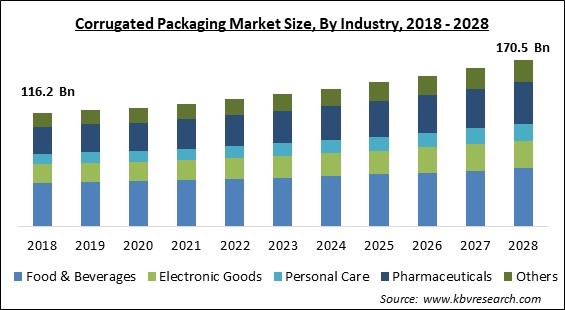

The Global Corrugated Packaging Market size is expected to reach $170.5 billion by 2028, rising at a market growth of 4.6% CAGR during the forecast period.

A disposable container with layers of material on its sides is known as corrugated box packaging. This type of packaging mainly contains three important layers, namely, the inside or inner layer, the middle layer, and the outer layer. Flutes are formed on the middle layer, which refers to its design as strong, wave-shaped arches that offer support and cushioning for heavy objects put inside a corrugated box.

There are several characteristics and aspects of a corrugated board that can be measured. These include grammage, bending resistance, impact resistance, cushioning, edge crush test, burst strength, compression strength, flat crush test, and moisture content. The edge crush test measures force per unit of width and compute box compression strength, and KN/m or lb/inch are its units of measurement. The burst strength of a corrugated sheet is the amount of force required to cause a rupture. It is measured in KPa or lb/inch2.

The effectiveness of corrugated boxes is directly measurable by the box compression strength and expressed in kgf or N units. The flat crush test determines the stiffness of flutes and measures it in KPa. Any material's weight per square meter is expressed in grams. Numerous highly directed features are present in anisotropic corrugated fiberboard. For instance, edge crush, tensile, bending stiffness, and surface qualities vary depending on the angle to the flutes and the direction of the producing machine.

Corrugated packaging is frequently composed of paperboard and is appropriate for various products, including food, medicines, equipment, and other goods. To create food packaging boxes, juice boxes, cardboard boxes, milk cartons, and other items, sheets of heavy-duty layered paper are folded, trimmed, and shaped into corrugated packaging. Since it is thicker and more durable, corrugated cardboard is frequently used to make furniture as well as shipping boxes.

Important expenditures were made for market development and expansion by key corporations to make up for the loss. These Investments helped to lower the carbon footprint and also improved the businesses' environmental performance by bringing a significant decrease in CO2 emissions. Despite the adverse effects of the pandemic, the market had recovered by 2021's end. As a result, the end-user sector and companies making corrugated packaging have resumed operations. Additionally, several businesses have already shown strong signs of recovery. On the other hand, COVID-19 infection rates are once more on the rise, especially in China. This has led to negative market sentiments and threatens to damage the corrugators industry.

Organizations are expected to significantly impact the sector by implementing strict laws and regulations that promote the use of recyclable paper-based products. Recyclable packaging is a crucial component of the "minimize, rework, and recycle" environmental program. Additionally, it is a big stride in the direction of eco-friendly packaging. There are increased greenhouse gas emissions due to the majority of single-use plastic products being produced using fossil fuels. As a result, authorities in several countries have restricted or outright forbidden the use of single-use plastics to protect the environment and advance sustainability. Therefore, it is projected that the corrugated packaging market will profit in the next years from the rise of green initiatives across numerous industries.

Many businesses now produce corrugated packaging using technological advancements. For example, SUN Automation Group introduced a brand-new AI-based platform, which is OEM-neutral and made to give corrugated manufacturers information about the functioning of their equipment. Such developments will lead to less downtime, better maintenance cycles, and more earnings. Therefore, the integration of innovation and technology in otherwise tedious processes will rapidly cater to the increasing consumer demand for sustainable packaging and thus propel the growth of the market.

Manufacturers must invest more time in drying corrugated boxes when moisture and humidity levels are high. Since businesses want to complete this process more quickly, the adhesive or ink might not entirely dry, giving the cardboard a flimsier appearance, much as how a sponge retains water and wetness. Conversely, when the cardboard is kept in excessively dry environments for a long time, the lack of moisture makes the cardboard act like a sponge that has been entirely dried out. Extreme rigidity and fragility set in, making it more challenging to fold the box without damaging the paper. Therefore, insufficient weatherproofing may hamper the market's expansion during the forecasted period.

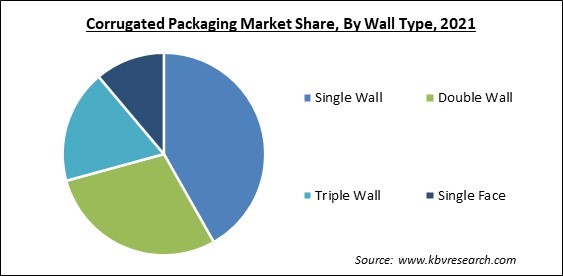

Based on wall type, the corrugated packaging market is categorized into single wall, double wall, triple wall, and single face. The single wall segment garnered the highest revenue share in the corrugated packaging market in 2021. In single wall corrugated packing, an inner and an outer liner are separated by a fluted corrugated sheet. In lighter shipping boxes, a single wall board is employed. Corrugated single-wall boxes offer an affordable packaging option for both ordinary consumer use and online enterprises. In addition, it is perfect for storing, organizing, and moving objects during house moves because it is made for mild to medium-duty use. These benefits are advancing the growth of the segment.

