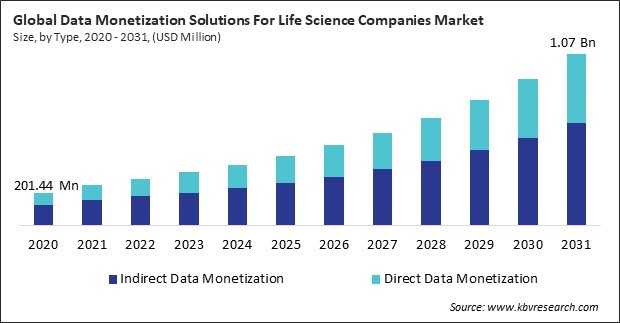

“Global Data Monetization Solutions For Life Science Companies Market to reach a market value of 1.07 Billion by 2031 growing at a CAGR of 16.1%”

The Global Data Monetization Solutions For Life Science Companies Market size is expected to reach $1.07 billion by 2031, rising at a market growth of 16.1% CAGR during the forecast period.

The demand for data-driven solutions is driven by rising healthcare expenditure, growing healthcare needs, and the rapid digitalization of the sector in countries like China, India, and Japan. The region has seen significant advancements in healthcare and life sciences, with an increasing focus on data analytics, AI, and cloud technologies. Thus, in 2023, the Asia Pacific region generated 1/4th revenue share in the market. Moreover, governments and organizations in the region are increasingly investing in technologies that facilitate the monetization of healthcare data to improve outcomes and drive innovation.

Integrating RWE into clinical research enables a more dynamic approach to understanding diseases and patient responses. It allows for continuous monitoring and assessment, providing a more accurate picture of drug performance and patient health trends. This particularly benefits rare diseases and chronic conditions where long-term data is crucial. The growing importance of RWE thus creates substantial demand for advanced data management and monetization tools that can handle complex datasets and deliver actionable insights. Additionally, Regulatory frameworks worldwide are evolving to enforce stricter data transparency and privacy standards. Life science companies must navigate these complex regulatory landscapes while maintaining robust data monetization strategies. Thus, the rising importance of real-world evidence (RWE) in clinical research and growing consumer awareness and demand for data transparency propel the market's growth.

However, the costs of achieving and maintaining compliance can deter companies from investing in data monetization solutions. This financial strain highlights the need for cost-effective and scalable solutions to mitigate these challenges and make data management more accessible and efficient for life science companies. In conclusion, the high data management and integration costs hinder the market's growth.

The unpredictable nature of the pandemic made it challenging for life science companies to plan their long-term business strategies, including data monetization. This uncertainty led to hesitations in adopting new data-driven solutions. The economic downturn during the pandemic led to budget cuts and financial constraints for many life science companies, making it difficult for them to invest in advanced data monetization tools and technologies. Thus, the COVID-19 pandemic had a negative impact on the market.

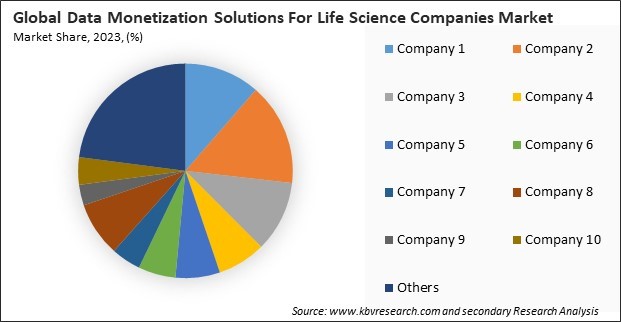

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

The direct data monetization segment is further subdivided into software and services. In 2023, the software segment attained 53% revenue share in the market. This indicates a growing preference for software-based solutions that enable life science companies to analyze, manage, and monetize data efficiently. Software tools offer scalability, customization, and advanced features such as data analytics, AI, and machine learning, allowing companies to unlock their data assets' full potential. These solutions also support the integration of various data streams, providing valuable insights and enhancing decision-making capabilities.

