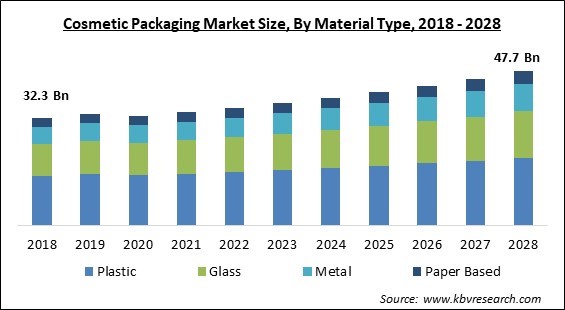

The Global Cosmetic Packaging Market size is expected to reach $47.7 billion by 2028, rising at a market growth of 4.6% CAGR during the forecast period.

Cosmetic packaging is important in the marketing of various cosmetics items since it attracts the attention of the buyer. To make the packaging appealing, different graphical and packaging designs are essential. This refers to both primary and secondary packing. Paper and board-based packaging is commonly used for secondary packaging due to its ease of processing and ability to be customized to meet specific needs.

In the projected future, the market is expected to be driven by changing packaging styles, novel package designs, and rising demand for cosmetics due to the growing youth population. Furthermore, the market is expected to be driven by rising demand for cosmetics as a result of changing grooming habits across both genders during the forecast period. For the sale of cosmetics, producers rely on significant advertising through various media. Packaging innovation is a vital aspect in attracting customers, and it will have an impact on the packaging industry's overall growth in the next years.

Furthermore, because of rising disposable money and changing lifestyles, emerging economies such as China and Japan are presenting a great chance for the cosmetic sector to grow. As a result, rising cosmetics demand has a direct impact on the market for this industry, boosting the market expansion over the predicted period. As the number of new entries into the cosmetics sector grows, so does product and packaging innovation in order to obtain a competitive advantage. These are some of the major drivers expected to propel the cosmetics packaging industry forward throughout the forecast period.

Cosmetic shop income decreased by a significant margin in the early phases of the COVID-19 pandemic, according to the business of Fashion and McKinsey and Company. The disruption of the value chain has had a substantial influence on market growth; however, corporations are adopting new ways to cope with the new limits, mitigate the impact of the worldwide pandemic, and adapt to changing customer preferences. Manufacturers intend to take advantage of new technologies and implement strategies that will result in fundamental and long-term changes.

Consumers may learn everything they need to know about a product from the label, including how to use it and where it came from. Companies mention the contents as well as the product's function, especially if it is uncertain. The contact information for the entity responsible for putting the product on the market is typically included on the label. Labels also serve as a source of product tracking data. The labels are simple to read, especially for customers who are viewing the product. Some mixtures, such as perfumes, might be specified as a single ingredient. The customer perceives secondary packages as the outermost package. The secondary package contains the primary packages. Certain details may only display on secondary packages. The most relevant information must be provided on both the primary and secondary packaging, especially if the product is prone to misuse.

In today's cosmetic market, for example, when there is so much competition, it has never been more important to guarantee that the product is packaged in high-quality, unique, attention-grabbing, and highly efficient packaging. Packaging that is both attractive and functional will go a long way toward ensuring the company's success in the cosmetics market. Packaging is what attracts a consumer first and foremost. Additionally, the use of cosmetic products has grown exponentially and there are a variety of cosmetic products a person uses in a day. These products take a reasonable amount of space and thus the consumers want the packaging to be beautiful and immaculate.

Plastics are the most commonly utilized packaging material in this business, with the majority of it ending up in landfills. According to the EPA (Environmental Protection Agency), around 70% of the plastic trash generated by the cosmetics industry is not recycled and instead ends up in landfills. Furthermore, the majority of the main packaging is composed of single-use plastic paper, with a considerable number of them being multilayered to give them a more premium appearance, adding to the excessive usage of plastics. Microbeads, little plastic particles used to exfoliate in rinse-off personal care products, were also shown to be inflicting major damage to the marine environment and other water bodies.

Based on Material Type, the market is segmented into Plastic, Glass, Metal, and Paper Based. The plastic segment acquired the largest revenue share in the cosmetic packaging market in 2021. This is owing to its ease of use and sanitary features. The inexpensive cost of plastic is one of the key reasons for its popularity. It's also light, flexible, unbreakable, and long-lasting. Furthermore, it is odorless and pleasing to the eye.

Based on Application, the market is segmented into Skin Care, Hair Care, Perfume, Oral Care, and Others. The hair care segment procured a significant revenue share in the cosmetic packaging market in 2021. Hair care product adoption is fast expanding in emerging economies like India and China, which is expected to drive the hair care industry. There are also a variety of hair care products available now, from shampoos to hair dyes to hair oils and serums.

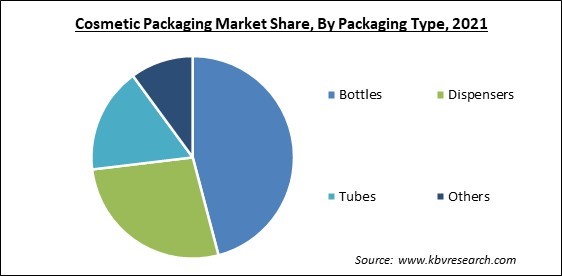

Based on Packaging Type, the market is segmented into Bottles, Dispensers, Tubes, and Others. The bottles segment acquired the largest revenue share in the cosmetic packaging market in 2021. Acrylic bottles with matching jars are attractive and can be used to store healthy body creams or facial treatments. PP airless bottles can also be used to store creams and lotions. They are, nevertheless, less expensive to manufacture and lighter in raw plastic material. Acrylic airless bottles are a combination between polypropylene airless containers and complete acrylic airless bottles.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 35 Billion |

| Market size forecast in 2028 | USD 47.7 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 4.6% from 2022 to 2028 |

| Number of Pages | 226 |

| Number of Tables | 393 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Material Type, Application, Packaging Type, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. The APAC region acquired the largest revenue share in the cosmetic packaging market in 2021. China is one of the largest cosmetics markets in the world. The rapid rise in disposable income, together with the growing number of young people, is predicted to promote cosmetics consumption in the country and the surrounding regions. As social media influencers have greater ways to reach out to young people and influence them on social media platforms, digital transformation is considerably propelling market growth in the region.

Free Valuable Insights: Global Cosmetic Packaging Market size to reach USD 47.7 Billion by 2028

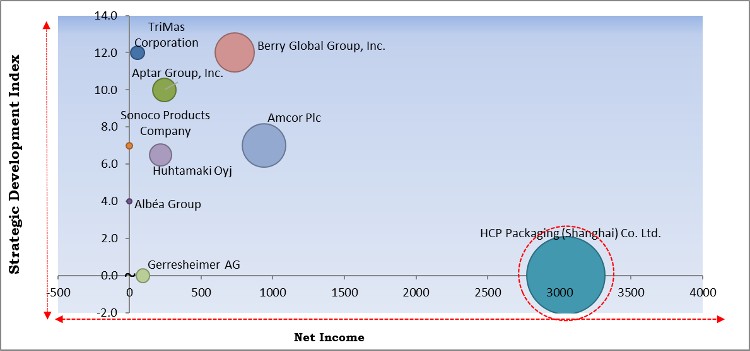

The major strategies followed by the market participants are Acquisitions. Based on the Analysis presented in the Cardinal matrix; HCP Packaging (Shanghai) Co. Ltd. is the major forerunner in the Cosmetic Packaging Market. Companies such as TriMas Corporation, Berry Global Group, Inc. and Aptar Group, Inc. are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Albéa Group, HCP Packaging (Shanghai) Co. Ltd., TriMas Corporation, Graham Packaging Company, Amcor Plc, Sonoco Products Company, Huhtamaki Oyj, Berry Global Group, Inc., Aptar Group, Inc., and Gerresheimer AG.

By Material Type

By Application

By Packaging Type

By Geography

The global cosmetic packaging market size is expected to reach $47.7 billion by 2028.

Gives Information Regarding the Product are driving the market in coming years, however, Negative Environmental Impact of Cosmetic Packaging limited the growth of the market.

Albéa Group, HCP Packaging (Shanghai) Co. Ltd., TriMas Corporation, Graham Packaging Company, Amcor Plc, Sonoco Products Company, Huhtamaki Oyj, Berry Global Group, Inc., Aptar Group, Inc., and Gerresheimer AG.

The expected CAGR of the cosmetic packaging market is 4.6% from 2022 to 2028.

The Skin Care segment acquired maximum revenue share in the Global Cosmetic Packaging Market by Application in 2021, thereby, achieving a market value of $15.3 billion by 2028.

The Asia Pacific market dominated the Global Cosmetic Packaging Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $17.3 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.