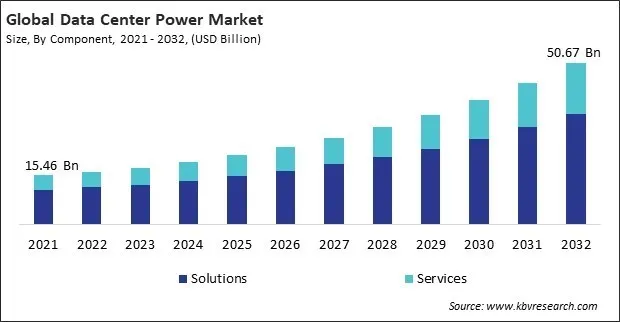

“Global Data Center Power Market to reach a market value of USD 50.67 Billion by 2032 growing at a CAGR of 12.8%”

The Global Data Center Power Market size is expected to reach $50.67 billion by 2032, rising at a market growth of 12.8% CAGR during the forecast period.

The North America segment recorded 36% revenue share in the market in 2024. This dominance is attributed to many hyperscale data centers, advanced IT infrastructure, and key market players in the region. The growing demand for cloud services, big data analytics, and AI applications has further driven investments in power-efficient and resilient data center infrastructures.

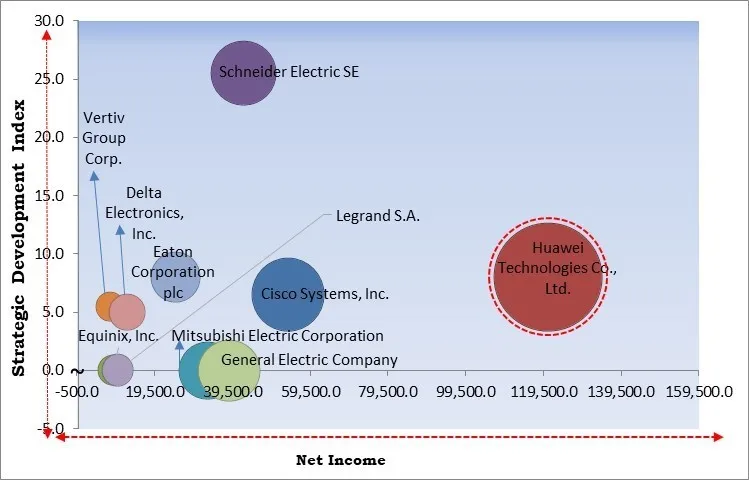

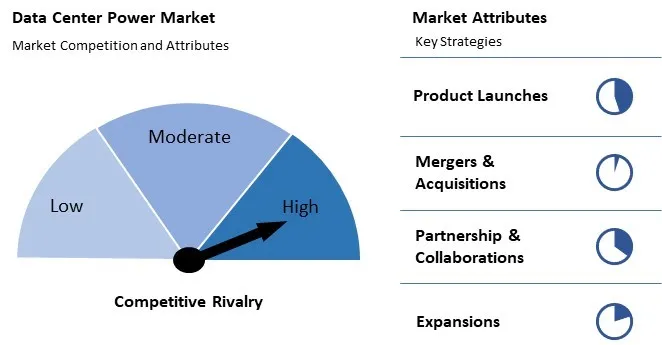

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In December, 2024, Schneider Electric announced new AI-ready data center solutions, including liquid-cooled designs and the Galaxy VXL UPS, to address energy and sustainability challenges. In collaboration with NVIDIA, the solutions aim to optimize power efficiency and support AI workloads sustainably. Moreover, In November, 2024, Delta Electronics, Inc. has launched the SMART PDU I-Type, a compact 1U DC distribution unit with up to 21 intelligent, programmable breakers and remote management. It optimizes power distribution, enhances operational efficiency, saves space, and reduces costs for telecom and data center operators. Its design supports scalable, energy-efficient infrastructure for growing 5G and data needs.

Based on the Analysis presented in the KBV Cardinal matrix; Huawei Technologies Co., Ltd. is the forerunner in the Data Center Power Market. In October, 2024, Huawei Technologies Co., Ltd. New-Generation All-Flash Data Center solution, launched at GITEX 2024, enhances data center performance, resilience, and energy efficiency. With innovations like diskless architecture and AI-powered storage, it supports sustainable, high-performance infrastructure for industries undergoing digital and intelligent transformation. Companies such as Cisco Systems, Inc., Schneider Electric SE, and General Electric Company are some of the key innovators in Data Center Power Market.

The increasing popularity of colocation services significantly drives demand for scalable power infrastructure within data centers. As more enterprises seek to outsource their IT infrastructure to colocation providers, the need for flexible, high-capacity power systems supporting diverse tenant requirements is growing rapidly. Hence, this trend toward colocation benefits the clients and is a significant catalyst for power solution manufacturers and integrators, ensuring long-term growth for the market.

Additionally, The explosive growth in global data generation is a fundamental driver for the market. Data is being produced at unprecedented volumes, from high-definition video streaming and social media content to IoT sensors and AI-driven analytics. According to the United Nations, in 2020, approximately 64.2 zettabytes of data were created, which is a 314 percent increase from 2015. In conclusion, this evolving landscape prompts continuous innovation in power technologies, positioning the market as a critical enabler of the data-driven economy and ensuring a strong growth trajectory.

