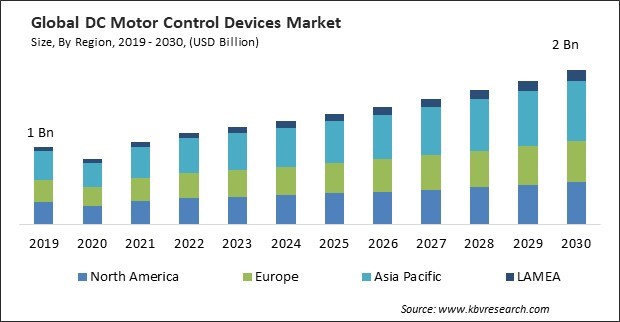

The Global DC Motor Control Devices Market size is expected to reach $2 billion by 2030, rising at a market growth of 6.8% CAGR during the forecast period.

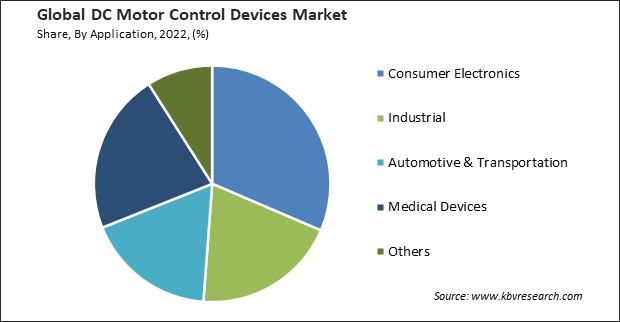

DC motor control devices play a crucial role in the propulsion systems of electric vehicles. Thus, the Automotive & Transportation segment acquired $212.8 million in 2022. These devices ensure precise control over the speed, torque, and direction of electric motors, contributing to electric vehicles' overall efficiency and performance. It provides variable speed control, allowing automotive systems to operate at optimal speeds based on the driving conditions. This optimization contributes to energy efficiency, reducing power consumption and enhancing the overall performance of electric and hybrid vehicles. It contributes to precise control over steering assistance in power steering systems. This enhances vehicle maneuverability, responsiveness, and overall driving experience. Some of the factors impacting the market are rising adoption of electric vehicles, integration of Internet of Things technology and complexity in system integration.

The global shift toward electric vehicles drives the demand for these devices. These devices are essential components in electric vehicles, controlling motor speed and providing precise power management. As the automotive industry continues to invest in electric propulsion systems, the market is poised to experience significant growth. It contributes to optimizing battery efficiency in electric vehicles. They regulate the power supplied to the motors, managing acceleration, deceleration, and overall energy consumption. Efficient motor control enhances the range of electric vehicles and maximizes the utilization of stored energy in the battery, addressing a critical concern for EV owners. Additionally, the integration of IoT technology into industrial processes and consumer applications is a significant growth driver. IoT-enabled allow for remote monitoring, predictive maintenance, and data-driven decision-making. Systems' intelligence and efficiency are enhanced by connecting and communicating with other systems and devices. IoT technology allows for dynamic control and optimization of energy usage in DC motor systems. IoT-enabled motor control devices can adjust motor operations to maximize energy efficiency by analysing real-time data and environmental conditions. This is especially crucial in applications where precise control over speed and torque is essential for optimal performance and energy savings. The seamless integration with other connected devices and systems enhances the overall intelligence of the environment, contributing to the development of smart and interconnected industrial solutions. As a result of the integration of IoT technology, the market is anticipated to increase significantly.

However, Integrating DC motor control devices into existing systems or designing new systems with these devices can be complex. Compatibility issues, the need for additional sensors, and challenges in system integration may arise, requiring specialized knowledge and expertise. Complex integration increases the risk of system failures or malfunctions. Ensuring the reliability of the entire system, including these devices, becomes challenging as the number of interconnected components grows. System failures can result in downtime, maintenance costs, and potential damage to equipment. Complexity in system integration is a significant challenge that hampers the growth of market.

By application, the market is categorized into consumer electronics, automotive & transportation, industrial, medical devices, and others. In 2022, the consumer electronics segment held the highest revenue share in the market. These devices are extensively used in automated home appliances such as washing machines, dishwashers, and robotic vacuum cleaners. These devices enable precise control over motorized components, improving household appliance performance and energy efficiency. These devices are crucial in providing haptic feedback in smartphones. Vibrating motors controlled by these devices enhance the user experience by providing tactile feedback for notifications, alerts, and touch interactions.

Under consumer electronics type, the market is classified into smart motorized devices, high-end toys, social robots, and others. In 2022, the smart motorized devices segment witnessed the highest revenue share in the market. Smart motorized devices, driven by DC motor control technology, enable precise control over motor operations. This level of control is crucial in applications requiring accurate positioning, speed regulation, and torque adjustments, such as robotics, manufacturing, and medical equipment. Smart motorized devices often have programmable features, allowing users to customize control parameters based on specific applications. This flexibility enhances adaptability to various industries and applications, providing tailored solutions. Integrating smart motorized devices aligns with the principles of Industry 4.0, where digital technologies, automation, and connectivity converge to create intelligent and efficient industrial processes.

