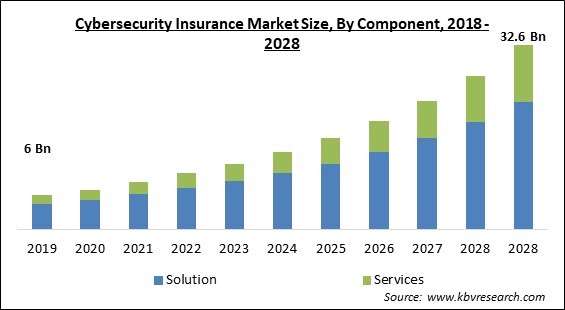

The Global Cybersecurity Insurance Market size is expected to reach $32.6 billion by 2028, rising at a market growth of 18.8% CAGR during the forecast period.

Cybersecurity insurance plays an important role in banking and financial institutions. Throughout the forecast period, the sector is anticipated to control a sizable portion of the market. Identity fraud is common there and it is one of the businesses that is tightly controlled and governed, which drives up demand. The landscape of every nation's essential infrastructure and business networks is evolving as a result of improvements in information technology, communication technologies, and the smart energy grid. However, as technology advances quickly, so do the hazards that accompany it.

Personal information is valuable, cybercriminals commit crimes where personal data, including credit card numbers, identities, medical records, and other details, is sold on the dark web. It is one of the few things that have caused the demand for cybersecurity to rise. One of the most quickly expanding recent technologies is cloud computing, which has helped to break down traditional IT borders, open up new markets, fuel the mobility movement, and enhance unified communications. To reduce the risks associated with maintaining sensitive data in the current cybersecurity scenario, a variety of IT stakeholders and companies are turning to innovative insurance models.

A wider variety of security controls and technologies would be considered by insurers as the market for cybersecurity insurance continues to develop. As a result, the degree of data sensitivity and an organization's capacity to sufficiently disguise it will be crucial in evaluating the overall risk, which is what is motivating the adoption of new technologies like microsharding. To limit the attack surface and remove data sensitivity, microsharding technology divides data into units as small as one-digit bytes before distributing shards to various locations.

Numerous governments and regulatory bodies have mandated that both public and commercial enterprises adopt new methods for working remotely and upholding social distance during the COVID-19 pandemic crisis. Since then, several firms' new business continuity plans (BCPs) have been based on digital methods of conducting business. People are increasingly inclined to employ digital technologies due to the widespread usage of BYOD devices, the WFH trend, and the penetration of the internet into every corner of the world. This is driving the demand for cyber insurance measures to protect against the fallout from cyber-attacks.

Among the most recent hot technologies, AI and blockchain are predicted to give risk analytics solutions increased capabilities and offer up new business opportunities. These technologies' integration with risk analytics programs would help cybersecurity insurance companies with some of their most pressing problems. The development of modern technologies enables quicker transactions and settlements, making it easier for financial institutions and their clients to perform transactions while removing the need for middleman fees. To analyze claims, manage reserves, and provide policy coverage, risk analytics solutions are crucial.

Organizations are legally required to notify impacted parties in the case of a breach. This may increase the entire cost of a data breach, especially when it comes to security updates, identity theft protection for those affected by the breach, and defense against potential legal action. User data would be protected from cyber criminals by the coverage provided by cyber liability plans for these exposures. compensation for business loss due to disruption. An IT breakdown brought on by a cyberattack can disrupt corporate operations and cost organizations money and time.

One of the main things preventing the cybersecurity insurance market from expanding is the higher price of cybersecurity insurance. Due to the ransomware assaults over the past two to three years, insurance firms have been forced to pay out hefty claims. The expense of recovering the compromised system is substantial, even if the cybersecurity insurance firms do not pay the ransom. To compensate for the increased costs resulting from the extra services, such as aid with data recovery following a ransomware attack, cybersecurity insurance firms are raising the coverage rates.

Based on component, the cybersecurity insurance market is segmented into solutions (Cybersecurity solutions, Analytics Platforms, Disaster Recovery & Business Continuity) and services. The services segment witnessed a significant revenue share in the cybersecurity insurance market in 2021. Due to the growing use of technologies like Blockchain and the Internet of Things. Moreover, post-incident services are expected to expand the market. Zurich Cyber Security Services, Aon Cyber Risk Professional Service, Munich Re Cyber Risk Services, and others are a few of the well-known offerings.

On the basis of insurance coverage, the cybersecurity insurance market is bifurcated into Data Breach and Cyber Liability. The cyber liability segment garnered the highest revenue share in the cybersecurity insurance market in 2021. It is because businesses can purchase a variety of coverage choices under a cyber liability insurance policy to help guard against data theft and other cyber security problems. Every type of business that uses technology to conduct business, from multinational corporations to mom-and-pop shops, is at risk from cyberattacks.