On the basis of packaging type, the corrugated packaging market is divided into containers, boxes, trays, sheets, and others. The trays segment recorded a significant revenue share in the corrugated packaging market in 2021. For moving small, light loads, corrugated trays are ideal. When moving plants or transporting cans, bottles, and other random goods, the simple-to-fold sides give stability and security. These are usually shipped and stored flat. The most common are five- and four-panel trays. Trays with four-panel generally lack the top surface, while the five-paneled trays does have them.

Based on industry, the corrugated packaging market is segmented into food & beverages, personal care, pharmaceuticals, electronic goods, and others. The pharmaceutical segment garnered a remarkable growth rate in the corrugated packaging market in 2021. The expansion can be due to the increased awareness of the benefits of corrugated packaging over alternatives. This packaging has developed as a sterile, dust-free method of shipping medical products, making it possible to transport delicate items like pills, capsules, lab equipment, and medical supplies with ease. In addition, the rising prevalence of chronic illnesses and the increased usage of medical devices are expected to raise demand for corrugated boxes, specifically for medical packaging applications, especially in emerging nations.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 125.5 Billion |

| Market size forecast in 2028 | USD 170.5 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 4.6% from 2022 to 2028 |

| Number of Pages | 241 |

| Number of Table | 405 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Industry, Packaging Type, Wall Type, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

On the basis of region, the corrugated packaging market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment procured the highest revenue share in the corrugated packaging market in 2021. Corrugated packaging is frequently used in Asia-Pacific for consumer goods, appliances, pharmaceuticals, and other items. For example, pharmaceutical companies utilize corrugated packaging to ensure the integrity and efficacy of their goods by keeping moisture away from the product and making it resistant to outside effects such as biological moisture, adulteration, contamination, oxygen, and mechanical damage.

Free Valuable Insights: Global Corrugated Packaging Market size to reach USD 170.5 Billion by 2028

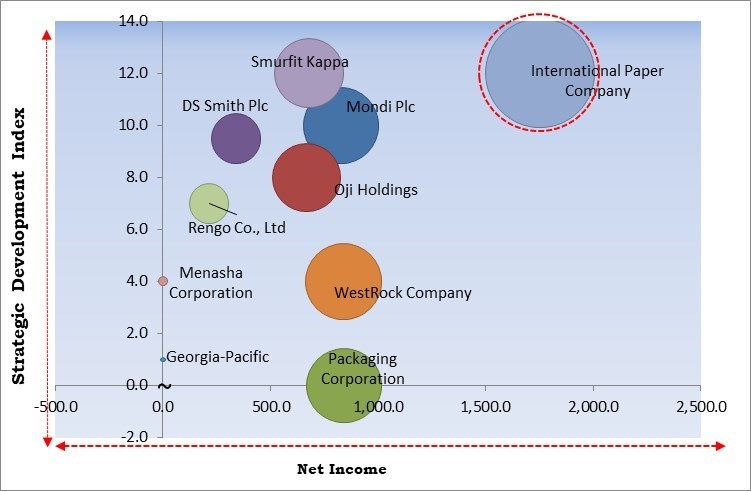

The major strategies followed by the market participants are Acquisitions. Based on the Analysis presented in the Cardinal matrix; International Paper Company is the forerunner in the Corrugated Packaging Market. Companies such as Smurfit Kappa Group plc, Mondi plc, and DS Smith plc are some of the key innovators in Corrugated Packaging Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include DS Smith Plc, Georgia-Pacific LLC (Koch Industries, Inc.), Mondi Plc, Oji Holdings Corporation, International Paper Company, WestRock Company, Smurfit Kappa Group plc, Menasha Corporation, Packaging Corporation of America, and Rengo Co., Ltd.

By Industry

By Wall Type

By Packaging Type

By Geography

The global Corrugated Packaging Market size is expected to reach $170.5 billion by 2028.

Increasing environmental consciousness has increased the demand for sustainability are driving the market in coming years, however, Lack of sufficient weatherproofing of corrugated boxes restraints the growth of the market.

DS Smith Plc, Georgia-Pacific LLC (Koch Industries, Inc.), Mondi Plc, Oji Holdings Corporation, International Paper Company, WestRock Company, Smurfit Kappa Group plc, Menasha Corporation, Packaging Corporation of America, and Rengo Co., Ltd.

The Food & Beverages segment acquired maximum revenue share in the Global Corrugated Packaging Market by Industry in 2021 thereby, achieving a market value of $59.8 billion by 2028.

The Boxes segment is leading the Global Corrugated Packaging Market by Packaging Type in 2021 thereby, achieving a market value of $61.8 billion by 2028.

The Asia Pacific market dominated the Global Corrugated Packaging Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $63.1 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.