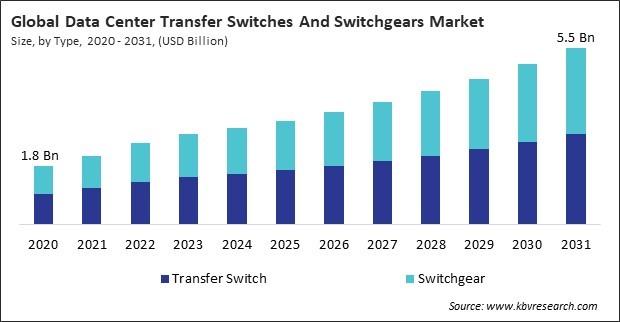

“Global Data Center Transfer Switches And Switchgears Market to reach a market value of 5.5 Billion by 2031 growing at a CAGR of 9%”

The Global Data Center Transfer Switches And Switchgears Market size is expected to reach $5.5 billion by 2031, rising at a market growth of 9.0% CAGR during the forecast period.

Rapid urbanization, increasing internet penetration, and the proliferation of digital services have driven the growth of data centers in this region. Countries like China, India, and Japan are witnessing significant investments in data center infrastructure, leading to an increased demand for reliable power solutions Hence, the Asia Pacific region generated 27% revenue share in the market in 2023. Additionally, enhancing energy efficiency and reducing operational costs in data centers has spurred the adoption of advanced transfer switches and switchgears in Asia Pacific.

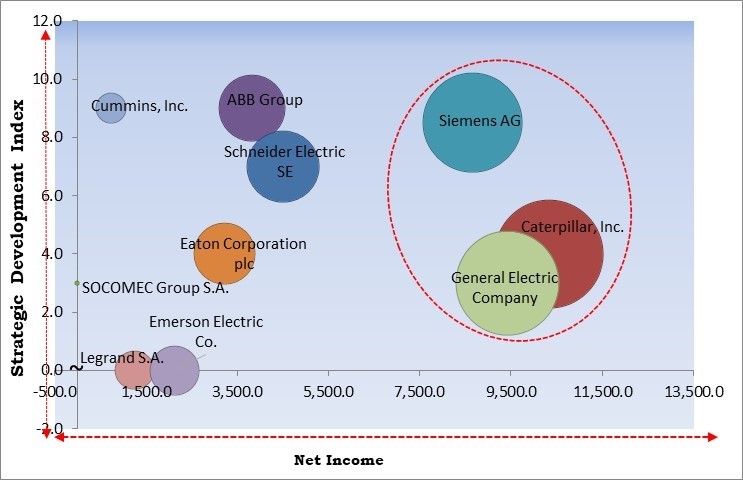

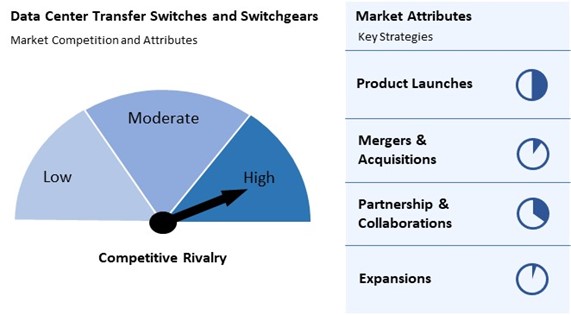

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In July, 2024, ABB has launched a new range of innovative switches and sockets in Vietnam, enhancing safety, convenience, and smart integration for residential and commercial buildings. The ORIGEN, INORA, and ZENIT lines prioritize user-friendly features while meeting high safety standards. Additionally, in April, 2024, Schneider Electric has launched the EasySet MV, a new compact and sustainable air-insulated indoor switchgear. Designed for ease of installation and maintenance, it features vacuum circuit breaker technology, enhanced monitoring capabilities, and improved reliability, setting a new standard in electrical distribution.

Based on the Analysis presented in the KBV Cardinal matrix; Siemens AG, Caterpillar, Inc. and General Electric Company are the forerunners in the Data Center Transfer Switches And Switchgears Market. In February, 2024, GE Vernova a subsidiary company of General Electric Company has launched GridBeats, a portfolio of software-defined automation solutions designed to modernize grid operations and enhance resilience. Companies such as ABB Group, and Cummins, Inc. are some of the key innovators in the Market.

Many data centers are adopting hybrid solutions combining renewable energy and traditional power systems. This approach not only enhances energy resilience but also allows for better load balancing and energy optimization. Transfer switches and switchgears are critical components in managing the flow of electricity between renewable sources, energy storage systems, and the data centre’s power distribution network, ensuring efficient utilization of stored energy and minimizing reliance on the grid. In conclusion, the surge in renewable energy integration within data centers drives the market's growth.

Organizations are increasingly recognizing the importance of business continuity planning (BCP) to mitigate risks associated with power failures. Effective BCP involves implementing strategies that ensure continuous operation even during unexpected events. Regulatory requirements for power reliability and data protection are becoming more stringent. Organizations must adhere to industry standards that mandate minimal downtime and high data availability. To comply with these regulations, data centers must invest in high-quality transfer switches and switchgears that guarantee seamless power switching and continuity during outages or maintenance periods. Thus, the increasing demand for uninterrupted power supply in data centers drives the market's growth.

Procuring components that are compatible with non-standardized systems can be challenging, leading to delays and increased lead times in supply chains. Diagnosing and resolving issues in a system with limited standardization can be more complex and time-consuming, as technicians must navigate a mix of different technologies and interfaces. Data centers operating in different regions may need to comply with various local regulations and standards. Limited standardization complicates compliance efforts, as operators must ensure that all components meet the necessary requirements. In conclusion, limited standardization across transfer switch and switchgear systems is impeding the growth of the market.