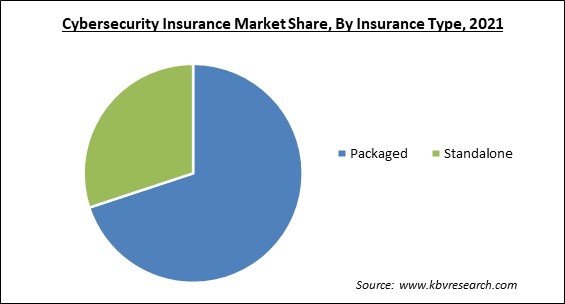

By insurance type, the cybersecurity insurance market is divided into Packaged and Stand-alone. The standalone segment witnessed a substantial revenue share in the cybersecurity insurance market in 2021. It is because the demand for solo insurance is projected to increase due to its comprehensive cover policy. The Swiss Re research on personal cyber security insurance predicts double-digit growth for standalone insurance over the next few years.

Based on organization size, the cybersecurity insurance market is classified into small & medium enterprises (SMEs) and large enterprises. The large enterprise segment procured the highest revenue share in the cybersecurity insurance market in 2021. An enterprise with more than 1,000 employees invests heavily in cutting-edge technology to improve efficiency and productivity. In the highly competitive environment in which their businesses operate, large companies frequently choose cybersecurity insurance solutions and are expected to invest heavily in advanced cybersecurity insurance solutions in the future.

On the basis of end-user, the cybersecurity insurance market is categorized into Technology providers [Insurance companies, third-party administrators, brokers, and consultancies, Government agencies] and Insurance providers [Financial services, Telecom & IT, Healthcare and life science, Retail and Consumer goods, Telecom, Travel, tourism, and hospitality, and Others. The insurance provider segment registered a substantial revenue share in the cybersecurity insurance market in 2021. Due to the vast clientele that the sector serves and the sensitive financial information at risk, the BFSI business is one of the vital infrastructure categories that frequently experience data breaches and cyberattacks.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 9.9 Billion |

| Market size forecast in 2028 | USD 32.6 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 18.8% from 2022 to 2028 |

| Number of Pages | 431 |

| Number of Tables | 783 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Insurance Coverage, Insurance Type, Organization Size, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the cybersecurity insurance market is analyzed across North America, Europe, Asia Pacific and LAMEA. The North America region garnered the highest revenue share in the cybersecurity insurance market in 2021. Because North America's economies are stable and well-established, it can make considerable investments in R&D projects, which helps the market for cybersecurity insurance to create new technologies. The market in this area is anticipated to develop significantly due to the presence of the majority of major players in the cybersecurity insurance market.

Free Valuable Insights: Global Cybersecurity Insurance Market size to reach USD 32.6 Billion by 2028

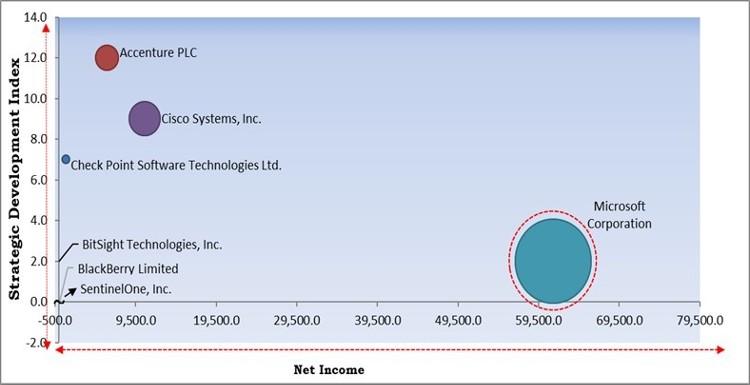

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Microsoft Corporation is the forerunner in the Cybersecurity Insurance Market. Companies such as Cisco Systems, Inc., Accenture PLC, Check Point Software Technologies Ltd. are some of the key innovators in Cybersecurity Insurance Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Cisco Systems, Inc., Microsoft Corporation, Check Point Software Technologies Ltd., Accenture PLC, FireEye, Inc., SentinelOne, Inc., UpGuard, Inc., CYE (Cyesec Ltd.), BlackBerry Limited (CYLANCE), and BitSight Technologies, Inc.

By Component

By Insurance Coverage

By Insurance Type

By Organization Size

By End User

By Geography

The global Cybersecurity Insurance Market size is expected to reach $32.6 billion by 2028.

Use Of Blockchain Technology With Artificial Intelligence (Ai) For Risk Analysis are driving the market in coming years, however, Rising Expenses For Cybersecurity Insurance restraints the growth of the market.

Cisco Systems, Inc., Microsoft Corporation, Check Point Software Technologies Ltd., Accenture PLC, FireEye, Inc., SentinelOne, Inc., UpGuard, Inc., CYE (Cyesec Ltd.), BlackBerry Limited (CYLANCE), and BitSight Technologies, Inc.

The Solution segment acquired maximum revenue share in the Global Cybersecurity Insurance Market by Component in 2021 thereby, achieving a market value of $22.6 billion by 2028.

The Technology Provider segment is leading the Global Cybersecurity Insurance Market by End User in 2021 thereby, achieving a market value of $19.4 billion by 2028.

The North America market dominated the Global Cybersecurity Insurance Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $11.6 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.