAP SE, ADP, Inc., UKG, Inc., Oracle Corporation, Ceridian HCM Holding, Inc., IBM Corporation, Paycom Payroll LLC, Paylocity Holding Corporation and Cornerstone OnDemand, Inc.

The expected CAGR of this Market is 7.3% from 2023 to 2030.

The Cloud segment is leading the segment in the Market, By Deployment Type in 2022; thereby, achieving a market value of $11.2 billion by 2030.

The North America region dominated the Market, By Region in 2022; thereby, achieving a market value of $5.97 billion by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.