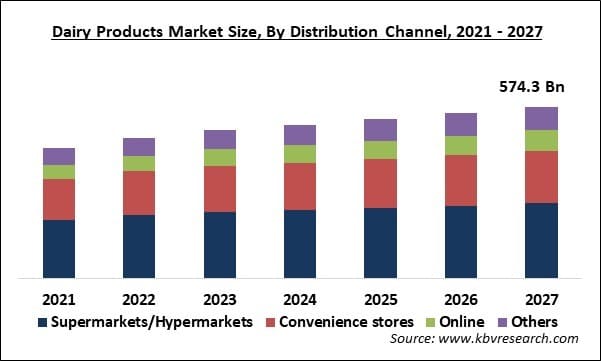

The Global Dairy Products Market size is expected to reach $574.3 billion by 2027, rising at a market growth of 4.7% CAGR during the forecast period. Dairy products are among the important elements of a healthy diet, which are currently witnessing a huge demand across the globe. There are many manufacturers who manages the growing requirements of the health-conscious population all over the world. Various new products like lactose-free, low-fat, and cholesterol-free dairy products are emerged in the market due to the changing trends and preferences among people.

Factors that are contributing to the surging growth of the dairy products market are the increasing consumption of dairy products and the rising inclination of people towards the dairy product for a protein-rich diet. In addition, the high availability of dairy products owing to modern retail facilities & cold chain logistics will further support the growth of the market. Moreover, the Covid-19 pandemic has witnessed the increasing sales of the dairy product via online distribution channels, which further boosted the market growth. It is because dairy products contain several health nutrients like riboflavin, calcium, vitamin A, niacin, potassium, vitamin D, and phosphorus.

With the outbreak of the Covid-19 pandemic, the demand for dairy products has been increased due to the nutritional value they offer to the consumers. The ongoing pandemic has impacted several sectors of the market. Some sectors have witnessed a growing graph while others have recorded a downfall. However, the dairy products market has seen an increasing demand because many experts have suggested consumers to increase their intake of various dairy products due to the various nutrients offered by them. These nutrients include Vitamin A, Vitamin D, potassium and calcium.

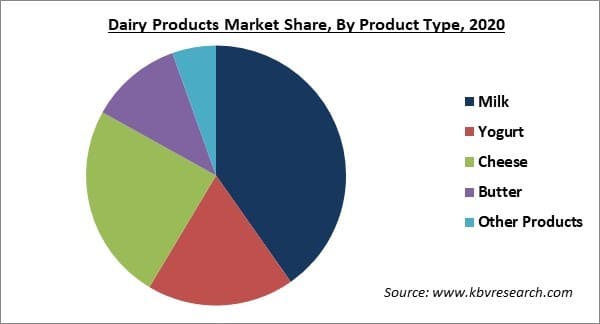

Based on Product Type, the market is segmented into Milk, Yogurt, Cheese, Butter and Other Products. On the basis of product, the milk product segment held the highest revenue share of the market in 2020. This segment is estimated to continue this trend during the forecast period. Factors like increasing milk consumption in the emerging nations because of its high nutritional content like calcium and protein are responsible for this high growth.

Based on Distribution Channel, the market is segmented into Supermarkets/Hypermarkets, Convenience stores, Online and Others. The online segment is estimated to exhibit the fastest growth rate during the forecast period. It is because online channels are more convenient to people as compared any other distribution channel. A few of the popular online distribution channels that deliver dairy products are Sainsbury’s, Ocado, Just Milk, Mr. Case, and Walmart.

| Report Attribute | Details |

|---|---|

| Market size value in 2020 | USD 354 Billion |

| Market size forecast in 2027 | USD 574.3 Billion |

| Base Year | 2020 |

| Historical Period | 2017 to 2019 |

| Forecast Period | 2021 to 2027 |

| Revenue Growth Rate | CAGR of 4.7% from 2021 to 2027 |

| Number of Pages | 184 |

| Number of Tables | 295 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Companies Strategic Developments, Company Profiling, Competitive Analysis |

| Segments covered | Product Type, Distribution Channel, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. By region, Europe emerged as a leading region in the dairy products market with a significant revenue share in 2020. The region would maintain this trend even during the forecast period. In this region, Germany is the major country which is estimated to register substantial growth owing to increasing consumer demand for creamers, cheese, and milk desserts. In addition, the demand for clean label & high-quality dairy products is expected to fuel the growth of the regional market.

Free Valuable Insights: Global Dairy Products Market size to reach USD 574.3 Billion by 2027

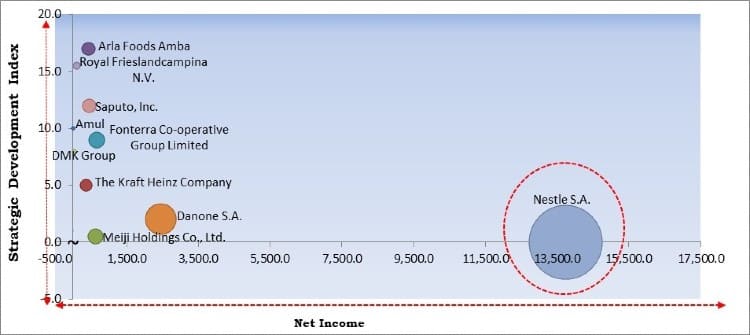

The major strategies followed by the market participants are Acquisition. Based on the Analysis presented in the Cardinal matrix; Nestle S.A. is the major forerunner in the Dairy Products Market. Companies such as Arla Foods Amba, Royal FrieslandCampina N.V., Saputo, Inc., and Amul are some of the key innovators in the market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Arla Foods Amba, Fonterra Co-operative Group Limited, Amul (The Gujarat Co-operative Milk Marketing Federation Ltd.), The Kraft Heinz Company, Nestle S.A., Danone S.A., Royal Frieslandcampina N.V., Saputo, Inc., Meiji Holdings Co., Ltd., and DMK Group (Deutsches Milchkontor eG).

By Product Type

By Distribution Channel

By Geography

The global Dairy Products market size is expected to reach $574.3 billion by 2027.

Growing awareness among consumer related to the nutritional food habit are driving the market in coming years, however, Availability of substitute goods of dairy products have limited the growth of the market.

Arla Foods Amba, Fonterra Co-operative Group Limited, Amul (The Gujarat Co-operative Milk Marketing Federation Ltd.), The Kraft Heinz Company, Nestle S.A., Danone S.A., Royal Frieslandcampina N.V., Saputo, Inc., Meiji Holdings Co., Ltd., and DMK Group (Deutsches Milchkontor eG).

During Covid-19 pandemic the dairy products market has seen an increasing demand because many experts have suggested consumers to increase their intake of various dairy products.

The supermarket/hypermarket market segment garnered the highest revenue share in 2020. This segment is also expected to maintain its dominance during the forecast period.

Asia-Pacific region is projected to be the fastest-growing region of the Dairy Products market over the forecast period.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.