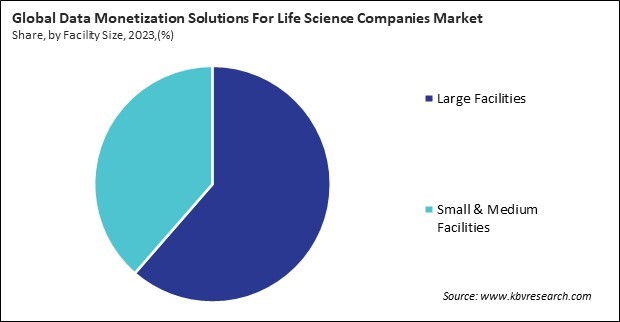

On the basis of facility size, the market is segmented into large facilities and small & medium facilities. In 2023, the small & medium facilities segment attained 39% revenue share in the market. The growing availability of cost-effective and scalable data monetization solutions enables these organizations to participate in this market. These facilities are increasingly adopting solutions that cater to their specific needs, such as cloud-based platforms and customized services, allowing them to effectively monetize their data without the substantial investments required by larger facilities. Both segments are essential in driving the growth of the data monetization solutions market for life science companies, each contributing to the market in unique ways.

The indirect data monetization segment is further subdivided into software and services. In 2023, the software segment attained 64% revenue share in the market. This segment includes advanced analytics software, artificial intelligence (AI)-driven platforms, and data management tools that allow life science companies to unlock the value of their data without directly selling it. These software solutions enable organizations to derive insights from vast data, optimize processes, and enhance decision-making, driving indirect revenue through improved operational efficiencies and partnerships.

Based on type, the market is divided into indirect data monetization and direct data monetization. In 2023, the indirect data monetization segment garnered 62% revenue share in the market. Indirect data monetization involves using data to create additional revenue streams through partnerships, licensing, or other external collaborations rather than directly selling the data. This approach has gained significant traction as life science companies look to leverage their valuable datasets without necessarily selling them outright. Indirect monetization strategies can include using data to enhance research and development, improve operational efficiencies, or partner with other organizations to provide insights that drive innovation and business growth.

By mode of deployment, the market is divided into cloud and on-premises. In 2023, the cloud segment registered 67% revenue share in the market. This performance reflects the increasing preference for cloud-based solutions among life science companies. Cloud deployment offers numerous advantages, including scalability, flexibility, and lower upfront costs, making it an attractive option for organizations looking to manage and monetize vast amounts of data efficiently. Furthermore, cloud solutions enable seamless data sharing, integration, and access across multiple stakeholders and geographies, particularly valuable in the globalized life science industry.

Free Valuable Insights: Global Data Monetization Solutions For Life Science Companies Market size to reach USD 1.07 Billion by 2031

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region witnessed 39% revenue share in the market in 2023. This dominance can be attributed to the presence of many life science companies, including pharmaceuticals, biotechnology, and medical device manufacturers, who are at the forefront of adopting data-driven strategies. The region’s advanced healthcare infrastructure, strong R&D investments, and a high degree of digital transformation in the life sciences sector further drive the demand for data monetization solutions.

| Report Attribute | Details |

|---|---|

| Market size value in 2023 | USD 331.08 Million |

| Market size forecast in 2031 | USD 1.07 Billion |

| Base Year | 2023 |

| Historical Period | 2020 to 2022 |

| Forecast Period | 2024 to 2031 |

| Revenue Growth Rate | CAGR of 16.1% from 2024 to 2031 |

| Number of Pages | 325 |

| Tables | 480 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Market Share Analysis, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Type, Facility Size, Mode of Deployment, Region |

| Country scope |

|

| Companies Included | Oracle Corporation, Microsoft Corporation, Google LLC (Alphabet Inc.), Salesforce, Inc., SAP SE, SAS Institute Inc., Infosys Limited, Accenture PLC, Cisco Systems, Inc., Siemens AG |

By Type

By Facility Size

By Mode of Deployment

By Geography

This Market size is expected to reach $1.07 billion by 2031.

Rising Importance of Real-world Evidence (RWE) in Clinical Research are driving the Market in coming years, however, High Costs Associated with Data Management and Integration restraints the growth of the Market.

Oracle Corporation, Microsoft Corporation, Google LLC (Alphabet Inc.), Salesforce, Inc., SAP SE, SAS Institute Inc., Infosys Limited, Accenture PLC, Cisco Systems, Inc., Siemens AG

The expected CAGR of this Market is 16.1% from 2024 to 2031.

The Large Facilities segment is leading the Size in 2023, thereby, achieving a market value of $645.76 million by 2031.

The North America region dominated the market by Region in 2023; thereby, achieving a market value of $401.40 million by 2031.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.

Drivers

Drivers

Restraints

Restraints

Opportunities

Opportunities

Challenges

Challenges