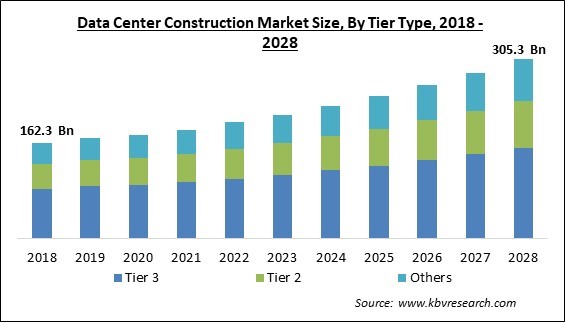

The Global Data Center Construction Market size is expected to reach $305.3 billion by 2028, rising at a market growth of 7.5% CAGR during the forecast period.

Data center construction is the collective operation of physically building a data center facility. The main goal is to plan and construct a data center with the appropriate capacity, disaster-resilient systems, and an effective layout to carry out all required operations. Backup power sources, data transmission links, security equipment, fire suppression systems, and air conditioning are typically included in the infrastructure.

Construction of data centers as per proper planning ensures that every resource is used to its fullest potential and that every environmental factor is considered. A data center is utilized to address IT-related computer equipment and systems. Under the flooring and the tiles, air can circulate owing to the data center's structure. Data volumes have also increased with a large increase in internet usage, sophisticated software development & installation methods, and a rise in the number of equipment connected to both public and private networks.

In essence, a facility's design, planning, and building are all included in the construction process. IT infrastructure, several ancillary expenditures, power distribution, and cooling solutions are all included in the data center construction. The demand for data center building is expanding due to rising data consumption and industry demand for cloud computing.

Continual investments in building hyperscale structures, which house cooling equipment, IT infrastructure, and power products, are also predicted to occur in the market. The industry for data center building is expected to increase as public cloud providers like Facebook, Google, and Amazon continue to spend on modernizing their current infrastructure.

The COVID-19 pandemic negatively impacted the market for data center building. However, the COVID-19 outbreak came when demand for data center capacity was rising quickly, which stopped the development of new facilities. In addition, the market had a specific effect, such as increased data network traffic due to more people using programs like Microsoft Office and Zoom. A data center's construction was further complicated by the pandemic's supply chain interruption, which hindered the market's expansion. The need for data capacity has almost tripled since the pandemic, and many businesses are moving toward hybrid cloud infrastructure. As a result, the market has witnessed a rise in data center construction.

The Internet of Things (IoT) is a setting in which various electronic gadgets, including computers, electric meters, televisions, air conditioners, and mobile phones, are connected to computers and networks. Due to minimal human involvement, gadgets can now consume, exchange, and generate data. One element anticipated to propel the data center construction market is IoT device creation and rising use. Data centers have emerged to meet the need to store this data due to the substantial information exchange among devices. Many billions of connected IoT devices contribute to the production of more data and are anticipated to increase the demand for data center construction. Therefore, in the coming years, the expansion of the IoT industry will directly influence the expansion of the data center construction market.

The number of data centers being created worldwide has significantly increased due to large investments being made in new expansion and construction by top data center service providers. Real estate, as well as investment firms, are encouraged to purchase data centers by the developed nations' data center industry. Such purchases typically result in expansion plans, which strengthen market growth. With unanticipated demand from both existing as well as new clients in data centers, the majority of expenditures will be concentrated on the expansion of the edge data center sector. Hence, the increasing number of data center projects worldwide and the improved battery technology are propelling the market's growth.

The effects on the environment are extensive, affecting biodiversity, climate change, pollution, and natural resources. Despite the complexity of the problems, there are several chances for growth and long-lasting beneficial effects. Small and medium-sized businesses might not establish a new data center because of the high expense of building one. The vendor's attention is directed at areas with lower construction prices. Therefore, these limitations may restrict the growth of the data center construction market in the coming years.

On the basis of type, the data center construction market is divided into IT infrastructure, electrical infrastructure, and miscellaneous expenses & others. The miscellaneous expenses and others segment witnessed a substantial revenue share in the data center construction market in 2021. The costs of the security infrastructure, the property, the building, and the shell construction, among other charges, are included in other expenses. Physical and digital security of the data center is included in the security expenditures. The increasing frequency of cybercrime and data breaches drives service providers to invest aggressively in highly advanced security solutions.

Based on tier type, the data center construction market is segmented into tier 2, tier 3, and others. The others segment garnered a remarkable growth rate in the data center construction market in 2021. The other segment consists of tier 1 and tier 4. Tier 1 infrastructure has enough power and cooling to handle IT demand. These facilities have only one path for electricity and cooling, and no important systems are redundant. Additionally, tier 4 is essentially a data center with every component redundant and entirely fault-tolerant.