Under industrial type, the market is fragmented into ATM machines, pan tilt zoom cameras, water pump, actuators & other robotic devices, and others. In 2022, the ATM machines segment held the highest revenue share in the market. The core function of an ATM is to dispense cash. These devices are crucial in cash dispensing, ensuring accurate counting, sorting, and dispensing banknotes. The motors controlled by DC devices play a key role in this process's reliable and efficient operation. These devices are employed in the card-handling systems of ATMs. This includes motorized card readers and mechanisms for card insertion and retrieval. Precise control is necessary to ensure smooth card transactions and prevent card jams. ATMs provide users with transaction receipts. The receipt printing systems utilize these devices, ensuring accurate paper feeding, cutting, and printing. This contributes to the production of clear and reliable transaction receipts for users.

Under automotive & transportation type, the market is divided into marine outboard motors and others. In 2022, the marine outboard motors segment dominated the market with maximum revenue share. The primary use of marine outboard motors is to provide the main source of power and propulsion for boats. These motors are mounted externally on the boat's transom, and their DC motor control devices allow for precise control over the boat's speed and direction. Marine outboard motors are commonly used in small to medium-sized watercraft, including fishing, pleasure, dinghies, and inflatable boats. Their versatility makes them suitable for various recreational and commercial applications. Inflatable boats, RIBs, and dinghies commonly use marine outboard motors. The precise control offered by these devices ensures efficient operation, making these setups popular for recreational and professional applications.

Under medical devices type, the market is segmented into CPAC machines, oxygen concentrator machines, breast pump, and others. In 2022, the CPAC machines segment led the market by generating highest revenue share. CPAC machines, if designed for precise control and automation, can enhance the performance of these devices. This is particularly important in applications where accurate speed, torque, and position control are critical, such as robotics, industrial automation, and electric vehicles. Advanced control algorithms and machine learning integrated into CPAC machines can enable smart and adaptive control of DC motors. These systems can learn and adapt to changing operating conditions, improving efficiency and responsiveness in various applications.

| Report Attribute | Details |

|---|---|

| Market size value in 2022 | USD 1.2 Billion |

| Market size forecast in 2030 | USD 2 Billion |

| Base Year | 2022 |

| Historical Period | 2019 to 2021 |

| Forecast Period | 2023 to 2030 |

| Revenue Growth Rate | CAGR of 6.8% from 2023 to 2030 |

| Number of Pages | 370 |

| Number of Table | 570 |

| Report coverage | Market Trends, Revenue Estimation and Forecast, Segmentation Analysis, Regional and Country Breakdown, Porter’s 5 Forces Analysis, Company Profiling, Companies Strategic Developments, SWOT Analysis, Winning Imperatives |

| Segments covered | Application, Region |

| Country scope |

|

| Companies Included | ABB Group, Eaton Corporation PLC, General Electric Company, Johnson Electric Holdings Limited, Omron Corporation, Rockwell Automation, Inc., Schneider Electric SE, STMicroelectronics N.V., Toshiba Corporation, Ametek, Inc. |

| Growth Drivers |

|

| Restraints |

|

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the Asia Pacific region led the market by generating the highest revenue share. As the use of electric vehicles expands in the Asia Pacific region, the demand for these devices increases. These devices are crucial for controlling the motors in electric vehicles, influencing factors such as acceleration and braking. The healthcare industry in APAC employs DC motor control devices in various medical equipment and devices. Developing smart cities and infrastructure projects in the Asia Pacific involves the integration of various technologies, including DC motor control devices.

Free Valuable Insights: Global DC Motor Control Devices Market size to reach USD 2 Billion by 2030

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include ABB Group, Eaton Corporation PLC, General Electric Company, Johnson Electric Holdings Limited, Omron Corporation, Rockwell Automation, Inc., Schneider Electric SE, STMicroelectronics N.V., Toshiba Corporation, Ametek, Inc.

By Application

By Geography

This Market size is expected to reach $2 billion by 2030.

Rising adoption of electric vehicles are driving the Market in coming years, however, Complexity in system integration restraints the growth of the Market.

ABB Group, Eaton Corporation PLC, General Electric Company, Johnson Electric Holdings Limited, Omron Corporation, Rockwell Automation, Inc., Schneider Electric SE, STMicroelectronics N.V., Toshiba Corporation, Ametek, Inc.

The expected CAGR of this Market is 6.8% from 2023 to 2030.

The Asia Pacific region dominated the Market by Region in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $776.8 million by 2030.

Our team of dedicated experts can provide you with attractive expansion opportunities for your business.