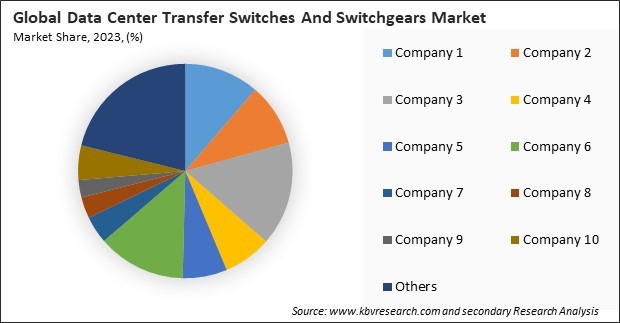

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

The switchgear segment is further subdivided into low voltage switchgear, medium voltage switchgear, and high voltage switchgear. In 2023, the low voltage switchgear segment recorded 39% revenue share in the market. The exponential growth in data generation and the need for data storage have led to a surge in the construction of data centers. Low voltage switchgear is critical in ensuring reliable power distribution within these facilities, thus driving demand.

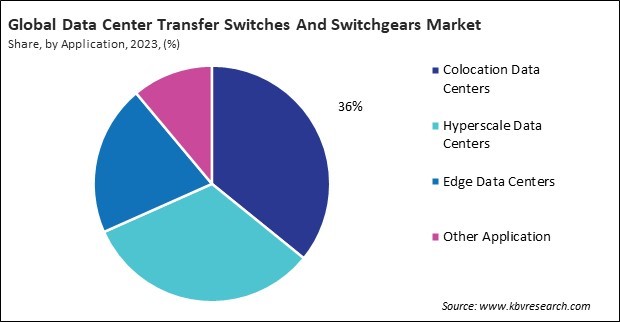

On the basis of application, the market is segmented into colocation data centers, edge data centers, hyperscale data centers, and others. In 2023, the colocation data centers segment attained 36% revenue share in the market. Colocation data centers, which offer shared space and infrastructure for multiple enterprises, are becoming increasingly popular due to their cost-efficiency, scalability, and enhanced security features. These data centers rely heavily on robust transfer switches and switchgears to ensure uninterrupted power supply and to maintain operational continuity for their tenants.

The transfer switch segment is further subdivided into static transfer switches, automatic transfer switches, bypass isolation transfer switches, and others. In 2023, the automatic transfer switches segment attained 48% revenue share in the market. Automatic transfer switches (ATS) are essential for ensuring a reliable transition from primary to backup power sources, automatically detecting power failures, and initiating the switch to backup systems without human intervention. This functionality is vital for data centers that require continuous operation and cannot rely on manual processes.

Based on type, the data center transfer switches and switchgears market is divided into transfer switches and switchgear. The switchgear segment procured 47% revenue share in the market in 2023. Switchgear, including medium and high voltage types, is essential for controlling and protecting electrical equipment within data centers. Their role in ensuring reliable power distribution and facilitating the safe operation of electrical systems cannot be overstated. The significance of the switchgear segment highlights the increasing emphasis on robust power management solutions to maintain operational continuity and minimize downtime in data centers.

Free Valuable Insights: Global Data Center Transfer Switches And Switchgears Market size to reach USD 5.5 Billion by 2031

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region witnessed 36% revenue share in the market in 2023. This can be attributed to several factors, including many data centers, significant investments in infrastructure, and the increasing reliance on cloud services. The region’s robust technological advancements and a well-established IT ecosystem further contribute to the high demand for efficient power management solutions.

The Data Center Transfer Switches and Switchgears Market is highly competitive, driven by the increasing demand for reliable power management solutions in data centers. Providers are focusing on offering robust transfer switches and switchgear systems that ensure uninterrupted power supply and enhance operational efficiency. As data centers expand and adopt advanced technologies, the need for scalable and flexible power distribution solutions grows. Competition revolves around delivering products that incorporate smart technology, energy efficiency, and safety features, as operators seek to optimize uptime and reduce operational risks.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 2.8 Billion |

| Market size forecast in 2031 | USD 5.5 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 9.0% from 2024 to 2031 |

| Number of Pages | 321 |

| Tables | 454 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Competitive Landscape, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Type, Application, Region |

| Country scope |

|

| Companies Included | ABB Group, Siemens AG, Schneider Electric SE, Caterpillar, Inc., Cummins, Inc., Eaton Corporation plc, Emerson Electric Co., Legrand S.A. (Legrand Group), SOCOMEC Group S.A., General Electric Company |

By Type

By Application

By Geography

This Market size is expected to reach $5.5 billion by 2031.

Increasing Demand for Uninterrupted Power Supply in Data Centers are driving the Market in coming years, however, High Initial Capital Investment for Advanced Systems restraints the growth of the Market.

ABB Group, Siemens AG, Schneider Electric SE, Caterpillar, Inc., Cummins, Inc., Eaton Corporation plc, Emerson Electric Co., Legrand S.A. (Legrand Group), SOCOMEC Group S.A., General Electric Company

The expected CAGR of this Market is 9.0% from 2024 to 2031.

The Transfer Switch segment is leading the Market by Type in 2023; thereby, achieving a market value of $2.8 billion by 2031.

The North America region dominated the Market by Region in 2023; thereby, achieving a market value of $1.9 billion by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges