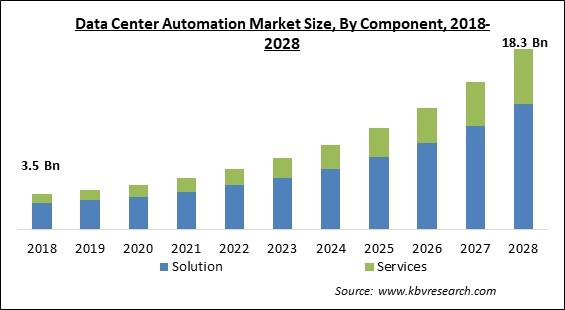

The Global Data Center Automation Market size is expected to reach $18.3 billion by 2027, rising at a market growth of 20.1% CAGR during the forecast period.

A data center refers to the facility with a network of computers and storage systems that is used to process, organize, store, and distribute huge amounts of data for a company or organization. Data center automation is the process of managing and automating a data center's procedures and workflow. It aids in the automation of data center operations, monitoring, administration, and maintenance duties that are now carried out by humans.

The data center team benefits from the prospects created by data center automation, which is currently in the market's stage of deployment strategy. The rise of social networking, cloud computing, analytics, and mobile computing is expected to boost the demand for data center automation. A significant amount of data created is unstructured, encompassing raw audio, files, or text from a variety of sources, including blogs and social media platforms.

Manual monitoring, remediation, and troubleshooting are too slow to be successful and can put businesses at risk due to the tremendous expansion in data and the speed at which businesses work today. Daily operations can be made autonomous through the process. In an ideal world, the data center provider would have API access to the network, allowing it to communicate with public clouds and migrate data and workloads from one to the other. Software solutions that provide centralized access to most or all data center resources are commonly used to deliver data center automation. This access allows for the automation of servers, storage, networks, and other data center administration duties in the past.

The covid-19 pandemic has undoubtedly hastened the digital transformation process. The predominance of remote work will significantly speed up cloud capabilities, even after the pandemic. Companies would look to embark on a new normal, whether it's more IT solutions for an agile workforce, larger data storage to fuel the spread of online commerce, or resilient IT systems to handle any future healthcare emergencies. Many businesses seeking to reduce the risk of disease transmission, whether on-premises or in collocation, have accelerated the deployment of data center automation as a result of COVID-19.

With the passage of time, networks grow increasingly complex. A single data center can house hundreds of servers. Managing the entire network is thus extremely difficult. Repetitive jobs, on the other hand, can be handled by IT automation. As a result, the IT staff can devote their attention to a more vital responsibility. It will aid in the enhancement of the network's security. Enterprises benefit from data centers because companies have greater storage capacity, many advanced servers, and faster processing capabilities. Data centers are in higher demand than ever before, spanning all industries.

As all firms aim to increase their entire energy efficiency, it makes this, an important factor for the data center automation market. Organizations favor data center automation because it lets them operate with optimum energy efficiency while minimizing their environmental impact. Demand for energy-efficient automated data centers is increasing as a result of the drive to minimize electricity costs. In data centers, storage systems and high-density blade servers provide more computation capacity per watt of energy spent.

The staff in data centers is often in charge of a highly complex environment that includes a diverse mix of programs, databases, and rival platforms. Managing this environment via scripting and platform/application-specific scheduling tools can be time-consuming and inefficient, posing task management issues. These disjointed tools necessitate constant upgrading in the face of change, resulting in higher operating expenses and lower employee productivity. Additionally, there is a data security issue that is impeding market expansion.

Based on components, the data center automation market is segmented into solutions and services. The solution segment acquired the highest revenue share in the data center automation market in 2021. This is due to the growing need for server automation systems in data centers, which enable businesses or users to deploy, configure, patch, and maintain virtual, physical, and cloud servers rapidly and securely. Server automation ensures that pre-configured policies are followed and that IT productivity is increased by up to a significant rate due to an intelligent and tight loop for automated remediation. These factors would contribute to the growth of the data center automation market.

By operating environment, the data center automation market is fragmented into Windows OS, Unix OS, Linux, and another Open-Source OS. The Linux and Other Open Source OS segment garnered a significant revenue share in the data center automation market in 2021. Linus Torvalds' Linux kernel provides the foundation for a set of open-source Unix-like operating systems. The term "Linux distribution" refers to a grouping of Linux packages. Linux is an open-source and free operating system for computers (OS). An operating system is a software that controls the hardware and resources of a computer, such as the CPU, memory, and storage.

Based on the end-user, the data center automation market is bifurcated into BFSI, IT and telecom, Retail, Public sector and utilities, Energy, Manufacturing, Healthcare, and Others. The BFSI segment acquired the maximum revenue share in the data center automation market in 2021. It is because BFSI companies are removing errors from human procedures and are focusing on enhancing coordination between IT security and IT operations. Data management can be used to do operations such as customer analysis, fraud detection, and other related duties. The financial sector's intense rivalry puts the burden on banks to be more efficient and responsive. Banks must also increase their resources and infrastructure, as well as improve their operating efficiency.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 5.2 Billion |

| Market size forecast in 2028 | USD 18.3 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 20.1% from 2022 to 2028 |

| Number of Pages | 247 |

| Number of Tables | 393 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Component, Operating Environment, End User, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the data center automation market is analyzed across North America, Europe, Asia Pacific, and LAMEA. North America emerged as the leading region in the data center automation market in 2021 with the largest revenue share. In terms of technology breakthroughs and adoption, North America is the most advanced region. It has a well-equipped infrastructure and the financial means to invest in data center automation software. In addition, using data center automation solutions improves efficiency and lowers costs for data center operations including incident and event management.

Free Valuable Insights: Global Data Center Automation Market size to reach USD 18.3 Billion by 2028

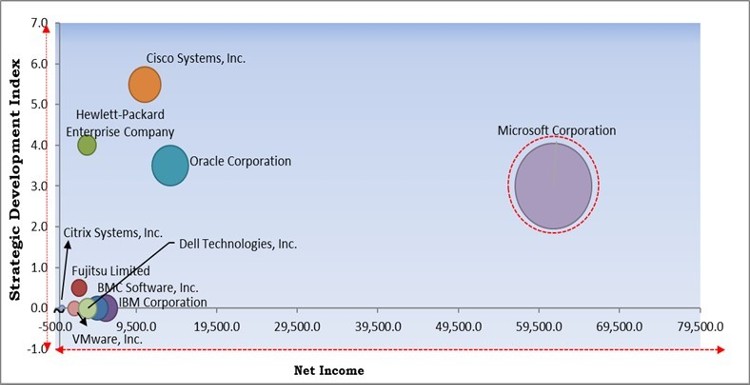

The major strategies followed by the market participants are Geographical Expansions. Based on the Analysis presented in the Cardinal matrix; Microsoft Corporation is the major forerunner in the Data Center Automation Market. Companies such as Oracle Corporation, Cisco Systems, Inc. and Hewlett-Packard Enterprise Company are some of the key innovators in Data Center Automation Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include IBM Corporation, Oracle Corporation, BMC Software, Inc., Fujitsu Limited, Citrix Systems, Inc., Cisco Systems, Inc., Microsoft Corporation, VMware, Inc., Hewlett-Packard Enterprise Company, and Dell Technologies, Inc.

By Component

By Operating Environment

By Operating End User

By Geography

The global data center automation market size is expected to reach $18.3 billion by 2028.

More savings in energy are driving the market in coming years, however, market expansion is hampered by data privacy and security issues growth of the market.

IBM Corporation, Oracle Corporation, BMC Software, Inc., Fujitsu Limited, Citrix Systems, Inc., Cisco Systems, Inc., Microsoft Corporation, VMware, Inc., Hewlett-Packard Enterprise Company, and Dell Technologies, Inc.

The expected CAGR of the data center automation market is 20.1% from 2022 to 2028.

The Windows OS segment acquired maximum revenue share the Global Data Center Automation Market by Operating Environment in 2021 thereby, achieving a market value of $8.76 billion by 2028.

The North America market dominated the Global Data Center Automation Market by Region in 2021, and would continue to be a dominant market till 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.