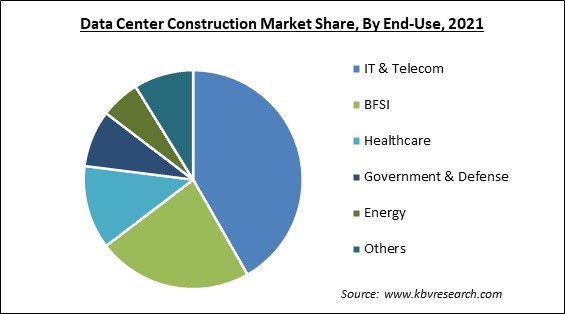

On the basis of end-use, the data center construction market is divided into IT & telecom, BFSI, government & defense, healthcare, energy, and others. The IT and telecom segment procured the highest revenue share in the data center construction market in 2021. The segment is expanding as a consequence of the spread of smartphones as well as the increase in the number of people using the internet activity around the world. In addition, the segment led due to the rollout of 5G networks, and the trend is anticipated to persist during the forecast period.

| Report Attribute | Details |

|---|---|

| Market size value in 2021 | USD 185.7 Billion |

| Market size forecast in 2028 | USD 305.3 Billion |

| Base Year | 2021 |

| Historical Period | 2018 to 2020 |

| Forecast Period | 2022 to 2028 |

| Revenue Growth Rate | CAGR of 7.5% from 2022 to 2028 |

| Number of Pages | 334 |

| Number of Table | 554 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Companies Strategic Developments, Company Profiling |

| Segments covered | Tier Type, End-Use, Type, Region |

| Country scope | US, Canada, Mexico, Germany, UK, France, Russia, Spain, Italy, China, Japan, India, South Korea, Singapore, Malaysia, Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria |

| Growth Drivers |

|

| Restraints |

|

Region wise, the data center construction market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region witnessed the largest revenue share in the data center construction market in 2021. Strong investment in data center construction projects has contributed to North America's high revenue share. Since the US has a developed economy, it already has a well-established, high-tech network infrastructure. In addition, major cloud service companies, including Amazon, Google, and Facebook, are also based there. Such businesses are investing in building mega facilities to increase their processing power and data storage. As a result, the market for data center construction has fresh growth prospects.

Free Valuable Insights: Global Data Center Construction Market size to reach USD 305.3 Billion by 2028

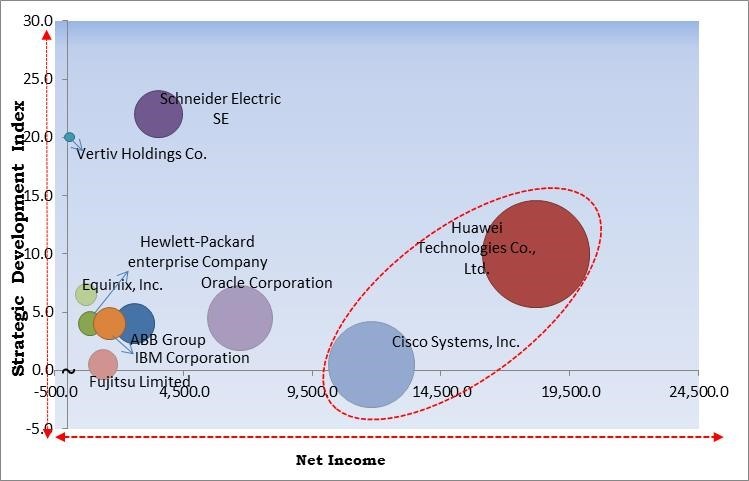

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Cisco Systems, Inc. and Huawei Technologies Co., Ltd. are the forerunners in the Data Center Construction Market. Companies such as Schneider Electric SE, ABB Group and Oracle Corporation are some of the key innovators in Data Center Construction Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Hewlett-Packard enterprise Company (HP Development Company L.P.), IBM Corporation, ABB Ltd., Schneider Electric SE, Oracle Corporation, Cisco Systems, Inc., Vertiv Holdings Co., Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Fujitsu Limited and Equinix, Inc.

By Tier Type

By End-Use

By Type

By Geography

The global Data Center Construction Market size is expected to reach $305.3 billion by 2028.

Increasing number of data center expansion projects are driving the market in coming years, however, Limitations of data center services and providers restraints the growth of the market.

Hewlett-Packard enterprise Company (HP Development Company L.P.), IBM Corporation, ABB Ltd., Schneider Electric SE, Oracle Corporation, Cisco Systems, Inc., Vertiv Holdings Co., Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Fujitsu Limited and Equinix, Inc.

The Tier 3 segment acquired maximum revenue share in the Global Data Center Construction Market by Tier Type in 2021 thereby, achieving a market value of $154.2 billion by 2028.

The IT Infrastructure segment is leading the Global Data Center Construction Market by Type in 2021 thereby, achieving a market value of $172.1 billion by 2028.

The North America market dominated the Global Data Center Construction Market by Region in 2021, and would continue to be a dominant market till 2028; thereby, achieving a market value of $112 billion by 2028.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.