However, One of the most pressing restraints for the market is the steep upfront capital required to deploy advanced power infrastructure. Modern data centers demand high-performance, redundant, scalable power systems to ensure consistent uptime and operational efficiency. However, these systems—such as modular UPS units, intelligent PDUs, and advanced backup generators—come with significant costs, especially when paired with necessary integration technologies like energy monitoring software and automation tools. As a result, the high capital investment requirement remains a significant roadblock to widespread adoption and scalability within the market.

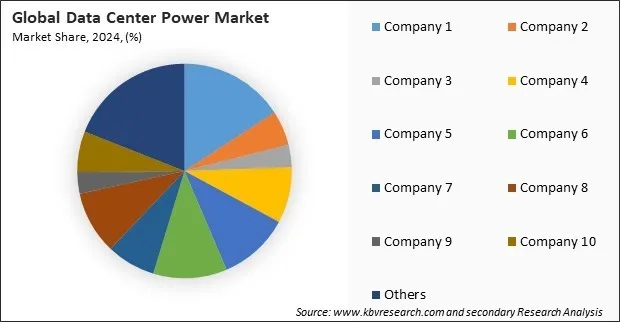

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

Free Valuable Insights: Global Data Center Power Market size to reach USD 50.67 Billion by 2032

The UPS segment acquired 67% revenue share in the market in 2024. This segment's dominance is attributed to UPS systems' critical role in providing immediate backup power during outages, ensuring uninterrupted data center operations. As data centers continue to support essential digital infrastructure, the demand for high-capacity and energy-efficient UPS systems has surged.

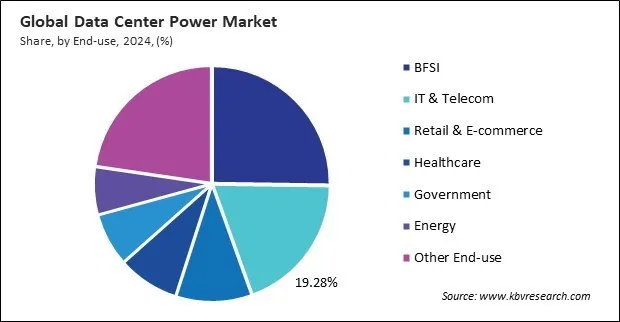

Based on end-use, the market is segmented into IT & telecom, BFSI, government, energy, healthcare, retail & e-commerce, and others. The IT & telecommunications segment acquired 19% revenue share in the market in 2024. The expansion of cloud computing, data-intensive applications, and growing internet users are major contributors to this segment's demand for power infrastructure. Telecom operators and IT firms increasingly invest in high-density data centers to support 5G networks, IoT, and AI technologies, boosting the need for efficient and scalable power systems.

The competition in the Data Center Power Market becomes more fragmented and dynamic, with increased opportunities for regional and emerging companies to gain market share. Innovation, energy efficiency, and strategic partnerships become key differentiators. The absence of dominant players fosters a more level playing field, encouraging diverse solutions and intensifying the race for technological advancement.

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment witnessed 27% revenue share in the market in 2024. Rapid digital transformation, expanding internet penetration, and a surge in data consumption are fuelling the growth of data centers across emerging economies like China, India, and Southeast Asian countries. Government initiatives to develop smart cities and enhance IT infrastructure support market expansion.

| Report Attribute | Details |

|---|---|

| Market size value in 2024 | USD 19.65 Billion |

| Market size forecast in 2032 | USD 50.67 Billion |

| Base Year | 2024 |

| Historical Period | 2021 to 2023 |

| Forecast Period | 2025 to 2032 |

| Revenue Growth Rate | CAGR of 12.8% from 2025 to 2032 |

| Number of Pages | 332 |

| Number of Tables | 484 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Component, End-use, Region |

| Country scope |

|

| Companies Included | Schneider Electric SE, Mitsubishi Electric Corporation, Cisco Systems, Inc., Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Eaton Corporation plc, Vertiv Group Corp., Legrand S.A. (Legrand Group), Delta Electronics, Inc., Equinix, Inc., General Electric Company |

By Component

By End-use

By Geography

This Market size is expected to reach $50.67 billion by 2032.

Rise in Colocation Driving Demand for Scalable Power Solutions are driving the Market in coming years, however, High Initial Capital Investment Required for Advanced Power Infrastructure Deployment restraints the growth of the Market.

Schneider Electric SE, Mitsubishi Electric Corporation, Cisco Systems, Inc., Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Eaton Corporation plc, Vertiv Group Corp., Legrand S.A. (Legrand Group), Delta Electronics, Inc., Equinix, Inc., General Electric Company

The expected CAGR of this Market is 12.8% from 2023 to 2032.

The Solutions segment led the maximum revenue in the Market by Component in 2024, thereby, achieving a market value of $35.00 billion by 2032.

The North America region dominated the Market by Region in 2024, thereby, achieving a market value of $18.00 billion by 2032.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges